BlackRock, Inc. (BLK) manages a short-term fixed income exchange-traded fund, or ETF, called the iShares Short Maturity Bond ETF (BATS:NEAR), which we believe presents a few interesting talking points.

Near-term bond vehicles are usually considered low-risk investments as they possess low duration and convexity. However, this actively managed ETF’s cyclical attributes challenge the assumption, which is why we decided to discuss the asset in today’s analysis.

Let’s traverse into the core of the analysis and find out what is in store for the iShares Short Maturity Bond ETF.

Top-Dow Analysis

Holdings Overview

The iShares Short Maturity Bond ETF is a diversified fund, holding approximately 386 instruments. Therefore, a style-based analysis is best suited instead of going through the ETF bond-by-bond.

Below is a breakdown of the vehicle’s maturity schedule. The fund’s constituents possess a weighted average maturity of 1.06 years, meaning it does not expose itself to the term risk premium nor the liquidity risk premium; however, the tradeoff is that lower duration exposure usually results in lower returns.

iShares

The following diagram illustrates the iShares Short Maturity Bond ETF’s credit rating exposure. Firstly, remember that this is an actively managed fund, and although it is constrained to short-term securities, its credit exposure might alter as time progresses.

Based on the fund’s data, iShares’ portfolio managers seem to have a balanced view of credit risk. The bonds at or below BB are considered non-investment grade and often represent stock-like characteristics. The balanced view implies an “it could go either way” attitude toward the credit risk outlook and no real conviction for the time being.

iShares

The iShares Short Maturity Bond ETF’s sector exposure conveys a bit more conviction than purely looking at its credit exposure. For instance, the iShares Short Maturity Bond ETF’s 30.51% exposure to industrials implies that it is bullish and probably expects credit spreads to compress in the coming quarters.

Further, the ETF’s exposure to Commercial Mortgages and CLOs (Collateralized Loan Obligations) suggests additional cyclical conviction as both sub-asset classes are cyclical; moreover, the mortgage space runs significant basis risk via prepayments/late payments, which suggests the iShares Short Maturity Bond ETF’s portfolio managers anticipate a smoothening in economic volatility.

iShares

Commentary: Our Outlook

The first matter to discuss for this section is the short end of the yield curve.

Although we hold the view that disinflation will continue into the latter stages of 2023, we believe that core inflation is holding up stronger than most market participants anticipated. Thus, the short end will likely stay unmoved for the time being, presenting little scope for now.

Herewith is a diagram of the current U.S. Treasury Yield curve.

U.S. Yield Curve (worldgovernmentbonds.com)

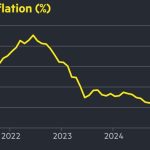

To support the aforementioned argument, here’s a diagram showing the U.S. inflation rate.

Another factor to consider is the corporate credit outlook.

According to the latest option-adjusted spread data, credit risk within the U.S. is dissipating, allowing cyclical bonds to flourish. However, the outlook is what matters, and, in our view, we might see a slight uptick in credit spreads during the following quarters as the VIX looks likely to revert to mean and interest rate policy remains uncertain.

St. Louis Fed

Here’s a simple moving average breakdown of the VIX to support the aforementioned claims.

VIX SMA (MarketWatch)

Although we think the yield curve and credit spreads are unlikely to provide much support to the iShares Short Maturity Bond ETF, enhancements in corporate balance sheets provide a reason to cheer.

Newly released data by S&P Global on August 22nd shows that investment-grade and non-investment-grade companies’ cash positions have started ticking up, providing a basis to conclude that credit downgrade risk is fading. If sustained, the cash position ratio might provide significant support to the iShares Short Maturity Bond ETF’s cyclical positions.

S&P Global

In general, there isn’t much reason to conclude that the iShares Short Maturity Bond ETF will receive significant price support. However, the tail risk experienced in the bond market earlier in the year seems to have dissipated. Therefore, I am willing to bet that the ETF’s interim returns hinge on its dividends.

Income and Distribution

I charted the iShares Short Maturity Bond ETF’s income versus dividend distribution in the diagram below. Although distributions mostly settle below income, the diagram conveys low distribution volatility.

Monthly Income Vs. Distributions (Author’s Work, Data from BlackRock)

As things stand, the iShares Short Maturity Bond ETF has a trailing annualized dividend yield of 3.75% (note that the ETF distributes monthly), which we believe is highly lucrative. Past data communicates that the distribution will likely decrease when interest rates settle lower; however, a reduction in income will probably be met with price returns as interest rates and bond prices are negatively correlated.

Seeking Alpha

Value-at-Risk

I measured the iShares Short Maturity Bond ETF’s Value-at-Risk on a 5% annualized basis. The results are visible in the diagram below, which shows that, according to my calculations, the iShares Short Maturity Bond ETF has a VaR of 4.828%.

Although VaR is not a guarantee, it gives investors a credible measure of tail risk for securities with normally distributed returns.

Author’s Work, Data from BlackRock

Sidenote: The formula I used for VaR is available via this link.

Final Word

Our analysis shows that the iShares Short Maturity Bond ETF possesses a few price risks. However, its low Value-at-Risk and lucrative distributions balance the argument.

Although this asset is suitable for risk-averse income-seeking investors, we think its total return prospects might disappoint until the inflationary cycle becomes more transparent.

Consensus: Hold/Neutral.

Read the full article here