Written by Nick Ackerman, co-produced by Stanford Chemist.

Virtus Equity & Convertible Income Fund (NYSE:NIE) is a hybrid closed-end fund that is having a solid 2023, thanks to the heavy tech exposure. In particular, the fund runs a portfolio that’s pretty heavily weighted toward the mega-cap tech names, the Magnificent Seven, that have ultimately been driving the broader market results this year overall.

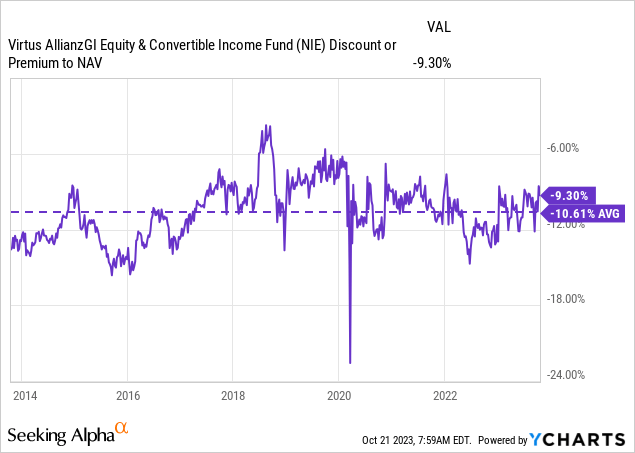

The fund has even seen its discount narrow throughout the year, which hasn’t been the case across the board as CEFs overall are sitting near historically wide discounts. That being said, it remains at a fairly wide discount, so shareholders currently holding probably aren’t at a place where they need to offload it from their portfolio.

The Basics

- 1-Year Z-score: 1.06

- Discount: -9.30%

- Distribution Yield: 9.97%

- Expense Ratio: 1.07%

- Leverage: N/A

- Managed Assets: $602.1 million

- Structure: Perpetual

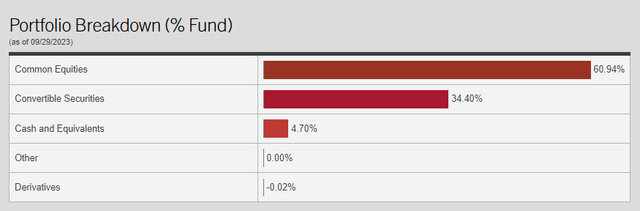

NIE’s investment objective is “total return comprised of capital appreciation, current income, and gains.” In an attempt to achieve this objective, the fund will “under normal circumstances, invest at least 80% of its net assets in a combination of equity securities and income-producing convertible securities.” The fund will vary in terms of its allocation, but generally, 40-80% will be allocated to equities, and the convertible sleeve will make up the remainder.

The fund also incorporated an options writing strategy instead of employing leverage in the form of borrowings. The strategy will be against individual positions in the fund at “approximately 70% of the value of each stock position.”

Being a non-leveraged fund in a rising rate environment can be seen as a positive. Most leveraged funds have seen their borrowing costs go up due to being based on floating rates. Some funds have hedged themselves, and some have fixed-rate financing; however, without employing borrowings at all, that’s one less thing to worry about with NIE.

Performance – Discount Deep, But Not A Steal

The initial discount the fund carries might make it look quite attempting at first. However, as we generally caution, it isn’t about just the absolute discount but also the relative discount.

Over the last year, the fund’s discount has actually narrowed. That’s what caused the fund’s 1-year z-score to go to 1.06. A z-score is a measurement to tell us if the current discount is over or under the average of a given period. A positive number means it is overpriced, while a negative means it is trading below the average. At a z-score of just over 1, we aren’t looking at extreme overvaluation by any means.

Even looking over the longer term, we see that the fund is trading above its decade-long average. The discount in the case of NIE has averaged just over the double-digit mark.

Ycharts

So again, it isn’t indicating that NIE is severely overvalued, but it also means that investors aren’t getting the best deal at this time if they were to initiate a position. Current holders can probably feel fairly confident continuing to hold at this level, too, without having to worry about a severe discount widening driving massive losses, excluding black swan-style events.

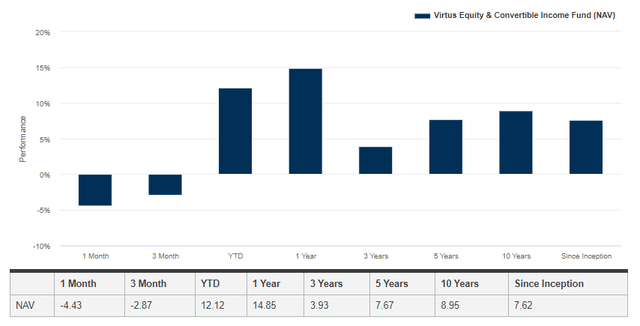

The annualized performance shown below is fairly respectable, and the data is through September 29, 2023, so we get the September slump reflected in these results.

NIE Annualized Performance (Virtus)

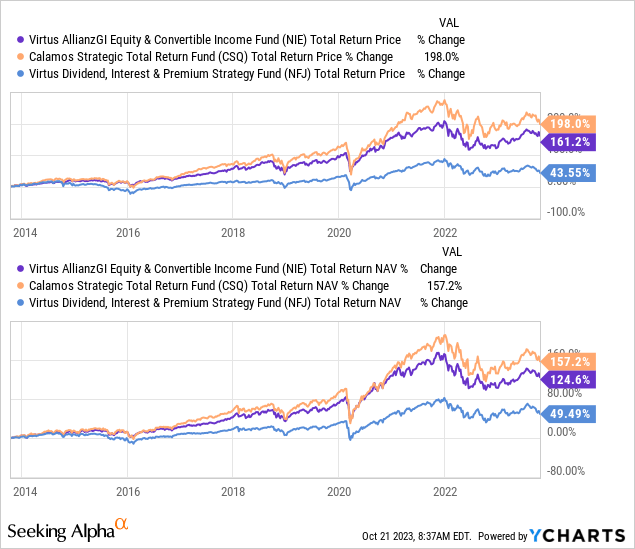

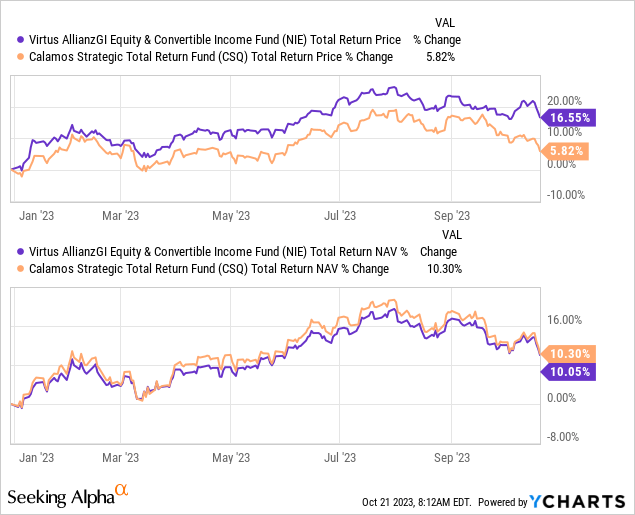

Given the unique approach of NIE as not only a hybrid equity/convertible fund but also employing an options writing strategy, a direct peer can be difficult to compare results against.

The Calamos Strategic Total Return (CSQ) could be a general comparison as they also take a heavy equity approach with a sleeve of convertibles and a dash of high-yield bonds. The fund even writes options as well.

Another fund NIE could be compared to is its sister fund, Virtus Dividend Interest & Premium Strategy Fund (NFJ). However, the fund is more value-oriented rather than positioned in the mega-cap tech names.

That said, CSQ is a leveraged fund, and given the strong bull market in most of the last decade, we’d expect to see CSQ outperform. And voila! That’s exactly what we see. We also see that both of those funds easily outperformed NFJ with its value-oriented approach.

Ycharts

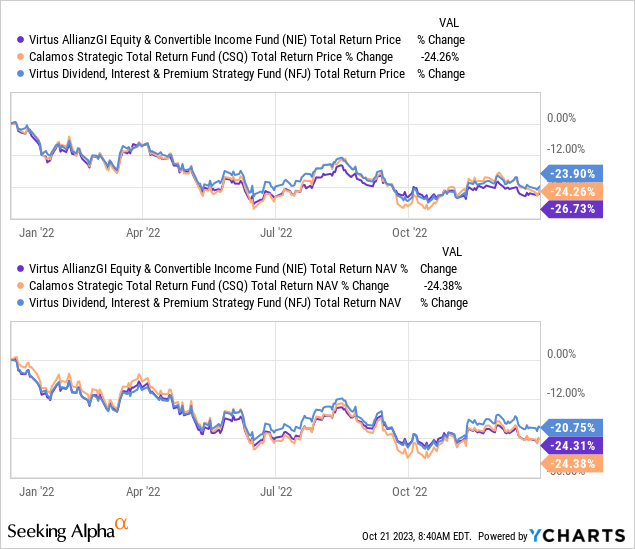

In a down year, we should expect to see NIE outperform CSQ. However, that didn’t take place in 2022, as the fund’s results were virtually the same.

Ycharts

NFJ, in this case, showed that its value-oriented portfolio had some resiliency to a drop. That being said, it wasn’t by a meaningful amount, and we saw other funds, such as BlackRock Enhanced Equity Dividend Fund (BDJ), perform significantly better with a value-oriented approach and incorporating a call-writing strategy.

Looking at NIE and CSQ on a YTD basis, these funds are showing nearly identical performance as well on a total NAV return basis. We’ve seen the fund’s total share price results outperform, but that comes with the reduction in the fund’s discount. Subsequently, CSQ saw itself go from trading at a premium to NAV to now trading at a bit of a discount.

Ycharts

Portfolio positioning is certainly playing a role here; as noted, CSQ carries some high-yield bond exposure. That being said, the NIE performance would be a bit disappointing if a leveraged fund can outperform in a down year.

On the other hand, NIE is still trading at a more attractive absolute discount. CSQ is trading at a relatively more attractive discount based on its nearer-term history.

However, the fund’s premium really only started to come about around 2017/2018. Prior to that, this was a fund that hit the 10%+ discount level regularly. CSQ also enjoys a portion of their borrowings being fixed rate. The first preferred falls off in 2024, which would have to be refinanced at a much higher rate than the 4% they are blessed with today. However, the second maturity isn’t until 2026, which means there is some hope that rates will be lower by then.

All this being said, I’m a holder of CSQ but wouldn’t be a buyer until we get to a 5% discount and, ideally, a 10%+ discount. Thus, I don’t believe that making a move from NIE to CSQ based on the long-term comparison in a mostly bull market with interest rates pegged to zero is warranted.

Distribution – Enjoying Capital Gains

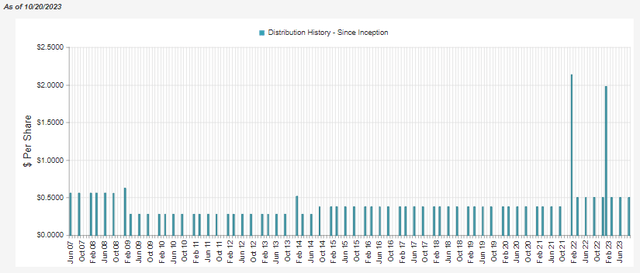

Investors are enjoying a ~10% distribution rate. On an NAV basis, it works out to 8.99%, which is quite elevated, but thanks to the strong performance this year, coverage hasn’t been a problem.

NIE Distribution History (CEFConnect)

The fund has even been able to pay out some significant year-end specials in the last two years, thanks to a strong equity market in prior years. 2022 was a tough year for the fund, but thanks to massive gains from those prior years, they had a lot of realized gains to harvest.

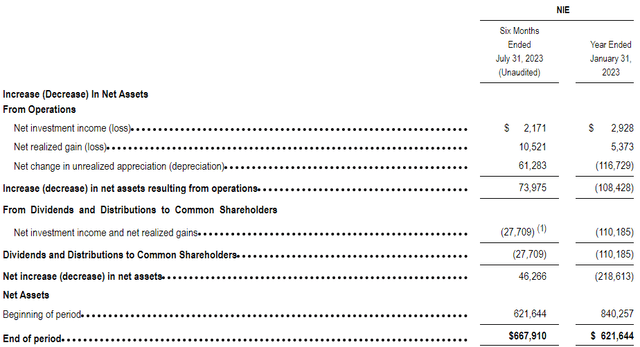

Capital gains are a keyword here as, like most equity CEFs, they will rely significantly on capital gains to fund their distributions. As of the last semi-annual report, the fund’s net investment income coverage came to only around 5%.

NIE Semi-Annual Report (Virtus)

That might seem low, but with a heavy tech-focused portfolio, it isn’t that uncommon. If one expects equities and, in particular, tech to start struggling, then one should expect that NIE’s distribution would come under pressure. From what we’ve seen now, though, the fund’s distribution shouldn’t be at risk.

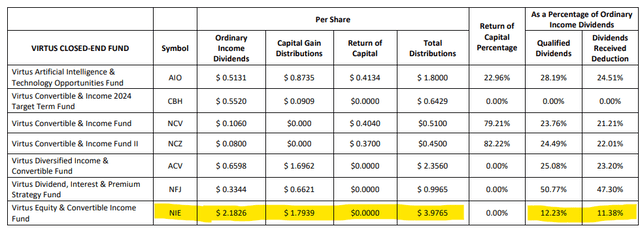

For tax purposes in 2022, the fund’s distribution was classified primarily as ordinary income with a substantial portion as long-term capital gains. Primarily, the large year-end special really drove the massive total distributions seen for the year. A portion of that ordinary income was classified as qualified dividends, which allow for a lower tax rate. That being said, if the fund continues to pay such a large portion as ordinary income, then holding in a tax-sheltered account would be more appropriate.

NIE Distribution Tax Classification (Virtus)

NIE’s Portfolio

The fund is fairly active, with the turnover rate coming in at 52% in just the first half of the year alone. That does put it on pace to be more active this year than in prior years. Over the last five years, the fund’s average turnover rate came to 72.6%.

The fund’s positioning is right in the middle of where they intend to weigh the portfolio sleeves in terms of equity versus convertibles.

NIE Asset Allocation (Virtus)

In the convertible sleeve, the portfolio is primarily listed as “not rated” for credit quality. That isn’t that unusual, as most companies issue convertible securities directly to institutional investors and forego the time and costs of getting the issue rated. By selling to qualified institutional buyers such as Voya, who manages NIE, the idea is that they’ll have their own internal process for rating these securities they are buying.

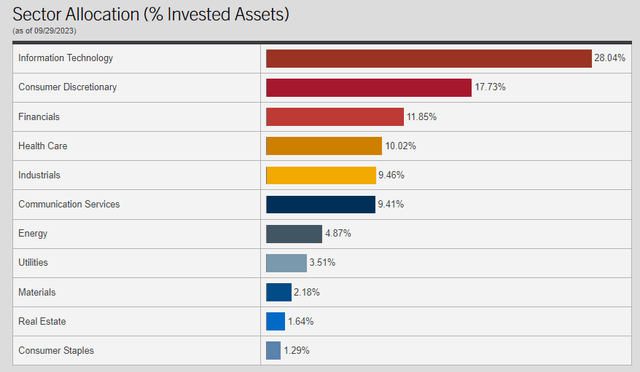

In terms of sector allocation, the fund has heavily weighted itself in the technology and consumer discretionary sectors.

NIE Top Sector Allocation (Virtus)

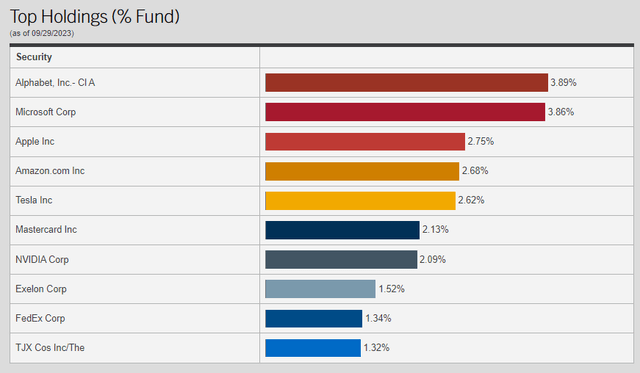

However, given the top ten weightings of the fund, it is no surprise to see these sorts of sector allocations. The mega-cap tech names represent the top weightings, with Alphabet (GOOG), Microsoft (MSFT), Apple (AAPL), Amazon (AMZN), Tesla (TSLA) and NVIDIA (NVDA) all being present for a weighting of almost 18%.

NIE Top Ten Holdings (Virtus)

The only name missing here is Meta Platforms (META). That said, as of their last semi-annual report, it was still a holding in the portfolio, just not at a large enough weight to make it to the top ten list.

Conclusion

NIE is a hybrid fund that doesn’t employ any borrowings for leverage, which could be seen as a positive in this environment. That being said, not being leveraged didn’t help the fund materially against the leveraged CSQ ‘peer’ during 2022’s tough market. The fund still saw a deep drop, and I’m not sure if that is saying NIE is a poor fund or if we should be commending CSQ on its positioning to be able to thwart the downside despite being leveraged.

Overall, NIE is trading at a deep discount, but relatively speaking, it isn’t a bargain at this time. Therefore, in my opinion, I’d be mostly neutral at this time as it doesn’t look like a ‘Buy’ nor is it a ‘Sell’ for those already holding.

Read the full article here