November may be an in-between month. It will be a month of limited monetary policy actions and a period of heightened geopolitical tensions. Fiscal policy may be more interesting, with a Japanese supplemental budget, more measures expected from China, and a debate in Europe over the re-implementation of the Stability and Growth Agreement. In the US, the drama that played out in the House of Representatives could still leave the federal government with insufficient spending authority.

In light of recent geopolitical developments, Ray Dalio of Bridgewater was quoted suggesting that the odds of a world war were near 50%. Others simply recognize that the risks are the greatest in decades. And yet, the capital markets have been amazingly orderly. To be sure, there was some dramatic price action, like the nearly $64 (~3.4%) rally in gold prices on October 13 and the 6.2% rally in oil prices in the week after Hamas’s attack and the dramatic rise of nearly 65 bp in the US 10-year yield since the September 19-20 Federal Reserve meeting.

The dollar had already snapped its 11-week rally against the Swiss franc in the first week of October, but the franc was the only G10 currency to appreciate against the dollar in the week after the Hamas attack and in October through the last full week of the month. The slightly higher than expected US September CPI (year-over-year rate was unchanged at 3.7% rather than decline as forecasted) halted the dollar’s slide several days into the war.

The dollar’s dramatic price action on October 3 when the dollar briefly traded above JPY150 sparked speculation that the BOJ intervened, but it does not appear to be the case. While the market was reluctant to rechallenge the JPY150 level, it succeeded in pushing the greenback to new highs for the year on October 26 near JPY150.80. It elicited little more than verbal warnings from officials. For its part, China appears to have used formal and informal channels to manage the yuan’s exchange rate. The dollar’s strength is spurring other countries to support their currencies.

The outperformance of the US economy remained stark in Q3. The initial official estimate is that the world’s largest economy expanded by 4.9% at an annualized pace in Q3, which was faster than China’s reported growth (0.9% quarter-over-quarter). Beijing has signaled more economic support will be forthcoming, while economists expected the US economy to slow dramatically. Japan is also putting together another economic package that will likely include tax rebates and an extension of subsidies for household use of electricity, cooking gas, and gasoline.

Although many were critical of the Federal Reserve for not ending its extraordinary monetary stimulus before it did, several times during the cycle, the market has expected the central bank to pivot, but it has not. In September, the median projection reduced the number of cuts anticipated to two from four. The derivatives market (swaps and futures) favored three. However, once again, the market converged with the Fed rather than the other way around. Firm September CPI and retail sales seemed to sway it. Indeed, it appears that the soft landing (no recession) and higher-for-longer (on rates) is the new consensus.

Yet, in fairness, soft-landing scenarios may be part of the cycle itself. Later in the cycle, the optimism is typically dashed, considering how many business cycles have ended without a recession and a meaningful rise in unemployment. One does not have to look far to see emerging headwinds, the tightening of credit, the cumulative effect of the rise in interest rates, the resumption of student loan debt servicing, and rising debt stress levels. Consumer spending increased faster than income for four consecutive months through September. That said, if there is no compelling evidence that these widely recognized headwinds are taking hold, the risk is of a December Fed hike, which the market sees as less than a 25% chance. This is especially true it seems if US long-term rates pull back.

Identifying the proper level of analysis in the recent geopolitical developments is difficult. Some see the rapprochement between Israel and Saudi Arabia (pipeline with US backing, though ironically relying on ports owned or managed by China) as having been sabotaged. Others suggest Russia’s covert and indirect machinations are at work. There also are those who put recent events in the context of the long and brutal history of the two people.

There are several frozen conflicts, stalemates of sorts, if you will, with Israel-Palestine being the most explosive. Even before October 6, it looked like the earlier Armenia and Azerbaijan conflict was going to be renewed. The conflict is partly a result of Russia’s weakness, not strength. Kosovo and Serbia tensions are reportedly rising. The US has stepped up in military presence off the coast of Korea to deter any escalation there. The flare-up of a number of fires is cited as evidence by some of the weaknesses or distractions of the chief firefighter, the US. Yet, there have been such claims for years, and even at the peak of the unipolar world, there were numerous conflicts. As the political scientist professor and author Paul Poast put it, “war is persistent but not prevalent.”

The threat of a broader war in the Middle East or Central Europe is part of the unknown knowns, but there is another risk we can pinpoint more precisely. November 17. The current spending authorization needs to be extended, or there will be a partial closure of the US federal government. In addition to many services not being available, more than 2 mln workers will be directly impacted, and the pay of 1.3 mln active-duty troops will be disrupted. Although a partial government shutdown will not impact Washington’s ability to service its debt, Moody’s, the last of the biggest three rating agencies to maintain a AAA rating for the US, has warned a shutdown would be credit negative. The struggle to choose a new speaker for the House of Representatives reflects an important split in the Republican Party, which may make a budget agreement difficult. There is also a reasonable chance that another short-term fix is agreed upon.

Moody’s gives Italy the lowest of its investment-grade ratings. The outlook is negative, and the results of its review will be announced on November 17. It looks like a close call, even though S&P affirmed its rating for the country a few ago one-notch higher than Moody’s. Italy’s 2024 budget raised the deficit target to 4.3% from 3.7% six months ago. Moreover, Meloni government is assuming 1.2% growth next year. The Bank of Italy’s forecast is 0.8%, and the IMF’s is 0.7%. Slower growth than the government expects would lift the size of the deficit. The government does not project meeting the 3% threshold until 2026.

The third of the three large rating agencies, Fitch, will review Italy a week earlier, but its current rating is the same as S&P. A loss of investment grade status is highly unlikely. It recognized the government’s budget as a significant loosening of fiscal policy. This may signal a change in the outlook from stable to negative. Moody’s decision is more immediately important, and if it takes away Italy’s investment grade rating, the market impact may be minimal for two reasons. First, Italy’s bond yields have risen dramatically in recent weeks in absolute terms and relative to Germany. Second, it will not impair the use of Italian bonds as collateral in ECB operations.

Between the sharp rise in US interest rates and the geopolitical developments, risk appetites were impaired. Emerging markets paid a steep price. The MSCI index of emerging market equities fell for the third consecutive month (~-4.5% in October) and is down slightly on the year. The losses have been concentrated in Asia Pacific, where China’s CSI 300 is off almost 8% for the year and Hong Kong’s Hang Seng is down about 12%. Central European and Latin American equities have fared better this year but struggled in October. The premium paid over the US, measured by the JP Morgan Emerging Market Bond Index widened slightly for the third consecutive month. Emerging market currencies mostly weakened. Latin American currencies, which outperformed earlier this year, generally underperformed in October. The Chilean and Mexican pesos were the weakest of the emerging market currencies, falling about 4.4% and 3.6%, respectively, against the dollar last month. After the Russian ruble, the Polish zloty was the strongest with a 3.5% gain, encouraged by the national election outcome and what is anticipated to be the freeing up of EU funds that had been blocked previously.

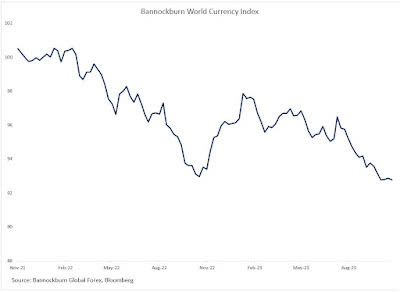

Bannockburn’s World Currency Index, a GDP-weighted basket of the currencies are the dozen largest economies, briefly fell to new multi-year lows in early October, slipping marginally through the low set in November 2022. It remains in its trough, suggesting new lows are likely, which in turn, means that the US dollar has not peaked in the spot market. We had thought it did, but the continued outperformance of the US economy, and the stream of poor news from Europe and Asia, while geopolitical tensions are elevated, may extend the dollar’s run.

The Mexican peso (1.8% weighting in the BWCI) was the worst performer, with its roughly 3.7% decline. The Canadian dollar’s loss of 2% was the most among currencies from high-income countries in the index. Outside of the Russian ruble (2.8%), which is a special case, only the Brazilian real (2.4%) gained against the dollar in October. appreciating by about 1.7%.

The BWCI uses one-month forward currency rates. Converting the forwards to interest rates allows us to derive a funding index. The implied rate bottomed in April 2022 near -1.7%. It reached about 3.4% in November 2022. It fell to around 1.7% by the end of February 2023. The implied funding cost of the BWCI has soared to about 6.30% in October. Among the members of the BWCI, China may still cut rates, while Brazil has finished its tightening cycle has begun cutting rates. Russia will likely hike rates again, and, as we noted, Japan has lifted the upper band for the 10-year JGB but has not hiked overnight rates and its balance sheet continues to expand. The market sees the US and ECB cutting rates in late Q2 or early Q3, though the central banks have not ruled out an additional hike. Of the high-income countries in the index, Australia is seen to be the most likely to hike again.

U.S. Dollar

The outperformance of the US economy remains notable. It is a force lifting US rates and the dollar. Part of this is likely traced to its fiscal policy. For the fiscal year that ended at the end of September, the US budget deficit was 6.3% of GDP, after a 5.4% deficit last year. While revenues were weaker, expenditures (e.g., defense, health care, Social Security, and debt servicing costs) also rose. The deficit is expected to slip back below 6% in 2024.

In contrast, the eurozone aggregate deficit is around 3.5% this year (3.6% in 2022) and may fall toward 3% next year. Japan’s budget deficit is around 5.3%-5.5% after a 6.7% deficit in 2022. It is seen falling to around 4% next year. The Office for Budget Responsibility projects a UK budget deficit of 5.1% for the current fiscal year (from 4.3% in 2022) and narrowing to 3.2% in the next fiscal year.

The other important support for the US economy comes from consumption. In Q3 GDP, consumption rose by 4.0% after a modest 0.8% growth in Q2. Still, with monthly consumption growth exceeding income growth in three of the four months through September, it does not look sustainable. And student debt servicing has resumed for the first time in three years, which is also seen hampering consumption. Debt stress levels are rising and credit conditions tightening, which also do not bode well for the critical engine of the US growth.

The market looks for the economy to slow dramatically in Q4. The median forecast in Bloomberg’s survey sees the economy slowing to below 1% annualized and not returning above 1% until Q3 24. The Federal Reserve appears to have signaled no change in rates at the meeting that concludes on November 1. It would be the second consecutive month on hold.

The surge in US interest rates (50-60 bp on the 10-year yield since the last FOMC meeting that concluded on September 20), which Fed officials link rise of the term premium tightens financial conditions for the central bank. The December 2024 Fed funds futures contract implies an effective Fed funds rate of about 4.70% at the end of next year. It currently is 5.33%. This implies that market anticipates the two cuts the September Summary of Economic Projections (median) anticipated and about a 50% chance of a third cut.

The Dollar Index (SP500, SPX) set the high for the year on October 3 near 107.35. After rallying for 11 consecutive weeks through the end of Q3, it consolidated mostly above 105.50 in October. Although we had thought the early October high could be significant, the risk now seems to be a new high is recorded.

Euro

The economic impulses for the eurozone have not changed much in the past month. The economy appears to have stagnated or worsened in Q3 and the outlook is not much better for Q4. Germany, the largest economy in the bloc is likely contracting slightly.

Berlin and Paris stuck a deal that will allow government assistance for the French nuclear plants, but a larger agreement on the new fiscal rules remains elusive. Without an agreement by year-end the old rules come back, which seem to be somewhat harsher and less flexible than some of the proposals for the new.

The European Central Bank does not meet in November, but the market thinks it is done. Last October, 1.5% jump in eurozone CPI will drop out of the 12-month comparison, slowing year-over-year pace to almost 3%. However, this may mark the low point until late Q1 24. Further out, the swaps market has fully discounted a rate cut by the end of H1 24.

Risks to the eurozone seem biased to the downside in terms of geopolitics and economics. After declining almost 7.5% from mid-July through early October, the euro corrected higher last month. It stalled late in October in front of $1.07, the upper end of the $1.0660-$1.0700 range we highlighted last month. The risk is that the euro revisits the low for the year near $1.0450.

| As of October 27 | Indicative closing prices | Previous |

| Spot | $1.0565 | $1.0575 |

| Median Bloomberg One-month forecast | $1.0650 | $1.0635 |

| One-month forward | $1.0585 | $1.0580 |

| One-month implied vol | 6.7% | 6.8% |

Japanese Yen

The dollar traded above the JPY150 threshold three times in October. The first time (October 3) spurred price action than many observers thought could have been official intervention. The dollar dropped from about JPY150.15 to almost JPY147.40 in less than a quarter-of-an-hour. It recovered and settled slightly above JPY149.00. We are skeptical that it was intervention, but a Ministry of Finance report due shortly is authoritative.

The second time (October 23), the dollar rose to about JPY150.10 and then retreated in an orderly and calm fashion. It rose through JPY150 on October 25 and reached JPY150.80 on October 26. In addition to the fear of intervention, it is also a common level of option strike. Participants may also have been reluctant to press further ahead of the Bank of Japan meeting on October 30-31. Some press accounts warn that the 1.0% cap on the 10-year bond could be lifted again.

The yield has risen from around 0.50% at the end of July and 0.86% in late October. The BOJ has made unscheduled purchases to help steady the bond market and have made five-year loans to banks. Ostensibly, this offers low-yielding money to banks to buy bonds. This is understood to be complementing the Yield Curve Control. It was the sixth such operation this year.

The BOJ will update its economic projections and inflation for the next fiscal year is likely to lifted to 2.0% or slightly higher. We look for the BOJ to stand pat now but suspect the next move in December may not be an adjustment to the long end but rather to bring the overnight rate from -0.10% to zero. It has been negative since January 2016, but is effectively near -0.02%.

Meanwhile, ahead of the supplemental budget that seems likely to include a modest tax rebate, Prime Minister Kishida announced that the gasoline, electricity, and household gas subsides that had already had already been extended to the end of the year will continue until the spring.

| As of October 27 | Indicative closing prices | Previous |

| Spot | JPY149.65 | JPY149.35 |

| Median Bloomberg One-month forecast | JPY147.20 | JPY146.85 |

| One-month forward | JPY148.90 | JPY148.55 |

| One-month implied vol | 8.1% | 8.7% |

British Pound

The UK economy contracted by 0.6% in July and grew by 0.2% in August. Without posting its strongest monthly growth since March, the economy may contract in Q3. Most economists look for a string of stagnant quarters running until Q2 24.

On the other hand, better news is likely on the inflation front. Recall that in October 2022, consumer prices jumped 2.0%. It will drop out of the 12-month comparison. The year-over-year rate can fall from 6.7% in September to below 5.5% in October. However, the base effect turns somewhat less favorable until February-April 2024. Core prices and services prices are bound to prove stickier.

The Bank of England meets on November 2. The swaps market looks for it to stand pat (~95% probability) and has almost an 80% probability of it sitting tight in December too. Sterling fell to seven-month lows in early October (~$1.2035) and recovered by three-cents before falling back. That pullback was deeper than we expected, finding support near $1.2070. A retest of the lows cannot be ruled out until the $1.2335 area is overcome.

| As of October 27 | Indicative closing prices | Previous |

| Spot | $1.2120 | $1.2200 |

| Median Bloomberg One-month forecast | $1.2215 | $1.2305 |

| One-month forward | $1.2125 | $1.2205 |

| One-month implied vol | 7.5% | 7.6% |

Canadian Dollar

The economic contrast with the US and the risk-off sentiment weighed on the Canadian dollar in October. The US dollar rose to new seven-month against the Canadian dollar following the Bank of Canada meeting and reached CAD1.3845 after the strong Q3 US GDP the following day.

The overnight rate was left unchanged at 5.00%, and although officials said they are prepared to hike rates again, if necessary, the market is skeptical. For example, the swaps market prices in slightly more than a 25% chance of a cut by the end of H1 24 compared with a roughly an 85% chance of a cut at the end of September. While the central bank raised its inflation forecasts and now sees CPI at 3.0% next year rather than 2.5%, it also cut its growth forecast to 0.9% from 1.2%.

The economists in Bloomberg’s survey see the Bank of Canada’s growth forecast of 0.8% in Q3 and Q4 23 as too optimistic. The median projection is for growth of 0.5% and 0.4%, respectively. The US set the high for the year in March near CAD1.3860, and a move above there could spur gains toward the two-year high set in October 2022 almost CAD1.40. We suspect that it will take a broader setback in the US dollar and/or a strong recovery in risk appetites for the Canadian dollar to establish a floor.

| As of October 27 | Indicative closing prices | Previous |

| Spot | CAD1.3870 | CAD 1.3575 |

| Median Bloomberg One-month forecast | CAD1.3675 | CAD1.3515 |

| One-month forward | CAD1.3865 | CAD1.3580 |

| One-month implied vol | 5.7% | 5.8% |

Australian Dollar

Among the G10 currencies, the dollar-bloc and Scandinavian currencies were the weakest performers in October. These currencies typically underperform in risk-off environments. The Australian dollar fell to new lows for the year in October near $0.6285.

In fact, it traded below $0.6300 eight times but only settled below it once. It looks like it is carving a base, but it needs to reestablish a foothold above $0.6450 to boost confidence that a durable low is in place. A break of $0.6250 could spur a return to last year’s low near $0.6170. A smaller than expected decline in Q3 CPI spurred a shift in market expectations for the central policy. The odds of a hike at the November 7 meeting are now seen as a 50/50 proposition, double what it was before the CPI. The odds of a hike before the end of the year are near 75%. Yet, the economy is weakening.

Australia lost full-time jobs in two of the past three months through September and preliminary October PMI composite tumbled by a large 4.2 index points to 47.3, the lowest since January 2022. Price pressures are also easing. The year-over-year rate has fallen from 7.8% in Q4 22 to 5.3% in Q3 23, and likely toward 4.5% in Q4 23.

| As of October 27 | Indicative closing prices | Previous |

| Spot | $0.6335 | $0.6435 |

| Median Bloomberg One-month forecast | $0.6420 | $0.6490 |

| One-month forward | $0.6340 | $0.6445 |

| One-month implied vol | 9.9% | 9.8% |

Mexican Peso

The peso fell for the third consecutive month in October, matching the longest decline since 2015. The driver seems to be a combination of market positioning and risk-off. In fact, the six most actively traded Latin American currencies have trended lower over the past three months. Still, since the start of 2022, the peso remains the world’s strongest currency, appreciating about 13% against the greenback.

The macro considerations, like the favorable interest rate pick-up and the near/friend-shoring meme remain intact. Although President AMLO is relaxing fiscal policy, monetary policy remains tight even as inflation falls. The central bank has signaled the overnight rate will remain at 11.25% for a protracted period, which the market suspects means well into next year.

Major US equity indices have also fallen for the three months through October, and the nearly 100 bp rise in the US 10-year Treasury yield has dragged Mexican rates higher. Its 10-year dollar and peso bond yields have surged about 115 bp over the same time. The dollar reached a seven-month high against the peso in early October a little below MXN18.50.

A break warns of the risk of a return to the MXN19.00 area, which dollar has not closed above since February, despite fraying the area on an intraday basis in March during the US bank stress. On the other hand, a dollar push below MXN17.75 would lift the peso’s technical tone.

| As of October 27 | Indicative closing prices | Previous |

| Spot | MXN18.11 | MXN17.42 |

| Median Bloomberg One-month forecast | MXN17.95 | MXN17.39 |

| One-month forward | MXN18.22 | MXN17.52 |

| One-month implied vol | 13.9% | 12.2% |

Chinese Yuan

China’s economy appears to be doing a bit better, but the weight of the property market remains a drag. Country Garden has defaulted on a dollar bond.

More economic measures are likely to be announced and a cut in rates or reserve requirements is still possible before year-end. Local governments will be able to draw on next year’s bond-issuance quota and the central government’s deficit will be allowed to rise to 3.8% from the 3% target announced in March.

The strong-arm of the state continues to make foreign investors wary. The Foxconn probe, the detention of three employees from WPP, and formal charges of espionage been brought against an executive from Astellas Pharma does not sit well. The employee of a Japanese trading company was detained in March and there is still not public acknowledgement or indication of specific charges.

October’s trading was shortened by the national holidays, and the dollar traded between about CNY7.27 and CNY7.3185, well inside the September range (~CNY7.24-CNY7.35). The PBOC continues to use the fix to limit the dollar’s strength. It is difficult to tell what the large state-owned banks do for their own account and customers and what is done on behalf of the central bank but press reports have noted their dollar selling activity.

A meeting between Biden and Xi on the sideline of the APEC summit in mid-November remains possible though it has not yet been confirmed.

| As of October 27 | Indicative closing prices | Previous |

| Spot | CNY7.3175 | CNY7.2980 |

| Median Bloomberg One-month forecast | CNY7.2820 | CNY7.2800 |

| One-month forward | CNY7.2020 | CNY7.1960 |

| One-month implied vol | 5.1% | 5.2% |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here