Thesis

Nu Holdings (NYSE:NU), through various holding companies, operates a digital bank and offers various digital solutions in Brazil and international locations in Mexico and Colombia.

The company started by providing access to a credit card to the larger population. Slowly, it started exploring other financial products as the need arose. They were able to effectively leverage the customer data and provide better services to them. Its acquisition of Olivia AI – a data company using AI and machine learning platforms to implement retail banking solutions, Easynvest – a digital investment platform, and others, showcases the company’s understanding of identifying customer demands. The company has its own cryptocurrency and allows its users to hold crypto assets on its platform.

Initially founded in 2013 in Brazil, it has slowly been establishing its reach to various Latin American countries. With the increased adoption of smartphones in these countries it can compete with big banks, offering much-needed banking solutions at lower costs, to which access was very limited due to high fees. The reach of smartphones has also helped in opening up markets to new customers.

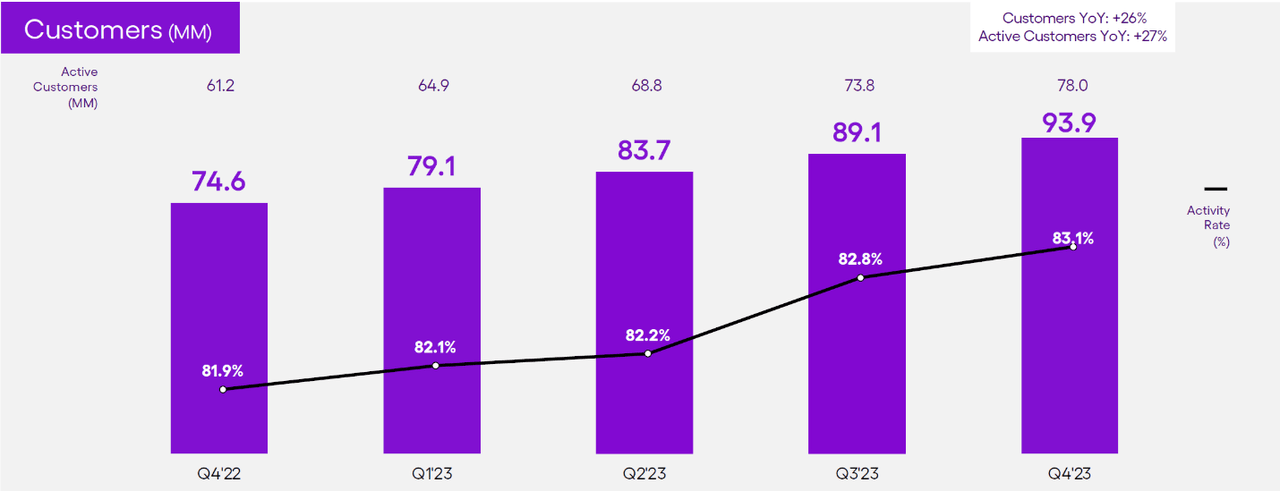

The company has a total user base of 93.9 million with nearly 83% active customers. The company has added 26% new customers over the past year. The continued increase in its customers has helped the company to offer additional financial services, helping increase its revenues and profitability. The company has aggressively started its campaign to reach new markets in Colombia with its user base reaching 800,000 users. Whereas the customer base in Mexico has reached 5.2 million.

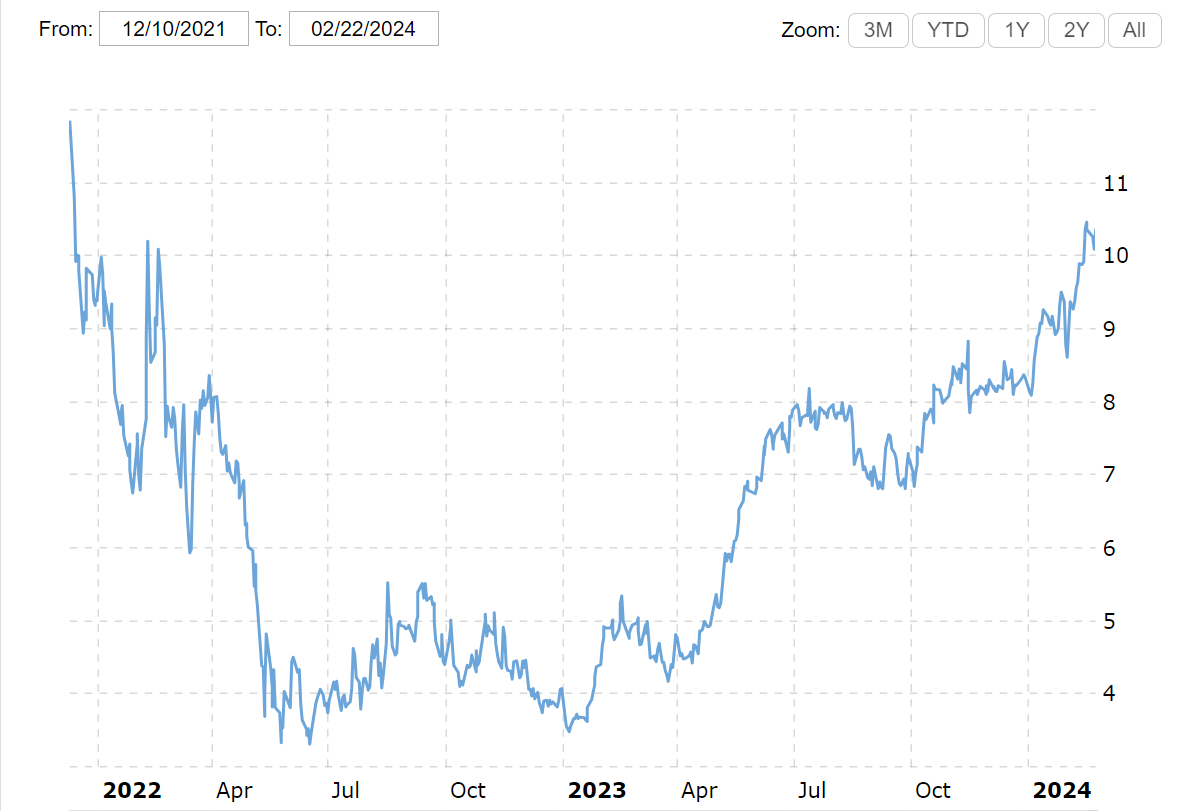

NU’s current stock price is up over 110% over the past year making buying opportunities less favorable at the moment. The company’s revenues and customer base have experienced exponential increases over the year, and the stock has lots more to offer as it penetrates new markets in Latin America.

Macrotrends

Nimble Infrastructure

The company has been able to effectively convert a large population of the country, which was alien to banking and bank accounts due to high fees, to loyal customers. For many, the company serves as a primary banking service provider. Its operations don’t require any physical buildings, and all transactions can be done over the app. This allows them to save a lot of money, which helps them increase margins on products offered by the company. This has also helped the company grow organically, with 75% of new customers added over the past year.

Q4 2023 Earnings Presentation

Leveraging Customer Data to Cross-sell and Upsell Products

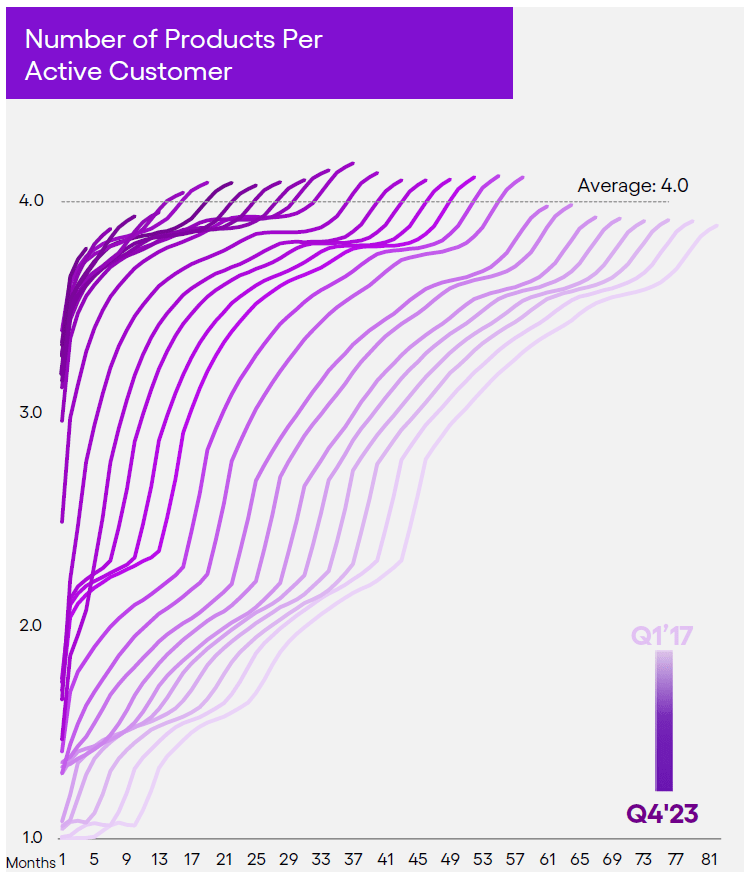

The company has been using data collected through customer transactions, to better understand the needs of the customers and efficiently target and develop the right products for the specific customer. Their past acquisition of Easynvest is testimony to that, where the company was quick to understand the urgency to have a platform where individuals could make investments. This allowed NU to capture a huge market share of retail investors. The company has been able to effectively cross-sell many products with third-party vendors and later develop its own products such as life insurance.

Q4 2023 Earnings Presentation

Move into Colombia

The company recently got permission to operate as a financing company in Colombia, which opens a huge market for the company. The company will be able to appeal to a larger demographic in the country and offer more services through its app. The company has been offering high yields on savings to its customers when compared to its competitors. It has been able to increase its deposits in savings accounts by serving as the primary account for 53% of its users. I believe this expansion provides an optimistic growth trajectory for the company with the efforts to create an expanding source of customers and thus revenue.

Q4 2023 Earnings Presentation

Financials

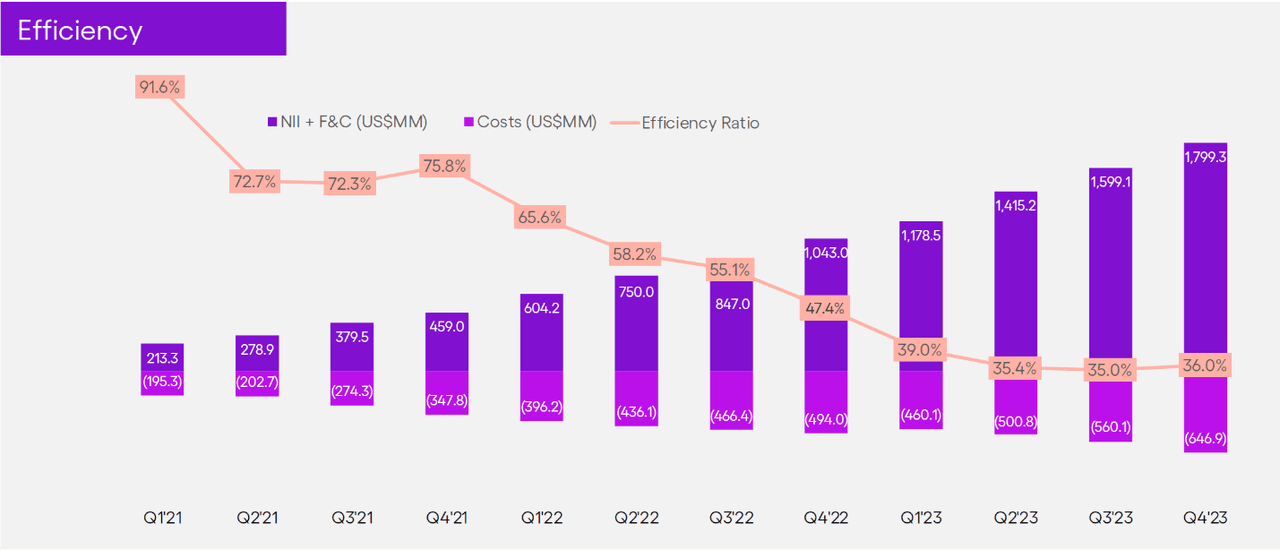

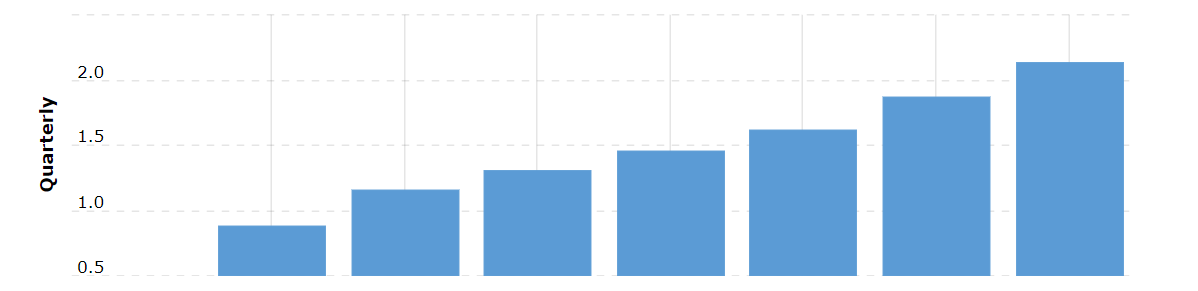

Nu Holdings has increased its revenue growth each quarter, although a major portion of the increase in the last quarter can be attributed to the holiday season. The revenue for the quarter was up 12.55% from the previous quarter and 66% YOY from the 4th quarter of 2022. The revenue for the whole year was up 67.54% from 2022. Most of this gain was seen from the interest income at 81.13% YOY compared to a 28.48% YOY growth in revenue generated from fees and commissions.

Macrotrends

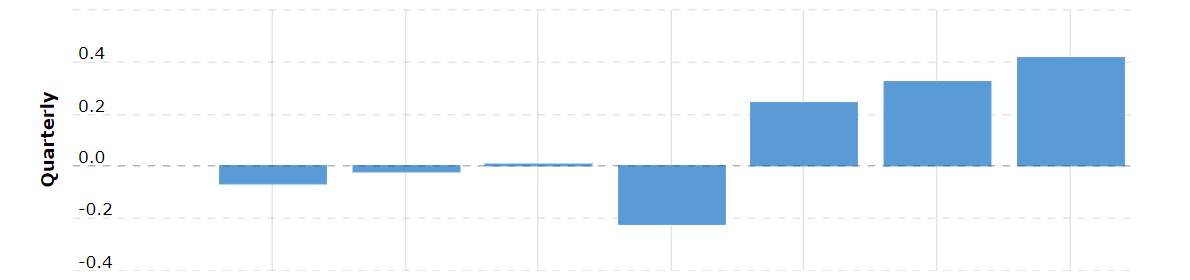

Total transaction cost was up only 45%, so the gross profit increased 110% which is optimistic for the company’s future in adding additional revenue with fractional costs. The operating expenses also increased by nearly 98%. The company boasted a positive net income before taxes and positive earnings equivalent to $0.212 per share over the year 2023.

Macrotrends

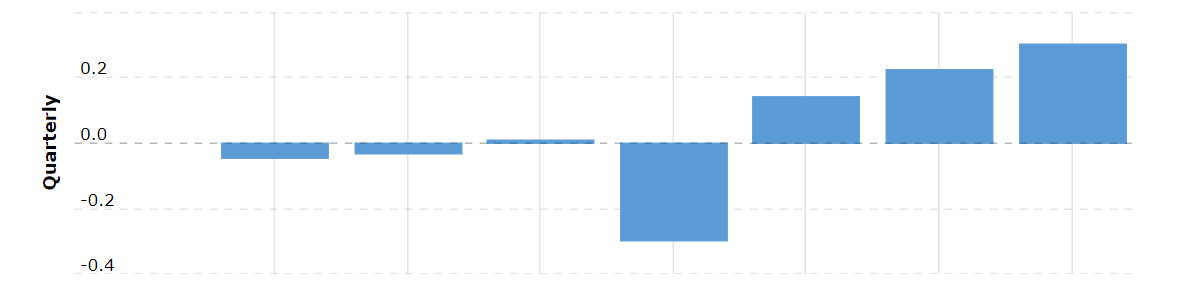

The company’s balance sheet increased by nearly half, whereas the receivables in the credit card division overdue for more than 30 days increased to 7.3% from 6.3% in 2022. The company was effectively penetrating the market in terms of loans provided to individual customers which increased in value by 98%. The company also increased its borrowing to $1.1 billion from $0.58 billion. The funds were mainly borrowed by holding companies in Mexico and Colombia, to be used for boosting the growth of company operations in the respective countries. The total fair value of crypto assets held by the company increased to 8.5 times over the past year.

Macrotrends

Valuation

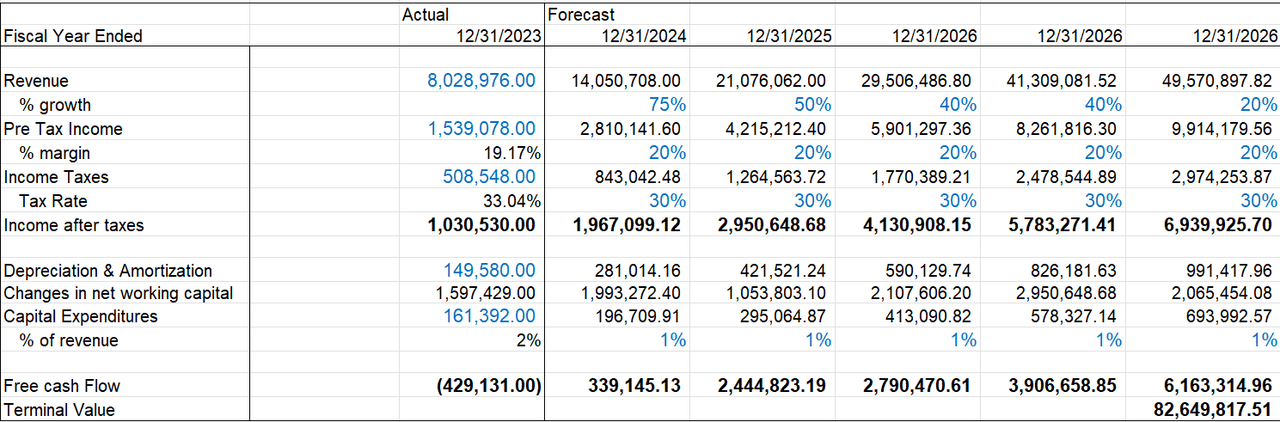

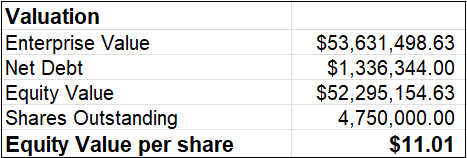

For the valuation, I have used the values as reported in US dollars. There might be some changes in the forecast based on the existing currency exchange rate at the time as the valuation doesn’t consider any costs associated with transactions incurred for FX currency exchange.

Author’s Material

The short-term growth rate assumes the company will keep on expanding into new markets and increase its customer base and revenues. The long-term growth rate for the valuation and WACC is assumed to be 5% and 12.84%.

Author’s Material

As a result of these considerations, the intrinsic value is computed at $11.01 per share, essentially reflecting the prevailing stock price. The price has been flying up recently and even though the company is quite solid, it is currently trading at its expected fair value which limits the upside for investors looking to buy in now.

Risk

The company is operating in different countries, which increases its vulnerability to changes in government rules and regulations. The company is also facing increased competition in its different divisions such as loan financing from Creditas in Brazil. Its majority share of revenues is generated from its interest income segment, i.e. interest earned on late payments of credit cards, loans, etc. This makes the gross profit more vulnerable to the fluctuations in the interest rates by the Central Banks. However, by diversifying its customer base in different countries, it should be able to mitigate some of these risks.

Conclusion

In conclusion, through my research in Nu Holdings, I believe it is a fundamentally strong company. There are multiple avenues of growth available for the company looking forward. However, due to the valuation, the buying opportunities are not so favorable at the moment, and it is likely better to wait for a dip in the market to scoop up some shares. Taking all the factors into consideration, I would recommend a HOLD rating for this company.

Read the full article here