On Holding AG (NYSE:ONON) is an innovative company in athletic footwear that was incorporated in Switzerland (2010) and then listed in the NYSE (2021). The company engages its activities in the running segment with a competitive advantage in its patented cushioned platform technology called CloudTec. In 2022, On Holding reached $1.3 billion in sales, with 96% of the total group revenue coming from footwear. In terms of geographical sales distribution, North America, the EU, and APAC accounted for 60%, 29%, and APAC 7% of sales, respectively. With the remaining part (4%) in the rest of the World. In a nutshell, we decided to initiate On with an equal weight valuation, recognizing the company as a highly innovative brand ready to gain end-market share. However, we are skeptical about its aggressive long-term growth expectation and margin. Execution risks in achieving scale and higher cost of marketing investment should also priced in. In addition, the company’s valuation is very elevated versus its closest peers, and this might add space to a potential stock de-rate, especially in a period of ‘higher-for-longer‘ interest rates. Despite that, in our forward-thinking view, here are below our positive and negative key takeaways that might help current and potential On investors:

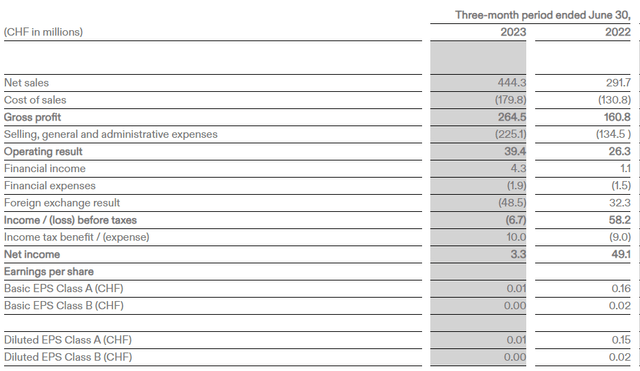

- On a positive note, On Holdings achieved solid Q2 results with an adjusted EBITDA of 7% above consensus estimates. Despite that, the investor bar was probably much higher, and the stock negatively reacted on the reporting day. In numbers, the company increased sales by 52% on a yearly basis and reached an adj. EBITDA of approximately CHF 62.7 million (Fig 1);

- Despite these positive results, the P&L was partially offset by higher SG&A expenses. This was also reported by On management team, which is investing in topline growth. Related to the SG&A, this ratio was 11% above Visible Alpha forecasts. Looking deeper, we believe that logistic expenses and higher storage costs should prove to be temporary while hiring expenses and marketing costs could last longer and might represent a source of potential downside;

- Looking at Wall Street estimates, Q2 results make for ON the 8th consecutive sales beat with solid demand, especially in North America and the APAC region. At the same time, there was a miss in the EMEA area;

-

ON’s inventory declined by 7% on a quarterly basis. This might help investors inventory fears. The CEO reaffirmed inventory’s lower trajectory and more normalized levels by 2023-end. According to our analysis, On inventory should reach CHF 460 million on the current top-line sales projections. Here at the Lab, we commented on shoe inventory in 2022 with a publication called ” Implications Of Nike’s Profit Warning.” At that time, the company “did not have enough inventory to meet consumer demand, whereas today, the company intends to increase product discounts to eliminate warehouse inventory.” This concern posed another sector risk, and Puma (within our coverage) was affected. Here at the Lab, related to On, we argued that inventory levels are in line with revenue growth, which in the last three fiscal years were at a plus 58%, 70%, and 69%, respectively. Having said that, Q2 inventories grew by 101% on a yearly level but lower than the last quarter (+186%);

- Related to point 4), ON’s Q2 solid gross margin was particularly remarkable given the competitors’ promotional environment and On shoes’ premium price;

- The key to report is the performance of the new product, which represented 60% growth in the past quarter. Investors are now willing to see the evolution of the lifestyle and apparel market share in the upcoming months. Here at the Lab, lifestyle consumers and products such as Cloudnova might add new markets, especially for kids. In addition, On is underpenetrated in regions such as Italy, France and Spain;

- A negative to report is that On increased sales by CHF 20 million, which was below expectation, implying a lower sales evolution for H2. This is mainly due to adverse currency development, as also highlighted by the management team. In number, given the new outlook, we now forecast -7 basis point deceleration vs. H1, and we arrived at yearly sales of CHF 1.81 billion (Fig 2);

- Lastly, On’s free cash flow is still in negative territory with a minus CHF 14 million and no significant progress vs. Q1 (-CHF 16 million), despite an uplift in inventory release (+CHF 5 million).

-

On Q2 Financials in a Snap

On Guidance

Conclusion and Valuation

Before moving on with the valuation, we should report On financial targets: 60% gross margin, 15% adj. EBITDA margin and sales of CHF 5 billion. While these indications are achievable in the long run, we are more concerned about short-medium-term execution risks linked to achieving this scale. In our view, this demanding valuation and high Wall Street expectations might provide a de-rating chance. The cash burn continues and ON trades with a 26x EV/EBITDA and a P/E at >50x. Looking ahead, On next catalyst is the investor day in early October. Here, we believe that the company plans to release sales estimates and EBITDA evolution for a three-year visible period. In our calculations, On EBITDA will likely double over the next two years, moving from 2023(E) of CHF 280 million to 2025(E) of CHF 460 million. With a current EV/EBITDA of 26x, we derived a target price of $26 per share. We believe On valuation looks full given the ongoing risks: a slowdown in consumer spending, adverse FX, and higher competition.

Read the full article here