Opera (NASDAQ:OPRA) is a public company known for its web browser of the same name. We have no doubt it is a nice browser, but it’s up against big rivals from companies like Google and Microsoft which can quickly copy features and can leverage other assets to bear on their market position.

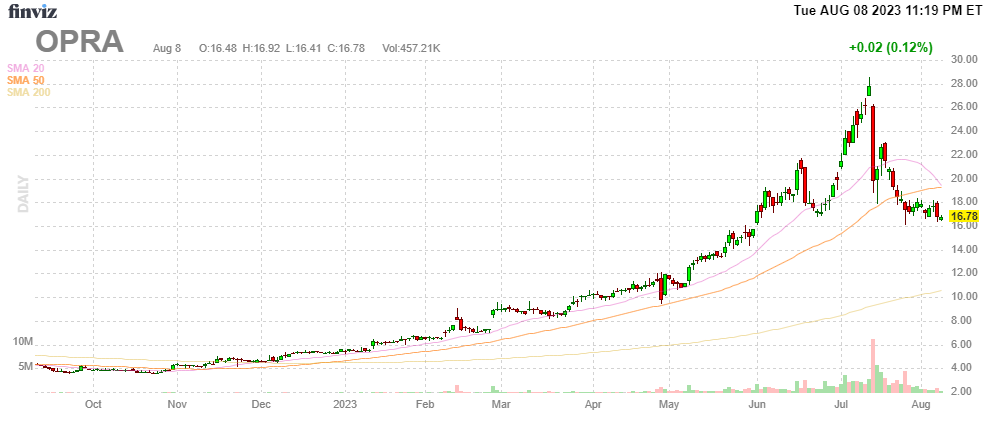

FinViz

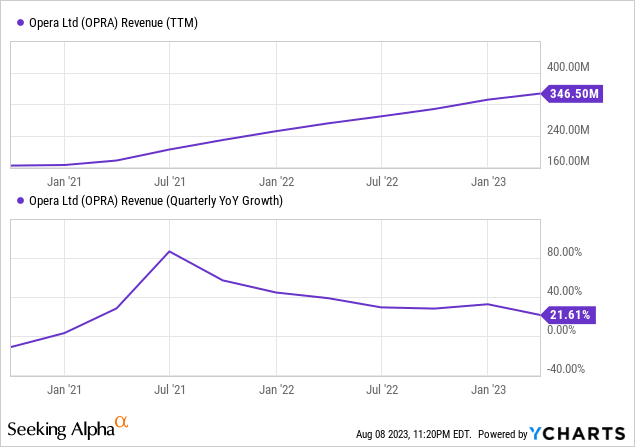

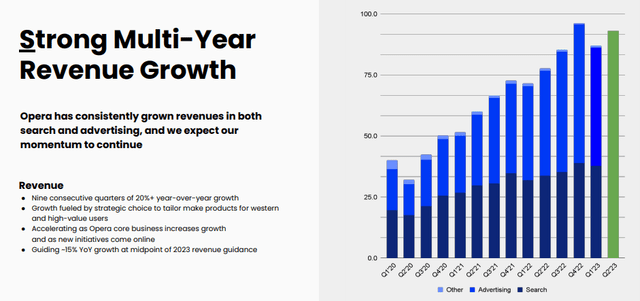

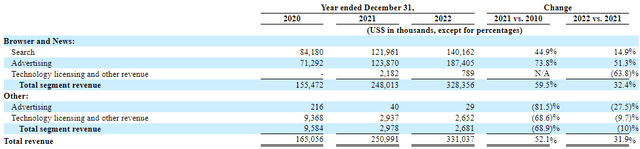

Opera generates income through search, advertising, and a category called ‘other’. While growth has come down from rather giddy heights, it’s still pretty substantial at 20%+, although the guidance for this year has it at 15% at the midpoint.

Revenue comes from two sources (the other category is negligible):

OPRA IR presentation

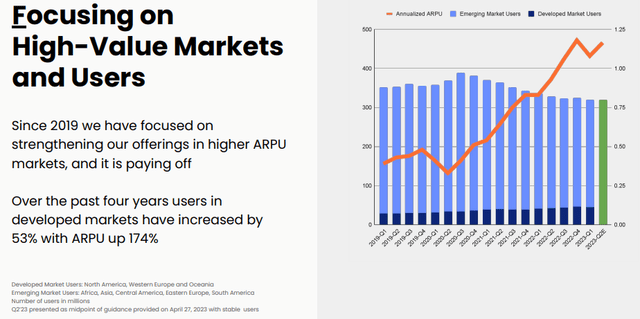

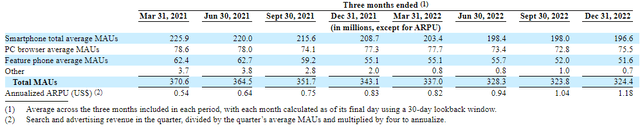

The company generates most of its revenue from emerging markets but has embarked on a concerted effort to target higher ARPU markets, which is paying off (but also note the decline in users from emerging markets):

OPRA IR presentation

ARPU doubled in two years and was up 30% in Q1/23 (y/y).

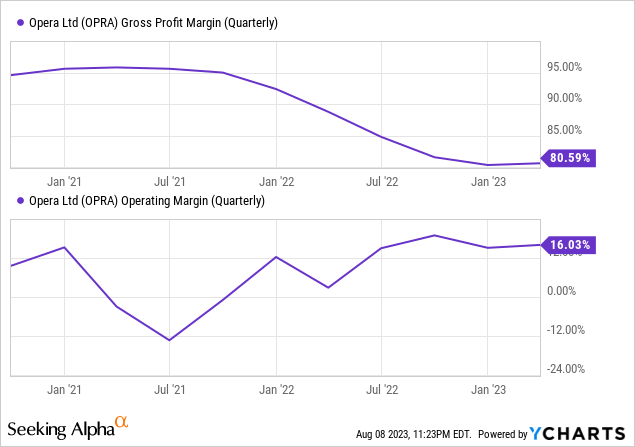

The company also generates generous margins (and the figures below are in GAAP) even if gross margin has come down quite a bit, 80%+ is still excellent and operating margin seems on an uptrend:

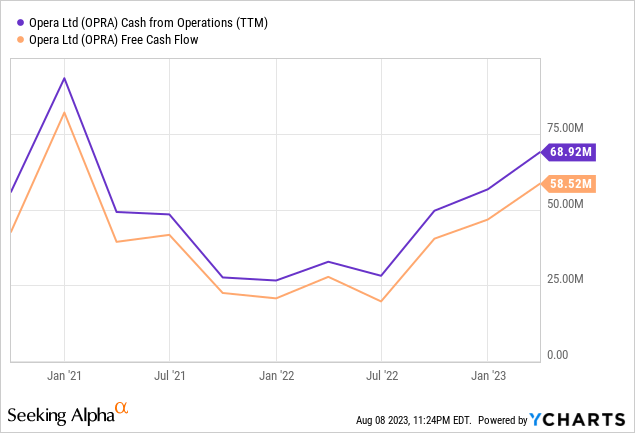

Given the revenue growth and excellent margins, it’s no surprise that the company produces quite a bit of cash:

Opex cash flow was $25.7M with free cash flow at $23.3M in Q1/23 and the company has $85M in cash and no debt.

Enough cash to buy back (370K) shares with $30M left in the program and pay a ($0.8) dividend, producing a 4.57% yield. The company can easily afford this as they have an ironclad balance sheet to boot.

Growth

There are three key drivers of growth:

OPRA IR presentation

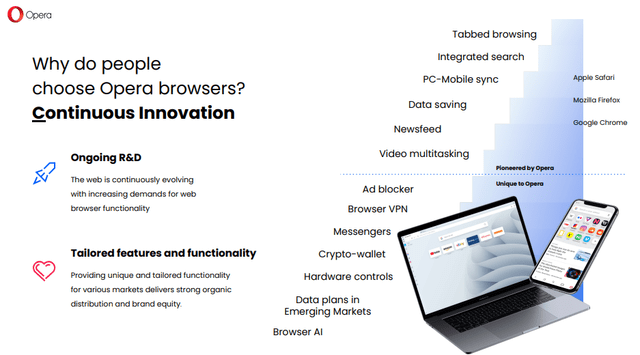

The first is key in our view. People usually get a browser when they buy a computer and they must have some reason to switch, that is, Opera must be able to offer some additional valuable functionality for enough people to ditch their own browser.

Opera has a nice feature list (below is by no means complete, feel free to peruse the website):

OPRA IR presentation

The last two are more interesting, which we think are genuinely new features not available in other browsers. Although one can recreate quite a bit of these with the help of plugins in other browsers, having a single platform is easier and could very well attract some people.

Opera doesn’t have the heft of the Microsofts and Googles of this world to get its browser pre-installed on computers, although (Q1CC):

We have also begun new integrations with OEMs and partners to preload zero processor as part of the OEM’s device system updates, creating a tailwind for potential user growth in the second half of the year… we see a trend well with middle of our partners and OEMs that they see the value of actually more actively pre installation the browser, especially a very good one like us. And so we just take the opportunity to start the pre installation, which, yes, it will definitely be contributing to our revenues among, revenue profits and others and users of course.

Any gains here are not in the guidance.

Blockchain/Crypto

They introduced their Web3.0 crypto browser in January last year which has abilities like enabling blockchain transactions and it’s integrated with a host of crypto platforms, basically offering a one-stop-shop for keeping customers diversified crypto assets in one place and executing seamless transfers and transactions.

Gaming

The company launched a desktop GX browser in Q2/2019 and a mobile version in Q2/2021. It acquired GameMaker Studio, a low-code platform for developing games for all sorts of platforms, in Q1/21.

The company also launched GX.games gaming portal. Opera GX had 18.2M MAUs and GX Mobile had 3.4M MAUs in Q1/23 with GX MAU growth at 32%.

This is one of the company’s most promising growth avenues not just for that 32% user growth, but especially as the ARPU for GX users is almost 3x that of the company average.

The user base was up another 80% sequentially to 22 million during the quarter raising ARPU 80% to $3.17 so there is strong momentum here, which should bode well for the near future with an influencer campaign started in May as well. There is also this (Q1CC):

We are recently announced that the live score features found directly in the browser for football and credit funds, has surpassed 50 million users less than six months after its introduction, which just speaks to the strengths of our distribution.

News Aggregation

Opera News is an AI-driven personalized newsfeed located in the sidebar of the browser as well as available as a stand-alone app for mobile and tablets. It has a huge (350M) user base, mostly in Europe and emerging markets

Artificial Intelligence

The company had its own AI engine driving the personalization of content (mostly news) but this year it has integrated generative AI with its new browser, Opera One which was launched in June 2023 from the PR:

With Aria, Opera One users are getting access to a leading generative AI service for free. The service is a result of Opera’s collaboration with OpenAI, but with expanded capabilities. Based on Opera’s own Composer AI engine, Aria connects to OpenAI’s GPT and is enhanced by additional capabilities such as adding live results from the web.

And management argued that (Q1CC):

It is a definitely beneficial to us in terms of user awareness and in terms of getting new users. So, that is very helpful.

However, management admitted that the search for the best business model to integrate AI is still on, so they haven’t figured that out yet, and here is our concern (from the company website, our emphasis):

No more digging through search engine results and endless webpage content. ChatGPT and Aria provide comprehensive answers instantly, often compiling information from multiple sources

“No more digging through search engine results,” it can’t be said more clearly than that. Will this cannibalize search revenue? It seems very well possible to us although management also:

in the future will expand by integrating additional capabilities such as search services powered by Opera’s key partners. All this innovation will be accessible through a unified and coherent user experience.

We’ll have to see about that. A more obvious retort is that generative AI increases engagement, which will boost revenue from advertisements. This seems considerably more plausible to us.

Ad revenue (+26% in Q1 to 56% of revenue) is indeed increasing faster than search revenue (+18%), but this isn’t yet the impact of AI. In fact, last year ad income increased by 51.3%, while search revenue increased 14.9%, from the 20-F:

OPRA 20-F

And here is a view on the development of MAUs:

OPRA 20-F

$20M in revenue comes from Russia (the Yandex partnership) which is continuing given the fact that the Chinese company Kunlun has a controlling stake in the company.

Another worry here is that the company isn’t a leader here. It does have AI capabilities, but the generative AI function is farmed out to ChatGPT, which is hardly an exclusive deal so we find it difficult to imagine how the company will be distinctive from the competition here (despite management claims).

Valuation

Add to that:

- 1.785M RSUs

- 100K options

- 2.925M Kunlun RSUs

And one arrives at a fully diluted count of 94.8M shares. At $20 per share that’s a market cap of $1.61B. Apart from the $85M in cash the company also has quite a few participations:

- A 9.5% stake in OPay (mobile payments fintech). The company had a 42.4% stake in NanoCred (microlending), which was sold for $131.7M but since most of NanoCred was subsequently sold to OPay this transformed into an additional 3.1% stake in OPay (to take that to a total of 9.5%).

- A 29.1% stake in nHorizon Innovation (Opera China).

- A 6.1% stake in Fjord Bank.

- A 19.4% stake in Star X was sold in April/22 for $83.5M with $28.4M received and the rest will be paid in Dec/23 and Dec/24 in two equal installments.

From the Q1CC:

our receivable from the sale of Star X totals 57 million present value and we value our 9.5% stake in OPay, which is classified as held-for-sale at 163 million. In total, that adds up to $305 million.

So one could argue the company’s EV is $1.21B, with sales guided at mid-point this year of $382M the shares sell at a reasonable multiple of nearly 3.16x EV/S.

Earnings estimates average at $0.73 this year, rising to $0.83 next year which gives the shares a p/e of nearly 23x, the shares seem not terribly expensive. EV/AEBITDA at 15.1x (AEBITDA is guided at $80M at midpoint) is fully valued, in our view.

Risks

- Staying on top of the innovation race

- Losing users, albeit in emerging markets with low ARPU

- Generative AI cannibalizing search revenue

- Reputational: Chinese control, Yandex

In order to try out a different browser than people are used to and is supplied by their new PC the company needs to stay ahead of the innovation curve. So far, the company has done very well here, especially on the gaming and crypto/blockchain fronts.

There is tremendous momentum in their gaming solutions and given that these fetch almost 3x of the average ARPU this is likely to drive the company forward for quite some time to come so the risk certainly doesn’t look imminent to us.

The company is losing users, but in emerging markets, ARPU is considerably lower. It is gaining users in developed economies, but one could argue that at some point the loss of users in emerging markets will reduce the heft of the company.

We already dealt with what we consider the AI-related risk and the fact that they have Russian ties with Yandex and are Chinese-controlled might not sit well with everybody, but we see little direct impact or danger.

The Shelf

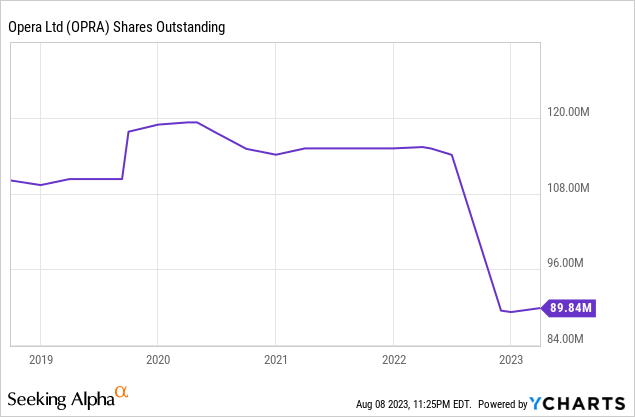

Controlling shareholders are cashing out via a shelf offering, selling up to 141.77M ordinary shares or equivalent ADSs in one or more offerings. Keep in mind there are 2 shares for every ADS so that amounts to 70.89M ADS.

That of course is a lot, given the 89.84M ADS out, creating a truly monstrous overhang at uncertain pricing (we assume these shares won’t be dumped on the open market but there will be negotiated deals for stakes, mostly with institutional investors).

SA contributor JR Research argues one should get out, although it seems to be less to do with the overhang as with the 600% rally and the main shareholders cashing out.

Sell-side analyst Vitanza from Cowen sees it as a considerable positive and we tend to agree. Given the financial performance of the company discussed in this article, we don’t see a sudden reversal in the company’s fortunes.

So the argument that the insiders know something that we don’t doesn’t seem all that plausible, but it’s not impossible either. We simply think they’re cashing out of a nice rally.

We don’t think investors should jump in feet first, especially given the strong rally the shares have already displayed in a relatively short time frame. One could consider a small initial position and see how the insiders get rid of their stakes. We do expect considerable institutional appetite for the shares.

Conclusion

The company has multiple things going for it:

- It’s a leading innovator in the browsing space, and this is gaining company users in developed countries even if it loses users in developing countries.

- Their gaming initiatives look especially promising as this is a large potential market, the user growth is fast and the segments score much higher ARPUs compared to the company average.

- Financial performance is stellar with 22% revenue growth and an AEBITDA margin of 25%.

- After coming back quite a bit from a huge rally the shares aren’t overvalued anymore.

- The company is shareholder friendly paying a (modest) dividend and buying back shares, and it has an ironclad balance sheet.

- There are some risks, it’s hard to keep up the innovation race against much bigger competitors or differentiate AI solutions from these same companies, and hitting upon the right business model with AI isn’t entirely straightforward.

- The shelf complicates calculations so we would limit to a first tranche buy if you like the name and keep a keen eye on how the insider sales progress.

Read the full article here