Investment Thesis

O’Reilly Automotive (NASDAQ:ORLY) is the leading retailer of automotive aftermarket parts with a highly profitable business model in an oligopolistic industry that is consolidating.

The company has been increasing its returns on invested capital to over 25% due to an efficient distribution network, pricing power, and superior customer service. Since ORLY generates strong free cash flows, it has reduced the share count by 5.8% annually over the last decade.

Recently, Brad Beckham was appointed as CEO of the company and I believe his extensive experience will help him successfully approach ORLY’s future challenges, such as the electric vehicle transition.

I expect ORLY to grow at 13% CAGR in the upcoming years and outperform the market.

Company Overview

ORLY is a specialty retailer of automotive aftermarket parts, tools, supplies, equipment, and accessories in the United States and Mexico.

The company was founded in 1957 and currently operates over 6,000 stores with an extensive product line of automotive hard parts, maintenance items, auto body paint, and accessories, while also offering enhanced services such as oil and battery recycling, wiper and bulb replacement, battery and electrical testing, etc.

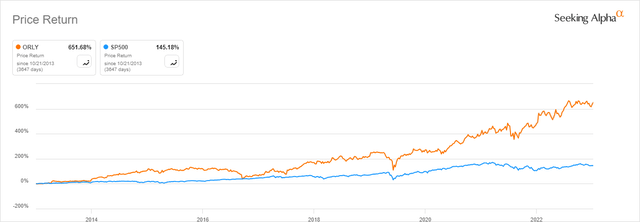

Although the auto parts industry could look boring, ORLY has a highly profitable business model, which combined with its growth strategy, has provided investors with superior returns over many years.

Seeking Alpha

Business Model

ORLY sells its products to both DIY customers (56% of revenue) and professional service providers (44% of revenue). Historically, ORLY has increased its sales to professional service providers at a faster pace due to the more fragmented nature of the business, which offers a greater opportunity for consolidation.

Its business model is based on providing its customers with:

- Superior in-store experience through technically proficient store personnel, who undergo extensive training.

- Great selection of products to be delivered same or next day.

- Competitive pricing, supported by a good, better, and best product assortment designed to meet all quality and value preferences.

- Stores in convenient locations supported by a strategic distribution network.

ORLY’s stores have access to over 154,000 stock-keeping units (SKUs) through an extensive network made by 29 distribution centers and 383 Hubs. More than 95% of the stores receive multiple same-day deliveries and deliveries on weekends of hard-to-find parts not typically stocked by other auto parts retailers.

The company owns 41% of the stores and 75% of the distribution centers, while the rest are leased under a fixed rent payment agreement for a minimum of 10 years, subject to one or more renewals at ORLY’s option.

Each store is staffed with a store manager, one or more assistant managers, and parts specialists. Stores are supervised by district managers, who have responsibility for an average of 10 stores. The company employs over 88,000 people and has great developing opportunities since many of its senior management members have worked as parts specialists at the beginning.

Its revenues consist of nationally recognized, well-advertised, premium brand products, and its proprietary private label products that make up more than half of its sales. ORLY purchases its products in substantial quantities from over 815 suppliers, which provides the company with significant pricing power and gross margins of over 50%.

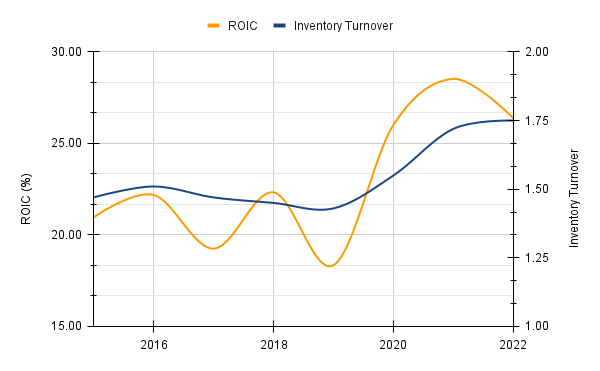

This business model has proven to be highly profitable with returns on invested capital over 25%, which have been increasing due to a higher inventory turnover and net income margins.

Author

The Net debt/EBITDA ratio is at 1.78x, which I don’t consider to be high given half of its debt is accounts payable ($6.2B) to its suppliers because of a long payment period. The rest are lease liabilities ($1.8B) and Senior Notes ($4.8B) at fixed rates of around 4%.

Growth Strategy

Apart from having a highly FCF generative business, ORLY has been able to grow sales by 8.5% CAGR since 2010 and its earnings per share (EPS) by 22.4% CAGR. To achieve these impressive results, the company has focused on increasing the number of stores, improving existing store sales, strategic acquisitions, and share buybacks.

Store increase

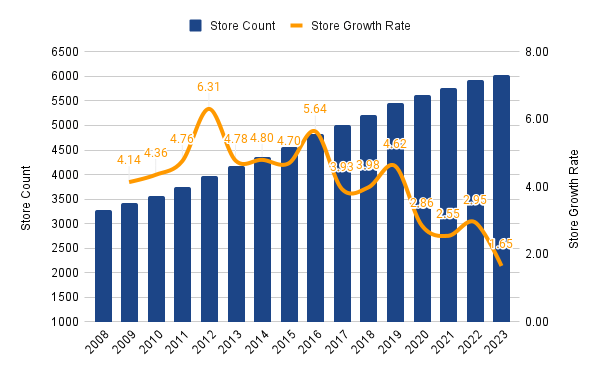

ORLY has been aggressively increasing its store count and consolidating the fragmented automotive parts market.

Thanks to ORLY’s dual market strategy, they are able to operate stores in less densely populated areas, which would not otherwise support selling primarily to retailers.

Author (Data from Annual Reports)

As the number of stores increases, the growth rate in store count has decreased since 2019. It is important to note that the 2023 growth rate only includes the first half of the year (100 new stores) and the company expects to open another 80-90 new stores, increasing the growth rate in store count during 2023 to 3%.

Improving Like-for-like

To increase same-store revenues, ORLY mainly is focused on two areas. The first one is improving customer satisfaction by providing superior service through its technically proficient staff and conducting systematic renovation and relocation of existing stores to enhance performance by optimizing square footage.

The second one is by offering competitive pricing for an extensive selection of products and qualities. The company has in place a Loyalty Program since 2013. Also, in 2017 ORLY launched its new website and has been heavily investing in improving its omnichannel platform since then.

Management expects to improve same-store sales between 5% and 7% annually.

Strategic Acquisitions

Over the years, ORLY has been pursuing strategic acquisitions of smaller independent operators, since it can operate more efficiently and effectively thanks to its national network and pricing power.

Its largest acquisition was in 2008 when ORLY acquired CSK Auto, Inc. for around $1B and increased the store count by 1,342, almost doubling its size.

Since then, it has done smaller acquisitions such as Bond Auto Parts in 2016, adding 51 stores, Bennett Auto Parts in 2018, adding 33 stores, and Mexico’s Mayasa Auto Parts in 2019.

Share Buybacks

ORLY has been consistently allocating its FCF into share buybacks, reducing the share count over the years and boosting EPS.

Its depreciation and amortization expenses are low when compared to revenues and currently stand at 2.3%, leaving lots of cash to return to shareholders.

Over the last 10 years, the shares outstanding have reduced from 111M in 2013 to the current 60M (2Q 2023), spending $19.4B in share repurchases.

Leadership Transition

Since ORLY became public, it has only had three CEOs. David O’Reilly, until he retired from the role in 2005, Greg Henslee until 2018, and the current CEO Greg Johnson.

Recently, ORLY announced the retirement of Greg Johnson, who has been working for the company since 2001, and the appointment of Brad Beckham as CEO in January 2024.

He has been in the company since 1996 and started as a Parts Specialist, being promoted to many roles such as Store Manager, District Manager, and Region Manager, before entering leadership positions.

Beckham was the Co-President since January 2023, when he was promoted from COO and Vice-President.

I believe the new CEO will continue ORLY’s growing journey successfully for many years. While he is only 44 years old, he has a long experience and knows every detail of the business, since he has grown from the most humble positions in the company.

Auto Parts Market Drivers

Four factors drive the aftermarket auto parts industry:

- Number of vehicles

- Miles driven

- Vehicle aging

- Repair Frequency

Despite the DIY market being more consolidated, the do-it-for-me (DIFM) market continues to be highly fragmented with many small operators, and I expect the trend to continue to be an oligopoly, as it has been happening during the last decade.

O’Reilly Analyst Day Presentation, 2017

Big national chains have been acquiring smaller and less efficient operators while increasing their pricing power and market share.

Currently, the biggest national operators are ORLY, AutoZone, Inc. (AZO), and NAPA Auto Parts, followed by a large distance by Advance Auto Parts, Inc. (AAP).

U.S. Energy Information Administration, International Energy Outlook 2021

The total number of vehicles will grow at 2% annually until 2050. While the number of ICE vehicles is expected to peak in 2038, electric vehicles (EVs) are expected to grow faster.

Vehicle miles traveled consistently grew from 107B in 1970 to 293.3B in 2019, representing a 2% CAGR, until COVID-related lockdowns caused a decline throughout 2020.

Miles traveled have recovered to pre-pandemic levels and during August 2023 stood at 288B.

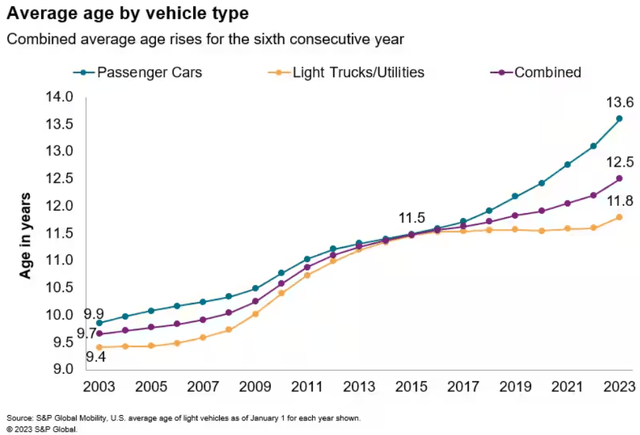

From the vehicle aging perspective, ORLY is enjoying a great opportunity, since the average age has been rising significantly and currently stands at its 20-year high, meaning more repairs will be needed.

S&P Global

Up until now, all is good news for ORLY, an increasing number of vehicles, miles driven at pre-pandemic levels, and vehicle aging at record levels, but there is one aspect that worries investors and that is the repair frequency rate as the EV transition advances.

EV Transition

Although it is true that EVs have fewer parts than ICM vehicles, I do not share the pessimistic view of many investors.

I consider that it would be simplistic to forecast the revenue expectations based on the number of parts of the vehicles, since on ICM vehicles, there are many parts that need to be regularly maintained, while others may never break during the vehicle’s lifetime.

While some studies suggest that the cost of maintenance, repair, and tire costs for EVs is 25% lower when compared to ICM vehicles, others suggest it is less than 7% cheaper.

The way cars are built has been changing significantly over the decades, and while we know for sure that some categories like oil changes will be declining until they disappear, there are also new opportunities arising such as the cooling systems.

Everybody thought the sky was falling when cars went from carburetors to fuel injection. And the same thing with how many ECUs or computers are on a car today.

We sell all those fuel injection parts, we sell all those computers.

(Brad Beckham, 2022 Investor Day)

Also, EVs are not going to be suddenly adapted, but this is a process that will take many years if not decades. While it is easier in cities and dense areas, in rural areas and long distances EVs are going to be more challenged.

Currently, less than 1% of cars in the U.S. are electric and they accounted for 7.9% of revenues during Q3 2023. Expectations are that in 2050 the number of ICE vehicles will still double EVs, so ORLY has plenty of time to adapt its inventory and train the staff.

Even if ICE vehicles grow at a faster pace during the next years and ICE peaks in 2038, since the number of vehicles will increase, the total spending in maintenance will grow at 2% CAGR, assuming a maintenance cost 25% lower in EVs and no inflation.

The overall result for ORLY will depend on how they are able to adapt to these changes, but I have no reason to believe they are not going to stay ahead and continue gaining market share.

Expected Growth

Given that I don’t see that much risk in the EV transition for ORLY and I believe the management is more than capable of finding new opportunities in other areas such as sensors, cooling systems, electronics, and computers, I expect the company can increase its like-for-like revenues at 5% annually.

These assumptions are at the low end of management expectations and they will be in line with inflation and the total number of cars increases.

The number of stores is expected to grow at 3% during this year, but in my base case scenario, I prefer to leave some margin of safety assuming a 2% store growth for the upcoming years. As ORLY becomes bigger, its store growth rate should gradually decline, but the company could pursue acquisitions in the future, consolidating the market and increasing its market share.

IBISWorld

I am not assuming any margin expansion in the base case scenario, although gross margins could increase as ORLY gains pricing power, improves its distribution network, and revenues from proprietary brands increase.

During the first half of the year, the share count has already reduced by 3.12%, and the yearly average reduction since 2014 has been at 5.8%. For the next years, I assume a 5% reduction in shares outstanding.

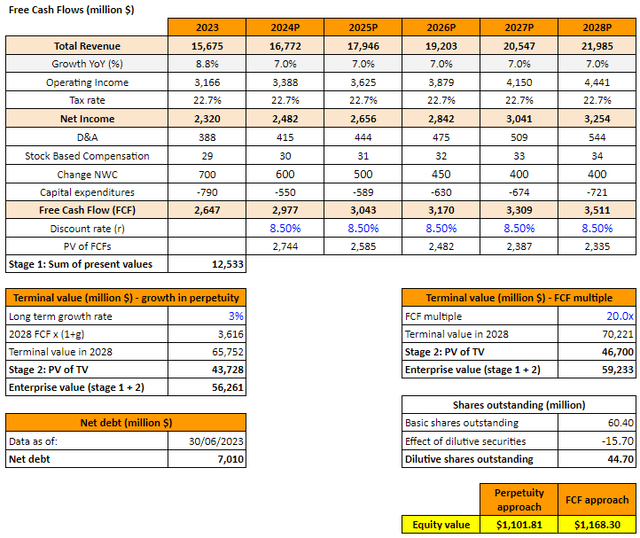

Using an 8.5% discount rate, which I believe is conservative given ORLY is paying less than 5% for its debt, and a 20x last twelve months FCF, my average fair price is at $1,130 per share (24% discount).

Author

Valuation

The consensus EPS forecast for 2024 is currently at $41.81 and ORLY is trading at 22x its NTM EPS, slightly above its 21.5x average.

TIKR.com

While it could be wise for new investors to look for a better entry price and place their buy order around $840 at 20x NTM, there is also a risk of missing an increase in price.

At the current price, during the next 4 years, ORLY could deliver a 13% CAGR on a base case scenario with revenues increasing at the low end of expectations and growth in store count declining.

Risks

Despite not sharing many investors’ worries about the EV transition, there are some risks worth tracking in the future and being aware of the possible effects on the company.

Inflation

An inflationary environment has its risks for the aftermarket auto parts industry and companies can get pressure from the salaries side and from demand reduction. Even the average ticket values can increase if ORLY is able to pass its customers’ price increases, the number of units sold will decrease.

From the supply side of the business, ORLY could be negatively affected on margins if transport costs increase since it imports around 30% of its goods from China. During the last couple of years, the company has been diversifying its supply chain and started buying from other countries and new national suppliers.

ORLY’s business model is quite defensive since spending on new cars will decrease during economic turmoil, while the average age of vehicles and the demand for maintenance will increase.

In a negative economic environment, customers need to repair their vehicles sooner or later, even though in an inflationary environment it is likely they will go for the cheaper product, which has lower margins.

Also, companies like ORLY can benefit from high inflation during short periods of time as long as they don’t have supply disruptions since they enjoy inventory appreciation.

Raising Interest Rates

Raising interest rates shouldn’t have a significant impact on the short term of the company, since interest expenses represent 1.1% of revenues and its long-term debt is at fixed interest rates of around 4%. The company has a revolving credit facility with variable interest rates but there are no borrowings outstanding.

If interest rates remain high for a long time and the company needs to issue more debt to pay back the outstanding Senior Notes, which expire between 2026 and 2032, the costs on interest expenses would increase but won’t have a significant effect on net income margins.

Oil Price Increase

An increase in oil prices could accelerate the transition to electric vehicles, making it harder for ORLY to quickly adapt to the new environment and inventory levels.

If oil prices remain high for a long period of time, traveling would be disincentivized and miles traveled would reduce, affecting negatively the revenues of auto parts.

Conclusions

Despite the ORLY investment having some risks and future challenges regarding the EV transition, I expect the company to adapt to these changes as it has always done.

The market might be excessively worried about the decrease in maintenance costs for EVs since the transition will take many years and the number of total vehicles will make up the lower maintenance costs.

I consider ORLY an outstanding business that operates in an oligopolistic market with pricing power and high returns on capital while conducting an excellent capital allocation.

Given the defensiveness of its business model and the current 24% discount on its fair price, I rate ORLY stock as a strong buy.

“Editor’s Note: This article was submitted as part of Seeking Alpha’s Best Value Idea investment competition, which runs through October 25. With cash prizes, this competition — open to all contributors — is one you don’t want to miss. If you are interested in becoming a contributor and taking part in the competition, click here to find out more and submit your article today!”

Read the full article here