2023 has been a year, which should have been pretty good for banks, but it just hasn’t played out that way. Higher rates have helped net interest income grow over the last few years, while credit quality has stayed quite strong. While the year started well, the panic that exploded in March as SVB and Signature Bank experienced bank runs, has only dissipated slightly for stock investors. Further complicating matters has been the regulatory “solution” to the problems those fringe banks experienced, which is basically broad-based increases in capital requirements, including for the big banks, which already have record amounts of capital, nearly double the capital and liquidity as prior to the Financial Crisis. These headwinds have created an opportunity to buy the common stock of Bank of America (NYSE:BAC) at a large discount to intrinsic value, providing nearly 50% upside potential over the next 2-3 years.

Under the stellar leadership of CEO Brian Moynihan, Bank of America has become one of the best banks in the world. The bank combines fantastic assets and operating businesses, great credit quality, and the size to be able to invest heavily in technology, which is more important than ever. The bank boasts an extremely low-cost deposit base, which is the envy of the industry in many respects. The bank has endured numerous major headwinds over the last decade, including Brexit, record-low interest rates, Covid lockdowns, and this inflation-induced rate-hiking cycle. Moynihan and his team really do a good job focusing on the basic blocking and tackling, making improvements in operating leverage, while increasing market share in its key businesses.

Bank of America 2nd Quarter Investor Presentation

Bank of America 2nd Quarter Investor Presentation

The bank has been a major beneficiary of higher rates which is evident in its net income growth, but like nearly all banks that had very few investment options on their massive excess reserves, BAC did misfire by adding too much duration when rates were incredibly low. The reality is that deposits in excess of loans grew from $0.5T in Q4 19 to $1.1T in Q4 21-Q1 22, and these excess deposits were stored in cash and investment securities. The bank still has $0.8T in excess deposits as of June 30, 2023, while 54% of those previous investments were held-to-maturity, and 46% were cash and available for sale securities. The misfire has been magnified by the failures of those fringe banks that aggressively grew their deposits with hot money, only to make huge, long duration bets where the rewards were paltry, while the risks were massive. BAC ended Q2 with $1.877 Trillion of deposits, which was down from $1.910T in Q1, and $1.984T a year ago. Many of BAC’s deposits are truly core operating deposits for companies and consumers and are therefore less of a flight risk than say the venture capital companies that dominated the SVB deposit base. Often noninterest bearing deposits have been migrating to higher-yielding options within the same bank, which adds to costs, but also has been an expected outcome. Deposit betas have outperformed relative to expectations until very recently, so barring bank runs, these issues are very manageable for the vast majority of banks, particularly the most important institutions such as Bank of America.

Bank of America 2nd Quarter Investor Presentation

Bank of America 2nd Quarter Investor Presentation

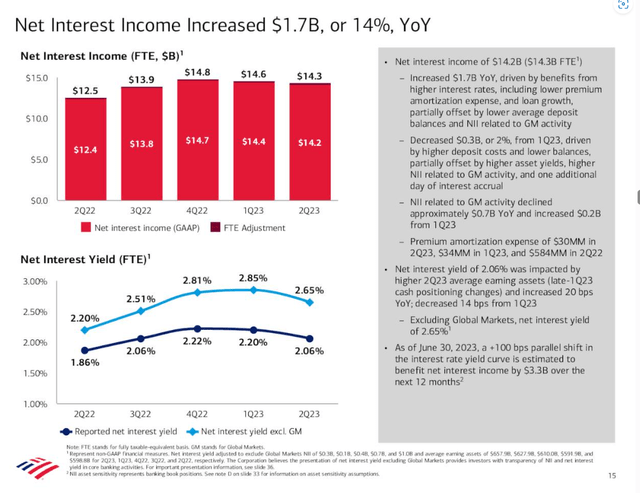

Bank of America had a very strong second quarter with earnings per share of $0.88, which was up 21% YoY. Revenue, net of interest expense of $25.2B, was up $2.5B, or 11% YoY. Net income of $7.4B was up 19% YoY. Net interest income was $14.2B, up $1.7B, or 14% YoY, largely due to the benefit of higher rates. Noninterest income was up 8% YoY to $11B, as higher sales and trading revenue more than offset lower service charges and investment and brokerage fees. Pretax, pre-provision income of $9.2B, was down 9% sequentially, but was up 17% YoY and was still obviously at very healthy levels. Nearly all the businesses grew organically, while the bank created operating leverage for the eighth consecutive quarter, which is a testament to management’s impressive work managing costs in an inflationary environment. BAC posted a ROCE and ROTCE of 11.2%, and 15.5%, respectively. The return on average assets was 0.94%.

Bank of America 2nd Quarter Investor Presentation

Bank of America 2nd Quarter Investor Presentation

BAC posted a provision for credit losses of $1.1B, including a net reserve build of $256MM, versus a release of $48MM a year ago. While credit losses are normalizing, net charge-offs of $860MM remained below pre-pandemic levels, which in itself was a period of good relative credit quality. The net charge-off ratio increased by 10 bps YoY to 33 bps. On the Consumer side, the allowance for loan losses stood at $7.75B, or 1.7% of total loans and leases, which is 2.68x annualized NCOs. On the Commercial side, the allowance for loans and leases was $5.2B, or 0.88% of loans and leases. These are very healthy reserves and due to CECL accounting where projected loan losses are frontloaded, they include some recessionary scenarios. BAC’s credit performance during 2020 was exemplary even in the worst reserve provisioning quarters, and of course thanks to generous government stimulus, those loss reserves proved to be way too conservative in that scenario. BAC is a reasonably conservative bank, very different than 15 years ago, when it had to digest the horrendous Countrywide acquisition. The bank is far less aggressive than competitors on both mortgages and credit cards, which were significant loss contributors during that recession.

Despite a period of substantial customer anxiety due to the “Bank Panic” which stemmed from pathetic duration mismanagement by a few oddball banks, BAC added 157,000 new checking accounts, 1.2MM credit card accounts, and 3.7MM consumer investment accounts in the quarter. Merrill Lynch and the Private Bank added 12,000 net new relationships in the quarter and has brought in $83B of total client flows since the second quarter of 2022. Merrill sent 52,000 referrals to other lines of business, speaking to its cross-selling strength. Global Banking saw $2.9B of Global Transaction Services revenue, which was up 23% YoY, while the investment bank ranked #2 in fees, growing its market share by 153bps YoY. Global Markets posted the highest first-half sales and trading revenue in over a decade. Average loans of $129B were up 12% YoY, and credit trading revenue was up 47% for the first half of 2023. The bank had zero trading loss days in the first half of 2023.

Bank of America 2nd Quarter Investor Presentation

The standardized CET1 ratio ended at a very healthy 11.6% up 23bps from Q1, while the company retained $876B of global liquidity sources. Average loans and leases grew $5B sequentially, while deposits decreased by $18B from Q1 23. BAC paid $1.8B in common dividends and repurchased $0.5B of common stock, mostly just offsetting shares awarded under equity-based compensation plans. The company announced that it will be enhancing its dividend by 9% beginning in Q3.

BAC ended the quarter with book value and tangible book value per share at $32.05, and $23.23, respectively. These numbers were up from $29.87 and $21.13, respectively, YoY. At a recent price of $28.76, BAC is only up a bit from its 52-week low of $26.32 and is down meaningfully from its 52-week high of $38.60. The stock trades at a discount to book value and just 1.13x tangible book value, which is way too cheap for a bank that is generating an ROTCE in excess of 15%. The stock trades at just 8.5x forward earnings and pays a solid and sustainable yield of 3.33%. While the projected increases in capital requirements are a negative for BAC and the industry in itself, those changes will take several years to occur, and hopefully will be watered down a bit, because they are really not needed whatsoever for the big banks who were not the problem this year. Capital markets have been very weak for the last year but are starting to show signs of opening up again, albeit at far higher rates, which should bode well for the investment banks. Ultimately, when rates do head down again, we are likely to see a massive refinancing boom once again. The industry is certainly out of favor, but long-term investors would be wise to accumulate shares at current levels, as I believe the stock has the fundamentals to trade in excess of $40 once again.

Read the full article here