Palantir (NYSE:PLTR) stock surged more than 20% after reporting Q1’23 earnings results; we continue to be buy-rated on the stock. In the context of the public wake-up to A.I. capabilities after OpenAI’s launch of ChatGPT and the current A.I. race between Microsoft (MSFT), Alphabet (GOOG), and the entire tech sector, we expect Palantir to be well-positioned to outperform in 2H23 and 2024. We believe Palantir will be among the fastest players to monetize A.I. to be profitable as A.I. is not new to the company; they’ve been in the business of data analytics for 20 years now. In Q1’23, the company reported its second consecutive quarter of GAAP net income profitability, at $17M, and its first-ever GAAP operating income profitable quarter with $4M of operating income. Palantir CEO, Alex Karp, expects the company to continue turning a profit every quarter toward the end of the year. Palantir reported net income from operating activities of $19,151 this quarter compared to $101,379 in Q1’22. This quarter also broke the record for free cash flow, reporting $189M, the strongest free cash flow quarter ever. We believe the company’s putting to rest investor concerns that Palantir is overhyped or unprofitable.

Our bullish sentiment is driven by our belief that the macro picture, though grim, arms Palantir with an attractive risk-reward profile. Palantir is a software company that develops “data fusion platforms” and “facilitates machine-assisted and human-driven data analysis.” Their main customer so far has been the U.S. government. We expect Palantir’s Artificial Intelligence Platform (AIP) launched just two weeks ago, to expand the company’s SAM and drive outperformance in 2024. AIP allows commercial and government customers to use large language models for their own private data sets.

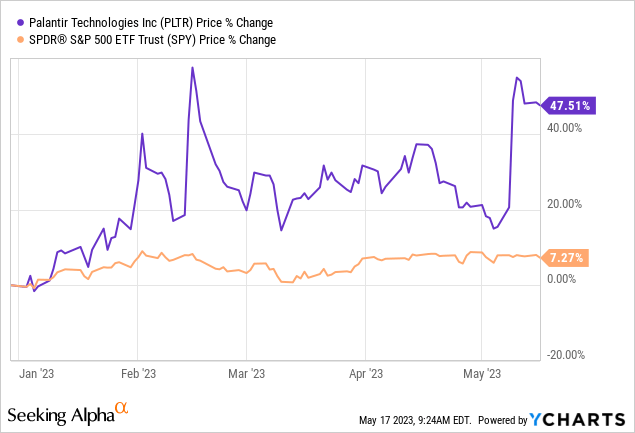

The stock is up roughly 13% since we published our buy-rating on the stock, outperforming the S&P 500 by 10%. YTD, the stock is up 48%, while the S&P 500 is up 7% during the same time. The following chart outlines the stock’s performance YTD against the S&P 500.

YCharts

Q1’23 and the “Just take the whole market” Strategy

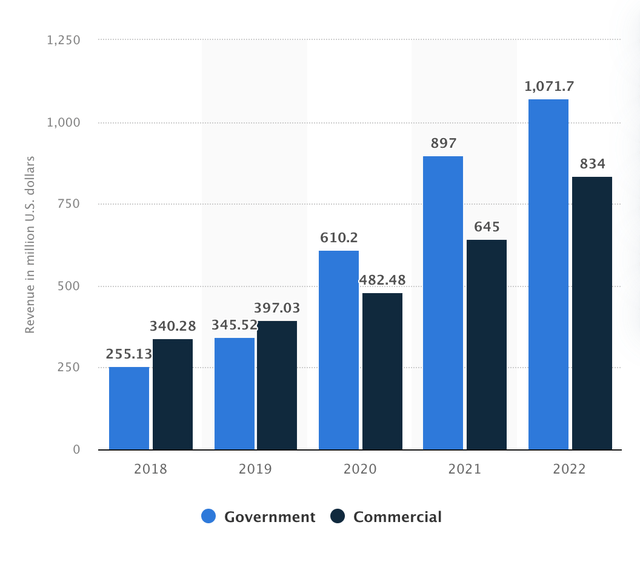

Palantir’s Q1’23 earnings report highlights a turnaround moment for the company, consistent with our investment thesis back in February. The company beat estimates on top and bottom lines, reporting Non-GAAP EPS of $0.05 and revenue of $525.19M, up around 18% Y/Y. We’re constructive on the company sustaining profitability as it monetizes A.I. for enterprise and military use and expands its customer base. Karp stated that the company’s strategy in the A.I. space is “just take the whole market.” We expect Palantir’s investment in A.I. to pay off big time amid the current race for A.I.-powered solutions. Palantir’s revenue has been primarily driven by government revenue, with government revenue at $289M this quarter, up 20% Y/Y from $242M in Q1’22, and U.S. government revenue growing 22% Y/Y. The following chart outlines Palantir’s revenue by segment as of 2022.

Statista

We’re constructive on government utilization of A.I. driving the stock higher as Palantir has the suitable client base to leverage its AIP defense. Another bright spot on the earnings call was the re-acceleration of Palantir’s U.S. commercial business, up 26% Y/Y and 39% sequentially. Customer count in U.S. commercial business soared 50% Y/Y. We expect U.S. commercial businesses to make up a more substantial part of revenue as the macro headwinds ease in 2024. We see an upside for the stock in 2H23 and 2024 as the company focuses spending on A.I. initiatives; in February, the company cut 2% of its workforce and is restructuring its cloud spending.

Looking ahead, the company projects sales between $2.185B and $2.235B for the full year. Expectations for Q2’23 revenue are slightly lower than consensus, at $528M to $532M. The company is under pressure to walk the talk of profitability and is betting on recovering commercial demand, which may be challenging if economic conditions worsen further. Still, we expect the company to outperform going forward due to its competitive edge in launching AIP and expanding its customer base. We recommend investors buy the stock on pullbacks.

Valuation

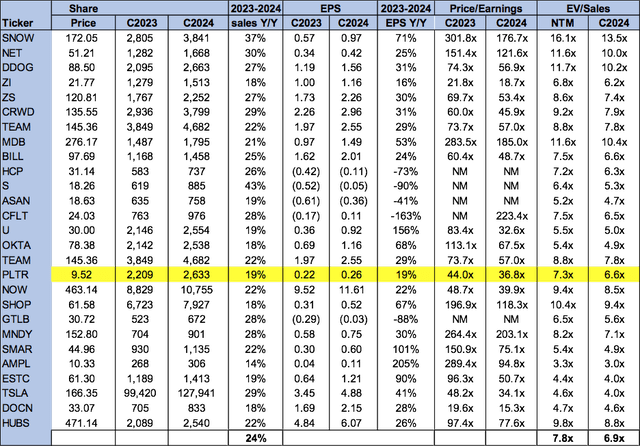

Palantir stock is reasonably valued. On a P/E basis, the stock is trading at 36.8x C2024 compared to the peer group average at 82.1x. The stock is trading at 6.6x EV/C2024 Sales versus the peer group average of 6.9x. We see favorable entry points into the stock at current levels and believe investors buying the stock will be well rewarded into 2024.

The following chart outlines Palantir’s valuation against the peer group.

TechStockPros

Word on Wall Street

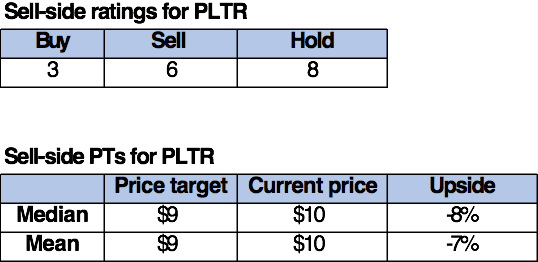

Wall Street is bearish on the stock. Of the 18 analysts covering the stock, three are buy-rated, six are sell-rated, and the remaining are hold-rated. We attribute Wall Street’s bearish sentiment to macro uncertainties tightening enterprise and government budgets in the near term. We don’t believe Palantir is immune to macro headwinds but expect hype around AIP to help offset the weaker spending environment.

The following chart outlines Palantir’s sell-side ratings.

TechStockPros

What to do with the stock

We maintain our bullish sentiment on Palantir stock as we expect the company to outperform in 2H23 and 2024. We believe Palantir is well-positioned to monetize the A.I. hype into profitability, and the company’s Q1’23 earnings report backs our investment thesis. We see Palantir’s government revenue growing on demand for defense utilization of A.I. We’re also more confident that commercial revenues will increase to become a more substantial amount of total sales. The stock is trading at roughly $10 per share, trading 40% higher than its 52-week-high of $5.92. We recommend investors begin exploring entry points into the stock on pullbacks.

Our Investing Group, Tech Contrarians, will launch on June 1st with a significant discount on the annual subscription for the life of the service. We cover everything software/hardware and semiconductors as engineers turned top analysts. Keep reading our work to see more of what’s ahead.

Read the full article here