Investment thesis

I maintain my Strong Buy rating on PayPal Holdings, Inc. (NASDAQ:PYPL) following the release of its Q3 earnings report yesterday (November 1) and the introduction of a new CEO. As the result came in roughly in line with my expectations, I also largely maintained my long-term financial projections and expect PayPal to keep growing revenue by high-single-digits and EPS in the low-to-mid-teens. With shares still valued at depressed valuations and down another 20% since my last article, these continue to present excellent value.

PayPal released its Q3 results yesterday, and following a minor top and bottom-line beat, shares are up 5% at the time of writing. Nevertheless, PayPal is down 20% percent since I last covered the shares after the Q2 earnings release, largely driven by deteriorating sentiment and a tough near-term economic outlook, which could increasingly start to impact consumer spending, impacting PayPal’s payment volume.

However, shares were already ridiculously undervalued back then. After another 20%% decline and results showing no substantial weakness, these are now trading at just 10.5x forward earnings, which is completely out of this world.

If you are looking for a deep-value idea, this is it! According to Wall Street’s projections, PayPal is now trading at an earnings multiple of 10.5x while being projected to grow sales by high-single digits for the foreseeable future and EPS in the mid-teens. Yet, shares are priced as if the company is not expected to grow at all.

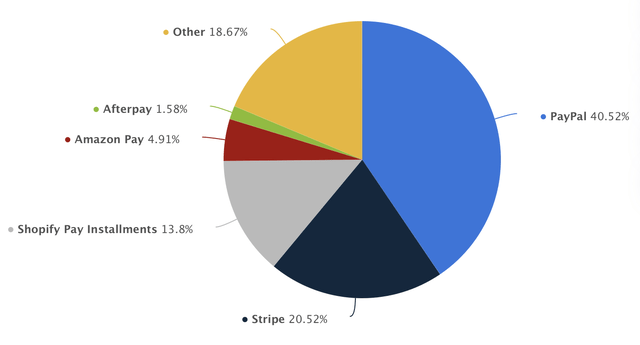

Meanwhile, PayPal continues to hold a 40.5% market share in online payment processing. With the digital payments industry projected to grow at a CAGR of 11.8% through 2027, the company undeniably has a solid growth outlook.

Digital payment processing market share (Statista)

Yes, the company has seen better days as competition is increasing, and the economic outlook is not looking great. Still, it remains one of the most broadly used payment platforms globally, with over 400 million active users and nearly $400 billion in payment volume flowing through the platform each quarter and $1.5 trillion over the last twelve months.

70% of Americans have used PayPal in the last five years, and while this is not the same as active customers, it does highlight the sheer breadth of PayPal’s offering and brand recognition. Furthermore, PayPal continues to expand its offering to grow its total addressable market, or TAM, and after the introduction of the Venmo Teen account, it now has exposure to all consumer groups.

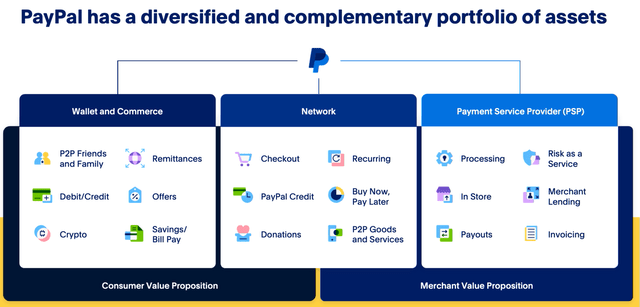

PayPal

Meanwhile, the company also has plenty of growth levers through new payment methods like Buy Now, Pay Later (“BNPL”), in which the company is also leading the way, as pointed out in my previous article:

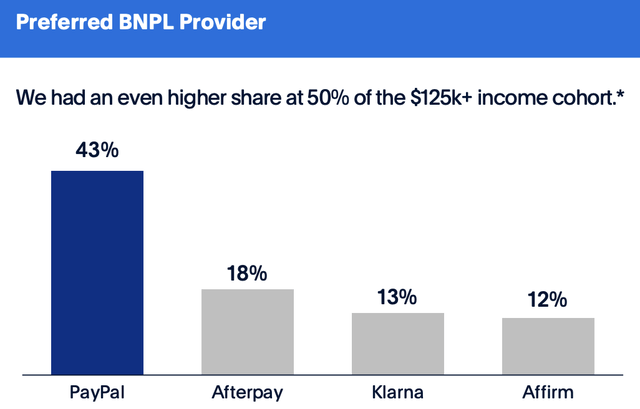

Furthermore, according to PayPal, the platform is the preferred buy now, pay later (“BNPL”) platform among consumers with 43% of BNPL users leveraging the PayPal platform. Among the high-income cohort, PayPal even reaches a share of above 50%, according to a survey performed by JPMorgan.

PayPal

Overall, I maintain the belief that PayPal is one of the best-positioned digital payment processors globally and should be able to grow TPV in the high-single to low-double digits for the foreseeable future, slightly below the growth projected for the industry as I do expect the increasing competition to cost it some market share. However, this will largely depend on management’s execution and rate of innovation. It is therefore worth mentioning, before we get into the quarterly results that PayPal has shaken up its management team.

Management changes are a positive – PYPL’s focus shifts to SMBs and Enterprises

Over the last few months, PayPal has announced a new CEO, CFO, and CTO. The new CFO will start in November, and the new CTO will start next year. Meanwhile, yesterday’s earnings call was the first for new CEO Alex Chriss, who started September 27 and so will have had, of course, no time to put his mark on the Q3 results yet.

The new CEO used to run Intuit’s (INTU) Small Business and Self-Employed group, showing the ability to become and remain a market leader and find ways to drive growth, which is precisely what PayPal desperately needs to regain investor confidence and get out of its negative spiral.

The CEO has strong experience working with small businesses and has overseen multi-billion-dollar acquisitions, an experience that could come in handy in his new role as PayPal CEO. While Alex may not have been the obvious choice for the role, this is a good move by the PayPal board. The man is relatively young at 46 years old and brings a fresh new wind, a lot of ambition, and vision into the company.

Alex’s experience with small businesses could potentially boost PayPal’s efforts in winning among these same customers as well, which is still a large opportunity for the company. During the earnings call, the new CEO already highlighted that he wants to focus his efforts on finding ways to improve the value offering to all three customer categories: consumers, small businesses, and large enterprises. Two quotes from the earnings call that stood out to me were the following:

“We must simply execute better and with higher velocity, and we will.”

“I can tell you right now what I care about most is high-quality customer growth and profitable revenue growth.”

For sure, Alex seems to have his priorities in the right place. And while the CEO has not had much time yet and will introduce a more actionable plan when PayPal reports its Q4 results, he has already given some insight into what to expect.

First of all, to maximize profitability and operations, PayPal will focus on technology consolidation and automation across the company as the cost base remains too high. He added the following:

We will become leaner, more efficient, and more effective, driving greater velocity, innovation and impact for customers.

PayPal already reports great margins, but Alex clearly sees more potential for cost-savings and efficiency improvements. As for the earlier mentioned growth in “high-quality customers,” the new CEO seems to have his eye set on significant expansion of the company’s operations to better serve SMBs and enterprises, which are higher quality customers due to the large and less economically sensitive volumes this brings to the platform.

Furthermore, he will aim to increase the number of transactions per active account, increasing user value, by increasing convenience, security, and availability.

PayPal is already working hard on improving the customer experience by improving accessibility and security through innovations like Passkeys and the introduction of PayPal and Venmo cards in the Apple Wallet. This should help the company grow TPV per user.

Furthermore, as of today, PayPal serves approximately 35 million active merchant accounts but will most likely focus more of its resources on growing this number over the next few years. However, more will become clear on this with the next earnings call.

Meanwhile, PayPal has already been working on this by recently releasing the PayPal Complete Payments solution, which should help small businesses sell globally and accept a range of payments, including PayPal, Venmo, and PayPal Pay Later products, to help drive checkout. PayPal now aims to launch this product globally over the next couple of quarters, which should help make its platform more attractive to SMBs.

For enterprise customers, PayPal already has a strong offering with Braintree, which continues to be a growth driver, as will be highlighted in the quarterly results in a moment. With the introduction of this platform, PayPal has proven that it can win in this market and take market share. With processed volumes of $450 billion over the last twelve months, it has a market share of approximately 10% of the payment volume of global large enterprise e-commerce, giving it a strong foothold in a massive industry.

As PayPal focuses more on winning the payment volume of SMBs and Enterprises, I believe this could accelerate growth if executed correctly, giving the company an even more reliable revenue stream. Overall, I am quite happy with the new CEO and will keep a close eye on the action plan to be introduced with the Q4 results.

PayPal Q3 results – Revenues and TPV growth remain solid

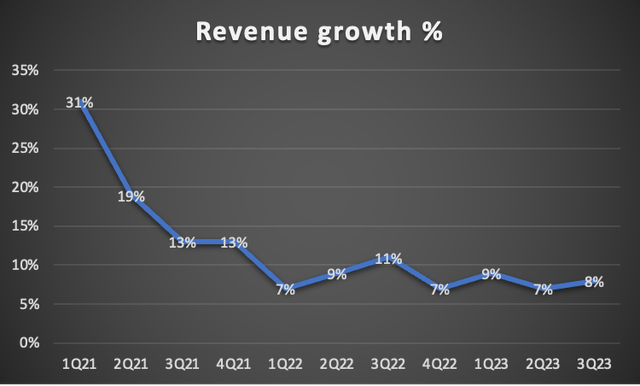

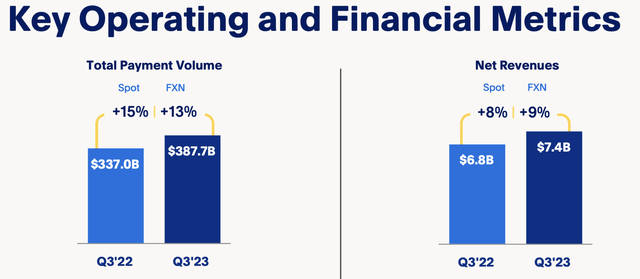

Now, moving to the Q3 results, PayPal reported revenue of $7.4 billion, up 8% YoY and sitting roughly in line with the Wall Street consensus. Also, this is a growth acceleration compared to the previous quarter (7%) but still down from Q1 (9% growth), indicating that growth remains stable in its 2-year range of high-single to low-double digits.

PayPal revenue growth (By Author)

Total payment volume (TPV) increased by a very impressive 15% YoY to $388 billion, driven by 10% growth in the US and 19% growth in International TPV, which accelerated by five percentage points sequentially in Q3 due to strength in Europe and Asia.

TPV is the most important indicator of operational health for PayPal, as this highlights growth in the usage of its platform. In the end, PayPal can only grow revenues if TPV grows as it takes a piece of each dollar processed through the platform. With TPV up 15% in Q3, this shows that PayPal continues to see strong activity growth. Unlike what some analysts claim, PayPal continues to operate as one of the strongest digital payment platforms globally and continues to see strong demand and growth in volumes.

Q3 financial data (PayPal)

Q3 TPV growth was mainly driven by volume growth in Braintree, indicating there might have been some weakness in consumer activity, which was offset by strong enterprise volumes. Venmo TPV increased 7% to $68B

PayPal’s global branded checkout volumes grew approximately 6% in the quarter on an FX-neutral basis, relative to 7.5% growth in Q3 last year. Growth has stabilized so far in Q4 and is in line with the year’s first half.

Meanwhile, the difference in growth rates between revenue and TPV resulted from a lower take rate, which was down 12 basis points to 1.91% (transaction take rate of 1.72%). Most of this decline resulted from lower gains from foreign currency hedges, a reduction in foreign exchange fees, and the headwind from lapping elevated contractual compensation from merchants last year. The take rate should stabilize going forward and recover by the second half of next year.

PayPal Q3 results – Increased user activity offsets Struggles in account growth

PayPal continues to struggle in terms of account growth, with this once again being down 0.9% YoY to 428 million active accounts (down 2.8 million). According to management, this is simply the outflow of low-quality customers from primarily Latin America and Southeast Asia, which is why payment volume is not seeing much of an impact from these user declines. Nevertheless, these consistent customer losses are far from positive.

I expect account growth to turn positive again in 2024, although at low-single digits, and to accelerate by 2025. Management has introduced several new products over the years, and considering the new CEO’s focus on high-value account growth, I see quite some incentive for faster growth here, especially in merchant accounts, which might drive faster consumer account growth as well.

PayPal certainly has a lot of room to grow user numbers, and while I do not expect this to return to consistent double-digit growth, it does not have to. While the disappointing growth in active accounts is far from ideal, it is not thesis-breaking. PayPal still has a long growth runway by simply leveraging its existing customers through additional offerings and higher purchasing activity.

The number of transactions through the PayPal platform was up 11% in Q3 to 6.3 billion and offset the decline in users comfortably. The number of transactions per active account was up 13% YoY and has shown a strong and consistent uptrend, driven by growth in Braintree.

As long as PayPal can grow the number of transactions by user, I view the current weak user growth numbers as a manageable problem. The market has been massively overreacting to these numbers in recent quarters. Don’t get me wrong here; losing customers is never a positive, but looking at external factors and how the underlying business is performing, we should not get overly worried by this. PayPal’s growth potential stretches beyond just growing users, and the current declines are still expected to be only temporary and should improve soon.

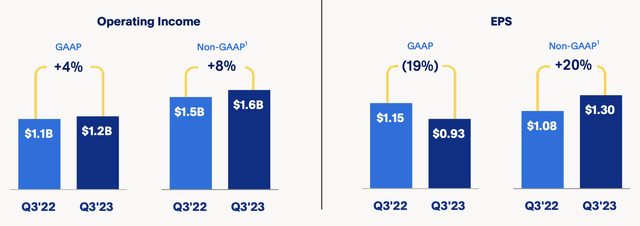

Moving to the bottom line, the operating margin was down 18 basis points YoY but up 80 sequentially to 22.2%, resulting in an operating income of $1.6 billion. Net income was up 14% YoY, but EPS was up an even more impressive 20% due to PayPal retiring a significant number of shares over the last year. EPS was $1.30, beating the consensus by $0.07.

PayPal Q3 financial data (PayPal)

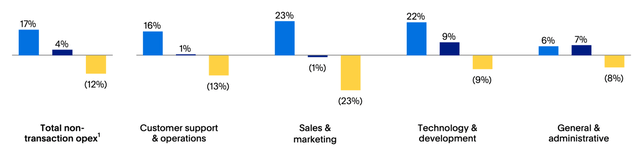

These strong margins were driven by a growing top line, and management showing solid efficiency improvements and cost savings, resulting in non-transaction-related expenses falling 12% YoY.

Operating expenses 2021, 2022, 2023 (PayPal)

This resulted in free cash flow (“FCF”) of $1.1 billion, representing an FCF margin of 15%. However, excluding temporary impacts on FCF, this was $1.9 billion, up 21% YoY. PayPal remains a cash flow machine, generating $3.8 billion in FCF YTD.

This allowed the company to grow its net cash position by $0.5 billion sequentially to $4.4 billion, comprised of $15 billion in cash and $10.6 billion in total debt. In the third quarter, management bought back $1.4 billion in shares, well covered by free cash flow. This means PayPal has now reduced outstanding shares by 7% over the last eight quarters.

Outlook & Conclusion – Is PayPal stock a buy, hold, or sell?

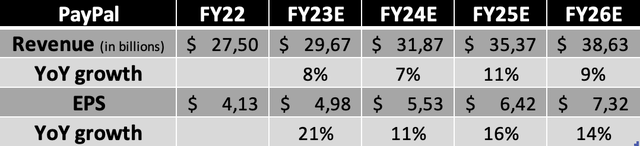

Following a slight slowdown in branded checkout growth, management now expects Q4 revenue to grow between 5% and 7%, slowing down from previous quarters but still sitting at the low end of its two-year range. This would result in revenue of around $7.9 billion at the midpoint of guidance, slightly below my expectation of $8.22 billion. As a result, management now expects revenue to be up 7.5% YoY for FY23.

Furthermore, management expects a slight YoY contraction in the operating margin in Q4, resulting in EPS to be approximately $1.36, representing 10% YoY growth. As a result, management now expects the FY23 operating margin to expand by 75 basis points from a previous 100 due to a shift in the product mix due to weakness in branded checkout and strength in Braintree. Nevertheless, a higher revenue number allowed management to upgrade EPS guidance to approximately $4.98, representing 21% YoY growth.

Taking these Q3 results, the Q4 outlook, and some operational developments, I now expect the following financial results through FY26. I have slightly lowered my FY24 sales and EPS forecast to account for a prolonged period of economic weakness and some slight operating margin weakness to persist throughout the year due to a change in revenue mix. Still, my long-term targets remain essentially unchanged.

Financial projections (By Author)

(Q4 revenue of $7.96 billion and EPS of $1.35).

Based on these expectations, shares are now, even after a 5% share price jump following the results, still valued at just 11x this year’s earnings, which, as I explained at the start of this article, is just ridiculous when considering the global strength and importance of this company.

This means shares are now valued at a 70% discount to the 5-year average valuation. While I agree that it should be trading at a significant discount with growth nowhere close to where it was over the last five years, considering the company’s growth outlook and incredible margin profile, I would argue that it deserves to be valued at 17x earnings at the bare minimum.

Based on my FY24 EPS forecast, this results in a price target of $94 per share, leaving an upside of 70%. Furthermore, using a 15x multiple and my FY25 EPS projection, this should mean investors are poised for annual returns exceeding 28%. Note that this leaves a lot of further upside for multiple expansions.

Overall, I have not changed my stance toward the shares and the company since the Q2 earnings report and continue to believe that PayPal Holdings, Inc. shares continue to trade at a significant discount to fair value, presenting an excellent investment opportunity. I have been adding to my position over the last three months, and as long as shares trade below my fair value estimate of around $80 per share, I will continue adding.

With PayPal Holdings, Inc. shares still presenting massive upside potential after posting Q3 results roughly in line with my expectations, I maintain my Strong Buy rating with a slightly lowered price target of $94 per share (down from $101).

Read the full article here