Description

My buy rating for Pegasystems (NASDAQ:PEGA) remains unchanged following the release of 1Q23 results, as the stock price has yet to reflect the intrinsic value I attribute to the company. In particular, PEGA’s ACV growth has been strong continuously, and it is now growing above its own ACV growth guide. The success of PEGA’s sales team, which has done an excellent job of penetrating the company’s current base of large customers, is a big reason for the company’s consistent success, in my opinion. The primary growth indicator for subsequent quarters (backlog) also increased, reaching 14% growth, a full 1000bps above 4Q22 growth. In my opinion, this is a testament to the success of the move to Pega Cloud, which should remain a driving force behind future expansion. Revenue and profitability came in below consensus, which may explain why PEGA stock price did not react as strongly as I had hoped. However, in my opinion, the miss in earnings was purely optical and not structural. Based on my analysis, I believe that the revenue mix shift to Pega Cloud mainly contributed to the poor term-license revenue performance. Once the transition is done, I anticipate a surge in activity similar to Pega Cloud’s explosive expansion. In sum, I am heartened by the efficient operation, and I think the current valuation represents a good opportunity for long-term investors who are willing to be patient.

Business model advantage

I have briefly touched on PEGA competitive advantage previously, which was its ability to utilize AI to automate processes and is highly adaptable and capable of digitizing most business processes. I think it’s important to go into more depth about AI because of the recent surge in interest in it (thanks, ChatGPT). With its model-driven approach, I think PEGA has a leg up on the competition when it comes to the topic of generative AI. At the current stage, PEGA models and software are being informed by generative technology, which simplifies solution implementation and developer support. PEGA is also taking strategic steps to enhance its capabilities in this area, integrating Bedrock from AWS and tools from other leading cloud providers. This integration empowers developers to efficiently build and scale Generative AI applications in the cloud. Of notable importance is PEGA’s proactive approach to mitigate the potential impact of increasing automation on its customer base. The company has successfully transitioned from user-based pricing to an outcome-based revenue model, which management anticipates will eventually dominate the company’s revenue streams, currently comprising 75% of its business. This shift provides insulation against potential challenges arising from the adoption of AI, ensuring a stable and sustainable revenue stream for PEGA. Overall, I believe the value of this generative AI ability lies in its fundamental capacity to stimulate further demand. This is especially true for PEGA, as its platform allows for complex workflows to be accomplished with little to no programming.

Pega Cloud

My opinion is that the revenue and profit shortfall compared to the consensus is not cause for alarm because it is primarily an optical issue (i.e. P&L does not reflect the underlying change in business accurately). The miss was primarily driven by a 39% decline in term license revenue, which is naturally expected as PEGA is shifting clients to cloud. Mathematically, revenue will decline as cloud recognition happens across a period of time while term licenses are one-off. The same logic applies to profits as well. While some might argue that Pega Cloud did not perform as well as it should have, I would point out that the 19% growth Pega Cloud faced a tough comp last year. It’s also worth noting that PEGA has been putting most of its effort into tapping into its existing (albeit only 10% penetrated) customer base. As PEGA pursues new logos in the coming months, I anticipate a growth spurt in the near future.

Macro weakness

Despite my confidence in the company and the stock, I am wary of the macro environment, which shows no signs of improving soon. Fortunately, PEGA appears to be handling this period well, and management noted that it has not seen the macro environment worsening the business in 1Q23. It appears that PEGA’s underlying customers are resonating well with the company’s transition to the cloud, and most importantly, PEGA’s sales teams have executed well to capture this demand. Therefore, I continue to have some hope that PEGA will make it through this period unscathed.

Valuation

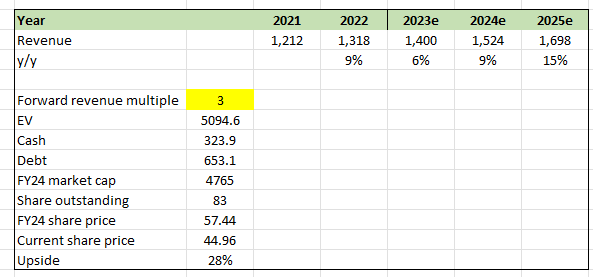

PEGA’s valuation remains appealing at 2.8x revenue if investors are willing to wait for growth to inflect as the transition to Pega Cloud is completed. Using the FY23 guided revenue figure and my assumption of accelerated growth, PEGA should generate around $1.7 billion in revenue in FY25. Even if we assume that revenue multiples do not inflect, as I believe they will, the upside from the current share price is still very appealing at 28%.

Author’s model

Summary

In conclusion, my buy rating for PEGA remains unchanged based on the recent 1Q23 results. PEGA’s strong ACV growth and the increase in backlog and the successful transition to Pega Cloud demonstrate the potential for future growth. While revenue and profitability fell below consensus, I believe this is a temporary optical issue driven by the shift to Pega Cloud. PEGA’s model-driven approach and integration of generative AI technology position the company favorably in the market. The transition to an outcome-based revenue model insulates PEGA from potential challenges arising from increasing automation. Despite macroeconomic uncertainties, PEGA has navigated this period well, and its sales teams have executed effectively. Lastly, the current valuation of PEGA presents an appealing opportunity for long-term investors, with potential upside as growth accelerates and the transition to Pega Cloud is completed.

Read the full article here