Note:

I have covered Performant Financial Corporation (NASDAQ:PFMT) previously, so investors should view this as an update to my earlier articles on the company.

More than two years ago, I praised Performant Financial Corporation’s (“Performant Financial”) decision to abandon its legacy student loan recovery business and focus on the rapidly growing healthcare segment:

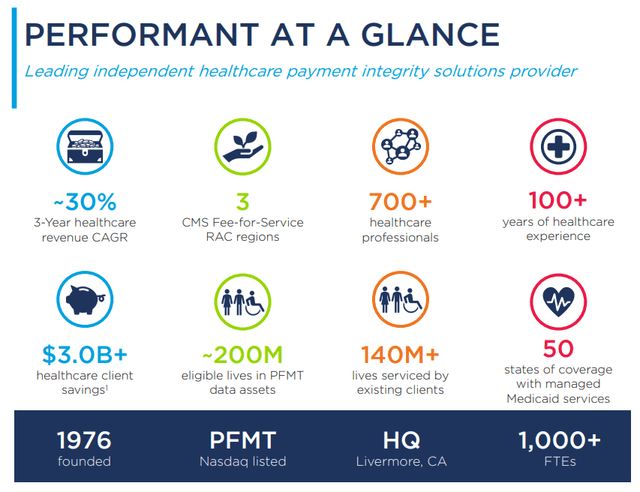

Company Presentation

Unfortunately, the performance of the new core business hasn’t always lived up to expectations in recent quarters.

Lower-than-expected profitability required the company to seek covenant relief under its credit agreement with MUFG Union Bank, which was originally scheduled to mature on December 17, 2026.

In exchange for a $7.5 million prepayment, termination of the revolving loan commitment, higher applicable margins, and advancing the maturity date by two years, MUFG agreed to modify certain covenants to provide the company additional time to improve profitability and move closer to management’s targeted Adjusted EBITDA margin of 20%+.

Regulatory Filings

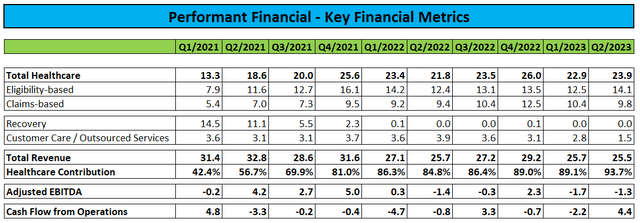

Last week, the company reported second quarter results with core healthcare revenue up both sequentially and year-over-year as well as decent cash generation.

That said, growth in the core healthcare business was hampered by lower claims volumes under the company’s government contracts while revenues for the legacy customer care / outsourced services segment declined even faster than expected and are not likely to recover to previous levels anytime soon as outlined by management on the conference call:

Our customer care/outsourced services business accounted for $1.5 million in revenues for the quarter. As a reminder, we anticipated our customer care revenues to decline sequentially until the restart of the federal student loan programs.

That being said, this quarter’s results reflected a steeper decline than both we and our client had anticipated. On a positive note, the programs are expected to restart in the latter half of this year. With that, we anticipate the renewed possibility of growth within customer care that will likely remain at the sub-$2 million mark for each quarter for the remainder of 2023.

Though the margin impacts are quite muted in comparison to what our healthcare market revenues drive, this near-term expectation could have a modest impact to EBITDA, call it roughly $0.5 million. We believe we’ll have a much clearer picture as to the future of our customer care market revenues as we close the year.

Despite recording negative Adjusted EBITDA of $1.3 million for the quarter, favorable working capital movements resulted in Performant Financial generating $3.0 million in free cash flow thus improving cash and cash equivalents to approximately $15 million at quarter end.

Taking into account the credit agreement’s $2.0 million minimum liquidity requirement, available liquidity at the end of Q2 was approximately $13.0 million, up from $10.3 million at the end of the first quarter.

On the conference call, management reiterated previous expectations for full-year healthcare revenues to come in between $105 million and $110 million and projected a range of $6.75 million to $8.0 million for the legacy business. Consolidated gross margin is expected to remain in the 40% range.

Given the company’s mediocre first half performance, achieving full-year healthcare revenue projections won’t be an easy task.

Bottom Line

Following a less-than-stellar first half performance, Performant Financial Corporation will require core healthcare revenues to grow by almost 25% from muted H1 levels to achieve the low end of management’s guidance.

Considering near-term execution risks and ongoing profitability issues Performant Financial Corporation’s risk/reward continues to look unfavorable.

As a result, investors should avoid the shares or even consider selling existing positions.

Read the full article here