Pfizer (NYSE:PFE), a titan in the pharmaceutical realm, stands at a crossroads, grappling with significant year-over-year revenue and earnings declines. These challenges are further compounded by the looming patent expirations of their leading drugs, which threaten to erode profits in the near future.

Yet, beneath this challenging facade, Pfizer’s narrative is woven with hope and strategic vision. A robust dividend yield underscores the company’s resilience, while upcoming product launches hold the promise of rejuvenating its revenue streams. This piece offers a technical examination of Pfizer’s stock price to gauge its potential future direction and pinpoint investment prospects. The stock is noted to be trading at a pivotal support level, indicating a promising long-term buying opportunity.

Pfizer’s Resilience Amidst Financial Challenges

For the second quarter of 2023, Pfizer reported revenues of $12.73 billion, marking a significant decline of 54% or $15.0 billion compared to the same quarter the previous year. This substantial downturn is primarily attributed to a decrease in global revenues from Paxlovid and Comirnaty, coupled with a hostile foreign exchange impact of $283 million.

The revenue from Paxlovid dropped by a staggering 98%, equating to $8.0 billion, primarily due to an absence of U.S. sales in anticipation of a transition in the latter half of the year and reduced contractual deliveries in numerous international markets. Comirnaty also experienced a decline, with revenues dropping 82% or $7.3 billion, chiefly because of decreased demand and contracted deliveries.

However, a silver lining emerges when considering revenues apart from Comirnaty and Paxlovid; there was a 5% operational growth, amassing $537 million. This was fueled by contributions from newly acquired products like Nurtec ODT/Vydura and Oxbryta, which brought in $247 million and $77 million respectively, and the Vyndaqel family’s strong performance, which rose by 43% due to increased uptake in the U.S. and developed Europe. Conversely, the revenues faced a downturn with products such as Inflectra, which saw an 81% decrease in the U.S., and Ibrance, which declined by 4% operationally due to global competitive pressures and other market factors.

Despite weaker quarterly earnings results, the long-term earnings demonstrate a robust positive trend, as illustrated in the chart below.

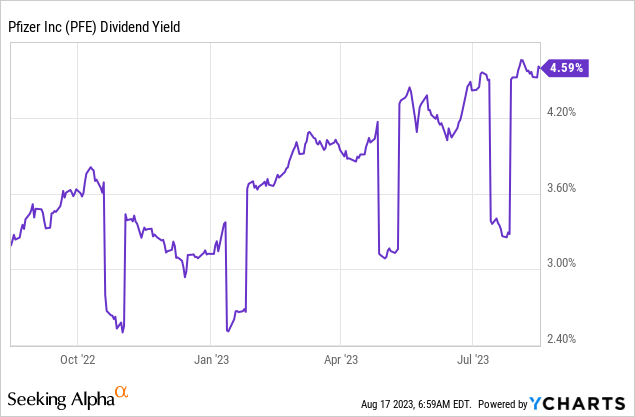

On the other hand, the dividend yield for Pfizer is 4.6%, which remains robust despite these challenges as shown in the chart below. A primary reason is the slew of new product launches, which the company forecasts will raise an additional $20 billion by 2030. This potential influx can effectively neutralize the impact of the impending patent cliff. Litfulo, an innovative solution for alopecia areata, and the respiratory syncytial virus vaccine, Abrysvo, are prime examples of Pfizer’s commitment to spearheading medical advances. Furthermore, with promising drugs like Elrexfio and etrasimod awaiting regulatory approval, there’s an anticipation of further augmentation in the revenue streams.

But Pfizer isn’t just about organic growth. Their strategic business development activities are projected to contribute an astounding $25 billion in revenue by 2030. The acquisition of Seagen alone, expected to conclude by early 2024, could boost Pfizer’s revenue by over $10 billion due to Seagen’s impressive lineup of cancer drugs. Pfizer’s strategic purchases, such as Arena Pharmaceuticals, Biohaven, and Global Blood Therapeutics, are all steps toward securing its future revenue streams.

A Deep Dive into Positive Price Momentum

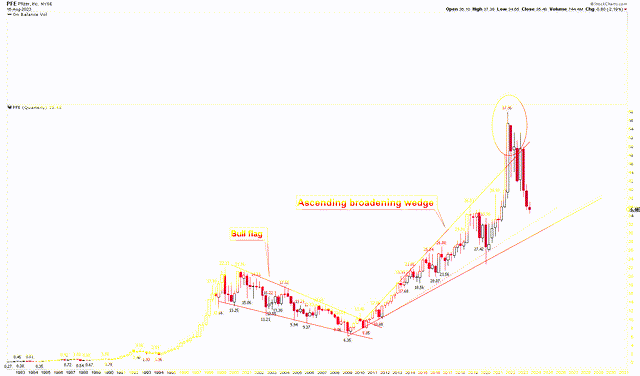

The Pfizer stock’s long-term trajectory looks predominantly bullish, as indicated in the quarterly chart. A closer look shows that between 1999 and 2009, there was a clear emergence of a bull flag pattern. In 2009, a combination of global events and internal challenges caused Pfizer’s stock to plummet to a low of $6.35. These events included the global financial crisis, the looming patent expiry of its primary drug Lipitor, and doubts over its substantial acquisition of Wyeth. However, post-2009, the stock rebounded significantly. This resurgence can be credited to Pfizer’s successful merger with Wyeth, a diversified drug portfolio, stringent cost-saving initiatives, and a broad recovery in the stock market. These positive developments restored investor confidence, driving the stock to higher values post the 2009 dip.

From this low, the stock experienced a substantial surge, reaching $57.95. This upward movement from the trough to its all-time high manifested as an ascending broadening wedge pattern, evident in the chart below. The stock took another hit during the COVID-19 recession, reaching the base of this wedge. During the early days of the pandemic, Pfizer, akin to numerous global companies, faced a stock value decline due to market uncertainties, supply chain interruptions, and fears of a decline in drug sales due to decreased healthcare visits. Yet, Pfizer’s stock made an impressive comeback, largely attributed to its joint venture with BioNTech to produce the BNT162b2 vaccine. This pivotal vaccine emerged as a cornerstone in global COVID-19 vaccination drives, solidifying Pfizer’s crucial role in the worldwide fight against the virus.

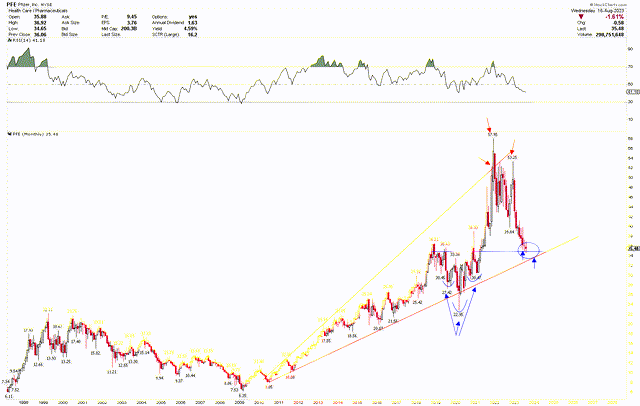

The chart shows that the peak in Pfizer’s stock was somewhat inflated due to high market demand, suggesting a potential substantial correction. Pfizer’s recent decline appears normal, and the stock is approaching a robust support range between $30-$35. This range could be a solid foundation for the stock in the upcoming years.

Pfizer Quarterly Chart (stockcharts.com)

For a deeper dive into this support zone, the subsequent monthly chart delineates a robust support area within the ascending broadening wedge pattern. This chart showcases the formation of an inverted head and shoulder during the COVID-19 recession’s low, with the head at $22.95 and the shoulders at $27.42 and $30.47. This pattern underscores Pfizer’s solid bullish foundation. The chart also reveals no consecutive two-monthly closes above this wedge line, indicating price consolidation before reaching its peak. The recent downturn has pushed the stock price towards the blue support line, which previously acted as the neckline for the inverted head and shoulder and currently functions as a significant support line.

With the stock’s deceleration at this support line, it hints at potential buying pressure building in this zone. This support point is further reinforced by the wedge line around the $32 mark. Collectively, this level is poised as a formidable support threshold.

Pfizer Monthly Chart (stockcharts.com)

Key Action for Investors

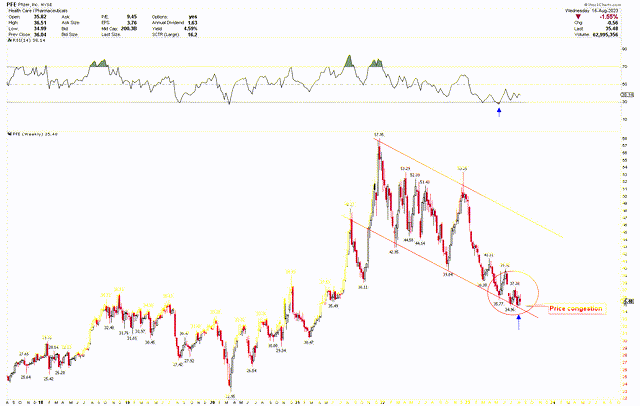

From the above discussion, it’s evident that the Pfizer stock price is nearing a crucial support zone ranging from $30 to $35. This zone represents a significant buying opportunity for those looking at long-term investments. The short-term perspective, as illustrated in the weekly chart below, highlights a red channel and price stabilization within this channel. There’s noticeable price accumulation at this support, with the RSI reflecting a bounce off this level. For long-term investors, the current stock price appears to be an ideal entry point. Yet, if the stock sees additional declines, it will allow investors to increase their holdings.

Pfizer Weekly Chart (stockcharts.com)

Market Risk

Dramatic declines in revenue might shake investor trust and create notable hurdles for Pfizer’s operational framework. Although Pfizer is on a proactive trajectory, introducing new offerings and having a roster of promising medications in the pipeline, the real-world effectiveness and market acceptance of these drugs—and their revenue potential—are uncertain until they’re demonstrably successful. The anticipated benefits from strategic buys and business growth endeavors, highlighted by the acquisition of Seagen and other pharma firms, need to materialize to confirm their investment rationale.

Furthermore, with Pfizer’s stock gravitating towards a significant support range of $30-$35, a dip below this mark might trigger more pronounced decreases in value due to the breakout from the ascending broadening wedge. Moreover, changes in the global economy, geopolitical tensions, and changes in healthcare regulations can influence Pfizer’s operational dynamics and stock value.

Bottom Line

Pfizer, despite its recent challenges, including a dramatic revenue drop and looming patent expirations, exhibits resilience and forward-thinking strategies that signal a potential turnaround. The company’s robust dividend yield, imminent product launches, and proactive acquisition activities suggest a pathway to reclaim lost revenues and perhaps even surpass previous highs. From a technical perspective, the Pfizer stock price is nearing a solid support level between $30 and $35. This suggests a potential price reversal, backed by robust support from both the wedge and horizontal lines.

Nevertheless, investors must remain cognizant of the inherent risks associated with Pfizer’s ambitious growth plans. The commercial success of their upcoming drugs, the smooth integration of acquisitions, and the unpredictable global economic environment underscore the uncertainties in Pfizer’s journey ahead. However, the company’s demonstrable resilience, robust financial health, and strategic acquisitions make it a compelling narrative of undervalued potential and long-term promise.

Investors may consider buying Pfizer stock at current levels and increasing holdings if the stock price declines further. A monthly close below $29 could challenge the long-term positive outlook.

Read the full article here