I’ve previously covered tobacco stocks, including international giant Philip Morris International (NYSE:PM). It’s been over two years since I covered the name, which you can read here.

Yet, the share price remains roughly level today with where it traded then. I’ll argue that the market is offering a gift to investors, and you know what they say about looking gift horses in the mouth… don’t do it.

Let’s peel back the layers of the company’s rapidly forming U.S. opportunity to justify optimism for a stock that’s struggled to stay over $100 per share for years. Because once the market sees the opportunity ahead, it may not remain below $100 for much longer.

IQOS is coming to America

Philip Morris has spent nearly a decade building IQOS as the company’s future beyond combustible cigarettes. It launched its first market, Japan, back in 2014. Today, IQOS has a whopping 26.3% of the country’s total cigarette and heated tobacco unit market.

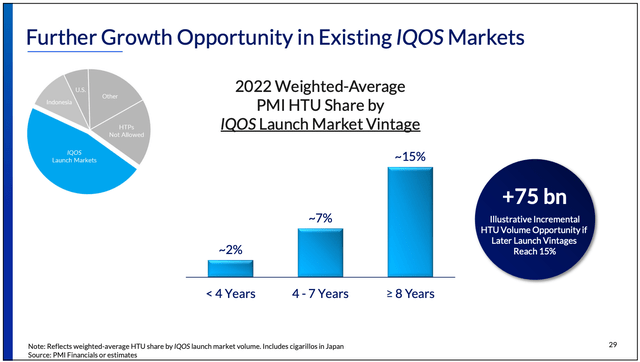

IQOS has steadily gained market share over time. Market share averages 2% until year four, 7% by year seven, and 15% in years eight and beyond.

Philip Morris International

IQOS comes to America next year following the expiration of the now-terminated commercial agreement between Altria (NYSE:MO) and Philip Morris on April 30.

The United States is a needle-moving opportunity for Philip Morris, which it previously (up until the Swedish Match acquisition) couldn’t access. America’s tobacco market is worth an estimated $105 billion, the world’s second-largest behind China.

Zyn, for the win

Philip Morris’ assault on the U.S. nicotine market goes beyond IQOS. It acquired Swedish Match roughly a year ago, the company that makes Zyn, a brand of oral nicotine pouches.

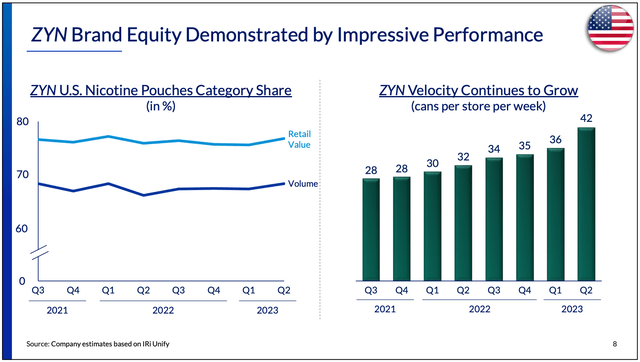

Zyn was a great asset to acquire because it established itself as the leading nicotine pouch brand in the United States. Altria’s growing its On! brand, but as you can see below, it’s currently fighting an uphill battle. Zyn retail and volume share have begun rising again in 2023 as Philip Morris invests in capacity and growth.

Philip Morris International

Management believes the product category could grow three-fold by the decade’s end, which is an ample opportunity for Philip Morris. Based on current market share and pricing, that’s $3.5 billion in additional potential net revenue by 2030 from the U.S. market alone.

This U.S. growth will have an even more significant impact on the bottom line. Philip Morris sells heavily in emerging markets where it can’t price aggressively because customer incomes are smaller. U.S. Zyn is six times more profitable than international cigarettes, and IQOS is three or four times as profitable. Moving to smoke-free products is a very beneficial shift for Philip Morris.

The bigger picture

A gradual decline in cigarettes could potentially reset the landscape of the nicotine industry in America. Ironically, Philip Morris arguably has the upper hand over Altria and others because its incoming IQOS brand has repeatedly proven itself in previous launch markets.

Altria has been preparing for this, most notably its failed Juul investment. While not fatal to the company, that flub has arguably put Altria behind the eight-ball in competing.

Zyn has already become the majority leader in its category, signaling an influx of market share gains coming to Philip Morris over the coming years. Philip Morris has been knocked as the “inferior” tobacco stock for years because of its lack of U.S. presence and diminished pricing power in foreign markets. However, the tide is seemingly turning and doing so aggressively.

Thesis risks

The obvious risk to Philip Morris is that the company needs to capitalize on the opportunity ahead of it. While IQOS has dominated internationally, it won’t have the support of the Marlboro name in America. It must establish its brand with U.S. consumers who may look to whatever Marlboro-themed product Altria offers. One could argue that even non-smokers know the Marlboro brand; investors should recognize Altria’s established brand equity.

Investors will likely need to wait years to discover how successful Philip Morris is at capturing U.S. business. But the stock pays a handsome 5.6% dividend yield at today’s prices, and the upside is becoming too hard to ignore.

Read the full article here