Intro

In my previous article about Premier Financial (NASDAQ:PFC) I was too pessimistic and my sell rating at $15 per share turned out to be an incorrect prediction. The reason for this wrong rating is that I tend to undervalue companies with deteriorating fundamentals too much and this caused me to miss a good opportunity. After all, even a company with declining fundamentals can turn out to be a good investment if bought at a bargain price, and a few months ago this was the case with Premier Financial.

In any case, Q2 2023 has once again highlighted a number of issues, but the price per share still remains at a discount despite the recent rise of about 50%.

Valuation

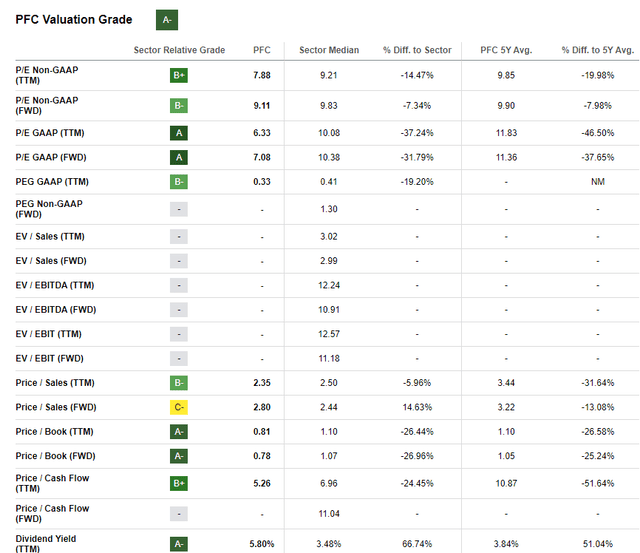

Seeking Alpha

As mentioned, Premier Financial is apparently still at a discount; in fact, its valuation multiples are significantly lower than those of the industry median. Its FWD PE and FWD Price/ Book value are 7.08x and 0.78x, respectively; while for the benchmark sector these ratios are 10.38x and 1.07x, respectively.

What’s more, the dividend yield of 5.80% compared to 3.48% for the industry median should also be highlighted. In short, based on these ratios, Premier Financial sounds like a bargain. But what is its fair value?

I personally prefer to assess a bank’s fair value on the basis of its Price/Book Value, and that ratio has averaged 1.10x over the past five years. Multiplying this by the current Book Value per share of $26.23, its fair value would amount to $28.85 per share, which means that Premier Financial is undervalued by about 35 percent.

Overall, Premier Financial still looks cheap but that does not mean it is necessarily a buy. Companies are often cheap for a reason, and in the case of this bank I believe there is more than one.

1st reason: unrealized losses of the investment portfolio and CRE

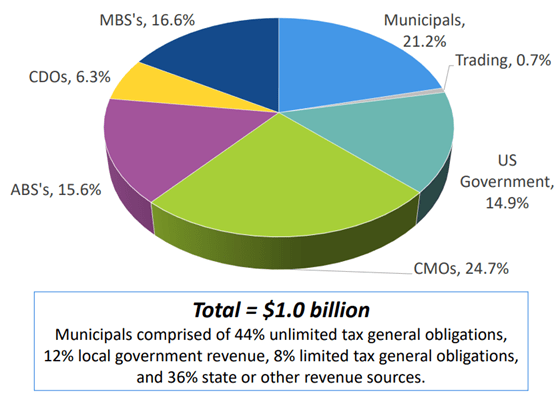

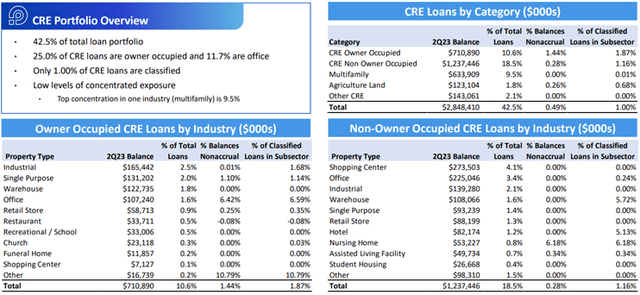

Premier Financial Q2 2023

The investment portfolio represents about 11% of total assets and consists entirely of AFS securities. 80% of them are rated AAA, 12% AA and 99% of them are investment grade. In short, the credit risk of this portfolio is minimal since most of these securities are risk-free.

In any case, while credit risk is not a problem, it should be pointed out that the same cannot be said for market risk driven by fluctuating interest rates.

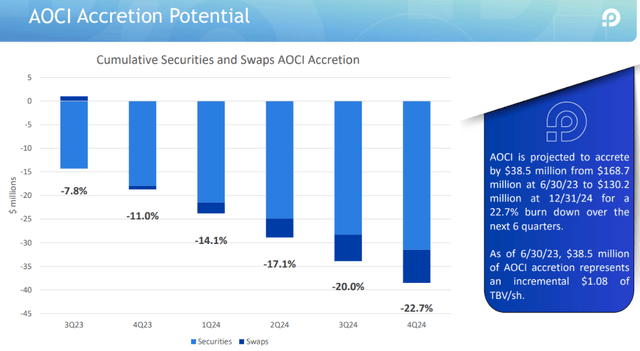

The rapid rise in the Fed Funds Rate has caused a large unrealized loss in fixed income securities that is eroding Premier Financial’s equity. To date, this unrealized loss amounts to $168.70 million, about 18 percent of equity, and is accounted for in “accumulated other comprehensive income AOCI.” If these securities were held to maturity, their expected weighted average life is 6.5 years, Premier Financial would report no realized loss, but we cannot know in advance whether this will be the case. Should the bank need immediate liquidity in the future, it may be forced to sell its securities at a loss.

Premier Financial Q2 2023

Premier Financial estimates that over the next six quarters this unrealized loss is expected to shrink by about $38.50 million, which would result in an increase in tangible book value per share of as much as $1.08.

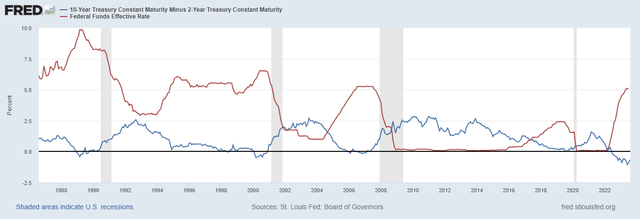

The reliability of this estimate lies mainly in what the Fed’s behavior will be regarding the interest rate decision. Should they be reduced more than expected, the unrealized losses would be reduced even faster. Anyway, with a reduction in interest rates my hunch is that on the one hand the AOCI problem would be solved, and on the other hand a worse one could be created. Historically, when the yield curve was inverted and the Fed started cutting rates, there was almost always a recession in the following months.

Federal Reserve Bank of St. Louis

Typically, in recessions, the CRE segment is the most distressed, as firms may experience financial difficulties, which consequently may reduce demand for commercial real estate.

Premier Financial Q2 2023

Currently, Premier Financial has 42.50% of its loan portfolio in CRE, which is a huge exposure. In addition, 11.70% of them belong to the office category. This aspect, may partly explain why this bank is trading at such low multiples compared to its sector.

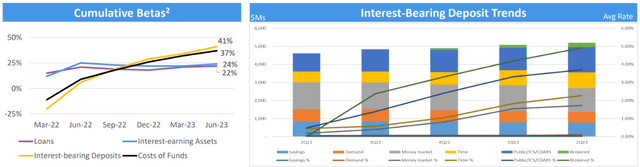

Second reason: the yield on assets does not increase enough

The rapid increase in the Fed Funds Rate is not generating a balanced reaction in Premier Financial’s balance sheet. In fact, costs of funds has a cumulative beta of 37% while for interest earning assets it is only 24%.

Premier Financial Q2 2023

This means that as interest rates rise, the rising yield on Premier Financial’s assets cannot keep pace with the rising cost of liabilities. As a result, it is inevitable to have declining profitability.

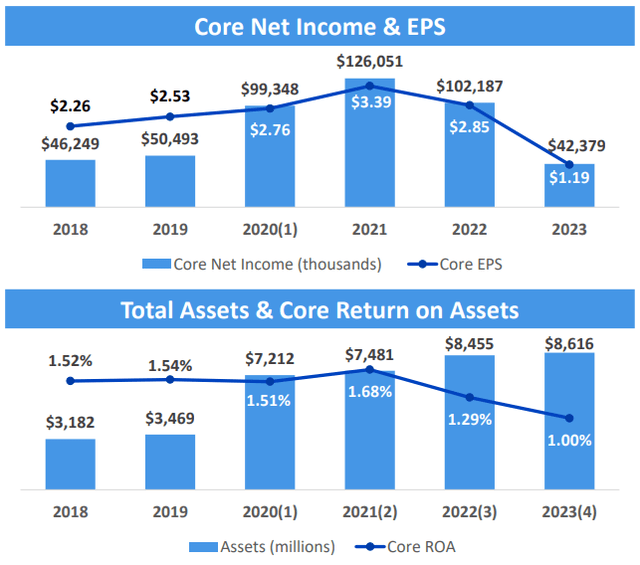

Premier Financial Q2 2023

As we can see from this picture, core net income has been declining since 2021 and with it core EPS. Total assets are increasing but Core ROA is also declining since 2021. In other words, it is evident that the rapid increase in the Fed Funds Rate has had an overall negative impact, both from an income and financial perspective.

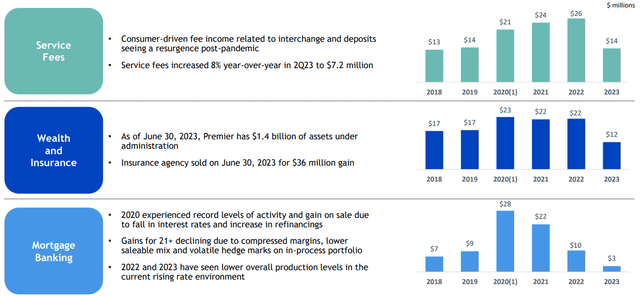

Premier Financial Q2 2023

Finally, non-interest income also experienced difficulties in growth this quarter and declined sharply from last year. In this regard, the major sale of First Insurance Group to Risk Strategies Corporation should be highlighted. That sale generated a gain of $36.30 million before transaction costs of $3.70 million and taxes of $8.50 million.

Conclusion

Premier Financial is not going through an easy time as the cost of its liabilities is growing faster than the yield on assets. It also does not help a rather rigid financial structure where the loan to deposit ratio is 97% and could be a constraint to issue new loans at current interest rates. As for unrealized losses, there is no need to sell AFS securities at the moment, but it is a situation that needs to be monitored.

On the positive side, Premier Financial seems undervalued according to both its valuation multiples and its Price/Book Value. As a result, even if the fundamentals are declining, the current price per share may be low enough to justify a purchase anyway. Personally, I prefer to buy banks with a growing NIM and greater financial flexibility, which is why I cannot consider Premier Financial as a buy. However, a sell might turn out to be a too pessimistic rating given the TTM P/E of just 6.33x: I think a hold is more appropriate.

Read the full article here