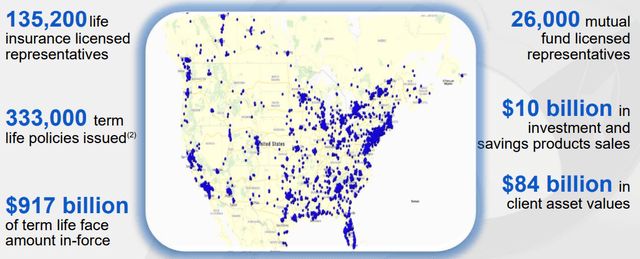

Primerica (NYSE:PRI) is a Duluth, Georgia-based insurance and investment firm with a particular focus on middle-income oriented products. The firm operates as the parent company to National Benefit Life, Peach Re, and Vidalia Re, amongst other firms.

Primerica Annual Presentation

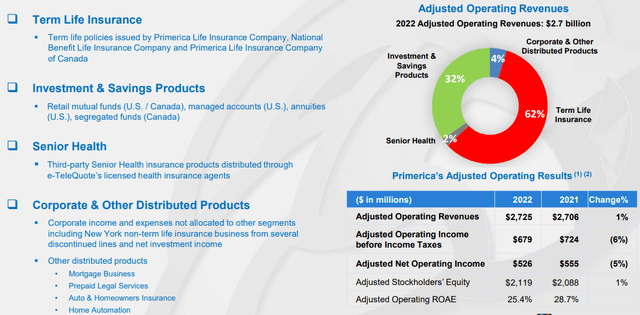

Remaining highly integrated along the retail financial continuum, Primerica segments itself into term life insurance, investment, and savings products including mutual funds, amongst other operations, Senior Health products, and Corporate and Other Distributed Products.

Primerica Annual Presentation

Through these activities, Primerica has supported Q1 revenues of $706.47mn, a 0.04% decline, alongside a net income of $124.54mn- a 53.60% YoY increase- and a free cash flow of $182.89mn, a 6.38% decline largely driven by declining operational cash flow.

Introduction

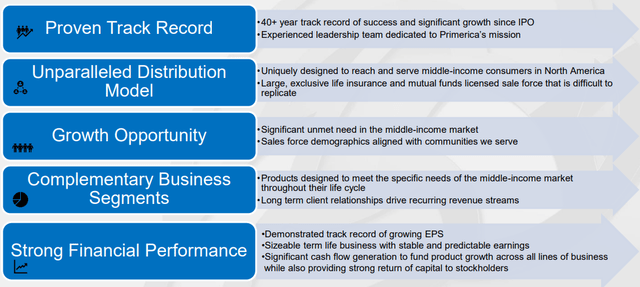

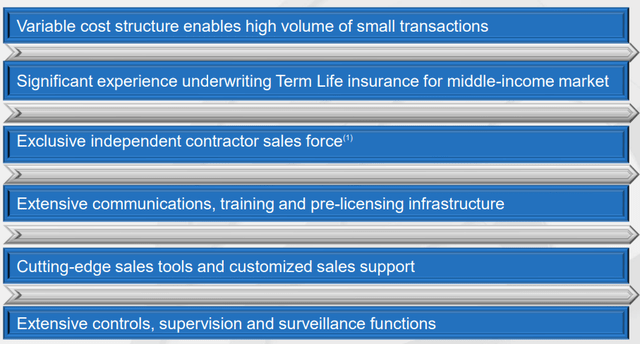

Core to any investment thesis for shareholders is Primerica’s fivefold value proposition, which stresses the firm’s experience and relative stability in addition to a cost-lean distribution model which reduces costs while supporting accelerated scalability. In turn, this enables greater access to the underserved middle-income insurance and investment/saving service, with these periphery business segments supporting upselling and overall superior financial performance, itself enhanced by Primerica’s disciplined capital allocation strategy.

Primerica Annual Presentation

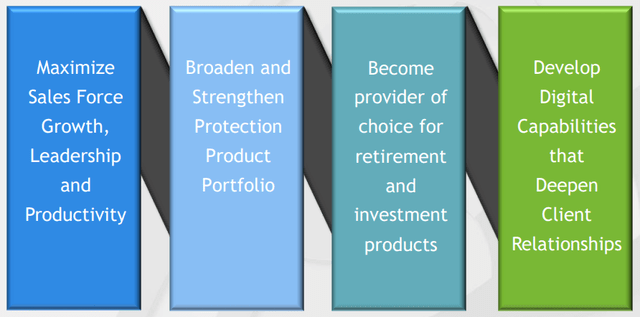

For the continuation of these strategies, Primerica has laid out four primary strategic objectives. The said objectives include the maintenance of sales force scalability, accelerated development in insurance segments, increased upselling and points of entry to Primerica via retirement and investment products, and the application of technology to create operational efficiencies and support client retention.

Primerica Annual Presentation

The accretive effect of this operational strategy, alongside a highly effective capital deployment strategy and slight undervaluation would have supported a ‘buy’ rating, but Primerica’s outsized annual growth lead me to rate it a ‘hold’, with potential for an upgrade.

Valuation & Financials

General Overview

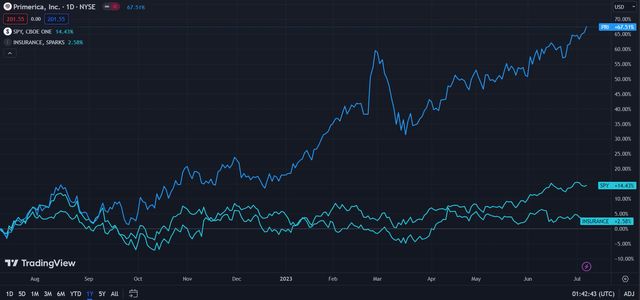

In the TTM period, Primerica’s stock, up 67.51%, has outperformed both the TradingView Insurance Index, up 2.58%, and the general market, as represented by the S&P500 (SPY), up 14.43%.

Primerica (Dark Blue) vs Industry & Market (TradingView)

Primerica’s significant overperformance can be credited to a combination of upgrades from the likes of Raymond James (RJF) and the operational strengths which spurred said upgrades, with significant YoY net income growth and subsequent buybacks and dividend increases.

Comparable Companies

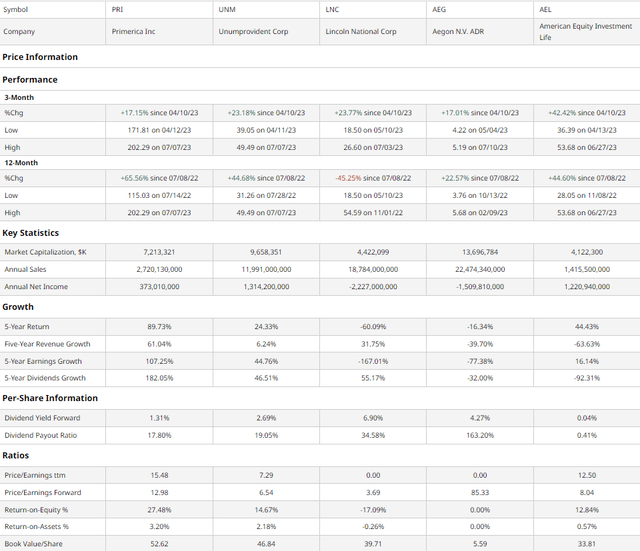

Although term life insurance remains the plurality of Primerica’s revenues, the presence of the firm across different financial products reduces comparability with peers. As such, it makes the most sense to compare Primerica with similarly sized financial services companies with a presence in insurance. These include the Unum Group (UNM), a Tennessee-based insurer, Lincoln National (LNC), which runs a number of life insurance and annuity subsidiaries, Aegon (AEG), a Dutch life insurance, pensions, and asset management firm, and American Equity (AEL), a leader in fixed-index annuities.

barchart.com

As aforementioned, as exemplified above, Primerica has seen significant and best-in-class price action over the TTM period. However, although the firm has seen a highly positive trailing three months, the company has experienced the second-worst quarterly stock performance, largely justified by Primerica’s previous accelerated growth. Despite this positive action, I believe Primerica is not overvalued and may be slightly undervalued with its highly positive growth capabilities and commitment to shareholder returns.

For instance, Primerica maintains peerless ROE and ROA, signifying extensive ROIC and the firm’s reinvestment abilities. This is further supported by Primerica’s historic competencies, with the firm experiencing outsized growth in revenue and earnings over the past five years.

And although the company may not have the highest dividend payout at 1.31%, Primerica is dedicated to incremental increases in shareholder return, with the largest 5Y dividend growth of 182.05%.

That said, it seems the market has adequately priced in Primerica’s positive attributes, with the firm’s trailing and forward P/E being much higher than the average rate amongst peers.

Valuation

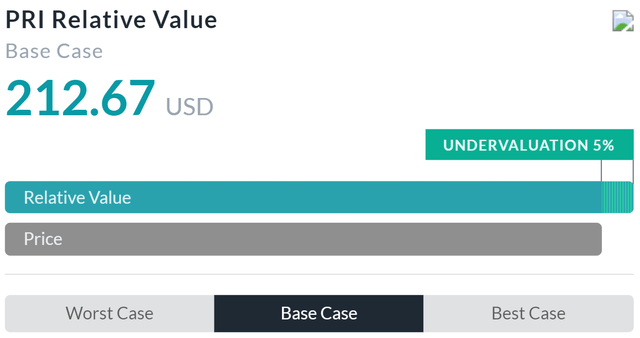

According to my discounted cash flow model, at its base case, the net present value of Primerica is $211.21, meaning, at its current price of $201.55, the firm is undervalued by ~5%.

My model, calculated over 5 years without perpetual growth, assumes a discount rate of 9%, incorporating Primerica’s higher debt levels, along with an increased cost of capital, but also the firm’s modest equity risk, with low long-run beta. Additionally, to be conservative, I calculated an average revenue growth rate of 6%, despite the firm’s average trailing 5Y revenue growth rate being 10.35%, accounting for downstream demand compression and lower potential investment income.

Alpha Spread

Alpha Spread’s multiples-based relative valuation tool supports my thesis on undervaluation, estimating an undervaluation of 5%, with a relative value of $212.67, in line with my own calculation.

Thus, taking an average of my DCF and Alpha Spread’s relative valuation, the stock remains undervalued by ~5%, at a price of $211.94.

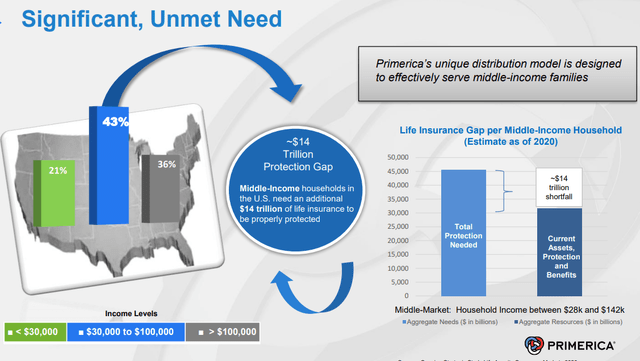

Primerica’s Unique Middle-Market Integrative Approach Drives Long-Run Value

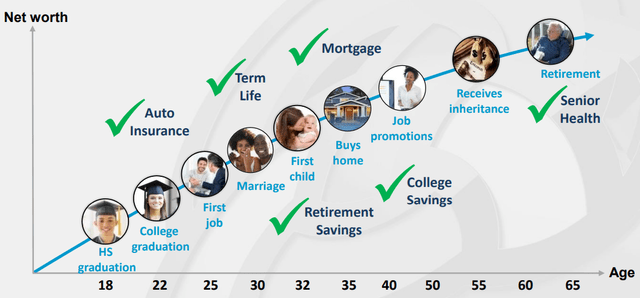

At the very center of Primerica’s macro growth strategy has been its focus on middle-income US markets, an underserved group with an >$14tn life insurance protection gap. As such, between Primerica’s affordable term life insurance policies and investment products, this market is serviced throughout its financial consumer journey. Moreover, with Primerica’s distributed service model, the firm is well-positioned for accessibility for the said consumer group.

Primerica Annual Presentation

Primerica has thus developed a distinct business model aimed at penetrating the middle market with high degrees of efficacy. The firm has dedicated itself to large-volume but low-value transactions, enabled by its unique independent contractor sales force and term life insurance proposition. Enhanced by superior stakeholder accountability and workforce infrastructure, Primerica is thus able to remain accessible to lower net-worth clients while retaining relatively strong margins.

Primerica Annual Presentation

Alongside the increased access to middle markets, Primerica aims for integrative growth along the consumer journey, through its investments in mutual funds and savings/investment products for existing and new Primerica consumers. This serves to enhance the unit economics of the firm, increasing consumer revenues and cash flows.

Primerica Annual Presentation

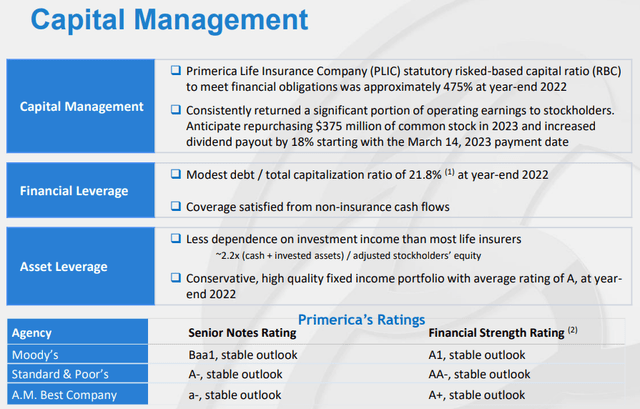

With the cash flow generation of the latter strategies, Primerica employs a balanced capital deployment strategy, focusing on financial stability above all, with the firm currently maintaining strong credit ratings and concentrating on deleveraging, and then reinvestment and capital returns via an incrementally increasing dividend and $375mn, in 2023, share repurchase program.

Primerica Annual Presentation

Wall Street Consensus

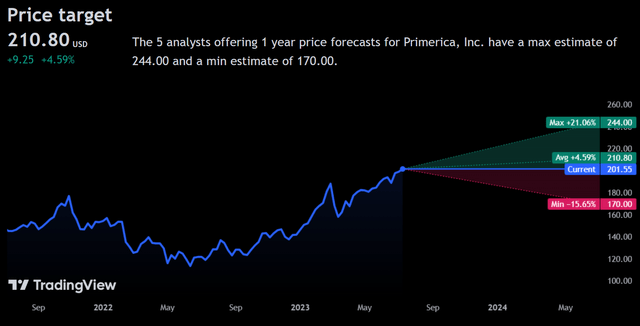

Analysts generally agree with my hold rating on the stock, estimating a 1Y price target of $210.80 or a 4.59% annual price increase.

TradingView

However, at the minimum projected price, analysts expect a 15.65% decline to a price of $170.00.

This reflects investor anxieties surrounding Primerica’s extensive YoY outperformance and its ability to sustain its financial success. I hold similar reservations, thus my ‘hold’ rating.

Risks & Challenges

Interest Rates Continue to Impact Core Capabilities

Although Primerica has largely sidestepped the brunt of the impact of rising interest rates, the negative long-run pressures the current economic climate may have may lead to reduced scalability and product demands, particularly amongst the cost-sensitive middle-income markets. This works alongside the negative balance sheet pressures of sticky interest rates, which diminish existing portfolio values and reduce investment income for the firm.

Range of Vertical Operations May Augment Regulatory Stress

Primerica remains involved across a range of financial activities, each of which operates with a range of regulatory complexities and compliance costs. The firm’s accelerated growth across these verticals, particularly senior health insurance products, may lead to additional regulatory pressures and increased compliance costs, leading to slowed growth and scale capabilities.

Conclusion

In the long run, although Primerica maintains operational strength through its distributed workforce, focus on middle-income markets, and integrated product mix, its YoY rally and fair valuation support a continuation of its current price.

Read the full article here