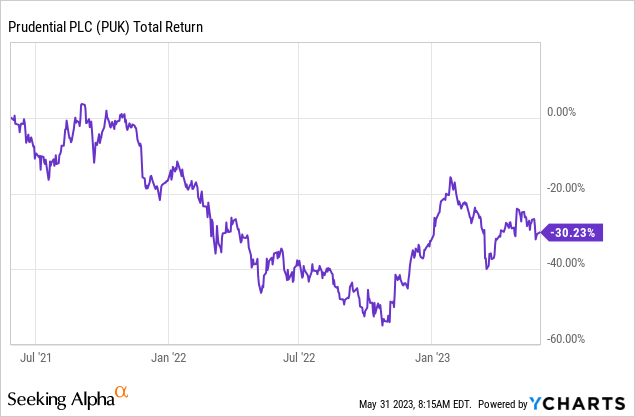

Notwithstanding a substantial rally off their 2022 lows, shares of Asia-focused life insurer Prudential plc (NYSE:PUK) have performed poorly these past couple of years, losing around 30% of their value in that time inclusive of dividends:

Prudential’s chief problem in recent years has been the severe and prolonged COVID containment policies in Greater China, which has decimated visitor numbers to Hong Kong from the mainland. Previously, these accounted for the bulk of the company’s customers in the city, which was itself the largest individual contributor to group sales and earnings.

While Hong Kong continues to be a drag, I do think this problem is largely transient in nature, and there are already tentative signs of a recovery in business there. Even without a full recovery, Prudential’s exposure to fast-growing markets in Southeast Asia and Africa will alleviate any softness in its core business over time. On double-digit long-term annualized dividend growth these shares look around 30% undervalued today. Strong Buy.

What Does Prudential Do?

Following various demergers, Prudential is now a fairly simple Asia-focused Life business. This is basically a protection and savings business (~95% of FY22 operating profit), while its asset management arm, Eastspring, also contributes modestly (~5%) to group operating earnings. Protection is essentially pure insurance – the payment of premiums in exchange for a payout triggered by a specific event (e.g. death or critical illness). Savings is slightly more complex, but basically combines life insurance with an investment component.

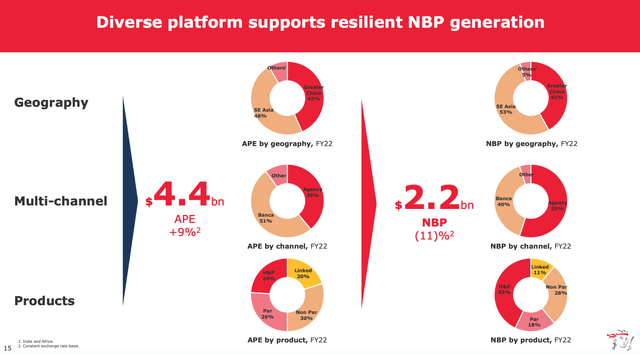

Prudential sells these products via a network of circa 500,000 agents and through banks (bancassurance), though its own app, Pulse, is increasingly a source of sales. Below is a breakdown of Prudential’s annual premium equivalent (“APE”) sales and new business profit (“NBP”) by geography, channel and product:

Source: Prudential plc FY22 Annual Results Presentation

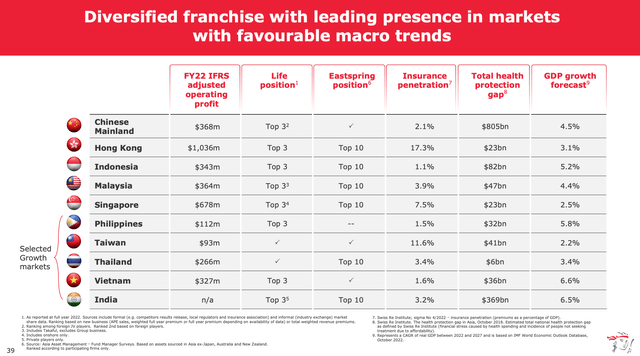

Geographically, Prudential’s key markets are Hong Kong and the Chinese mainland (via its 50/50 JV with state-owned CITIC), along with Southeast Asian markets Singapore, Indonesia and Malaysia. The company does have nice exposure to other fast-growing markets in Asia though, including India, Thailand, Vietnam and the Philippines, as well as in Africa.

Hong Kong A Major Drag

Before COVID, Hong Kong was the largest geographic segment of the company, accounting for just under 40% of Asian and Africa APE sales in pre-COVID 2019. A large portion of this business (around 50% of pre-COVID policies) came from visitors from the Chinese mainland. This flow dried up to virtually zero during COVID due to the strict containment policies enacted by the authorities across Greater China. Pre-COVID, there were around five million monthly visitors to Hong Kong from the Chinese mainland. Cross-border travel restrictions reduced that to virtually zero.

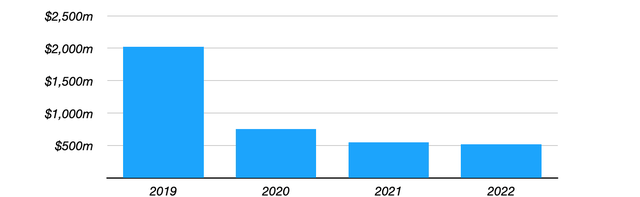

Prudential plc: Hong Kong APE sales FY19-FY22

Data Source: Prudential plc 2022 Annual Report

Although much of the world had removed restrictions by last year, this was not the case in Greater China, where anti-COVID measures remained severe even late last year. This has unsurprisingly had a detrimental impact on Prudential’s Hong Kong business. APE sales to Hong Kong clocked in at a little over $2B in 2019, with that falling to just $522m last year. As a result, Group APE sales also remain subdued, coming in at $4.4B last year versus $5.2B in pre-COVID 2019 (for the Asian segment only, as Prudential still had significant non-Asian operations back then).

Signs Of Recovery

There are signs that the trading environment in Hong Kong may be staging a recovery. February visitors from the mainland clocked in at 1.1 million, and this had grown to nearly two million in March. To be clear, this is still way below the levels recorded before COVID, but the trend is positive and represents a big step up on last year’s figures.

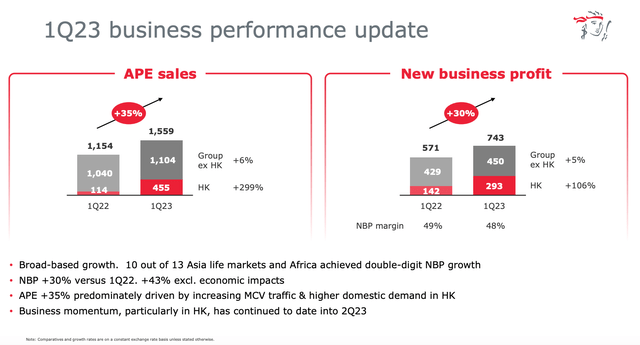

Source: Prudential plc May 2023 AGM Presentation

This is already starting to feed through to Prudential’s Hong Kong business. In Q1 FY23, Hong Kong APE sales were up nearly 300% year-on-year to $455m, with that powering a 35% YoY rise in group APE sales. NBP was likewise up sharply, with management noting that business momentum had carried over into Q2. This should lead to a big year-on-year improvement in the full-year FY23 Hong Kong results and, by extension, provide a nice boost to group-wide business too.

Shares Undervalued For Long-Term Investors

Although a recovery in the core Hong Kong market is a significant part of the bull case, growth elsewhere in Prudential’s business means it isn’t necessary to generate attractive returns. Many of the company’s markets, including ones with large populations like China and India, still have insurance penetration rates (i.e. premiums as a percentage of GDP) in the low single-digit range. That compares to a global average penetration rate of around 7% or so, with higher rates in developed markets like the UK, the US and France offsetting low rates in emerging markets.

Source: Prudential plc FY22 Results Presentation

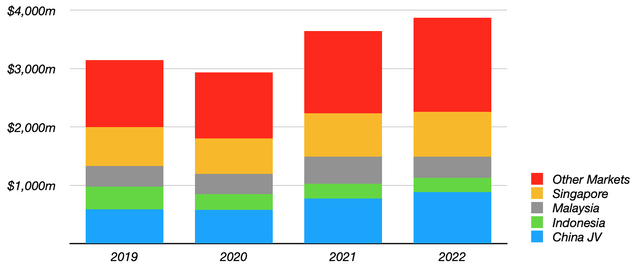

On top of that, the developing Asian and African markets that Prudential has exposure to are growing GDP at a healthy annualized clip. As consumers there play catch-up in terms of insurance coverage, that is going to be a nice dual tailwind for Prudential’s sales and earnings. Even with a brief dip due to COVID, ex-Hong Kong APE sales and NPB growth has been solid in recent years, and that is in USD terms, too. Local currency growth has actually been a few points higher still.

Prudential plc: Ex-Hong Kong APE Sales By Region

Data Source: Prudential plc Annual Reports

That growth has so far been masked due to the sheer extent of the drop-off in Hong Kong, but even a partial recovery there would be enough to significantly boost the growth story on a group-wide basis.

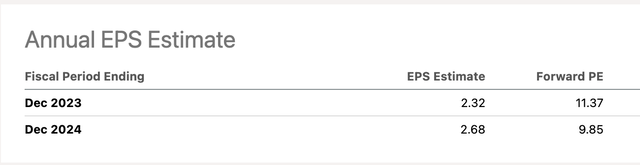

With that, I do think these shares are undervalued for long-term investors. I base that on my preferred method of valuing Prudential, which is a dividend discount model. The dividend (FY22: $0.1878 per share, and note that one ADR represents two ordinary shares) only represents a yield of around 1.4%, but as you can infer from Seeking Alpha’s EPS estimates this is on a payout ratio of around 15% as the company still has ample reinvestment opportunities to fund growth. In time that payout ratio will creep up as growth prospects and reinvestment needs moderate, which will itself be a nice tailwind for dividend growth.

Source: Seeking Alpha

With the above in mind, I’m modeling a long-term double-digit dividend growth CAGR, which discounting back to the present gets me to a fair value of $34.80 for the ADRs. That implies around 30% upside versus the prevailing price. I use a 9% discount rate for Prudential and a 2% terminal growth rate.

Summing It Up

Prudential has been held back by the impact of severe COVID restrictions in Greater China on its business in Hong Kong. Business there is showing tentative signs of recovery, and with that Prudential’s Asian growth story is going to become more prominent over FY23 and FY24. With these shares looking around 30% undervalued today, and with the cashflows from life insurance fairly predictable and stable, Prudential looks like a compelling way to play pan-Asian economic growth. Strong Buy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here