Investment thesis

My first cautious thesis about Qualcomm’s (NASDAQ:QCOM) stock aged well since the company significantly underperformed the broader U.S. market with an almost 16% price decline over the last quarter. Despite recent weakness in the stock price and the company’s solid long-term position, I downgrade my rating for QCOM to “Sell” because I expect the sell-off to continue. I am pessimistic due to the current harsh environment, and my analysis suggests the company’s upcoming quarter’s earnings release scheduled for next week is highly likely to disappoint investors, which might lead to a notable stock sell-off. Moreover, the stock is about 13% overvalued, according to my valuation analysis.

Recent developments

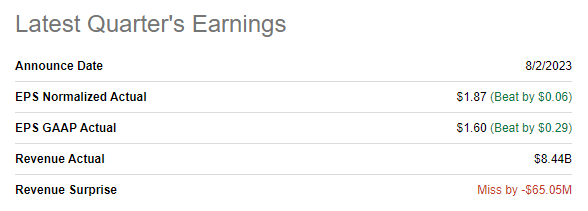

The latest earnings were released on August 2, when the company slightly missed consensus revenue estimates but outperformed from the bottom line perspective. Revenue dipped YoY by a notable 23% due to the weak macro environment, which softened demand from end markets. The gross margin demonstrated resilience despite revenue weakness, but the operating margin shrank by almost ten percentage points.

Seeking Alpha

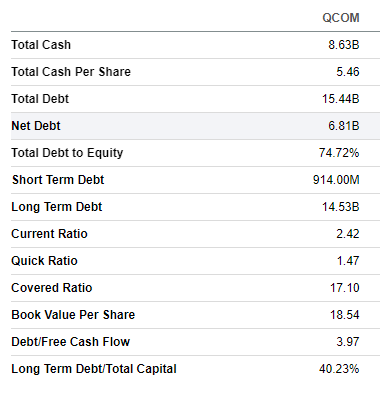

It is crucial to underline that despite a massive drop in the operating margin, it still remained stellar above 20%. QCOM is still a profitability superstar even amid the current harsh environment. Therefore, the company’s balance sheet looks solid, with moderate leverage and excellent short-term liquidity. That said, QCOM is well-positioned to weather the storm and continue investing in innovation to support long-term growth.

Seeking Alpha

I have no doubts about the company’s long-term bright prospects, given its diversified portfolio of products, massive brand and reputation, and its profitability and strong financial position. But short and medium-term prospects look cloudy, softly speaking.

Substantial inflation of 2020-2021 apparently drained consumers’ pockets, which we can see in increasing credit card delinquency rates and deteriorating savings rates in the U.S. That said, consumers are highly likely to cut on discretionary spending, and Qualcomm’s top line significantly depends on the global demand for mobile handsets. Despite being everyone’s must-have nowadays, upgrading your smartphone every year is apparently discretionary, and that is the reason why global mobile handset shipments are declining YoY. Even Apple (AAPL), with its massive brand loyalty, experiences disappointing new iPhone 15 sales in China, one of the world’s largest markets.

QCOM has been expanding aggressively to new end markets in recent years, primarily automotive and internet-of-things [IoT], which I consider to be a good initiative from the secular point of view because both industries are promising. However, the automotive industry is also highly cyclical and substantially depends on interest rates because a substantial portion of vehicle sales are financed by loans or leases. The fact that the revenue of one of the fastest growing companies on Earth, Tesla (TSLA), decelerated notably even after massive discounts offered across its models’ portfolio is a huge red flag for near-term automotive industry prospects.

The same goes for IoT, as smart products are also discretionary, and weakening consumers’ spending power is likely to make them postpone their plans to purchase smart electronics until better days. According to IDC, worldwide shipments of smart home devices are poised to continue to decline by the 2023 year-end, and the rebound should not be expected earlier than the next calendar year.

Seeking Alpha

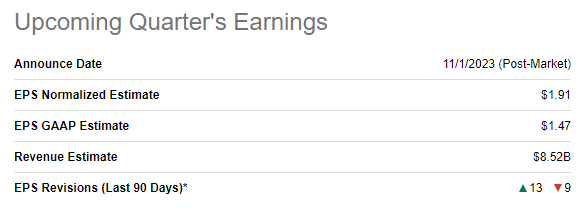

With all the above said, I think that there is a high probability that the company’s upcoming quarter’s earnings release, scheduled for November 1, will disappoint investors, which can lead to a massive stock sell-off. QCOM might top quarterly revenue consensus estimates of $8.52 billion and demonstrate resilient profitability, but I think it is highly likely that the guidance can be downgraded given numerous severe headwinds.

Valuation update

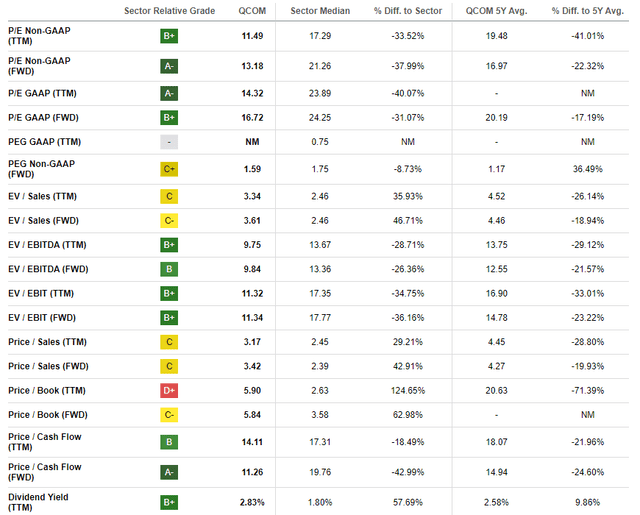

The stock significantly underperformed the broader U.S. market in 2023 with a 2.3% year-to-date price decline. Seeking Alpha Quant assigns QCOM an average “C” valuation grade. Most of the current multiples are substantially lower than the company’s historical averages, which might indicate undervaluation.

Seeking Alpha

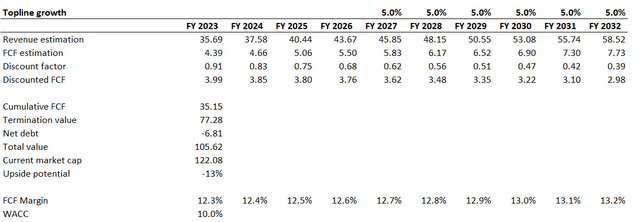

I want to proceed with the discounted cash flow [DCF] simulation to get more conviction. I use a 10% WACC for discounting, as I did the last time from QCOM. I have revenue consensus estimates available up to FY 2026 and project a 5% CAGR for the years beyond. I use a 12.3% TTM FCF ex-SBC margin for the base year and expect a more conservative ten basis points yearly expansion compared to 25 basis points in my previous valuation analysis. I use a more conservative FCF projection due to the worsening macro environment and hawkish rhetoric regarding the Fed’s monetary policy for longer.

Author’s calculations

According to my DCF simulation, the business’s fair value is about $106 billion. This indicates a 13% overvaluation compared to the current market cap. That said, my target price is approximately $92.

Risks to my bearish thesis

We already saw a massive rally in semiconductor stocks during the first half of 2023 after the generative AI mania started after the successful launch of ChatGPT. Therefore, there is always a substantial risk that “the next big thing” in software might suddenly pop up, which can boost demand for more computing capacity, which is impossible without semiconductors. That said, in our ever-evolving age of cutting-edge technologies there is always a possibility of new jaw-dropping technology releases that can add vast optimism to technology investors.

The valuation of semiconductor companies significantly depends on interest rates because the higher the WACC, the more the present value of future cash flows deteriorates. All eyes are on Fed’s Jerome Powell now, who has been hawkish in his recent public speeches, underlying that rates can remain higher for longer. But he cannot be hawkish infinitely, especially given that the U.S. economy already sends mixed signals about its health. Declining corporate profits for the fourth straight quarter also suggests that tight monetary policy is working. That said, there is a solid probability that the Fed might change rhetoric to more dovish, which might be a positive catalyst for technology stocks. However, I do not expect softer messages from the Fed until early 2024.

Bottom line

All in all, QCOM is a “Sell” amid current turbulence in the macroeconomic. Revenue is declining at a rapid pace on a YoY basis and my analysis suggests that the weakness is likely to sustain over the next few quarters. I am very pessimistic about the company’s upcoming quarter’s earnings release, and recent after-earnings sell-offs in many big names like Google (GOOG) and Tesla give me high confidence that the market will punish QCOM with a sell-off as well. Several massive near-term headwinds suggest that the management is likely to downgrade guidance for the foreseeable future.

Read the full article here