The investment rationale for the energy storage sector is straightforward: conventional fuel sources are dirty, and our current power methods, such as internal combustion engines, are inefficient. Therefore, there is a growing need for renewable energy and electrification. Given the intermittent nature of renewable sources and the increasing demand for energy storage, battery technology has become essential to the transition.

Four key parameters determine the competitiveness of batteries (of electric vehicles, for example): charge time, energy density, battery life, and production cost. Although lithium-ion (“Li-ion”) batteries have shown significant improvement across these aspects – such as an eightfold increase in energy density over the past decade – there remain crucial hurdles yet to be overcome, safety and cost included. This is why major battery and vehicle manufacturers are placing their bets on what could be the “holy grail” of battery technology: solid-state batteries.

Investment Thesis

QuantumScape (NYSE:QS) is one of the leading players in the solid-state battery field, backed by heavyweights like Volkswagen and Bill Gates. But beneath these glorious names lies a crucial question: is the company truly up for the challenge? As an investor focused on disruptive technologies, my evaluation follows a three-step process:

- Market Sizing: Does the company address a substantial problem?

- Technical Fundamentals: Is the technology feasible, scalable, and efficient?

- Survivability: Can the company weather the challenges before profit-positive, which are inherent in disruptive tech?

The case for solid-state batteries is compelling as it offers solutions to many problems of Li-ion batteries, such as the instability of liquid electrolyte and higher efficiency in cost and weight. QuantumScape’s technology also appears promising, boasting a theoretical energy density 50–100% higher than conventional Li-ion batteries and faster charging times.

The only things left are if the share price volatility will continue to hurt investor interests, and if the company can survive before full commercialization. With the projected timeline for the two product prototyping stages in 2024/25 and 2026/27, revenue generation may only materialize by 2027 at the earliest.

Hence, considering the comprehensive research, development, and commercialization roadmap, coupled with micro-level financial projections and macro market outlook, I assign a Hold rating to the company. Prudent investors should exercise caution and closely monitor development milestones and catalysts. Future investors should closely monitor development milestones and catalysts and remain cautious.

How is QuantumScape different, from Li-ion and even other solid-state batteries?

Analyst’s Note: This is my inaugural analysis on QS. While long-term and astute investors in QuantumScape may have encountered the following investment thesis multiple times, this section is tailored for readers less acquainted with battery technology. Feel free to skip ahead or share your thoughts on my grasp of the technology. We’re all on a learning curve when it comes to investing in disruptive technologies.

The common advantages of solid-state over Li-ion batteries are discussed widely. This includes higher energy density for more power, faster charging, improved range, compact size, and enhanced safety.

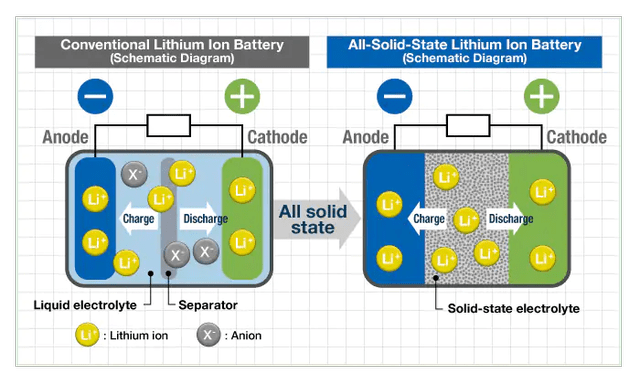

Of particular importance is the electrolyte composition. Traditional batteries employ a semi-liquid paste between the anode and cathode (as depicted in the graph below), a substance that is often flammable. In contrast, solid-state batteries, as its name suggests, avoids that risk by replacing the liquid with solid material. This also elevates thermal stability and ionic conductivity, facilitating quicker charging.

TDK

But not all solid-state batteries are built the same – they vary in terms of materials, structure, and other factors.

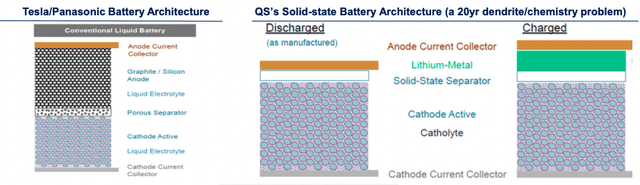

What sets QuantumScape apart is their unique approach to battery technology, notably the absence of an anode in their cell design. The company relies on in-situ formation of lithium metal upon first charging. The key advantage lies in lithium metal’s exceptional energy density, both gravimetrically and volumetrically. This gives QuantumScape a significant edge in charging time, a critical bottleneck in the development and full-scale adoption over traditional vehicles. However, it is worth noting that this is difficult to develop, not to mention commercialize.

Evercore ISI

Is QuantumScape getting there?

While the company is still in its testing and sampling stage, the company’s initial testing results have shown some promising signs:

A current density of >5 mA/cm² – we are not aware of other lithium-metal, anode-free cells with such high capacity capable of cycling at these current densities for over 800 cycles at room temperature. – QuantumScape management

- The volumetric energy density exceeds 1000 Wh/L, four times that of the current Tesla (TSLA) Model 3 cylindrical batteries

- It can provide energy in the range of 380-500 Wh/kg, while current Tesla batteries offer approximately 260 Wh/kg

- Charges to 80% capacity in 15 minutes (traditional lithium-ion batteries typically require 30 minutes or longer)

- Shows no degradation after 800 cycles, equivalent to a driving distance of around 380,000 kilometers

- Installed in vehicles with a range of 480 kilometers or more, the normal lifespan is expected to reach around 12 years.

Projected timeline of QuantumScape

Okay, enough theories, test results, and visions. Investors are itching for a reality check—when can they expect QuantumScape to deliver, and when will their investments start paying off?

|

Year |

Target Milestones |

|

2022-23 |

Delivered first A0 prototype (24-layer); Moving on to commercial product design of lower-volume B0 sample |

|

2024 |

Lower-volume B-sample to begin production with Raptor equipment at QS-0 factory |

|

2025 |

Higher-volume B-sample to begin production with Cobra equipment at QS-0 factory; Start development of QS-1 factory, a JV with VW |

|

2026 |

Completion of C-sample and commence small-scale production to be added to VW fleets |

|

2027 |

Large-scale commercialization and production at QS-1 factory |

Financial fundamentals: The path to revenue

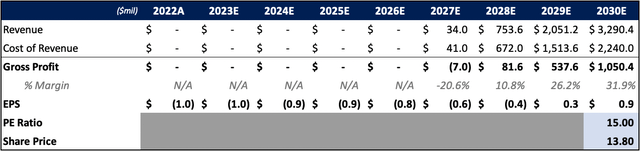

Solid-state batteries are undeniably the future, but they won’t be here soon, according to the company’s research and development timeline. In the financial model presented below, we operate under the assumption that the commercialization will adhere to the plan, with production scaling up by 2030. This assumption leads us to a target price close to US$14.

Analyst’s Research

However, as is the nature of financial models, the landscape of assumptions and projections is subject to change. The battery technology sector is influenced by a myriad of factors, such as government subsidies, international competition (especially those from China), and unforeseen technological breakthroughs. Therefore, the target price is derived from the base case scenario outlined by the company. It is a calculated estimate that acknowledges the potential for shifts in the dynamic battery tech environment.

Investment risks:

- Technology development: The targeted timeline of the B and C sample development might face delay, which will further delay the commercialization assumptions. Also, currently all advantages of QS’ technologies are not based on the size of battery stack for EV vehicles, and there is a risk of undermined performance when it is applied.

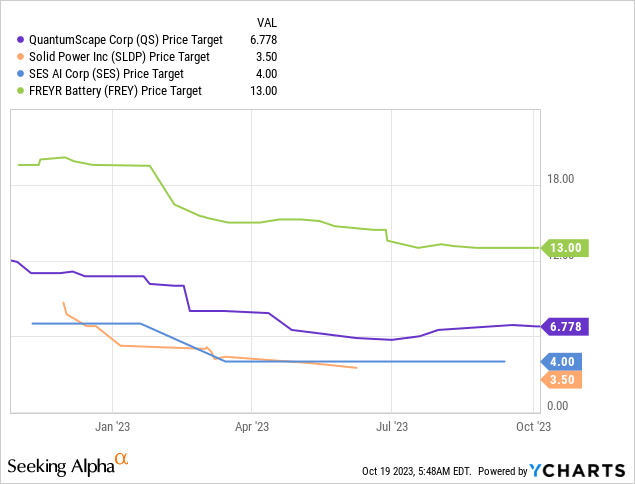

- Global competition: China is undoubtedly the leader in battery industry. Companies like CATL is already working diligently in delivering solid-state battery. Therefore, investors should not only compare the company with other listed or local peers.

- Cash burn: As shown in the model, revenue will not come in until 4 years from now and investors should expect cash burn for a longer period of time. Like most former SPAC companies, more rounds of financing are expected.

- Volatile stock with insider selling: The company is historically volatile with the management team selling shares potentially after catalysts.

Investment comments: Hold, until we see more signs of commercialization maturity

As mentioned in the introduction, the three things I value the most about a growth tech company is: market sizing, technological fundamentals, and survivability.

Demand is proving strong, but I will still be extremely cautious to see if QuantumScape can, not just deliver, but outperform its peers both in terms of go-to-market and scalability, in order to survive in the long term. But until then, I will remain on the sideline.

Read the full article here