Richardson Electronics (NASDAQ:RELL) offers engineered solutions and microwave tubes worldwide. RELL recently announced weak quarterly results. I expect weakness in the near term due to various headwinds like high inventory levels. In addition, its technical chart looks weak. So I think it would be wise to ignore it. Hence, I assign a hold rating on RELL.

Financial Analysis

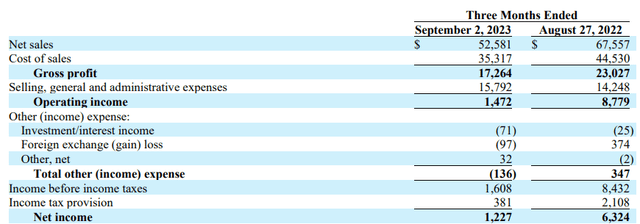

RELL recently posted its Q1 FY24 results. The net sales for Q1 FY24 were $52.5 million, a decline of 22.1% compared to Q1 FY23. The major reason behind the decline was underperformance in its power and microwave Technologies [PMT] and green energy solutions [GES] segments. The sales in the PMT segment were lower due to low demand from its semiconductor wafer fabrication customers. The GES segment sales were affected by low demand for ultracapacitor modules. Its gross margin for Q1 FY24 was 32.8%, which was 34% in Q1 FY23. The margins were affected by the manufacturing under absorption.

RELL’s Investor Relations

The net income for Q1 FY24 was $1.2 million, which was $6.3 million. Apart from the lower sales, the decline was due to various increased expenses like increased employee salary and higher scrap expenses. The sales decline definitely shows weakness, but it is not that concerning to me. Because the slowdown in the semiconductor market, which has been affecting the entire industry, was the real reason for the fall rather than an internal business problem. The semiconductor fab equipment industry is facing a slowdown and is expected to stay the same in 2024. So, the company’s sales might be adversely affected in 2024. Additionally, apart from the semiconductor slowdown issue, I think there are more headwinds that might hamper its growth in the near term. First, the high inventory levels might be a problem for the company because as there is a weakness in the market, its customers might look to clear their inventory and only order when the inventory levels are quite down. So, this might be an issue, and the general market condition is also not favorable. The interest rates are high in the U.S. and Europe, which can also be a headwind for the company. So considering these factors, I expect weakness in the coming quarters in terms of sales.

Technical Analysis

TradingView

RELL is trading at $10.77. After a solid run in 2022, the stock started to fall in 2023, and since then, the stock has been in a downtrend. Since January 2023, the stock price has fallen more than 56%, and there are no signs of recovery or trend reversal. Hence, I would advise you to stay away from the stock as there is a high chance that the stock price might continue to fall, and there is a saying: don’t try to catch a falling knife because it might hurt you. The same applies here. The next support zone that I see for the stock is $9.7, so I see it reaching $9.7 in the near future. The $9.7 level becomes an important level for the stock, and it will be quite important for the stock price to hold that level because if the price gives a breakdown from that level, then we might see a free fall in the stock. Because after $9.7, I see no major support zone. Hence, looking at the price action, I would suggest staying away from the stock.

Should One Invest In RELL?

The stock price has fallen more than 55% from its all-time high, but even after falling so much, I don’t think this might be the right time to buy the stock because there isn’t even one good reason to purchase the stock in my opinion. The current market conditions are unfavorable, and the near-term outlook isn’t looking positive, which might affect the financial performance of the company in the near term and the technical chart indicates further downside possibilities. Additionally, its valuation is on the higher side. RELL has a P/E [FWD] ratio of 34.74x, which is higher than the sector median of 23.89x, and has an EV / EBITDA [FWD] ratio of 14.04x compared to the sector median of 13.24x. So considering all the factors, I think it would be wise to ignore it. Hence, I assign a hold rating on RELL.

Risk

Various elements, such as cost, engineering prowess, vendor representation, variety of products, lead times, and quality of customer service, influence their overall competitive position. In the markets they service, there aren’t many rivals who use vacuum tubes. Additionally, only a few Chinese producers have improved their capacity to create vacuum tubes over the past few years. Technical obsolescence is the biggest threat to competition. Canvys operates in markets with a large number of competitors. Price reductions, lower profit margins, or a loss of market share could all be caused by increased competition and significantly negatively impact their operations, financial health, and business. They may face more rivalry from existing and/or new rivals as they grow their company and pursue their growth goals. A significant negative impact on their company could result from their inability to preserve and improve their competitive position.

Bottom Line

Their quarterly results showed weakness, and the future outlook isn’t positive. So, I expect we might continue to see weakness in the coming quarters as the semiconductor fab equipment market is facing weakness. In addition, there are more headwinds like the high inventory levels and rising interest rates. So investing in it right now might not be a good idea. Hence, I assign a hold rating on RELL.

Read the full article here