Rimini Street (NASDAQ:RMNI) is a company providing Oracle, SAP, Microsoft, Salesforce and IBM enterprise software solutions, ranging from support, managed services, to maintenance.

All-time share performance has been disappointing. Having gone public in 2017 at a $10 price level, the stock continued to trend down in the next three years. It reached its all-time high of about $11 in October 2021, but then saw another downtrend that continued until recently. The stock is currently trading at $2.8 per share, down -37% over the past year, and down -14% YTD.

I rate the stock neutral. My 1-year price target of $2.36 per share projects about -18% downside. At this level, RMNI does not present a compelling opportunity. Risk remains high, mostly due to the uncertainty in the outcome of the litigation process and the ROI from the headcount investments made by the under the period of slow growth.

Financial Reviews

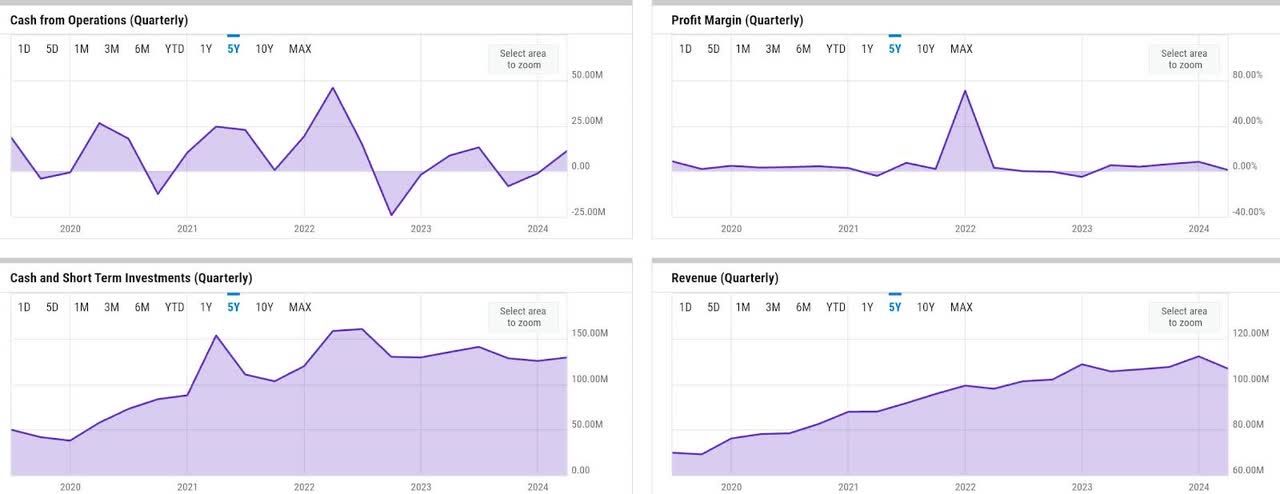

ycharts

Fundamentals have been relatively steady, though have weakened considerably over the past five years. In Q1, RMNI delivered a revenue of $106.8 million, a merely 1.17% growth YoY. This is the lowest quarterly growth rate in the last five years. Same time last year, revenue growth was still 7.8% YoY. Meanwhile, profit margin has also seen a bit of contraction, both on YoY and QoQ basis. In Q1, RMNI delivered a GAAP net profit margin of 1.23%. Operating cash flow (OCF) generation has also declined since 2022, when RMNI generated about $67 million of OCF. In FY 2023, RMNI delivered a mere $12.5 million of OCF, mostly driven by considerable OCF burn in Q3 and Q4. Nonetheless, RMNI generated about $11 million of OCF in Q1, and if the company could lower its cash burn or maintain positive OCF generation, it is in a good position to see an uptrend in annual OCF. Liquidity has been quite decent, despite the choppiness in OCF generation. In Q1, RMNI had $129 million of cash and short-term investments, an uptick from the previous quarter.

Catalyst

I believe there are minimal catalysts for RMNI at present. However, I would consider the appointment of a new EMEA GM and CRO as potential drivers for the successful sales execution and growing adoption of Rimini ONE.

As per its 10Q, Rimini ONE is a turnkey solution provided by RMNI to enable companies to outsource all SAP and Oracle capabilities. One thing that would be noteworthy here is the length of the agreement, which will lock in clients under a 15-year contract, a positive element that should enable RMNI to have better revenue growth visibility:

We also now offer an integrated package of our services as Rimini ONE™, a unique end-to-end, “turnkey” outsourcing option for Oracle and SAP landscapes designed to optimize our clients’ existing technologies with a minimum of 15 extended years of operating lifespan and enable our clients to focus their IT talent and budget on potentially higher-value, innovative projects that will support competitive advantage and growth.

Source: 10Q.

The newly-appointed leaders appear to have relevant experience that could accelerate the enterprise go-to market for the offering. As commented by the management in Q1 earnings call, the CRO, in particular, should help bringing in the enterprise sales network and access he has acquired in his past roles in HP and Cisco:

Subsequent to the quarter, we announced the hiring of a new general manager for the EMEA Theatre, Martyn Hoogakker, who joined us from Adobe with a successful career in sales and regional management and the hiring of our new Chief Revenue Officer, Steven Hershkowitz, who joined us following extensive and successful sales strategy and leadership experience with HP, Cisco and other companies.

Source: Q1 earnings call.

Risk

The biggest risk factor in RMNI remains the ongoing legal process as a result of the litigation with Oracle. It appears that the potential impact from the litigation remains uncertain, making it challenging for RMNI to even provide financial guidance for the FY.

Another risk to consider would be the possible share price underperformance due to RMNI’s relatively high investment activities in the midst of depressed top-line growth, as commented by the management:

Sure, Brian, it’s Seth. First of all, the investments that we’re making are global. Getting a managed service business plus our security business, our interoperability business, our observability business, our consulting business, infrastructure up and running globally means that as we bring on new customers, you’re not getting scale yet. Every new customer in the managed service side and a lot of those particular products I mentioned, require the addition of a new staff. So we’re not yet at a scale where we start to see returns from a single staff member generating multiple customers worth of revenue.

Source: Q1 earnings call.

Though these activities should ideally provide decent pay offs in the future as a result of successful execution in the best case scenario, they have contributed considerably to margin contraction in recent times. In the meantime, the expected scale and timing of the return of these initiatives could also still be uncertain.

Valuation / Pricing

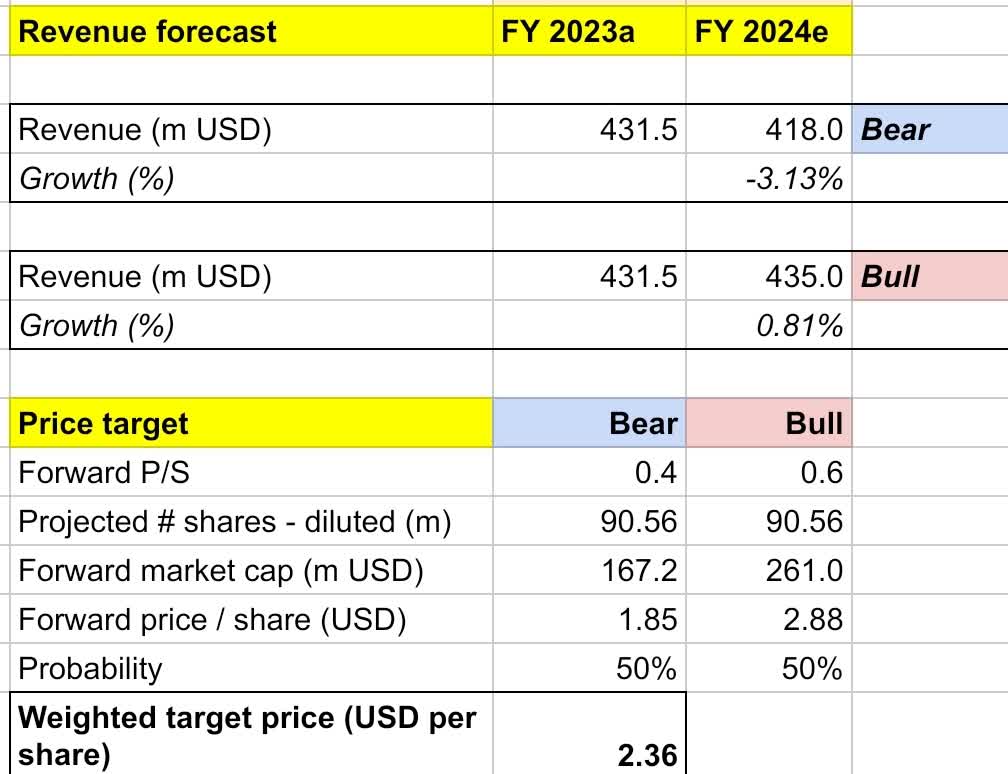

My target price for RMNI is driven by the following assumptions for the bull vs bear scenarios of the FY 2024 projection:

-

Bull scenario (50% probability) assumptions – I expect revenue to grow by 0.8% YoY to $435 million, in line with the market’s estimate. I assume forward P/S to expand to 0.6x to assume a share price reaching $2.8.

-

Bear scenario (50% probability) assumptions – RMNI to deliver FY 2024 revenue of $418 million, a -3.13% YoY decline. I assume P/S to contract to 0.4x, driving share price down to $1.85.

own analysis

Consolidating all the information above into my model, I arrived at an FY 2024 weighted target price of $2.36 per share, a projected 1-year downside of about -18%. I would rate the stock neutral.

My 50-50 bull-bear probability assignment is based on my belief that RMNI’s outlook is still highly uncertain, driven by the ongoing litigation process and also high investments being made amid slowdown in top-line growth. At this point, I believe investors should continue monitoring the adoption of the newly-introduced Rimini ONE solution. In my view, successful adoption here could bring in market confidence that positively affects share price. Overall, though, I feel that it remains challenging to value RMNI properly today until there is better visibility, likely after the company completes its legal process with Oracle.

Conclusion

RMNI is a company delivering software solutions, focusing on enabling enterprises to successfully implement and use Oracle, SAP, Microsoft, Salesforce, or IBM products. RMNI has minimal catalysts at the moment, though the appointment of the new EMEA leadership could probably help strengthen Rimini ONE’s adoption, mainly due to the relevant background and experience of the new leaders. I believe risk remains high, mostly due to the uncertainty stemming from the unclear outcome of the ongoing litigation process with Oracle, exacerbated by the management’s decision to continue making sizable investments that may continue to pressure profitability. My price target model yields a -18% downside with a price target of $2.36, suggesting an unclear outlook that has made valuing RMNI a bit challenging. I rate the stock neutral.

Read the full article here