Back in March, I placed a sell rating on Roblox (NYSE:RBLX) saying that while it has an attractive fly-wheel model that its valuation was sky-high. With the stock down -30% since then versus a 9% gain for the S&P, let’s catch on the name.

Company Profile

As a refresher, RBLX runs an online gaming and digital community platform. It’s front-end user experience, called Roblox Client, allows users to explore 3-D digital worlds and play games and buy virtual items created by developers in exchange for a digital currency called Robux. The company offers a free toolset for developers to build games and experiences to host on its platform.

RBLX takes 30% of each Robux spent on its platform, while developers receive 30% of the transaction and distributors 40%. Robux sales are recorded as deferred revenue and then recognized as revenue after consumable items are used or over the expected lifetime of a user if it is a durable virtual item.

Q2 Earnings Disappointment

Following its Q2 earnings reports, shares of RBLX sank -18.9% after the company posted mixed results.

For the quarter, the company saw revenue rise 15%, of 17% on constant currency basis, to $680.8 million. Revenue growth was strongest in the APAC region up 30% to $69.1 million. U.S. & Canada revenue climbed 13% to $439.5 million, while European revenue jumped 14% to $123.5 million. ROW revenue rose 23% to $48.6 million.

Bookings, meanwhile, rose 22% to $780.7 million, topping the consensus by $2.7 million. Bookings tends to be the more important number investors look at for RBLX, as it shows how much Robux users are buying in the current quarter. Bookings rose 19% in the U.S. & Canada to $487.6 million and 30% in Europe to $148.3 million. APAC bookings climbed 17% to $82.7 million, while ROW bookings were up 36% to $62.1 million.

Average daily active users (DAU) climbed 25% to 65.5 million, while average monthly unique payers jumped 19% to 13.5 million. Analysts were looking for DAUs of 65.8 million.

The young age of RBLX’s users has come under scrutiny, but the company said that users 13 and over are 5x larger than those under 13x and grew DAUs 33%, while users 17-24 year old DAUs grew 36%.

Average bookings per DAU fell -3%, or -2% on a constant currency basis, to $11.92, while average bookings per monthly unique payer rose 3% to $19.32. User engagement was up 24% to 14.0 billion hours, but came up short of analyst expectations of 14.4 billion hours.

Adjusted EBITDA came in at $37.9 million, down -31%. The company had $212.4 million in stock-based compensation in the quarter up, 45%.

The company generated $28.4 million in operating cash flow. Free cash flow was -$95.5 million.

Turning to its balance sheet, RBLX had $2.1 billion in cash and short-term investments, as well as $905 million in long-term investments. It had $1.0 billion in debt.

Looking ahead, the company didn’t give any formal guidance, but it did make some comments about upcoming quarters. It noted that it expects Q3 bookings to grow faster than infrastructure spending growth. It also said it anticipates double-digit adjusted EBITDA margins in Q4 and for full-year 2024. Finally it noted that it forecasts its bookings growth rate to exceed the growth rate in compensation costs starting in Q1 2024 and throughout 2024 and 2025.

Moving forward, RBLX will turn to advertising to help monetize its user base even more. The company said 19% of the top 100 experiences on its platform now have ad units and that it now has 200 brand activations on its platform.

In a shareholder letter, CEO David Baszucki said:

“Roblox, as an immersive 3D platform, enables brands to reach consumers in unique ways. Traditional media such as Linear TV and Out-of-Home offer brands reasonably low amounts of engagement with generally a passive viewer experience. Video and social media offer slightly more interactive experiences, but still fail to draw the levels of engagement of immersive interactive 3D. We offer brands a new way to connect with their audiences that is both much longer and more deeply engaging than existing alternatives. Brands are moving budgets from innovation to marketing to further invest and build on Roblox, similar to the days when they first created their websites and then social media channels. At scale, with proper measurement and attribution, this deep engagement should result in favorable economics for our creators, for brands, and for Roblox. “

Despite the reaction in the stock, the overall quarter from RBLX was not that bad. The company saw some accelerated growth in DAUs and hours engaged, while booking grew 20% or more for the second straight quarter after four prior quarters of sub-20% growth. That shows a business on solid footing, while its monetization efforts with advertising look like it could be a needle mover next year and in the years to come.

Given the interactive community of RBLX, there should be a lot of interesting ways for the company and brands to work together to create unique marketing campaigns. The ability to say buy Nike (NKE) shoes for your avatar, or games built around brands are all options. This looks like a pretty exciting opportunity in my book.

Valuation

Given its high gross margins (over 75%) and cash-rich balance sheet, I view an EV/Sales multiple, or even an EV/Booking multiple as the best way to value RBLX.

RBLX currently trades around an EV/S multiple of 5.1x based on the 2023 revenue consensus of $3.42 billion and 4.5x the 2024 consensus of $3.9 billion. Revenue growth is expected to be around 55% this year and 15% next year. The revenue numbers look too high in my view, given its current 18% growth, and I believe what is being reported on most sites (including Seeking Alpha and FinBox) as revenue estimates are actually booking estimates. Given that revenue in 2022 was $2.2 billion and bookings $2.9 billion, and both having been growing around 18-22% so far in 2023, I believe the $3.4 billion number indicates that the revenue consensus is really the bookings consensus on these sites.

Actual revenue growth is probably around 22% (back-half is likely higher) and revenue more around $2.7 billion. That would put its EV/S multiple at ~6.5x.

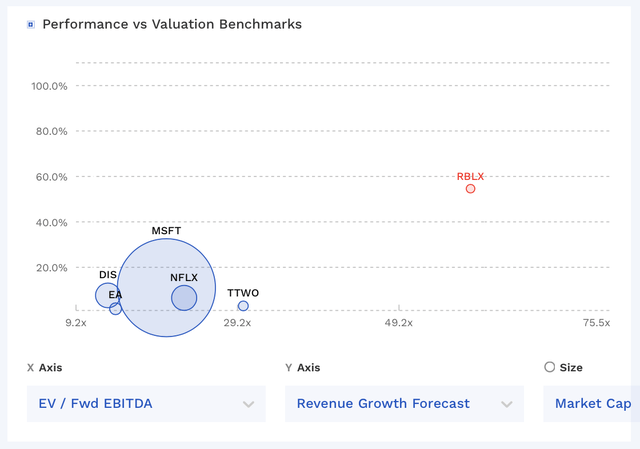

RBLX’s valuation has come down since my initial look at the stock, although it is still above that of a Netflix (NFLX) or Take-Two Interactive (TTWO), albeit with more growth and less profitability. RBLX is a bit of a unique asset, although video game makers may be the closest public peers. RBLX carries a higher valuation, but is growing quicker and is looking at ad revenue to be a potential boost.

RBLX Valuation Vs Peers (FinBox)

Conclusion

With the price of RBLX stock down significantly since my “Sell’ rating and some signs of momentum in the business, I’m going to remove my “Sell” rating and upgrade the stock to “Hold.” I really like the advertising opportunity, and think this could be a game changer for the company in its monetization efforts.

That said, I think its stock-based comp is too high, and I’d like to see some better progress in areas such as free cash flow. I think this is a stock to keep an eye on, but for now in a tough tape I’m going to remain on the sidelines. However, the ad opportunity looks exciting.

Risks to the downside remain that the company needs to begin to increase the monetization of its users. Average booking per DAU has not grown year over year for eight-straight quarters, which isn’t a great sign. Its advertising initiative will look to change this. Meanwhile, it has been spending a lot of money on infrastructure, trust, and safety, which has been keeping its profitability and cash flow down, despite growing revenue. It will need to show that the business can scale despite these increased expenses.

Read the full article here