Dueling Proverbs and Mixed Messages

“Do As I Say, Not As I Do.”

-John Selden

Or

“Actions Speak Louder than Words”

-Melancholy State of Province

The old Wall Street dictum “Don’t fight the Fed” is attributed to Martin Zweig, a finance professor and famous investor who wrote the book Winning on Wall Street in 1970. He used this phrase to explain the strong correlation between Federal Reserve policy and the direction of the stock market.

The idea behind this phrase is that investors should align their choices with the actions taken by the Fed regarding economic growth, interest rates and price stability. When the Fed’s monetary policy is loose, meaning that it lowers interest rates and injects liquidity into the system, it helps the economy expand, which boosts corporate earnings and stock prices. Therefore, investors should invest more aggressively in stocks when the Fed is easing or keeping rates low.

Conversely, when the Fed’s monetary policy is tight, meaning that it raises interest rates and drains liquidity from the system, it slows down the economy, which hurts corporate profits and stock prices. Therefore, investors should invest more conservatively in stocks when the Fed is tightening or keeping rates high.

The adage “Don’t fight the Fed” suggests that investors should not go against the Fed’s policy direction, because doing so would be futile and costly. The central bank has a powerful influence on financial markets and the economy, and its actions often create trends that are hard to reverse.

Yet, pundits in the second quarter have said investors are winning by doing exactly the opposite of the conventional wisdom of Zweig—they were buying stocks and winning while the Federal Reserve was lifting interest rates. We think that view is too narrow. The problem lies in mixed Federal Reserve messaging—what they are doing versus what they are saying, and the mixed messaging gave a green light to risk-taking in markets. In Q2 we had a narrow risk-on market, one that has been beneficial to deep value and long duration growth, and mainly skipped over core or GARPy (growth-at-areasonable price, QARPy (quality-at-a-reasonable price) stocks—which often describes the ones we tend to own.

Let us elaborate on the mixed messages from the Federal Reserve.

What the Federal Reserve did:

The market expectation was that the Federal Reserve would stop or slow down its monetary tightening and interest rate hikes as inflation eased, a few poorly run banks failed and the economy showed signs of slowing down. Indeed, the Federal Reserve paused (Case #1 for the market not fighting the Federal Reserve but surfing the wave), spurring the market.

The Fed’s launch of the new Bank Term Funding Program provided a backstop for banks to access liquidity from the central bank or other private lenders without facing a stigma or haircut. It was set up after the collapse of three lenders that had large exposure to sovereign debt and faced a run on deposits. Several errant banks gave a backstop to an otherwise healthy system. (Case #2 for riding the Federal Reserve wave—a liquidity promise otherwise known as more quantitative easing in the face of simultaneous quantitative tightening).

What the Federal Reserve said:

The Fed said it would resume its rate hikes (while it was pausing) if inflation did not subside or if the economy rebounded faster than expected.

The bank starting to speak louder now as economic numbers are coming in too hot after a quarter of mixed messages.

It seems the Federal Reserve has been speaking loudly and carrying a small stick, at least in Q2 2023.

What investors did:

The Fed’s actions spoke louder than their words this quarter. Their actions, which included a new form of bank QE and a pause, were perceived as a green light for risk-taking and speculation.

There was a rally in a few mega-cap stocks such as Apple, Meta Platforms, and NVidia, boosting major market indices in the US and attracting more investors to the growth category. Long-duration growth had a big quarter.

You also had an artificial intelligence frenzy, which spurred investors to bet on companies like Taiwan Semiconductor and others that were seen to benefit from the emerging technology trend.

In spite of higher interest rates, margin debt, one of the biggest indicators of risk-taking, increased by 9.4% in Q2 2023 to reach a record high of $1.03 trillion, according to FINRA data. This reflected increased borrowing by investors to buy more stocks amid the market rally.

What we see now:

We see several valuation gaps in today’s market: between mega-cap stocks and the rest of the market; between the technology sector and other sectors; and dollar-backed markets like the US versus emerging markets. We distinctly see value in many places now, especially down cap and outside of hardware technology. We are getting some of our best model returns since inception. Yet we do not necessarily see an immediate bullish catalyst in emerging markets and worry that some strong narratives look overvalued.

Rondure New World Strategy

This was one of our first periods of underperformance in a long time. The fund delivered a return of -3.75% in the institutional share class (MUTF:RNWIX) and -3.77% in the investor share class (MUTF:RNWOX), both net of fees in Q2 2023, against the MSCI Emerging Markets Index return of .90%.

The last time we remember feeling this bad about a quarter was when the Federal Reserve suddenly injected liquidity in October of 2019 through one of its seemingly endless QE programs, spurring a similar risk-on rally to end the year. We had been beating the market up until that point in 2019, but our more defensive, smaller capitalization companies could not keep up when the market went full throttle. It felt bad, as it does today, but our models are telling us returns are good in our names and to stay the course, which is what we are doing—following our process.

Our models say there is strong value in the portfolio at present—maybe the best we have seen, and it is not only in China. It is in Indonesia, Thailand, the Philippines, Mexico, and China to name a few. We think hardware technology is getting expensive now on the back of the AI theme. It was cheap at the end of last year.

The portfolio is overweight the reshoring, nearshoring, multi-shoring, and friend-shoring theme. We believe a new globalization story is at play that largely benefits emerging markets countries, other than China. We continue to think this new globalization story is a great story and valuations support a long position. Thailand, a multi-shoring story, took a break this quarter on some political uncertainty. We don’t think this is a thesis breaker. Just a short-term pause in a market that has done well.

In a world in which we look for Q (Quality), V (Value), and G/M (Growth or Momentum) to propel stocks, what is missing from EM as an investment is the G/M. That factor should or could transpire from the U.S. dollar peaking. An all-clear sign on core inflation would be the catalyst. Then, for the first time in a long time, you could argue you will have a three-legged stool in emerging markets (QVG/M).

Some of our best-performing holdings in Q2 2023 were B3 SA (the Brazilian exchange), Ace Hardware Indonesia (OTCPK:ACEHF, beaten up on long Covid closures in Indonesia and now recovering), and Chroma Ate Inc. (a Taiwanese automated testing company that plays into semiconductor testing for AI-artificial intelligence). Many of our stocks in India also had a strong quarter.

We have had an under-to-equal weight to Brazil, and with hindsight, maybe we were wrong, and Brazil does make sense to overweight. The “B” and “I” of BRICS (Brazil, Russia, India, China, and South Africa) is a flight to safety (and inflation does seem to be peaking in both, so that helps support the valuations too). The macroeconomic backdrop for Brazil isn’t bad, and Brazil has fairly good companies.

India is expensive on the surface, but in our opinion, it has some of the highest quality companies with exceptionally long duration growth stories. It is one of the few countries where we think the long run growth is worth the short run multiple risk. It is a place we look to structurally overweight. We still are cognizant that India sometimes gives valuation breaks (generally when/if money rotates to China).

Some of our worst-performing holdings in Q2 2023 were China Tourism Group Duty Free (OTCPK:CTGDF), Li Ning Co Ltd (OTCPK:LNNGF), and Anta Sports Products Ltd. (OTCPK:ANPDY) These holdings suffered from the obvious reason that virtually everything in China went down on political banter and what has been perceived as a disappointing post-Covid opening.

We are not of the opinion that Chinese manufacturing should be strong. The export economy there has myriad reasons for being weak. The first is its main export markets are trying to curtail spending (most developed markets where the biggest consumers sit are lifting rates to try to slow consumption), and the manufacturing sector is in the process of moving away from China to countries such as Mexico, Indonesia, India, and Vietnam, to name a few. We think supply chains shifting is a secular trend—bad for China and good for almost all other emerging markets.

Our positions in China are mainly tied to economic reopening—the same trades we have seen work in many other countries as they have abandoned lockdowns. We continue to believe that in a twist on Paul Revere’s words, the Chinese are coming (to services), but those stocks just did not do well this quarter. We believe Nike and Lulu lemon’s recent reports showed strong improvement in China and offer us a window into the Chinese recovery. We are hoping to see something similar as our domestic Chinese sporting goods companies report. We have added slightly to Li Ning and Anta, but we remain underweight China with a tilt to services and opening, as China’s economic prosperity has to morph to the Western developed model of consumption to a greater degree.

The biggest unknown and potential catalyst in China would be outsized stimulus from Beijing. This could come in the form of direct stimulus to consumers or in a variety of ways. Our holdings would likely participate, and emerging markets would likely fly.

Rondure Overseas Strategy

It was also a disappointing quarter for Overseas. Overseas returned -4.27% in the institutional share class (MUTF:ROSIX) and -4.19% in the investor share class (MUTF:ROSOX), both net of fees in Q2 2023, underperforming its benchmark.

Deep cyclicals and long duration growth led the way this quarter. Large caps beat the smalls, and we are overweight the smalls.

Again, as with New World, the quarter was like a repeat of the end of 2019 when the Federal Reserve spurred risk-taking and big caps with a round of quantitative easing/liquidity in October of 2019.

Our best performing stocks were in Healthcare, where Dechra Pharmaceuticals (OTCPK:DPHAY), a UK veterinarian drug maker, was propelled by an offer to take it private, and Abcam, a global leader in life sciences research tools, is reviewing potential takeover inquiries.

Some of our worst performing stocks were in the industrial and information technology sectors. Unlike in New World, where we outperformed in technology this quarter but suffered from a lower weight, we had an overweight in Overseas but suffered from stock selection. We simply didn’t participate in the massive rally in technology in the quarter.

In hindsight, we just didn’t appreciate how overweight we were to services (our business process outsourcing stocks that took a beating in the industrials sector as well) and what this level of “overweight” to business and IT services meant relative to AI (artificial intelligence) + a slowing economy in what has historically been a cyclical sector as a whole in technology. Some of these names had relatively big multiples and the economic slowdown coupled with a fear that the business models will become obsolete due to artificial intelligence took the wind right out of the stocks’ sails. We think the first risk is temporary and the second risk is overblown, but we do think we missed just how inexpensive good semiconductor and hardware technology businesses got in Taiwan and South Korea at the end of 2022. You had good businesses with great balance sheets and dividend yields on cheap valuations and low expectations. You had value. AI was the catalyst that drove a surge in the space. We missed a great deal of it, and now this is the space that is getting some of the lowest returns in our models. Expectations have gone up. We missed it.

With all of that said, we are really excited about what we are seeing for Quality, Growth, and Value in Overseas. We see a good combination of Quality and Value in Japan in the micro, small and mid-cap spaces where we fish. We also see a catalyst with an increasing focus on returns on equity in Japan. We hope and think the Japan rally is real this time due to this catalyst of higher returns and not a value trap. We do think the market might be due for a summer pause, but valuations and growth (the opening trade is alive and well in Japan and arguably a less risky way to play Chinese tourists than with Chinese stocks) look reasonable in Japan.

A favorite right now in Japan is Lifull Company (OTCPK:NXCLF). This is basically the Zillow of Japan. Japan still has a lot of development potential in the online marketing and services of real estate. In addition, real estate in Japan is a bargain for foreign investors at present, and Japan has some of the most liberal property ownership laws in the world. We think business will be strong for Lifull and the stock is cheap. It is one of many great niche micro caps on offer in Japan.

We also like the Quality and Growth (Momentum) on offer in India. India has some of the best companies in the world down cap. Management teams are good. The businesses also tend to be leaders in their niches, and you have an economic tailwind as India tries to take the development baton from China.

One of our favorite names in India is Westlife Foodworld Limited. This is McDonalds in India. It has a multi-decade growth story we adore. We think it will be a much bigger company in the years ahead.

India, like Japan, might be due for a pause, but any pause in the market, we see as a buying opportunity. We have a list of follows we have teed up to buy in India.

One of the things we love about the Overseas strategy is that it operates in inefficient spaces (micros, smalls, and mid-caps) outside of the US. We are able to own both emerging markets and developed ones in this strategy (and we believe this inflationary period shows just how blurry the lines are between developed and developing), but we prefer to find companies that we believe are underowned and under-followed.

This quarter certainly did not cement our case, but we still think bottom-up the space is attractive.

Small- and micro-cap international and emerging market stocks are inexpensive and profitable. In the US, the small cap space tends to be littered with unprofitable companies. Hot US markets mean profitable companies get pushed to bigger cap indices. Not true in international and emerging markets. Many profitable companies are small because they are simply ignored and unloved like the markets they represent. But we like the portfolio right now, and we think and have seen in the past that the tortoise almost always catches the hare when valuations and quality are supportive like they are in Overseas.

Outlook

We see this quarter as one where the Fed spoke loudly but carried a little stick. The risk is that core services inflation stays stubbornly high as animal spirits spur markets and the economy again. As John Connally, President Nixon’s Treasury Secretary, bluntly told a group of European finance ministers, “The dollar is our currency, but it’s your problem.” Unfortunately, that is absolutely true right now, and why we still worry about a catalyst in the short run if the dollar stays strong.

Whether or not we have a soft landing is irrelevant to the problem. We think the problem is that in order to put a resounding end to one of the craziest bubbles we have seen, the Federal Reserve will need to force a correction (not just weaken animal spirits for a quarter or two, which restarts risktaking and the economy) with the risk that they are stuck between a rock (inflation being sticky) and a hard place (and unintentionally breaking something like commercial real estate or a bank or anything with lots of leverage from years of low-to-no interest rates). This prolongs the problem of the dollar for international markets.

In this environment, where global money can capture a high yield with almost no risk in US sovereign debt, money gets sucked into US-dollar assets in the short run from many of the places we invest. We see quality and value in our portfolios. In fact, we see some of the best value we’ve seen since inception, but as we’ve said we worry about a catalyst.

There are reasons though or catalysts that could come sooner rather than later.

They include:

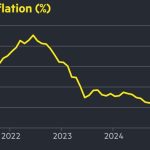

- Peak inflation. The faster this happens the faster money will seek other assets and not hide in high interest-bearing sovereign debt in the US. Falling interest rates in the US will lead to a falling dollar and higher multiples overseas. This should also broaden the trade from more than just a few themes.

- Peak dollar. China finally does big bang stimulus. We see a net/net stock in Hong Kong in a good company, but unlike the US, investors are not biting yet. This is a clear indication to us that China lacks what the US has in spades—animal spirits.

The longer-term catalysts are clear. Quality and Value are quite good overseas at present. Momentum could come from any of the above items, but we believe a new form of globalization, which is more inclusive of a broader array of countries than just the US and China, will be quite positive for many of the countries where we invest and for those nations’ stocks on a structural basis, meaning the longer-term driver of stock performance (Growth vs. Momentum) is in place. The world is about more than AI right now. We just need a few of the items above to happen for that value to be recognized. We truly believe you only just need one item to happen—inflation and hence the dollar need to peak not offer a mixed message.

Thank you for your continued support for Rondure Global Advisors. We appreciate your partnership and trust!

– The Rondure Team

Rondure Funds Performance as of 06/30/2023

|

Rondure New World Fund |

QTR |

YTD |

1 Year* |

3 Year* |

5 Year* |

Since Inception* |

|

Institutional |

-3.75% |

1.03% |

2.72% |

4.34% |

2.85% |

3.50% |

|

Investor |

-3.77% |

1.03% |

2.56% |

4.13% |

2.61% |

3.26% |

|

MSCI Emerging Markets TR Net Index[1] |

0.90% |

4.89% |

1.75% |

2.32% |

-0.93% |

2.67% |

|

Rondure Overseas Fund |

QTR |

YTD |

1 Year* |

3 Year* |

5 Year* |

Since Inception* |

|

Institutional |

-4.27% |

1.03% |

2.46% |

0.98% |

0.78% |

3.01% |

|

Investor |

-4.19% |

1.03% |

2.31% |

0.77% |

0.54% |

2.77% |

|

MSCI ACWI ex US Mid Cap TR Index[2] |

1.72% |

8.34% |

11.91% |

6.47% |

2.36% |

3.94% |

|

MSCI EAFE TR Index[3] |

3.23% |

12.13% |

19.40% |

9.48% |

4.90% |

5.73% |

Footnotes*Annualized [1] The MSCI Emerging Markets Total Return USD Index is an unmanaged total return index, reported in U.S. Dollars, based on share prices and reinvested dividends of approximately 1,383 companies from 26 emerging market countries. You cannot invest directly in an index. [2] The MSCI ACWI ex USA Mid Cap Index captures mid cap representation across 22 Developed Markets (DM) and 24 Emerging Markets (EM) countries*. With 1,200 constituents, the index covers approximately 15% of the free float-adjusted market capitalization in each country. You cannot invest directly in an index. [3] The MSCI EAFE Total Return USD Index is an unmanaged total return index, reported in U.S. dollars, based on share prices and reinvested net dividends of approximately 900 companies from 21 developed market countries excluding the US and Canada. You cannot invest directly in an index. Disclosure:Data shows past performance, which is not indicative of future performance. Current performance may be lower or higher than the data quoted. To obtain the most recent performance data available, please visit Rondure Global Advisors – Home. The Advisor may absorb certain Fund expenses, without which total return would have been lower. These expense agreements are in effect through August 31, 2023. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost. The Advisor has agreed to waive and/or reimburse fees or expenses in order to limit Total Annual Fund Operating Expenses After Fee Waiver/Expense Reimbursement (excluding acquired fund fees and expenses, brokerage expenses, interest expense, taxes and extraordinary expenses) to 1.35% and 1.10% of the Fund’s average daily net assets for the Fund’s Investor Class Shares and Institutional Class Shares, respectively. This agreement (“the Expense Agreement”) shall continue at least through August 31, 2023. The Adviser will be permitted to recapture, on a classby-class basis, expenses it has borne through the Expense Agreement to the extent that the Fund’s expenses in later periods fall below the annual rate set forth in the Expense Agreement or in previous letter agreements; provided, however, that such recapture payments do not cause the Fund’s expense ratio (after recapture) to exceed the lesser of 9i) the expense cap in effect at the time of the waiver and (ii) the expense cap in effect at the time of the recapture. Notwithstanding the foregoing, the Fund will not pay any such deferred fees and expenses more than three years after the date on which the fee and expenses were deferred. The Expense agreement may not be terminated or modified by the Adviser prior to August 31, 2023, expect with approval of the Fund’s Board of Trustees. An investor should consider investment objectives, risks, charges, and expenses carefully before investing. Visit Rondure Global Advisors – Home to obtain a Rondure Funds Prospectus, which contain this and other information, or call 1.855.775.3337. Read the prospectus carefully before investing. See the prospectus for additional information regarding Fund expenses. Rondure Funds will deduct a 2.00% redemption proceeds fee on Fund shares held 60 days or less. Performance data does not reflect the deduction of this redemption fee or taxes, which if reflected, would reduce the performance quoted. For more complete information including charges, risks and expenses, read the prospectus carefully. The objective of all Rondure Funds is long-term growth of capital. RISKS: Investing in foreign securities entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus. Investments in emerging and frontier markets are subject to the same risks as other foreign securities and may be subject to greater risks than investments in foreign countries with more established economies and securities markets. Diversification does not eliminate the risk of experiencing investment loses. Rondure New World Fund (RNWOX/RNWIX) – Inception date of 05/01/2017. Expense ratios as of prospectus dated 08/31/2022 are: RNWOX: 1.58% Gross / 1.35% Net, RNWIX: 1.27% Gross / 1.10% Net Rondure Overseas Fund (ROSOX/ROSIX) – Inception date of 05/01/2017 Expense ratios as of prospectus dated 08/31/2022 are: ROSOX: 1.88% Gross / 1.10% Net, ROSIX: 1.56% Gross / 0.85% Net |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here