I must admit that I didn’t expect RTX Corporation (NYSE:RTX) stock to suffer another meltdown in early September as I updated my thesis following its second-quarter or FQ2 earnings call.

Given the clarity provided by management at its previous earnings conference in July 2023, I had the conviction that RTX had fallen into highly pessimistic zones. Notwithstanding my confidence, sellers returned to batter RTX in September, as the company provided pivotal updates on its Pratt & Whitney Geared Turbofan or GTF engine issues.

Keen investors should recall that management highlighted a worse-than-anticipated impact, requiring more engine removal and inspection visits than previously forecasted. As such, the company downgraded its free cash flow or FCF outlook through FY25. Management noted that the “powdered metal contamination issue is recognized as frustrating and with a significant impact.” Furthermore, the impact is expected to go beyond the PW1100 fleet and could affect other models.

As a result, the company anticipated additional costs required for “customer support” measures, attributed to about 80% of these requirements. Notably, RTX downgraded its FY25 FCF to an estimate of approximately $7.5B, assessing a $1.5B hit to its previous forecast.

Notwithstanding the headwinds, RTX maintains its confidence in the long-term viability of its GTF program, as it works closely with customers and partners to reestablish credibility in its systems. Also, RTX stressed that there are no structural defects in the GTF program and doesn’t expect a much more significant impact than what was communicated.

However, I assessed that market participants are likely assessing a much harder hit to its near- to medium-term operating performance, which I believe is justified.

Accordingly, Wall Street estimates have been downgraded markedly to reflect the company’s latest update. Analysts expect RTX to post a FY25 FCF of $6.58B, well below RTX’s updated $7.5B outlook. I assessed that analysts have likely anticipated that the associated costs could balloon further, given the uncertainties on the total fleet impacted and the associated remediation costs needed. Moreover, RTX could be “compelled” to manage customers’ expectations better with more costly support measures to retain loyalty to the A320neo program.

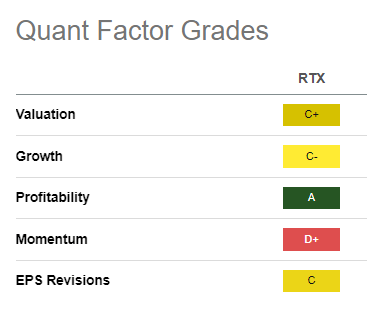

RTX Quant Grades (Seeking Alpha)

Despite that, RTX is no longer expensively valued, as Seeking Alpha’s Quant assigned it with a “C+” valuation grade. Its forward EBITDA multiple of 10.2x is also close to the one standard deviation zone under its 10Y average of 11.3x.

Moreover, its wide-moat and well-diversified commercial and defense business model should help mitigate the engine issues at Pratt & Whitney. I also gleaned that investor optimism has returned since the onset of the Middle East conflict between Israel and Hamas. While it’s not expected to have a marked near-term boost to Raytheon’s defense segment, intensified geopolitical headwinds could bolster longer-term defense spending.

As such, it could help overturn its weak momentum (“D” grade) and help RTX finally form a long-term bottom as investors price in the worst of its recent downgrades.

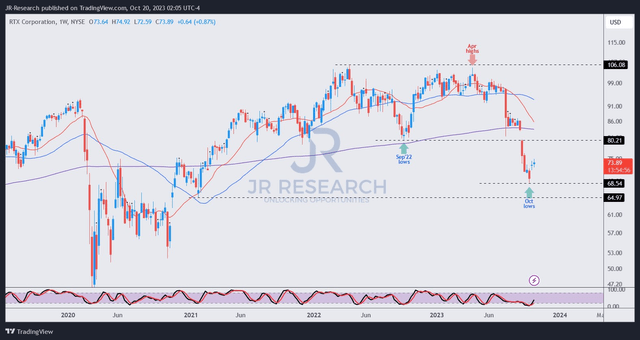

RTX price chart (weekly) (TradingView)

As seen above, RTX has bottomed out momentarily since early October, recovering to levels last seen in mid-September. However, I must stress that there isn’t a bear trap price action (false downside breakdown) supported by a validated bullish reversal.

Despite that, RTX’s valuation has improved further. Therefore, if dip buyers could support its October lows robustly, the worst is likely priced in, given the downgrade by management and a pessimistic outlook by analysts.

While I cannot rule out further short-term volatility on RTX, I have confidence in a much-improved risk/reward profile, given the recent bottoming and improved buying sentiments.

Rating: Upgraded to Strong Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Read the full article here