Investment Thesis

SDI Group (OTCPK:SDIIF) is a fallen angel within the small caps of the United Kingdom. The company had achieved spectacular returns in the last decade; however, the general fear in the market, high inflation in the UK, the exit of investments in small caps, an impairment, and the termination of a contract that had large profit margins created the perfect storm.

In this article, we will explore these significant headwinds that explain the 50% drop from all-time highs and analyze how to incorporate all of this into the valuation to determine if, at the current price, SDI can be considered a possible good investment. Anticipating, I indeed consider it to be.

Historical Price (Google Finance)

Business Overview

SDI Group is dedicated to designing and producing measurement and control instruments for very varied and quite niche sectors such as life sciences, healthcare, astronomy, aerospace and art conservation. Despite its size, the company has a track record of correctly executing its growth strategy over the last decade.

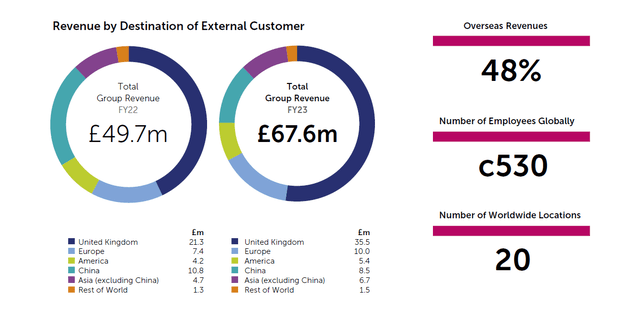

About half of sales are generated within the United Kingdom, SDI’s home country. Again, despite being a small company, its revenue is diversified geographically.

Revenue Distribution (SDI Group)

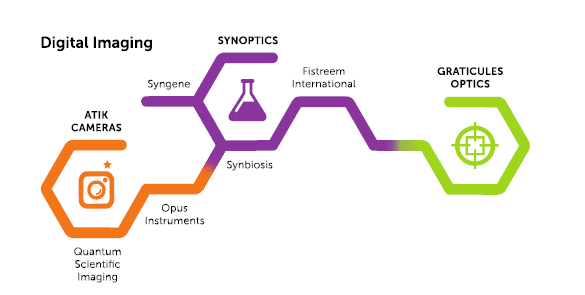

The products are segmented into the categories of Digital Imaging and Sensors and Control.

Digital Imaging

This division makes up approximately 30% of the company’s total sales.

Within this division, there are various product lines, including Atik Cameras, which are known for their high sensitivity and are used in applications such as capturing clear images of deep-sky astronomy.

Another significant brand under this division is Syngene, which produces equipment designed for scientists to capture images for protein and DNA analysis. These examples provide insight into the type of products manufactured within Synoptics Group’s Digital Imaging segment.

SDI Group

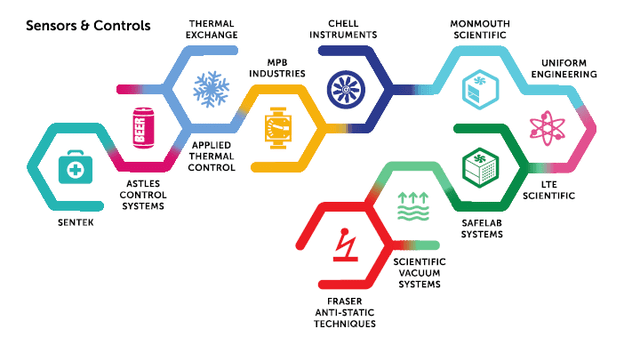

Sensors y Controls

This segment accounted for 70% of the company’s sales in FY2023.

Within this segment, the company operates several brands. For instance, Astles specializes in supplying dosing and control systems for chemical products to beverage can manufacturers and engineering component and engine manufacturers. Monmouth Scientific is focused on providing filtration fume cupboards and installations designed to maintain clean air environments. Sentek specializes in the production and sale of customized electrochemical sensors primarily used in water-based applications.

These sensors find applications in laboratory analysis as well as within the food, beverage, and personal care manufacturing sectors.

SDI Group

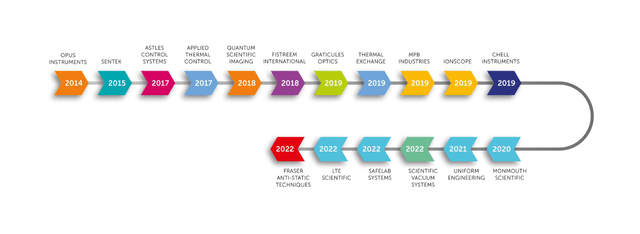

Acquisitions

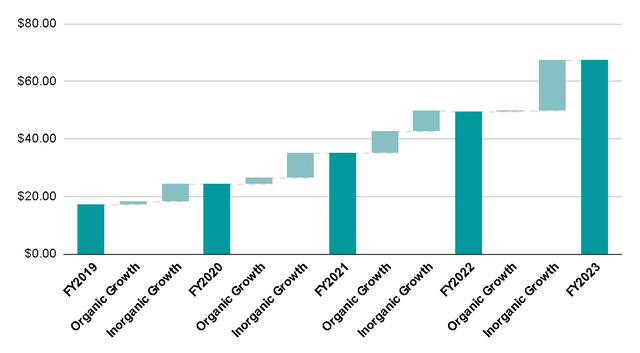

To capitalize on the highly fragmented and specialized nature of the markets in which SDI operates, the company has been implementing an acquisition strategy for several years. A significant portion of the company’s growth can be attributed to these acquisitions, as organic growth typically hovers around 5%. However, there were exceptions in FY2021 and FY2022 (corresponding to the real years 2020 and 2021) when substantial orders were placed for Atik cameras due to their applications in COVID-19 identification.

While these orders temporarily boosted organic growth and sales, they are expected to be completed in the current FY2024, leading to a normalization in growth and margins. We will delve into this topic further.

Revenue Bridge (Author’s Representation)

SDI adheres to a well-defined acquisition strategy that it has diligently followed in recent years. The strategy includes the following steps:

- Seek out profitable companies that generate Free Cash Flow.

- Evaluate the financial history of the target company to ensure its stability.

- Focus on companies that are leaders within their specific niche.

- Look for companies with a competent and effective management team in place.

- Pay a purchase price equivalent to 4 to 6 times EBIT (Earnings Before Interest and Taxes).

Once SDI identifies a suitable acquisition target and the transaction is completed, the company integrates the acquired products into its portfolio. It also implements robust financial controls and allows the acquired company’s management team to continue running the business autonomously. Through this approach, SDI aims to enhance the acquired companies’ sales, margins, and overall growth by capitalizing on synergies.

Since 2014, SDI has successfully executed 17 acquisitions following this method. Typically, they fund acquisitions using their existing net cash or by taking on bank debt and then they repay this debt shortly after completing the acquisition. This has been the recurring process for the past 8 years.

As previously mentioned, the market is highly fragmented, with over 2,000 potential acquisition targets in the United Kingdom, according to the management. Many of these companies were founded by individuals who are now in their 40s to 50s and are seeking retirement without a clear succession plan for their businesses. Consequently, selling the company becomes the most viable option, resulting in a consistent pipeline of potential sellers each year.

SDI Group

FY2023 Results

On September 3, SDI reported its FY2023 results, which initially appeared quite poor:

- Sales £67.6M (+36% YoY).

- EBITDA £11.8M (0% YoY) which represented an EBITDA margin of 17.5%.

- EPS of £0.04 (-49% YoY) and a profit margin of 5.8%.

But beneath these results lies an impairment that muddied the actual figures, therefore, it’s crucial to normalize SDI’s results to gain a clearer understanding of the company’s performance.

To be precise, the impairment amounted to £3.5 million. By adding this amount back to the reported profits, we arrive at the following figures:

- Sales £67.6M (+36% YoY).

- EBITDA £15.3M (+30% YoY) which represented an EBITDA margin of 22.7%.

- EPS of £0.07 (0% YoY) and a profit margin of 11%.

The results are not as dire as they initially appear, and I would even venture to say they are quite positive. The challenge the company faces is that, for this fiscal year, they will experience a loss of approximately £8 million in revenue from high-margin Atik camera contracts. Therefore, it’s crucial to take this factor into account in the valuation, as we will explore shortly.

It’s essential to highlight that an impairment is not a favorable occurrence, as it signifies that the board may have overpaid for the acquisition of Monmouth. However, it’s reassuring to note that such impairments do not appear to be a recurring issue for the board, which is a positive aspect given their history of 17 acquisitions over the past decade.

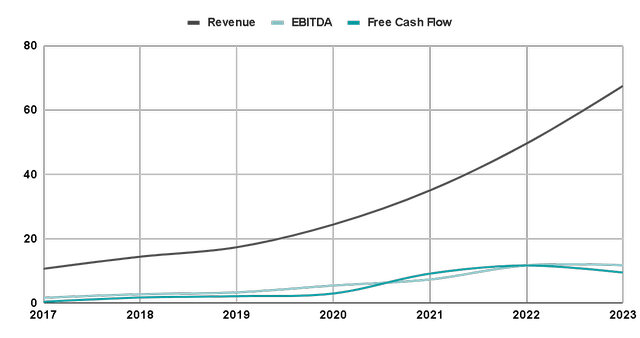

Key Ratios

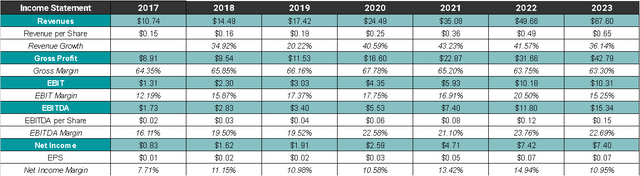

The company has achieved remarkable growth, with an annual increase of 27% between 2017 and 2023. Additionally, during this same period, EBITDA has grown by 35%, and Free Cash Flow has surged by 55%, indicating improving margins.

Author’s Representation

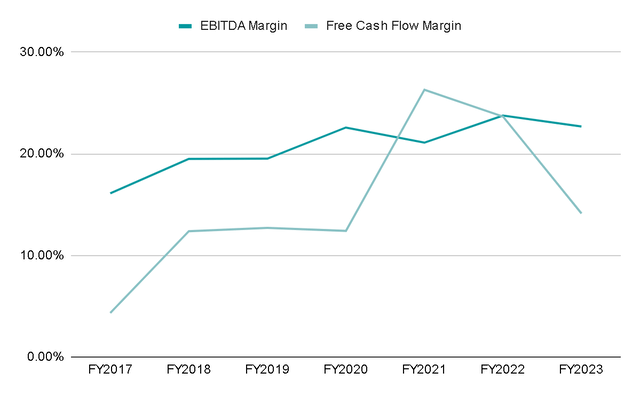

A closer look reveals that the growth in the EBITDA margin has been gradual. However, in the case of Free Cash Flow, there was explosive growth in 2021 and 2022, followed by a normalization in 2023. This trend aligns with the contracts for the Atik cameras, which were likely executed with very favorable margins.

Author’s Representation

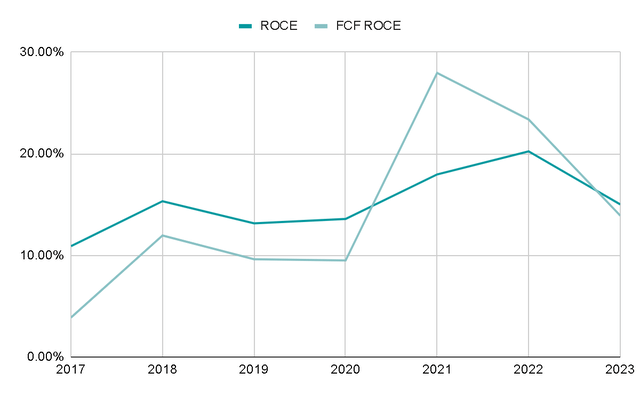

The company’s ability to achieve a 15% average Return on Capital Employed and a similar Return on Free Cash Flow invested is a key metric for assessing the efficiency of SDI Group’s acquisitions, given that acquisitions represent the primary use of capital.

Author’s Representation

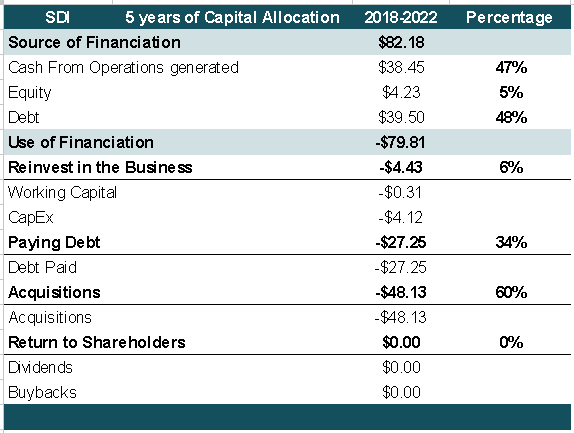

From 2018 to 2022 (FY2019 to FY2023), the primary sources of financing were cash from operations and debt, in equal proportions, as previously mentioned. Capital was predominantly allocated to acquisitions and repaying the acquired debt.

This approach is clear: use debt for acquisitions and subsequently pay that debt with generated cash. However, with recent increases in interest rates, it will be essential to monitor the company’s financial position. Highly leveraged situations may require a pause in acquisitions at some point.

Author’s Representation

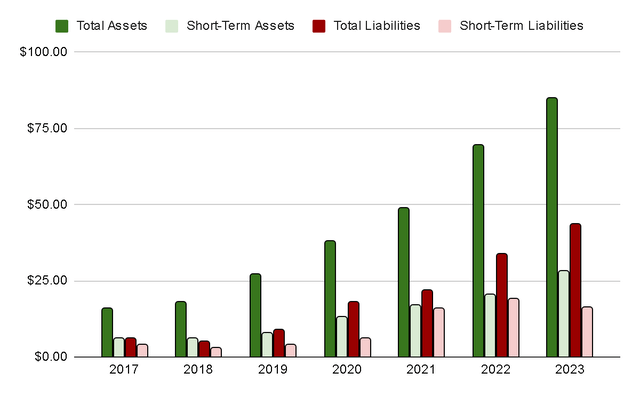

In terms of solvency, the company possesses nearly 2 times more assets than total liabilities, indicating that it has the capacity to sell its assets to cover all liabilities twice over in case of debt issues.

Regarding liquidity, SDI maintains 1.7 times more assets than liabilities, signifying that it is in a strong financial position to meet its short-term obligations and debts.

Author’s Representation

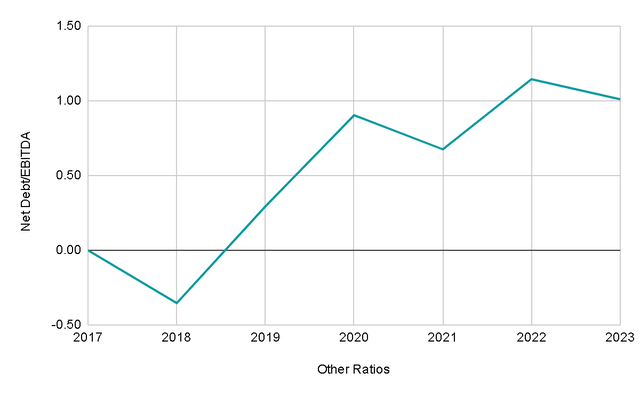

The Net Debt/EBITDA ratio, however, is showing an upward trend year after year, although it remains at a manageable level of 1x EBITDA. Monitoring this ratio to ensure it doesn’t approach 2x levels in the coming years will be important.

It’s important to note that these data are adjusted for the mentioned impairment, allowing us to gauge the underlying business performance without the noise generated by this accounting adjustment, which doesn’t entail a cash outflow.

Author’s Representation

Valuation

For the valuation, it’s crucial to consider a normalized environment of growth and margins. Management anticipates making 2 to 3 acquisitions during FY2024 and expects a loss of approximately £8M due to the Atik camera contracts. The company typically experiences organic growth ranging from 5% to 10% and for this year the objective remains the same.

(Source: Final Results Investor Presentation)

Additionally, with the loss of contracts featuring exceptionally high margins, it’s prudent to reduce the EBIT margin to the historical levels of around 15% that were prevalent prior to acquiring those contracts. This will provide a more realistic basis for the valuation.

Income Statement in Recent Years (Author’s Representation)

In FY2023, the company made 2 acquisitions contributing £17.5 million in revenue (approximately £8.75 million per acquisition). If they make another 2 acquisitions in the current year, I could estimate £15 to 20 million in sales. However, to be conservative, let’s assume they only make an £8 million acquisition, and organic growth remains at 0% due to recession concerns. Thus, FY2024 net growth would be around 0%.

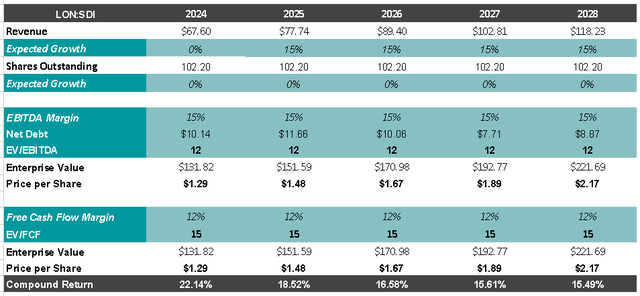

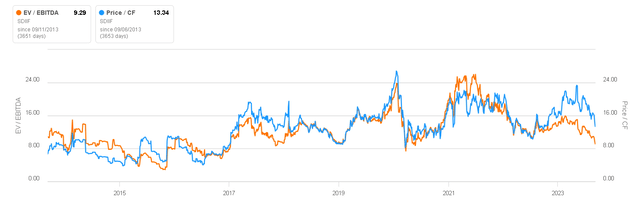

Following this challenging year, it’s reasonable to expect the company to return to its typical growth trajectory, but we’ll consider a more conservative 15% growth rate instead of the previous 27%. For exit multiples, we’ll use 12x EV/EBITDA and 15x EV/FCF, consistent with historical levels before 2020.

With this conservative valuation, it’s possible to estimate a compound annual return of 15% from current prices if purchased from the London Stock Exchange since valuation may vary slightly if purchased OTC.

Valuation (Author’s Representation) EV/EBITDA and P/FCF (Seeking Alpha)

Risks

Interest Rate Fluctuations: Changes in interest rates can significantly impact the cost of debt and therefore will affect the company’s ability to make acquisitions, unless SDI decides to sacrifice financial strength in order to continue growing inorganically, which I would consider very bad.

Integration Challenges: Successfully integrating acquired businesses can be complex. Cultural differences, technology integration, and management alignment can pose significant challenges and while the company has a great track record of doing this properly, it is still a risk to consider.

Market and Technology Risk: The measurement and control instruments industry may be subject to rapid technological advancements. If the acquired business operates on outdated technology, it may become obsolete quickly and growth and synergies would be worse than expected.

Final Thoughts

The company’s current condition justifies the recent drop in its stock price, but I’ve chosen to take a conservative approach in valuing it. Despite its challenges, the company remains well-managed with a strong track record, healthy profit margins, and a high return on capital employed.

Debt levels will require close monitoring, but I believe the company has the potential to achieve 10% annual growth in the coming years without requiring significant debt that puts SDI at risk. Therefore, I’m giving it a “buy” rating while keeping a watchful eye on its financial situation.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here