Thesis

Attractive investments can be difficult to find sometimes. Many investors and traders do not know what to do with their cash in between good ideas. Many of us feel the need to immediately redeploy our capital and end up placing it into sub-par investments at sub-optimal times.

With inflation eroding the value of the dollar at a concerning rate, holding wealth as cash for longer than a few days is not advisable. For the last year or so, I have viewed Treasury Bond ETF’s as short-term parking for my cash in between plays. After reviewing the factors which affect how it generates its yield, I currently rate SGOV as a Buy.

Background

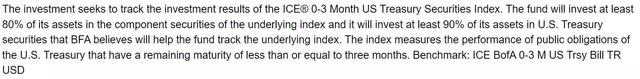

The iShares 0-3 Month Treasury Bond ETF (NYSEARCA:SGOV) is managed by BlackRock Fund Advisors. The fund generates its yield by investing in U.S. dollar denominated treasury securities with less than or equal to three months until maturity. They were formed on May 26, 2020 and currently charge a 0.07% net expense ratio.

Holdings

Like many single purpose ETFs, SGOV’s simple plan leads to their holdings being fairly straightforward. The primary difference between the various T-Bills below is that they all have different maturity dates.

SGOV Goals (Seeking Alpha)

SGOV Holdings (iShares.com)

Distributions

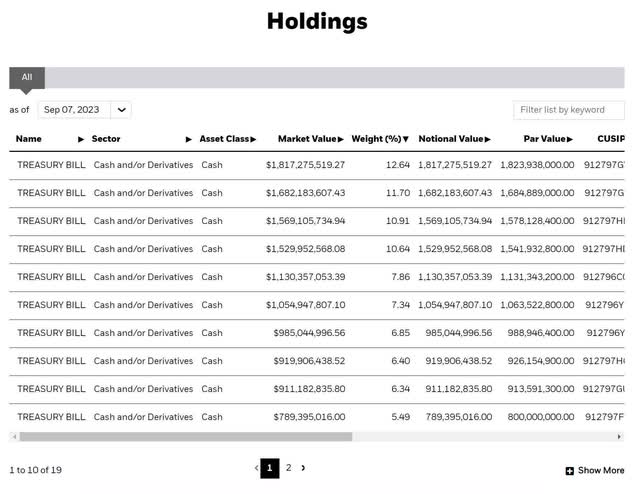

SGOV pays a monthly distribution which is currently at a ttm yield of 4.5%. This is only at an attractive level because the Fed Funds Rate is currently elevated. With rates elevated, the difference between the present value of their holdings and their final value at maturity is larger. When the Fed lowers rates, I expect this yield to drop.

SGOV Distribution History (Seeking Alpha)

SGOV Dates

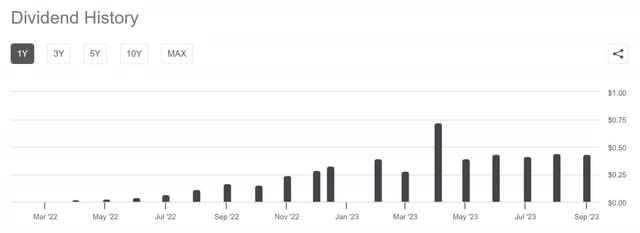

The fund consistently places its Ex-Dividend Date at or near the beginning of every month.

SGOV Dates (iShares.com)

Performance

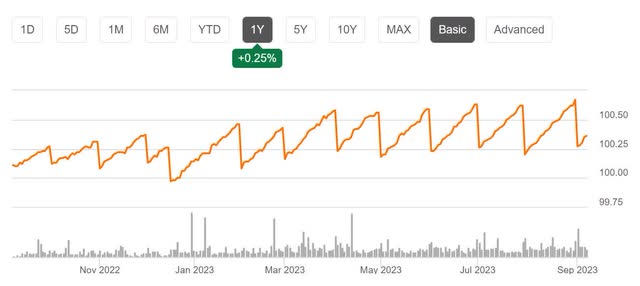

SGOV’s performance is extremely predictable. The fund experiences a drop at the beginning of every month. There are no options available on this ticker because most of the uncertainty has been removed from its performance.

SGOV Performance (Seeking Alpha)

Risks

SGOV is currently only presently attractive because the Fed is maintaining rates at an elevated level. This is causing stress on the system. If inflation drops by enough, or some aspect of our economy buckles under the stress, the Fed will be forced to begin lowering rates and SGOV’s yield will become far less attractive.

Catalysts

If core inflation were to begin rising, the Fed will be forced to elevate rates even further. While I doubt Powell will be faced with the same grim situation that Volcker was, this is a distinct possibility. Further increases in the Fed Funds Rate should grow SGOVs yield.

Conclusions

I believe that Treasury Bond funds will continue to stay attractive for as long as rates stay elevated. The iShares 0-3 Month Treasury Bond ETF is currently paying a slightly higher yield than the SPDR® Bloomberg 1-3 Month T-Bill ETF (BIL), so I currently consider it more attractive.

Also, with current headline inflation at 3.18% and core inflation at 4.65%, I do not consider SGOV’s 4.5% yield attractive enough to take it on as a long-term investment. Depending on one’s choice of broker and what interest rates they currently offer, SGOV is likely not much more attractive than holding cash. While I don’t see alpha here, I do see stability, reliability, and the ability to mitigate some of your wealth erosion while searching for the next good idea.

I believe the most attractive aspect of SGOV is the removal of some of the urgency to immediately redeploy recently freed up capital. This should help grant one the patience and clarity of mind needed to properly evaluate potential investments. I do not currently have a position in SGOV, nor do I plan on establishing one in the immediate future. However, every time I close a position without already knowing where I want to redeploy the capital, I will likely park it in SGOV until I find it a new home.

Read the full article here