About three months ago I covered iShares 0-3 Month Treasury Bond ETF (NYSEARCA:SGOV). In those 3 months, SGOV has returned investors a steady 1.12%. While this may not sound impressive, considering this is a practically risk-free investment, it’s a nice return. SGOV is my favorite ETF to make money in my sleep. SGOV offers a high current yield and ultra-low risk. I think it is the best ETF to make money in your sleep.

SGOV currently has a 30-day SEC yield of 5.34%. Its yield is 0.25% higher than when I last covered SGOV. In the world of T-bills, this is a sizable increase, but also, it appears that SGOV’s yields may stay higher than I previously expected, so it’s time to cover SGOV again and give it a rating upgrade from Buy to Strong Buy.

Holdings

SGOV’s holdings are very simple. It simply holds 0-3 month T-bills. SGOV only has 19 holdings. For most ETFs, I would see this as a problem because the ETF would likely be top-heavy and not be well diversified. But considering the 19 holdings are in ultra-safe and ultra-low volatility holdings, this isn’t an issue.

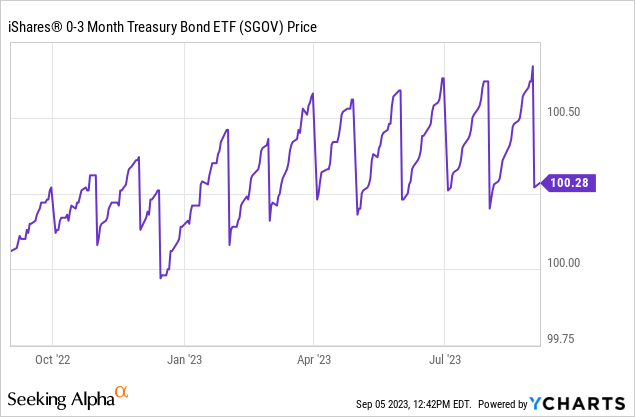

SGOV’s average weighted maturity is currently 0.09 years or roughly 33 days. SGOV pays dividends monthly and this gives SGOV a very predictable and odd pattern. The image below shows the price (does not include dividends) of SGOV.

Why the yield is so high

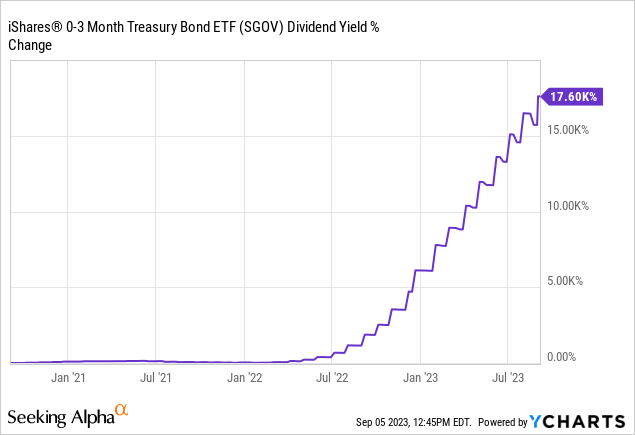

In the last three years, SGOV’s yield is up a whopping 17.6K%. This number is very exaggerated because SGOV’s yield was practically at zero 3 years ago.

SGOV’s holdings are heavily influenced by the Fed funds rate. As we all know, the Fed has been battling some very sticky inflation. They have raised rates to a level we haven’t seen since 2001. This made the yield of ultra-short-term bonds like the ones SGOV holds shoot up. Its yield is currently at 5.34% and SGOV is as almost risk-free as it gets! Every investor needs to take advantage of this however they can and make money while they sleep!

Why SGOV is my favorite ETF to make money in my sleep

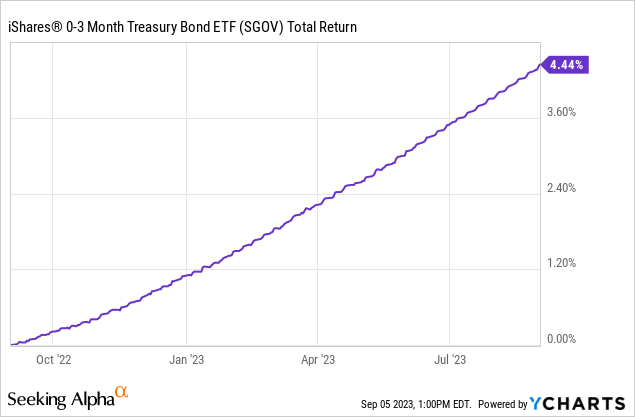

I’ve been saying SGOV is ultra-safe and ultra-low risk. Let’s look at the total return (including dividends) of SGOV over the last year.

This is the definition of a stable return. While this yield and return aren’t always going to be this high, as I’ll discuss shortly, for now, all I (or any investor) need to do is park cash in SGOV, live my life, and make money in my sleep with near zero risk.

Very few ETFs offer this combination of high yield and low risk, and I think SGOV does it the best. Another very popular ultra-short-term bond ETF is BIL. BIL holds 1-3 month T-bills and has a slightly lower 30-day SEC yield of 5.2%. BIL is still a great ETF and is likely to be better than SGOV in certain economic situations, but as of right now, SGOV has the higher yield and still offers the same low risk and volatility as BIL.

I also want to quickly mention money market funds (MMFs). I recently wrote an article on MMFs and I made the same argument for them as I am for SGOV, as both have very similar holdings. Both SGOV and MMFs are great right now. SGOV is likely to have a slightly higher yield but MMFs may be easier to invest in because most brokerages offer fractional shares of MMFs and they are only one dollar a share. Both are good choices; choose the one that best suits you.

How long will the yield stay high?

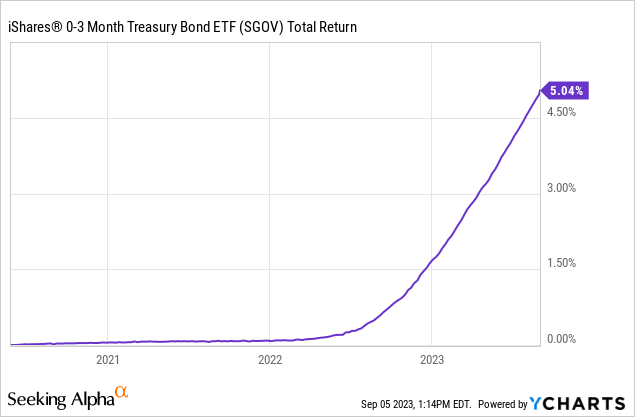

The flaw of SGOV is that when the fed funds rate goes down, SGOV’s yield also goes down. Let’s look at the same total return as above but zoom out to SGOV’s inception in mid-2020.

From mid-2020 to mid-2022 SGOV made practically nothing. If rates get cut, SGOV’s yield will go down.

How long will SGOV’s yield stay high? That’s a complicated and hard question to answer. I believe that SGOV’s current yield should be taken advantage of right now regardless of how long the yield stays this high, but I will still discuss what is likely to happen.

I’ve been predicting a recession for the last several months. Recent economic data has caused me to start accepting the possibility of a soft landing. After this last month’s jobs report, it appears the economy is slowing. Inflation is also slowly but surely going down. So what does all this have to do with SGOV’s yield?

If we go into a recession, the Fed will have to cut rates to stimulate the economy. They likely won’t cut rates to near zero again, but they would be much lower than they are now. The other possibility is that we don’t have a recession. If this is the case, the fed funds rate will remain high. If the fed funds rate stays high, SGOV’s yield will also stay high.

So which one of these is going to happen? I think we are likely to see a correction or even a bear market in equities within the next year but quite possibly not a full-blown recession. I also think interest rates will go down to about 3.5-4%. But I don’t think this matters in relation to SGOV. The great thing about SGOV is that it pays a high yield with no risk. It doesn’t matter how long this is the case. Take advantage of it while it offers high returns.

Conclusion

I think every investor should be using SGOV somewhere in their portfolio. Every investor wants a low-risk high-return asset, and SGOV provides this. Don’t worry about how long the yield will be high; for now, just buy SGOV and earn money in your sleep. I rate SGOV a Strong Buy.

Read the full article here