Dear subscribers,

Portfolios and assets on the West Coast have, in large part, been selling off for over a year. The company/REIT known as Retail Opportunity Investments Corp. (NASDAQ:ROIC) is a REIT in the midst of these issues. Since last October, the company has dropped by over 30% on the market – despite investment-grade credit, low debt, a very conservative yield and payout, and inarguably a mostly qualitative asset portfolio.

In this article, I’m going to be posting my view on this company, which I consider could be interesting to you, because of some of the fundamentals we see, as well as the overall upside that’s possible in case of both reversal and long-term positive trends.

Due to the West Coast exposure though, standard disclaimers apply here. You should probably consider not investing in this company either. But if you like me, believe that despite everything, quality players still have room to move – well, then you might be in good shape for investing in this company.

Let’s see what we have here – because ROIC is comparatively undercovered.

ROIC – Fundamental upside from West Coast Retail

The REIT has an investment-grade credit rating with a BBB-rating, it has less than 46% debt/cap, and a market cap of around $1.7B, making it a relatively small player in a big market. The yield isn’t prohibitive as I see it – 4.5% is still “good enough” for the current environment, and I see this slowly growing as we move into 2024 and 2025.

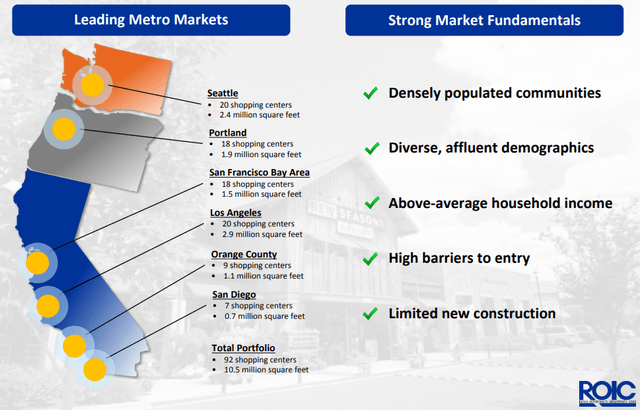

The company operates $3.4B worth of gross real estate assets, with 10.5M Sqft leased to a total of 2,044 different tenants. The occupancy is well above average, at almost 98.5%. Out of its properties, the company owns a total of 92 shopping centers – which also is the focus of ROIC operations.

Its operations have made it the largest grocery-anchored public shopping center REIT with an exclusive West Coast focus.

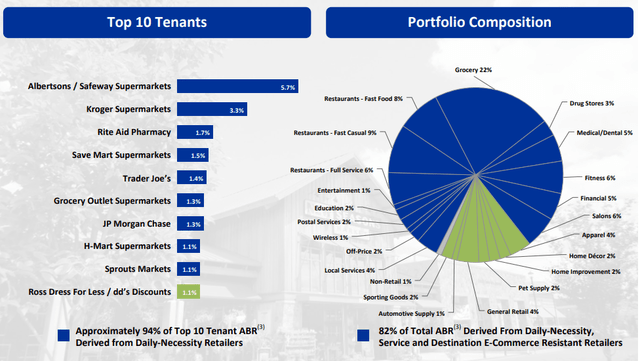

While this is a solid achievement, that’s also a highly specific one, given that there are many larger REITs, many larger shopping/retail REITs, and many also larger on the West Coast. However, it does have a 97%+ grocery/drug anchor, which is a very high rating among the overall public REIT sector.

ROIC is also a member of the S&P600 SmallCap index-.

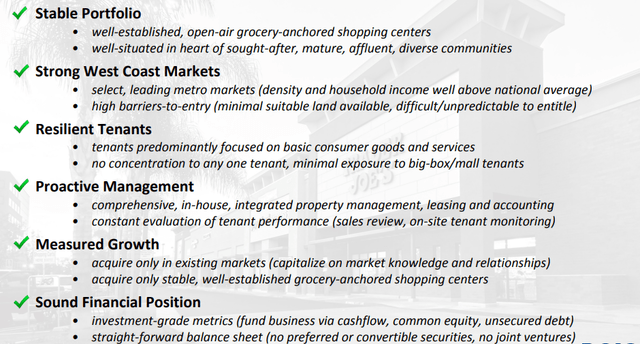

The company’s strategy does not, as I see it, meaningfully differ from any of the other conservative REITs we cover on iREIT on Alpha. It’s solid, but, this has become the standard M.O. for the entire sector.

ROIC IR (ROIC IR)

Where we separate the wheat from the chaff is how the company actually lives up to its risk-averse strategy. In this case, it’s going well.

Why?

Because the company has had a 96%+ occupancy rate for 10+ years running, and that includes the COVID-19 period. Very few REITs of any kind managed this, but ROIC did.

81% of ABR is derived from around 1,900 leases, which also makes the company very diversified. Each of these accounts is less than 1% of total and 82% of the ABR. Also, the rate of growth is impressive here, because ROIC started out in the GFC with exactly $0 of real estate value. That means that this entire history of growth was limited to less than 15 years.

The company’s management team is very experienced- by which I mean the people in the C-suite have over 25 years of West Coast, grocery-anchored strategy experience, with the senior management team having operated together for over 20 years, and successfully “worked” two public REITs – ROIC and Pan-Pacific Retail Properties, which after an 11-year history and growth from $400M to $4B was sold only a year or two before GFC.

So despite the company’s relatively limited size, and you probably never have heard about it, ROIC has a lot to like.

Here is its portfolio and diversification.

ROIC IR (ROIC IR)

As you can see, the company has diversification among the West Coast areas. At this point, I would argue that the challenges faced by the West Coast areas – all of them from Seattle to San Diego – are fairly well-known and well-covered. The downsides are known, and the upsides are known as well. I continue to invest in West Coast REITs and companies, but I put higher demands on quality.

My stance is that we’ll see a fundamental deterioration in the west coast, but that quality operators and “the best” players will continue to thrive.

I consider ROIC to be part of “the best players”.

The advantages named above are not invalid because the West Coast is encountering challenges. They are simply more “limited” to good operators.

As you can see the company’s diversification above, the company is diversified as follows in terms of subsectors.

ROIC IR (ROIC IR)

Grocery is therefore a major driver of the company’s results – and this is one of the better ABR diversions I’ve seen in this part of the country. The company’s anchor locations have a lease rate of 100%. They have had a 100% lease rate for over 5 years.

The variance in occupancy comes from the non-anchor locations, which at times go down to 95%, which still is in no way a “bad” number.

The company’s release trends are “okay”, but have declined over the past few years, reflecting the declining confidence in the geography. However, this has not impacted the overall occupancy, which since the COVID-19 trough of 97% on a portfolio-wide basis is actually up.

The company’s Same-store NOI growth does not outpace inflation – it’s at 3-5%, which is again acceptable, but not a trend that’s “outperforming” anything.

ROIC’s advantages come from its financial position. Maturities are well-laddered, but the company is 57% capitalized with equity, with 97% unencumbered GLA. Mortgage debt is less than 5% of the total, and the company operates at a net debt/annualized EBITDA of 6.5x, with an EBITDA coverage ratio of 3x. It’s not the best in the sector, but it’s also not at anything close to a worrying level given the company’s overall trends.

Second-quarter highlights, which is the latest set of results we have for ROIC, include almost $10M of net income on a quarterly basis and a total FFO of over $35M, which comes to a quarterly FFO/Share on a diluted basis of $0.27, or $1.08 annualized. This marks a 3.2% increase in NOI on a YoY basis, and despite all of the issues that are being publicized on the West Coast, comes at a 98.3% portfolio occupancy, which is at record highs.

The positives we’ve seen in other operators and REITs such as Simon Property Group (SPG) echo through to this company, where the company saw its most active 2Q23 in terms of leasing ever. The company executed over 425,000 Sqft of new leases, or almost 1M sqft on a 6-month basis. That also included a 16.8% increase in same-space cash rent on new rents and 6.6% on renewals. This is above the average, and for new rents, is well above inflation.

So that’s where the company manages well.

The company also declared its $0.15/share dividend, or $0.6/share per year, which comes to a current yield of just south of 4.5%.

It’s not the highest yielder, nor the best-rated REIT. That’s also why I would buy other companies before I would buy ROIC. But if you want grocery diversification, and you’re okay with West Coast exposure, this REIT actually has more upside than you might expect.

Let’s clarify that upside.

ROIC – The REIT valuation becomes compelling as it continues to decline

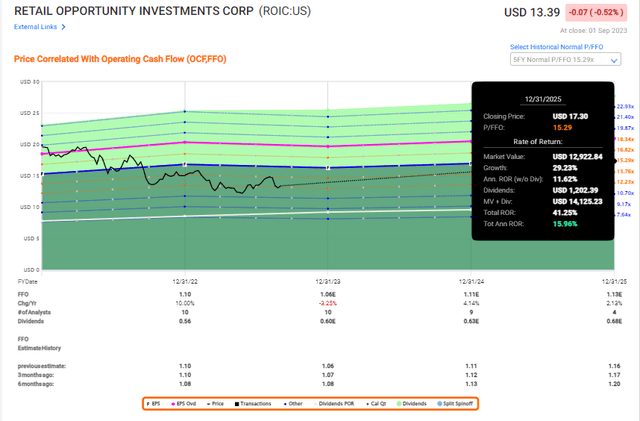

ROIC actually goes both up to very high valuations and very low valuations usually not typical for REITs in this sector. The size has something to do with this. The company typically trades at about a P/FFO of 15.3x, currently at below 12.5x.

Forecasting at 15.3x, that gives us an upside well within the range of my personal minimum investment upside of 15% per year, in this case at around 16% per year or 41% total RoR until 2025E based on a 2.2% annual growth rate and a 2025E share price of around $17.3.

ROIC Upside (F.A.S.T graphs)

That the company can hit these targets, I find no doubt in this. The company never, historically, fails to hit targets. 17% of the time on a 1-year basis they even beat estimates – the rest of the time they hit them with a 10% margin of error. This enables us to have a relatively high rate of conviction when it comes to what we can expect out of ROIC, even if the actual valuation may take years before we see 15-16x P/E again.

We’ve covered often as of late what sort of valuations we should be expecting for companies/REITs with very low growth rates. The consensus, and one we agree with, is that you shouldn’t expect too much out of them.

Personally, I would rather invest in a company with solid fundamentals, high yields, and a good future, than one entirely based on growth estimates with lesser safety. In layman’s terms, I’m willing to invest in companies I realize may go nowhere or increase in valuation very little in this part of the rate hike cycle, in exchange for normalization at a later stage.

When I invest I am primarily focused on the underlying asset quality and company quality of what I buy. Valuation then decides whether the company/these assets can be bought or not.

Perception of the company from the market at current levels is not something that’s necessarily of very high interest to me – because I know the market to be fickle and short-term focused.

Becoming comfortable with the discomfort of investing in a declining company you know to be qualitative is, as I see it one of the first important lessons any investor who wants to seriously grow their wealth needs to learn. If you can’t learn not to panic or act impulsively in reaction to decline, it’s my firm belief that your investments will probably never go anywhere positive – because you’re bound to then overreact to positive movements as well. I know investors who have rules that if companies decline 50% or more, they sell no matter what.

Such rules are not only illogical to me, they’re downright detrimental to value creation. When a company drops, I look at what caused the drop and I make necessary changes to my thesis or outlook, if it’s necessary. In 99% of the cases for me, no real change is necessary because the drop was caused by factors that I view as having less impact than the market does.

And usually, at least for me over my years of investing, I am proven right.

ROIC has an S&P Global target range starting at $14 and going up to $17. I would put a fair-target value at around $16, equating to around 14.5x forward P/FFO. This still puts us in the double digits. S&P Global average is around $15.5, with 5 out of 7 analysts at a “BUY” or equivalent positive rating. This gives us an upside in excess of 15%, and this is at a price/NAV of 0.8x.

At iREIT on Alpha, we give the company a PT of $18/share. So between $16-$18/share, I believe this company has a very good upside.

Here is my initial thesis on ROIC.

Thesis

- ROIC, or Retail Opportunity Investments Corp., is a REIT out of the West Coast with an investment-grade credit, over 4.4% yield, and a portfolio that’s attractively exposed above all to grocery anchors. The company’s solid performance speaks in favor of investing in this business as it navigates the challenging macro we find ourselves in.

- While I would not call this company the first investment anyone should make, ROIC offers meaningful diversification for those already invested in other companies, or those wanting higher West Coast exposure with a doubled-digit potential combined upside from yield and reversal.

- This company does not miss or fail its estimates or forecasts. Combined with the solid track record of management, I rate ROIC a “BUY” here, and would give the company a target of at least $16/share.

Remember, I’m all about :1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

This REIT currently fulfills all of my demands when it comes to a company I’m looking to invest money into.

Read the full article here