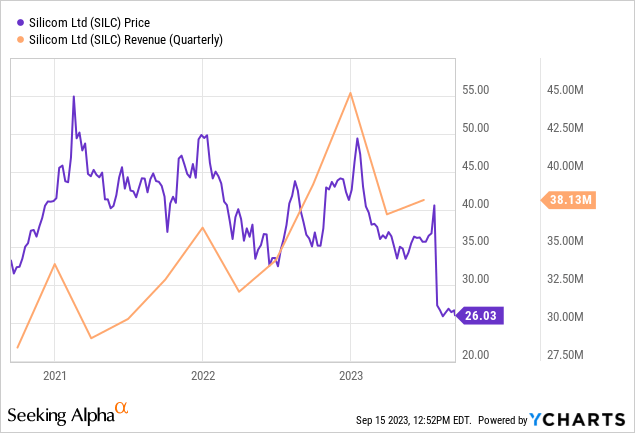

Silicom’s (NASDAQ:SILC) shares plunged by more than $14 despite the topline for the second quarter of 2023 (Q2) improving YoY by 11.4%. Well, at $0.66, its EPS (diluted) did represent a slight decrease of $0.04 (or 6%) compared to the second quarter of 2022, but, such a mixed performance does not normally lead to this degree of market volatility.

Thus, my objective with this thesis is to uncover the reasons for the market punishing the Israel-based company in this way, and show that even at the current level, it does not constitute an opportunistic buy. For this purpose, behind the sheer breadth of its addressable market which comprises HPC (high-performance networking), data infrastructure communications, cloud, and security, lies a company with an enterprise value of only around $123 million.

This begs the question of how Silicom functions given that there are much larger companies operating in the communications equipment industry.

The operating model and Design Wins

Looking deeper, the ability to produce network appliances, edge gateways, or server adapters means that the company has to compete with some of the largest players in the industry including Intel (NASDAQ:INTC), and Cisco (NASDAQ:CSCO) for server adapters.

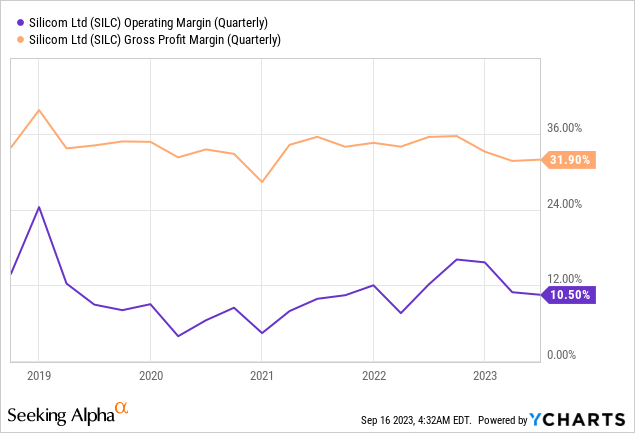

However, had this been true, profitability would have suffered, which has not been the case during the last five years as seen by the relatively stable figures for gross profit margin and operating margin as shown by the orange and blue charts below respectively.

Therefore, Silicom does not compete with them directly, as it is more of a specialized products company given that it tends to proceed through design wins whereby it has to submit a product that meets a specific requirement for the client company, before actually manufacturing the product.

The first example is its partnership approach with a leading U.S. telecommunication service provider for developing a strategic Edge Networking product involving $5 million in initial orders followed by an additional ramp-up after the completion of the first phase.

Second, coming to cybersecurity, it does not develop antivirus software but designs highly specialized server accelerator adapter cards used for encryption purposes as recently ordered by a major U.S.-based cybersecurity vendor. One of these cards is for the FPGA market. Now, Field-Programmable Gate Arrays or FPGAa are pre-fabricated silicon devices whose ultimate use is determined later in the field or in the application domain, not at the time of manufacture, and, after the circuit has been programmed for a specific purpose.

Visibility Problem and Delayed Orders

According to a report by MarketsandMarkets, from $9.7 billion in 2023, the FPGA market should reach $19.1 billion by 2028 after growing at a CAGR of 14.6% in this period. For investors, FPGA is used in everything from automotive, IT, telecommunication, industrial consumer Electronics, and military. Consequently, with cybersecurity threats on the rise, and Israel being a major center of cybersecurity innovation in the world, it comes as no surprise that Israeli play Silicom’s gear has been selected.

However, using the above figures to value the stock would not be appropriate as its circuit boards are embedded within devices like firewalls produced by major cybersecurity plays. Therefore, it ultimately depends on the dollar value of the orders received, and, also if the client orders from competitors. In this case, in addition to competing with smaller like Lantronix (NASDAQ:LTRX) with a market cap of $192 million, Silicom (whose products are pictured below) competes with bigger ones like Nvidia (NASDAQ:NVDA), after the semiconductor giant purchased Mellanox for $6.9 billion in 2019.

Silicom’s Products (www.silicom-usa.com)

Now, to be realistic, these competitors do not manufacture exactly the same products and the fact that Silicom won a $5 million contract shows that its R&D capability remains strong, but this remains a highly competitive market as, after the post-Covid supply chain disruptions of 2020-2022. Furthermore, with the accentuating geopolitical tensions between the U.S. and China, client companies look for other factors like just technical prowess. In this respect, as per Silicom’s SEC filings, there are risks that U.S. restrictions on certain trade with China can result in delays for design wins to translate into revenues.

On the other hand, supply chain problems have now eased and the company does not manufacture the sort of high-end GPUs made by Nvidia which is forbidden from being exported to China. Still, one of Silicom’s problems is its limited exposure to the end customer which in turn poses a visibility problem. This signifies that, unlike cybersecurity companies whose sales teams are in perpetual contact with corporations, have a precise idea of the way demand is evolving and can make accurate revenue forecasts, this is not the case for Silicom, which depends more on its client companies’ inventory levels.

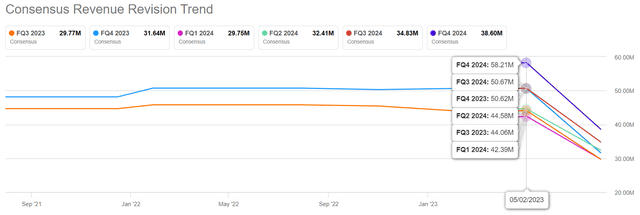

To exacerbate things, there was an above-average demand for the company’s product in the 2021-2022 period during the global supply crunch impacting electronics components including chips implying that client companies now have large inventories. Subsequently, with their inventory levels still high, they are delaying orders which has resulted in the management pushing out to later this year or 2024 revenues originally forecasted for the third quarter of 2023 (Q3). Along the same lines, given the current uncertain macro environment, clients have grown more cautious resulting in delays in obtaining the go-ahead (from client companies) to proceed to the manufacturing of components for which design wins have already been secured.

Explaining the Drop and Could Drop Further

As a combined effect of low visibility and order delays, the consensus revenue estimate by analysts for Q3 which stood at $44.05 million in May has now been revised downwards, to $29.77 million at the beginning of August. This is approximately a 33% decline which is huge.

www.seekingalpha.com

Worst, the EPS estimates have been downgraded by 66% (from $0.85 to $0.29). This explains the rather brutal market reaction.

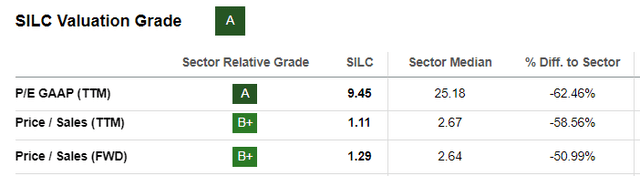

After such a drop, its valuation grade of A together with the stock trading at a discount of over 50% relative to peers in the IT sector both seemingly make for an attractive entry point.

Valuation Metrics (seekingalpha.com)

However, considering that the new consensus estimate of $29.77 million for Q3 which ends in September constitutes nearly a 32% drop over the $39.2 million obtained during the same period last year, the stock is poised to face further volatility when financial results are announced around October 30.

I believe that together with the 66% drop in earnings estimates, the stock could even retest its Covid lows of $23, which means an above three-dollar drop from the current share price of $26.2. This is the reason I have a Sell rating.

A Sell Position, but Keep on your Watchlist

In conclusion, this thesis has shown that despite producing double-digit YoY revenue growth, Silicom’s shares have still suffered because of a significant deterioration in the outlook both for the top line and bottom line, which means that despite its alluring valuations, it is not a buy.

Furthermore, given that this is a profitable company, and had $45.7 million of cash against only $7 million of debt as of the end of Q2, it is worthwhile to have it on your watchlist. Moreover, looking at its full-year 2022 income statement, its sales are relatively well diversified geographically with around 60% of exposure to the U.S. and 22% to Europe with the rest composed of East Asia. Moreover, share buybacks can provide some support to the stock, and to this end, around $44 million has been spent in recent years. Finally, with its lower valuations and ability to produce components for cybersecurity purposes as well as enterprise edge services, it could even be acquired by one of the large companies wishing to drill security right at the silicon level.

Read the full article here