Snap’s (NYSE:SNAP) recent struggles continued in the second quarter, despite an apparent stabilization in digital advertising. While companies like Meta (META) appear to be moving past market headwinds and the problems caused by Apple’s (AAPL) ATT initiative, Snap’s business continues to slide. Investors in the company need to have substantial faith in the management team, as Snap continues to invest aggressively in areas like AR and AI, despite the negative impact this is having on the bottom line in the near term.

Market

While there seems to be a consensus that digital advertising markets have stabilized somewhat, advertisers remain cautious, and ad spend growth varies significantly across verticals. Snap has seen strength in the CPG, restaurant, and travel verticals. Other sectors remained challenged though, and Snap is cautious about demand going forward as a result. Snap’s advertiser exposure is probably one of the factors contributing to the company’s recent poor performance. Snap has relatively high exposure to areas like entertainment and media, consumer goods and tech, which have all been areas of weakness over the past 12 months.

Pricing is also generally an issue in digital advertising at the moment, with ad supply growth outpacing ad demand growth. Given that many companies are looking to maximize revenue or create new revenue streams, ad supply growth could continue to outpace demand growth for some time. For Snap, this would contribute to weak growth and margin pressures.

Snap

Snap’s heavy investments in R&D in the face of weak growth are likely frustrating for shareholders but are best viewed in light of the company’s priorities:

- Driving DAU growth through product innovation

- Growing its direct response advertising business

- Creating new revenue streams

While these priorities make sense from a long-term perspective, Snap’s inability to return to growth or reduce losses in recent quarters has caused investors to take a very short-term view of the company. Snap’s desire to diversify its revenue streams through speculative businesses like subscriptions, AR, and AI also raises questions about the health of the core advertising business.

Stories/Spotlight

Total time spent watching Spotlight content more than tripled YoY, with Spotlight reaching over 400 million monthly active users on average in Q2. Spotlight is an important means of driving engagement with content beyond a users’ close friends. It aims to showcase entertaining snaps created by the community (user created or content publisher) and appears to be an attempt to create more viral content. Ads are now available in Spotlight for all advertisers globally, which should help Snap to improve monetization of this surface. In a demand constrained environment, this may further pressure CPMs though.

Snap has also introduced features to drive engagement and improve the monetization of Stories. This includes expanding the Stories revenue share program to more creators, which is likely aimed at supporting content creation on the platform. First Story was recently released as part of Snap’s takeover lineup. It enables advertisers to place the first video ad between Friend Stories.

My AI

My AI is an interesting development for Snap as it capitalizes on the hype surrounding LLMs but has added significantly to the company’s costs and has unclear monetization potential. My AI is an AI-powered chatbot which Snap users can converse with. At the end of the second quarter, over 150 million people had sent in excess of 10 billion messages to My AI. Snap has stated that My AI costs are manageable and that it has only been a modest contributor to the recent ramp in spend. The company believes that unit economics are reasonable given how My AI contributes to personalization and monetization. These statements seem questionable though given the recent rise in infrastructure costs. Snap has been trailing monetization through the use of sponsored links which connect users to partners that are relevant to the conversation.

Snap is trying to move down the demand funnel with its advertising business but needs to be able to perform targeting and attribution in order to do this. Privacy-enhancing initiatives from companies like Apple have hampered Snap’s efforts though. My AI could be a response to this as it potentially provides Snap with a treasure trove of user data that can be used to support its direct response advertising business. While My AI can potentially be monetized effectively in its own right, it probably should be viewed more as a data acquisition tool than a direct source of revenue.

Snapchat+

At the end of Q2, Snapchat+ had over 4 million paying subscribers. New features available to subscribers include app icons, custom themes, and Bitmoji pets & cars on the Snap Map. Subscribers can now also send Snaps to My AI and receive an AI-generated Snap in response.

While Snapchat+ is a high margin source of revenue, given adoption it appears to have fairly niche appeal and is bringing in only a fairly modest amount of revenue. Snap had previously been targeting 350 million USD revenue from Snapchat+ in 2023 indicating that the business is underperforming expectations. Whether Snap can differentiate the Snapchat+ service sufficiently to drive a meaningful increase in subscribers remains to be seen.

Advertising

Snap made changes to its ad platform in the first quarter which were designed to unify the ad experience and drive more conversions. Snap transitioned to click-based ad interactions across all of its advertising formats, having previously utilized a variety of interaction methods.

Snap has stated that it is improving its ad service through machine learning and by introducing new ways of measuring and optimizing ad spend. The number of active advertisers increased by more than 20% YoY in the second quarter. Advertiser retention has also reportedly improved.

Snap is also using machine learning to drive conversions. The company appears to be making some progress in this area, with purchase-related conversions increasing by more than 30% QoQ. Improvements in click-through conversions are driving strength amongst Snap’s ecommerce-focused advertisers. An important part of this is the quantity and quality of data available for targeting and attribution. Snap recently introduced its Event Quality Score system which helps advertisers to measure the quality and integrity of their data. Snap also continues to improve its privacy-preserving identity graph, which it believes will help connect identity, attribution, and optimization.

Snap has also seen strong adoption of its 7/0 Pixel Purchase optimization model, which contributed to a more than 40% QoQ increase in 7/0 Pixel Purchase conversions. The Snap Pixel is a piece of code that records the behavior of users who visit a store after clicking on the ad on Snapchat. This allows advertisers to see actions like what pages are viewed, products added to the cart and start or completion of checkout.

Financial Analysis

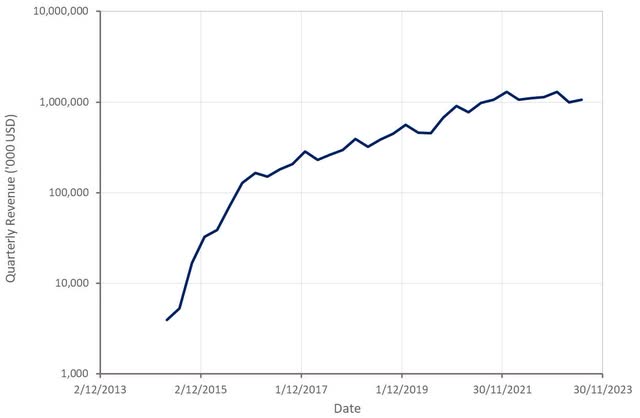

Snap’s revenue declined 4% YoY in the second quarter, despite stabilization in the advertising market. While Snap’s advertiser base may be creating additional headwinds for the company, this result appears particularly negative given the performance of companies like Meta.

Recent weakness is compounded by the fact that Snap is currently guiding for revenue to decline between 0% and 5% YoY in the third quarter. It should be noted that this ongoing weakness comes as Snap begins to lap far easier comparable periods from late 2022, meaning that expected performance is worse than what YoY growth figures indicate.

Figure 1: Snap Revenue (source: Created by author using data from Snap)

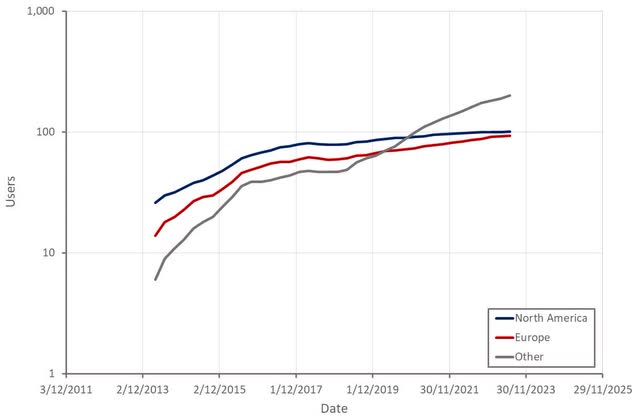

On a positive note, Snap’s DAUs continue to increase at a healthy pace, although this is being driven by regions with low ARPUs, which is a drag on margins. DAUs increased 14% YoY in the second quarter, with growth being achieved in all regions.

Figure 2: Snap DAUs by Region (source: Created by author using data from Snap)

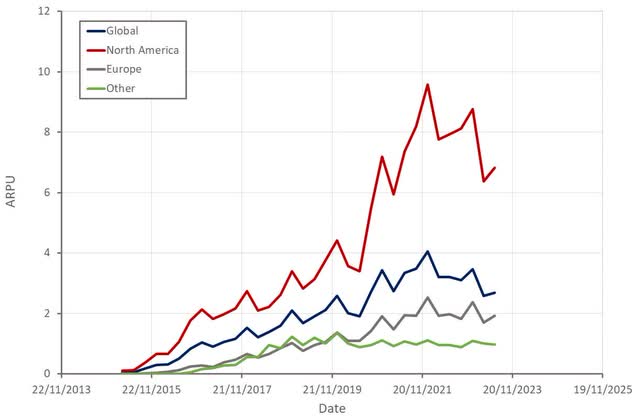

ARPU was down significantly YoY in the second quarter driven by a combination of strong growth in users from low ARPU regions and ARPU declines within regions.

Figure 3: Snap ARPU by Region (source: Created by author using data from Snap)

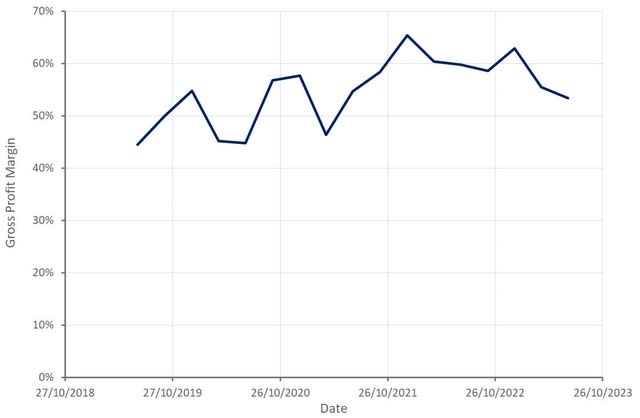

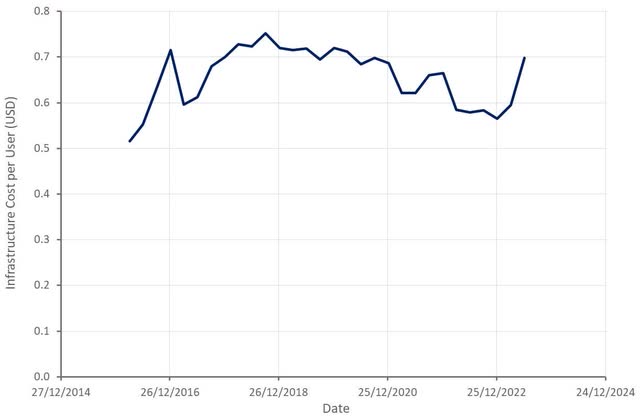

Snap’s gross profit margins have been disappointing in recent quarters and are one of the more concerning aspects of the company at the moment. This is largely the result of declining ARPUs, but the recent launch of My AI also appears to be driving infrastructure costs higher.

Figure 4: Snap Gross Profit Margin (source: Created by author using data from Snap)

Infrastructure cost per DAU increased by around 11 cents in the second quarter and is expected to increase a further 9-14 cents in the third quarter.

Figure 5: Snap Infrastructure Cost per User (source: Created by author using data from Snap)

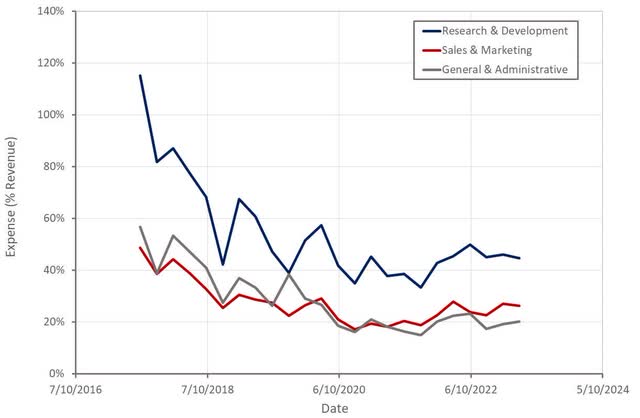

Snap’s margin problems have not been helped by the fact that the company continues to invest aggressively in the business, despite weak growth. The long-term outcome of this remains to be seen but Snap’s track record doesn’t inspire confidence that R&D investments will generate significant revenue streams.

Figure 6: Snap Operating Expenses (source: Created by author using data from Snap)

Conclusion

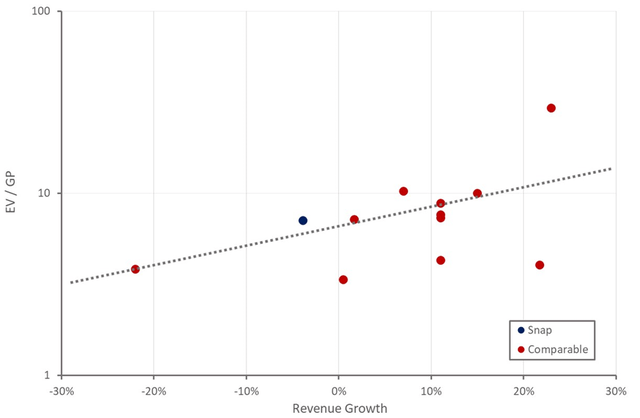

A reasonable argument could be made that Snap is undervalued on an absolute basis, assuming current headwinds prove temporary. Based on a discounted cash flow analysis, I would argue that the stock should probably be worth something more like 15 USD per share. Depressed valuations are common across digital advertising though, and there are companies that appear to be better positioned available at similar valuations.

Figure 7: Snap Relative Valuation (source: Created by author using data from Seeking Alpha)

Read the full article here