Solvay (OTCQX:SVYSF)(OTCQX:SLVYY), the residual succeeding essential chemicals business focused on soda ash as its primary product, is doing alright after the separation but not great. Prices are down with volumes not compensating and EBITDAs are getting hit. A cost control plan is underway, but some of the cost reduction this quarter is a red herring and not going to repeat. The full cost reduction plan of 300 million EUR per year is still a pie in the sky planned for 2028, meant to offset some amount of dis-synergies from the separation, which we labeled as a potential problem in our previous coverage. Guidance paints the picture that the pressure will continue on the business for the rest of the year. Factors like unsustainable importing into China is a factor for soda ash, pending one-off costs from the separation of around 50 million EUR and a current restocking tailwind all contribute to the pressured picture. With general industrial production trending down for a muted Europe, there really isn’t much in the way of tailwinds for the business. The valuation does look good though, continuing the trend of Solvay always being undervalued compared to peers, even on similar specialty exposures. There might be value a case here, but we can’t be bothered with it since it’s tough to make money when guidance and macroeconomic outlook are clearly against the business.

Previous Earnings

Soda ash is the majority of the business’ profits, which is an essential chemical product that is used in lots of applications, some big ones being in the production of glass including photovoltaic glass.

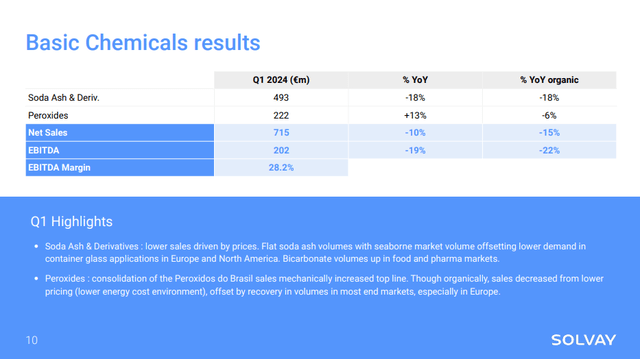

Basic Chemicals (Q1 Pres)

Prices were down significantly, by around 18-19% for soda ash. Peroxides did better due to consolidation effects, but volumes were also alright organically with new capacity in China to meet photovoltaic demand there, and general demand in healthcare.

In general, Solvay is suffering from price declines that are not being offset by volumes. The price declines are in many cases indexed to transportation and energy prices, but nonetheless, a lack of compensating demand in volumes is a testament to pressure on demand, which is also consistent with a fairly negative industrial production picture for Europe which can be used as a proxy of underlying activity in its chemical end markets, which are mostly in Europe. The US market is present in the mix, but its dynamics are remote from that of Europe due to the distance.

For basic chemicals, EBITDA was down around 22% on account of falling prices and unit margin.

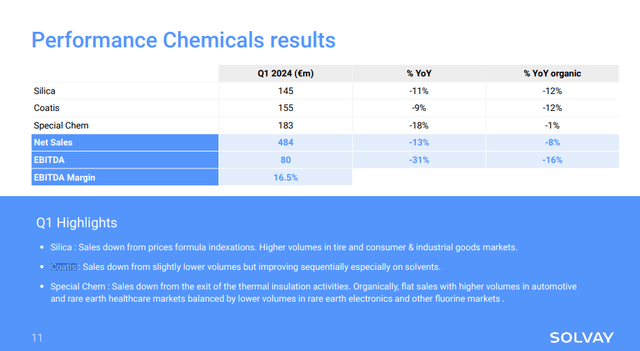

For performance chemicals, sales were down with volumes only slightly up, not able to offset price pressures in Silica and Coatis. The overall decline in sales from scope effects comes from this business, where a specialty chemical insulation business was disposed of. Electronics end markets were under pressure, which is consistent with our Japanese coverage in the space, and automotive and healthcare were doing decently well. With specialty chemical being more resilient in general thanks to more pricing power, down 8% in sales and 16% organically in EBITDA when excluding the disposal effects.

Specialty (Q1 Pres)

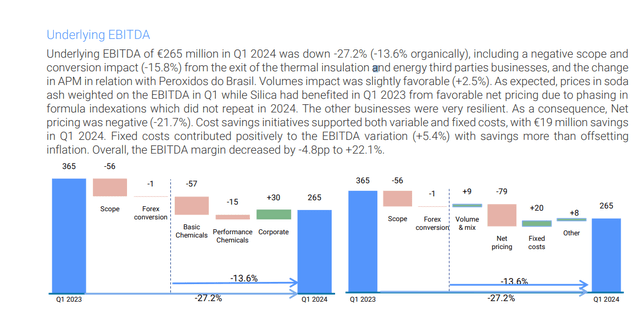

Overall, the demonstration of the scope effects as well as the price and volume effects can be seen below. Soda ash within the basic chemicals business still drives the majority of profits, and the company has been focused on this post separation with Solvay being the sink for the more commoditised businesses, at least with no more PFAS exposure.

Evolutions in EBITDA (Q1 Report)

Looking Forward

The Q2 results are coming towards the end of the month, but the picture is not expected to change much sequentially, with more of the same: EBITDA down, costs maybe marginally better controlled, modest volume growth against meaningful price decreases.

but we don’t see any major change or any major recovery in Q2 versus Q1. However, we will continue to control our costs and our cash as we did in Q1 for Q2. So this is more or less how Q2 should look like.

Philippe Kehren, CEO of Solvay

Indeed, on the demand side, we note that China was apparently uncharacteristically importing last quarter, and this is likely not sustainable since China usually supplies itself with domestic capacity. This demand will reduce from the European export markets. At least competitive Turkish capacity is at stable levels and will not flood new volumes into markets.

As for the cost savings, these are important to parse for contextualising the guidance. The separation was significant and therefore there will have to be dis-synergies. Backend and other corporate costs are no longer shared as an example. Costs will have to be controlled as a standalone entity in order to protect from even more major profit declines.

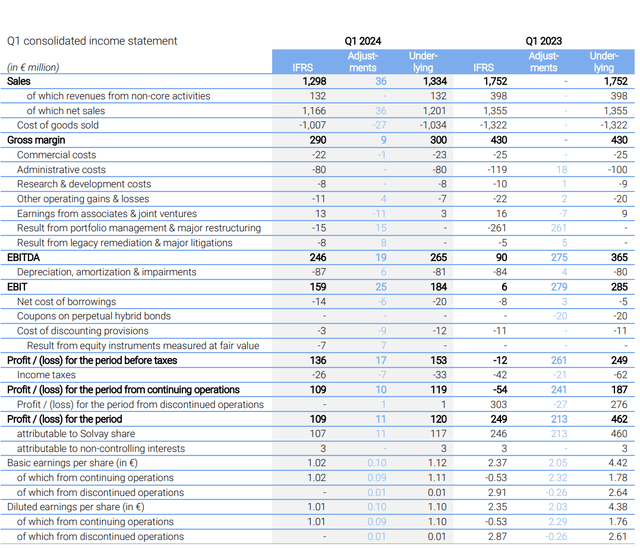

There were 19 million EUR in recurring and sustainable cost savings this quarter. The rest in the corporate savings was apparently not sustainable.

IS (Q1 Report)

Around 18 million EUR in costs are likely to return to the administrative line on a quarterly basis starting from next quarter. These have not been permanently eliminated.

On the flip side, this year will also include a final 50 million EUR in costs related to the separation that have not yet been paid out. That’s 20% of the Q1 EBITDA, and indicatively if you annualise it around 5% of the overall Solvay EBITDA that will be erased this year but on a non-recurring basis.

With ongoing pricing pressure, the year’s guidance is for a 10-20% decline in EBITDA, representing at least an easing in the declines as the comp for the full-year fills out, but still a pressured demand situation and these costs. Taking the 15% as a midpoint, 33% of that decline will be non-recurring from the costs related to the separation from Syensqo (OTC:SYNSY). But there was also a non-recurring benefit of around 10% of the guided decline. Still, the net is positive once the separation has been properly put in the rearview.

With rates coming down in Europe reflecting a weaker macroeconomic situation, we think that for the time being end markets will be weak. End markets for specialty chem like tyres within their automotive end markets and healthcare should do fine, and some of the businesses are now troughing since a restocking boost is helping results against weak destocking comps from last year, but the outlook is not great.

But the stock looks pretty cheap. BASF (OTCQX:BASFY) and Covestro (OTCPK:COVTY) are around similar levels of specialty exposures to Solvay post separation. Solvay is around 5.2x EV/forward EBITDA, against around 7x for BASF and even higher for Covestro. It looks a little cheap, and its prospects could be a lot worse. Admittedly, its imminent growth trajectory is poorer than peers currently, but quite a bit of it is still to do with frictions around the spin-off transaction of Syensqo.

Nonetheless, we believe that this reflects a continuation of Solvay’s previous situation, despite the separation, of being perennially discounted. PFAS exposure might have been a reason before but cannot be any longer. There is a case here for valuation that we quite like, since we are happy to reject the fairness of that continuing discount, but there is a lack of tailwinds with 2024 surely a down year in EBITDA. It’s difficult to make money when earnings will be shrinking, so we don’t want to really get into the value case any further right now, since it’s not a slam dunk.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here