British foodservice venue operator SSP Group (OTCPK:SSPPF) has been getting its business back on its feet. It has done a good job rebuilding revenues following years of travel shutdowns in some markets.

I last covered the name in my July 2021 “sell” piece, SSP: Overpriced For The Long Road Ahead. Since then, the shares have declined 23%. However, I maintain my “sell” rating at the current share price.

The Basic Challenge

I set out the business model, with its pros and cons, in my previous piece SSP Group: Weaknesses Remain so will not revisit them here.

The pandemic and associated government travel restrictions threw up two long-term challenges for the SSP investment case. One was the need to boost liquidity, which it did through a dilutive rights issue in 2021. That at least has helped the group manage move towards a healthier balance sheet.

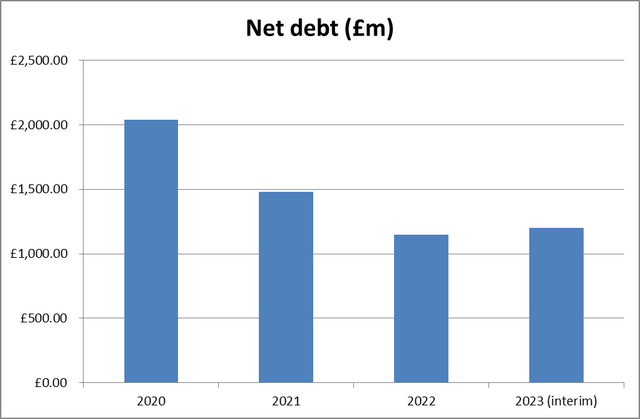

A change in reporting standards from IAS 17 to IFRS 16 makes a longer term comparison difficult, but even a look at the position since 2020 highlights why debt remains a concern.

Chart compiled by author using data from company announcements

Net debt, broadly speaking, has gone down. But it remains high: the current market cap is a little short of £2bn, so the current net debt is equivalent to well more than half of that.

The other was the fundamental weakness of a business model focused on transport hubs during periods when travel patterns change.

That second issue still strikes me as one of the key challenges for the firm even now that it has moved on to some extent from those tough years. Airport traffic is back – though we have been reminded, as post-11 September and during the 1970s energy crisis, that it can turn on a dime at any moment in a way which affected parties like SSP cannot influence. Traffic in U.K. railway stations, another important revenue source for SSP, has been changed – likely for the long-term – by a shift in working patterns brought about by the pandemic.

Current Performance

The company’s most recent trading update was in June, at which point it said that the first ten weeks of its second half saw revenues 10% above equivalent 2019 levels. The most recent figure included revenue from net contract gains, so I would not treat it as a like-for-like number.

The full-year outlook is revenue and underlying pre-IFRS 16 EBITDA to be at the upper end of c.£2.9bn-£3.0bn and c.£250m-£280m respectively for FY2023. The company expects a corresponding EPS (again, underlying pre-IFRS 16) of 7.0 -7.5p.

Planning assumptions for next year (in which the company declared itself to be “increasingly confident”, although I think it is a bit early for that myself) are of £3.2-3.4bn, with a corresponding EBITDA (underlying pre-IFRS 16) of £325-£375m.

Here is how those numbers compare to last year and the pre-pandemic 2019 numbers.

|

2019 |

2022 |

2023 est. |

2024 planning assumptions |

|

|

Revenue (£bn) |

2.8 |

2.9 |

2.9-3.0 |

3.2-3.4 |

|

underlying EBITDA (£m) |

not given |

142 |

250-280 |

325-375 |

|

Profit (£m) |

154 |

9 |

not given |

not given |

|

underlying EPS (p) |

29.1 |

7.7 |

7.0-7.5 |

Unknown |

Compiled by author using data from company reports

The 2023 plan essentially foresees revenue marginally ahead of 2019, which given the inflation of the intervening period probably means lower sales volumes in my view. Underlying EBITDA is expected to rise sharply this year and again fairly substantially next year. But I regard underlying EBITDA as a junk measure from an investor’s perspective. Looking at the statutory profit in the table above, last year came in at £9m, while underlying EBITDA came in at over 15 times as much.

What is perhaps most notable is that underlying EPS are only expected to get back to around a quarter of 2019 levels next year. That likely reflects lower earnings but also the share dilution. At the start of this year the company had an issued share capital of around 797m ordinary shares, compared to around 447m at the start of 2020. So while some of the EPS reduction is due to higher share count, some is down simply to weaker earnings despite the revenue recovery.

Strategic Plan

The company has been working to set out a strategy to help flesh out credibility for earnings growth. This was discussed at a U.S. investor event in June (one of the documents relating to the North American plan is here: others can be found on the group’s investor relations webpage). This includes:

· Growing sales more strongly by pivoting to structurally higher growth markets, principally North America and Asia Pacific;

· Boosting operating margin for the long term thanks to operating leverage driven by revenue growth, an efficiency programme and pricing to combat inflation;

· Growing earnings sustainably due to strong operating profit growth;

· Funding capex from operating cashflow; and

· Deleveraging.

The company also anticipates reinstating its ordinary dividend with a target payout ratio of c. 30-40%, returning surplus cash to shareholders in line with its capital allocation framework. The 2019 dividend per share was 11.8p. Even at the 40% level, if that is based on 2019 statutory profit after tax, that would equate to a dividend of 7.7p per share, suggesting a yield of 3.2% at today’s share price. For now, though, I am not fully confident that the 2019 statutory profit level will be coming back any time soon.

The above strategy looks fine and makes sense to me. The company has been on the acquisition trail in North America to help put it into action. But while the strategy seems solid enough, it does not particularly excite me. It will be a slow process over the medium term and it does not change the fundamental business model. Expanding in the airports in North America and the U.S. might look like a goldmine during the current travel boom. Wait a couple of years for a deep recession, let alone the next unforeseen event that suddenly upends travel demand, and I am not convinced it will look so smart.

Valuation

Based on the coming year’s forecast earnings per share (which, recall, are on an underlying not statutory basis), the prospective P/E ratio here is around 33.

That looks high to me for a company with a strategy I regard as fine but inherently risky. I maintain my “sell” rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here