Written by Nick Ackerman.

Starbucks (NASDAQ:SBUX) has been a portfolio position of mine for several years now. There are several headwinds that SBUX could face going forward, such as inflation and a cooling economy. A return to student loan payments is also something to keep in mind as capital from younger audiences goes back to paying bills rather than buying lattes. However, I suspect that’s probably going to be a negligible hit; they’ll find a way to get their sugary caffeine fix.

Valuation Might Be Rich But Has Strong Growth Potential

Last year, I took an assignment for an additional batch of shares after writing puts when the price fell. However, I ended up being quite early to writing puts as the shares fell dramatically with China still facing lockdowns over Covid concerns. That being said, we’ve returned back to writing covered calls on SBUX throughout this year, and that includes having to roll the calls written on several occasions.

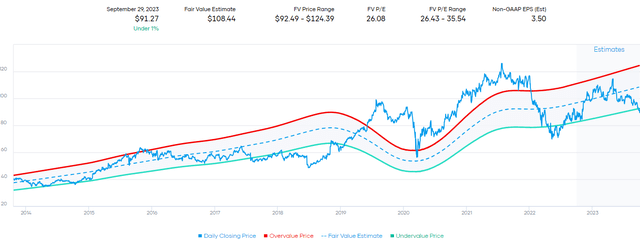

Here is a look at the valuation and why I’ve been reluctant to let this position go (besides being biased and drinking tons of Starbucks coffee) is that I believe that based on the fair value range, we could be able to see SBUX shares higher from current levels.

SBUX Fair Value Range (Portfolio Insight)

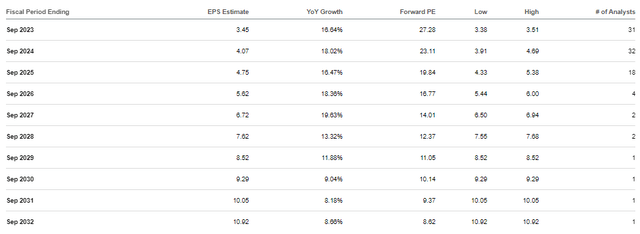

Of course, the argument against that is that SBUX is a richly priced stock with a P/E valuation of 27x forward estimates. That’s above the current broader market multiple. Analysts expect growth going forward, but even with that, you’d have to go out to 2025 estimates before breaking below a 20x multiple.

SBUX Long-term Earnings Outlook (Seeking Alpha)

Looking at the non-GAAP forward PEG ratio, that comes in at 1.56. It doesn’t necessarily mean excessive overvaluation but does suggest that it certainly isn’t a value stock by any means.

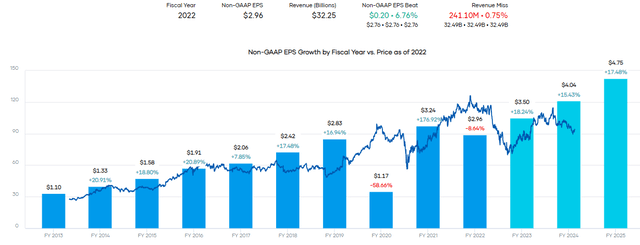

With earnings coming up, we’ll have a fresh set of data to look at soon enough. SBUX tends to surprise the upside with its EPS estimates, as the company has only missed 3 out of the last 16 quarters. For revenue, it’s been more of a mixed bag, with 6 of the last 16 quarters coming in short of expectations.

All this said, the company faces potential headwinds as well, with an expected slower economy.

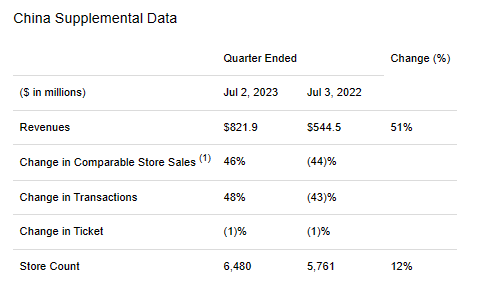

In particular, a slower China could mean earnings growth may be rosy at this juncture. China is a key part of their growth strategy. Last quarter, the comparable store sales increased by 46%, but that was coming off of the Covid lockdowns last year.

SBUX Q3 China Data (Starbucks)

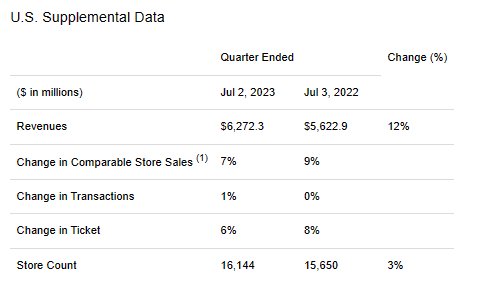

North American sales were up, but with growth being driven by the ticket price (price increases.)

SBUX Q3 U.S. Data (Starbucks)

New store openings likely helped drive revenue as well, with 588 net new stores, which brought the total count to over 37000. The U.S. and China account for 61% of their total store count.

During Covid, which was essentially the worst-case scenario of a total shutdown of the entire economy, we saw earnings react significantly with a massive drop. Thankfully, it was a short-lived event, and earnings once again popped higher. However, even with a mild recession, we would anticipate that earnings growth would slow or even go flat.

SBUX Earnings History and Forecast (Portfolio Insight)

‘Double Your Dividend’ Opportunity

Earlier this year, we highlighted how you could ‘double your dividend’ by collecting option premium with a covered call strategy on Trinity Capital (TRIN). This is another opportunity with Starbucks this time.

Here’s the trade we did earlier this week:

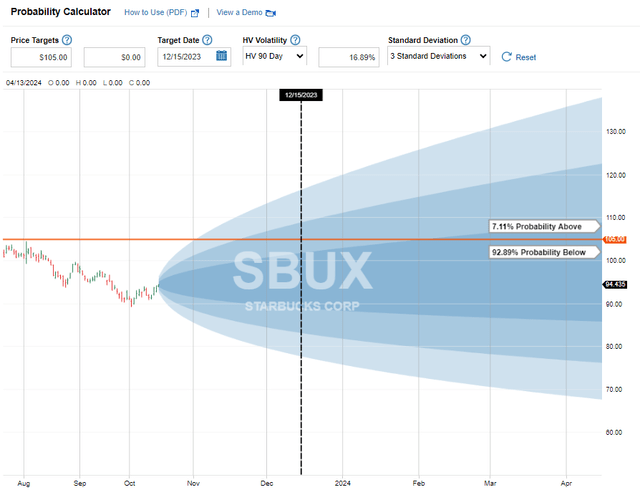

The Trade: Sell to Open Calls on Starbucks December 15, 2023 – $105 strike collected $0.75.

As of the market close on Friday, the bid/ask for this same trade is now at $0.82/$0.87. So an even better opportunity.

The probability of having these shares called away at $105 is fairly low, according to Fidelity.

SBUX Probability Graph (Fidelity)

However, a couple of important notes.

First, they have their earnings coming up on November 2, 2023. That always has the potential to cause more volatility and move the share price in ways not anticipated.

Second, the shares go ex-dividend on November 24, 2023. Since we are long the shares, we will be receiving that dividend, which was raised to $0.57 with this latest announcement.

On a side note, this was exactly what my estimate was in the update written prior to the declaration.

With all this being said, if I were to try to take my best guess, I would suspect the next quarterly payout would be $0.57 or around a 7.5% increase.

We would expect the share price will be adjusted by $0.57 on the ex-dividend date, which would move it away from our $105 strike price. This is likely reflected in the premiums being received for selling these covered calls with a slightly reduced premium.

With that being said, given the dividend declared plus the premium we received now for writing these calls, we have more than ‘doubled the dividend’ in this period. That is to say, we collected $0.75 in options premium, which is 1.32x the $0.57 quarterly dividend – but we’ll also be collecting that dividend as well for a total of $1.32 a share received during this period.

The option trade is only over the course of 58 days, which is considerably less than the ~90 days for each quarterly dividend. Therefore, if you wanted to get technical, if we could do a similar trade, we’d be able to do this trade 6.3x per year. That would work out to collecting roughly $4.72 in options premium at this rate, and technically, we could essentially more than ‘triple the dividend’ as the current annualized dividend rate comes to $2.28.

That isn’t that hard to imagine either, as we’ve been able to do more than that just this year. Of course, hindsight is 20/20, and that doesn’t mean over the next 12 months, we’ll get the same opportunity.

At this point, we’ve been able to collect a lot of option income from SBUX, and in particular, this year, it has been working out quite well. Though admittedly, 2022 saw the share price tank, and by taking the assignment at $101, it was too early to get into the position even after it had experienced quite a material decline prior to that.

| Ticker | Expiration Date | Upper Strike | Lower Strike | Current Price | Type Sold | Date Initiated | Premium Collected | Date Closed | Closing Cost | Gain/Loss |

| SBUX | 08/25/2023 | $110.00 | – | Expired | Calls | 07/17/2023 | $0.69 | Expired | – | $0.69 |

| SBUX | 07/21/2023 | $110.00 | – | Rolled | Calls | 04/17/2023 | $4.93 | 07/17/2023 | $0.04 | $4.89 |

| SBUX | 04/28/2023 | $105.00 | – | Rolled | Calls | 03/27/2023 | $0.86 | 04/17/2023 | $4.00 | -$3.14 |

| SBUX | 03/24/2023 | $111.00 | – | Expired | Calls | 02/15/2023 | $2.16 | Expired | – | $2.16 |

| SBUX | 02/17/2023 | $110.00 | – | Rolled | Calls | 12/12/2022 | $2.46 | 02/15/2023 | $0.24 | $2.22 |

| SBUX | 12/16/2022 | $105.00 | – | Rolled | Calls | 11/04/2022 | $0.51 | 12/12/2022 | $0.53 | -$0.02 |

| SBUX | 03/18/2022 | $105.00 | – | Expired | Calls | 02/07/2022 | $0.58 | Expired | – | $0.58 |

| SBUX | 02/04/2022 | $101.00 | – | Assigned | Puts | 01/07/2022 | $1.25 | Assigned | – | $1.25 |

In total, including the $0.75 collected today, we are looking at the total option premium received of $9.38 going back to January of 2022. $7.57 of that is in trades that expired this year (including the $0.75 received today.) Suffice it to say we’ve exceeded $2.16 in dividends paid over the trailing year alone by a material margin.

As shown above, we’ve also had luck in rolling these covered calls when we need to, so just because we are selling the $105 strike prices, that may not be where this trade ends.

Conclusion

Given the potential headwinds, it actually returns to why a covered call strategy may be even more appealing going forward. If we can continue to write covered calls in the $105 and $110 space because earnings aren’t as rosy as anticipated and the share price moves mostly sideways, that’s going to provide us with some cash flow. This would be along with the dividend during what could be a more challenging time.

Just like any strategy, there are pros and cons to consider. The main risk to this thesis would be that the share price falls dramatically, making trying to sell calls even at these sorts of strikes not bring in any meaningful option premiums. In that case, one would be looking at the dividend to provide some cash flow while waiting for a recovery. Additionally, turning back to writing puts could be a viable strategy, depending on how far a potential fall would go.

Finally, option writing isn’t about getting rich. Here’s what I’ve said before and is worth repeating:

One of the pushbacks I hear about writing puts/calls is, “it won’t make you rich. If it did, everyone would do it.” I absolutely agree too. It won’t make anyone rich overnight. That isn’t the goal of selling options, in my opinion. If you are looking for a get-rich-quick scheme, look elsewhere.

Option writing can be a great complement to dividend investors, whether utilizing cash-secured puts or covered calls.

Read the full article here