Today, we comment on Stem’s (NYSE:STEM) financial performance and its latest development (Barclays Energy Conference). Last time, although we reaffirmed an overweight valuation, we also lowered our target price, forecasting an adjusted EBITDA in 2023, 2024, and 2025 at $(21)/75/150 million, respectively. Before moving on with our analysis, we briefly reported the company’s H1 numbers.

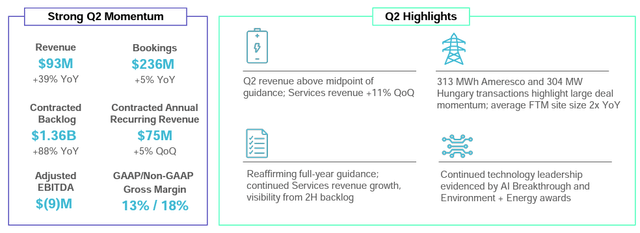

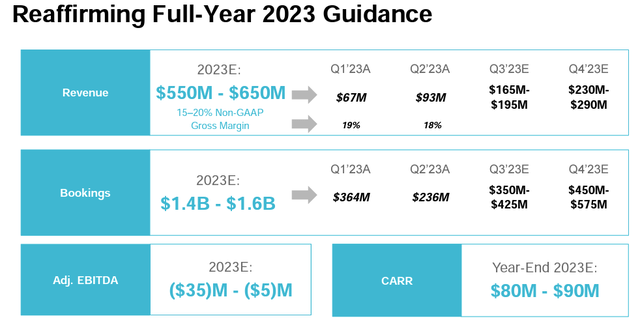

First, the company was in line with Wall Street consensus expectations. Bookings were lower than anticipated, mainly due to contract delays. Still, the management expected that the Q3 backlog would be supportive with the guidance to reach a yearly $1.4 billion order book value. This represents an increase vs. our estimates and covers our expected sales until 2025. This year, the company confirmed sales in the $550-650 million range, which implies a 65% growth year-on-year. This solid performance was mainly driven by solid end-market demand. The non-GAAP gross margin might reach 15-20% and is 450 basis points higher than in 2022. In Q2, sales reached $93 million and increased by a plus 39% on a yearly basis. Going down to the P&L, once again, Stem reaffirmed its adj. EBITDA guidance between $(35)-(5) million and reiterated expectation of being EBITDA positive in H2. In our view, this is a crucial milestone. Therefore, given the management guidance, we left our previous financial forecast unchanged.

Stem Q2 Financials in a Snap

Fig 1

Stem supporting evidence

What is critical to emphasize are the following facts:

- 75% of Stem’s 2023 annual top-line sales are expected in H2. The company provided Q3 sales guidance in the $165-195 million range, booking between $350 and $425 million. Management is confident in achieving this target and reaffirmed this milestone during the Q&A in Barclays’ latest conference call;

- Here at the Lab, considering the target growth, we get a sense that Stem will be able to maintain a positive EBITDA in 2024. Stem management seems confident in the software/services business;

- In July, the company started to offer a standalone software product to target vertically integrated FTM clients. This shift is a potential upside catalyst to higher margin solutions and reinforces our long-term thesis on the company. Modular ESS offerings are being offered to accommodate large customers with a 2024 target to achieve 25% of Stem’s bookings;

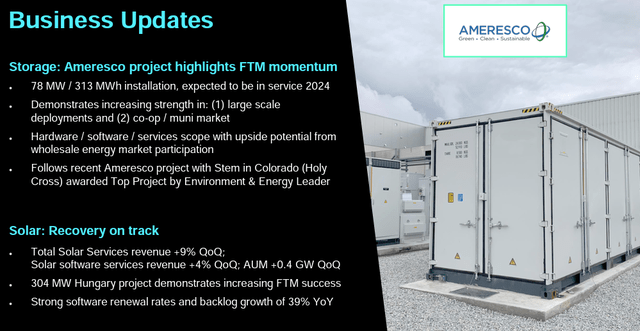

- In addition, Stem also communicated a win from Ameresco for a 313MWh battery storage solution (Fig 2). We view this latest deal as a new standard for Stem. Larger projects and more bundle offers, including design and network operations will drive 2024-2025 sales;

- We should also report an easing in supply chain constraints. Bottlenecks, mainly related to UFLPA, have sufficiently lowered. Therefore, sales and order books might further accelerate;

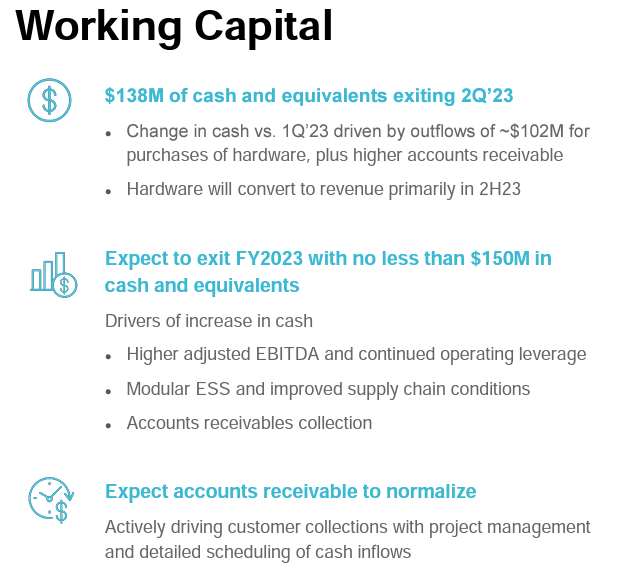

- The company ended the quarter with $140 million in cash and was guided to increase its cash position by $10 million at year-end (Fig 4). This is supported by a more excellent software/services shift (gross margin is at 80%). Therefore, the company will generate cash at the operating level, and working capital requirements will improve.

- We positively noted that Stem’s international expansion is not a priority for the moment, and the company wants to prioritize achieving profitability and capitalizing on the US IRA opportunity.

Stem & Ameresco deal

Fig 2

Stem 2023 Outlook

Fig 3

Stem cash evolution

Fig 4

Conclusion and Valuation

Here at the Lab, we are disappointed with Stem’s stock price performance. The company now trades at $4.3 per share. Even if we apply no changes in our financial estimates, the market no longer justifies Stem’s valuation. Our target price is based on a 6.5x EV/EBITDA 2026 multiple with a buy rating of $9 per share. The decrease in multiple is due to the current macroeconomic environment, sector slowdown, lower sales growth visibility, and Stem’s execution risk of shifting towards software contracts and being unable to reach its desired margin.

Mare Past Analysis

Read the full article here