As with any new CEO, Stitch Fix (NASDAQ:SFIX) appears to have kitchen sinked the current quarter. The personalized client service company is closing the UK business and forecasting weak FY24 results while new CEO Matt Baer discussed growth opportunities setting up a rebound. My investment thesis remains ultra Bullish on the stock, though Stitch Fix has a long path to reinvigorate the brand.

Source: Finviz

Kitchen Sink

Stitch Fix has a huge opportunity to utilize AI and machine learning to provide consistent personalized client service as a core offering. The company can use stylists working with AI to deliver apparel to clients on demand saving them time and providing a better experience.

The company spent a lot of effort in the last quarter streamlining operations in moves that boosted profits and reduced sales. Management decided to exit the struggling UK business, consolidate distribution centers, reduce inventory by 30% and cut marketing spend by 330 basis points.

All of these moves led to the following FQ4’23 numbers:

Source: Seeking Alpha

Like a lot of online retail companies, Stitch Fix saw a boost during the Covid shutdowns and now the company is facing the downside of consumers going back to stores. Quarterly revenues peaked at $581 million in FQ1’22 and revenues are now below the pre-Covid levels at $376 million.

What investors want to see is a bottom in the revenue trend and the removal of growth initiatives leads to lower revenues. Stitch Fix guided to FQ1’24 revenues down at only $355 to $365 million.

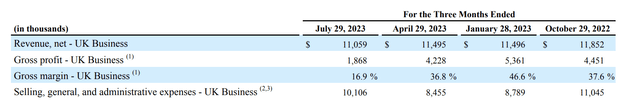

A big part of the ~$16 million dip in the October quarter is the exit from the UK business with $11 million in quarterly revenues. Stitch Fix is moving these remaining revenues to discontinued operations suggesting the pro-forma FQ4 sales were $365 million.

Source: Stitch Fix FQ4’23 earnings release

In essence, the online retailer isn’t guiding to any significant sales decline in the current quarter, but the reported numbers will show a large dip in revenues. The UK business was very unprofitable suggesting Stitch Fix needed a solution of either doubling down on spending to boost scale in the UK, or exit the business.

Right now, companies appear too focused on generating short-term profits to their own demise. Stitch Fix may have correctly exited a market with no hope for turning profitable, but the stock dipped below $3 in initial trading following earnings because the market isn’t excited about the limited adjusted EBITDA profits and cash flows with numbers at unsustainable levels without growth.

The focus needs to shift back towards active client growth. Stitch Fix reported FQ4’23 active clients of 3.3 million with a 5% sequential dip. The good news is that guidance for FQ1 is for a slight improvement in the sequential dip, but the new CEO has to come to the FQ1 earnings call with a reversal of the trend in active client dips. The UK business will lead to another loss of 180,000 clients.

Too Cheap

Stitch Fix has bounced off the lows due to the stock being far too cheap below $3 and signs the new CEO will now re-enter growth mode. The company generated $18 million of free cash flow in FQ4 and ended the quarter with $258 million in cash suggesting the cash exists to invest in the future.

The stock has 117 million shares outstanding leaving the stock valuation below $400 million. The enterprise value is a minimal $150 million due to the cash, even after the rally today.

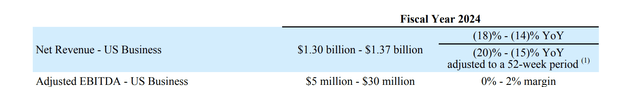

Stitch Fix has guided to FY24 revenues of at least $1.3 billion from a stock with a market cap of only $400 million. The main issue is the revenue guidance is for another to dip this year.

Source: Stitch Fix FQ4’23 earnings release

The personalized shopping service is guiding for FQ1 annualized revenues of $1.42 billion when excluding the UK business. The guidance has revenues dipping to as low as $1.3 billion for a quarterly revenue run rate of only $325 million.

Towards the high end of $1.37 billion, Stitch Fix guiding to roughly flat revenue for the year. Due to the kitchen sink quarter and focus on driving profitable growth in the future, the management team likely lowballed guidance during the quarter.

Takeaway

The key investor takeaway is that Stitch Fix has substantial upside potential, if the new CEO gets the business back into growth mode. The stock hardly trades above cash value and the company is now generating solid free cash flows.

The biggest ongoing concern is that management can’t turnaround the business. The stock could easily languish at the current levels for the next year without a return to client growth no matter how much cash flow is produced by consolidating distribution centers and closing the UK business.

Read the full article here