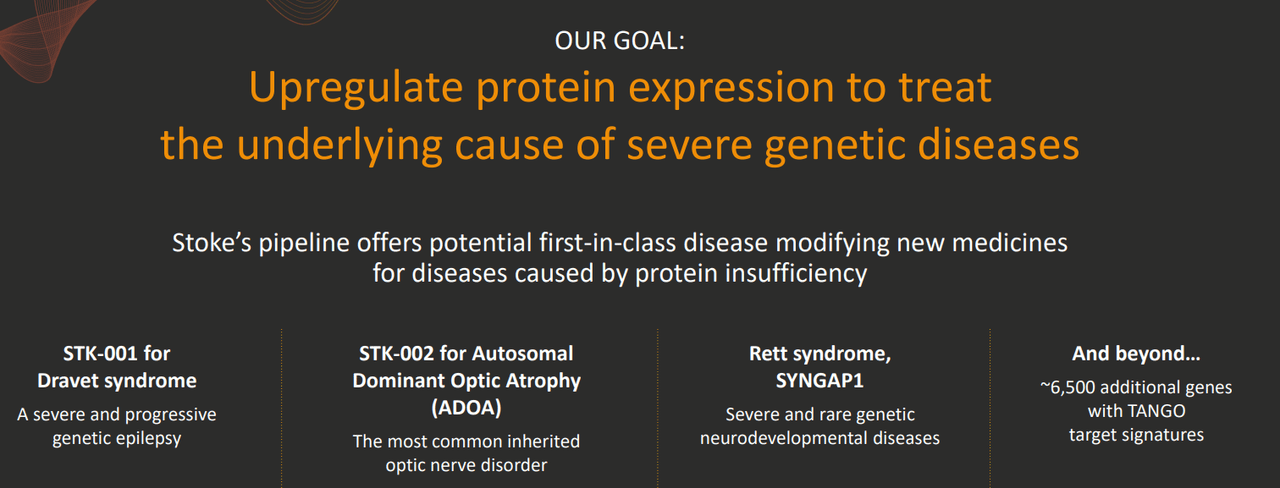

Stoke Therapeutics (NASDAQ:STOK) is a biotechnology company developing RNA-based therapies for severe genetic diseases caused by dysfunctional gene copies that produce essential proteins. STOK’s proprietary Targeted Augmentation of Nuclear Gene Output [TANGO] platform enhances RNA output from healthy genes, compensating for deficiencies provoked by non-functional mutated genes. The company’s pipeline focuses on Dravet syndrome, autosomal dominant optic atrophy [ADOA], Rett syndrome, and SynGAP1 disorder. Its leading candidate is a phase ½ drug indicated for Dravet syndrome. I believe STOK could have a well-defined path toward FDA approval relatively soon, contingent on STK-001’s safety and efficacy in more rigorous phase 3 trials. So, despite such inherent biotech risks, I deem STOK a “buy” for investors aware of the inherent risks.

STK-001: Business Overview

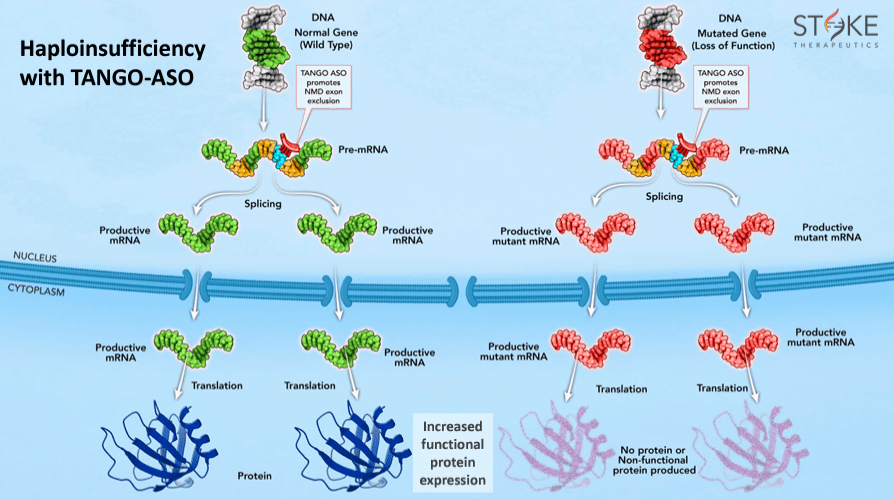

Stoke Therapeutics, founded in 2014 and based in Bedford, Massachusetts, focuses on repairing genetic health by developing RNA-based therapies for serious diseases caused by mutations that reduce the production of fundamental proteins. STOK’s proprietary research platform is the Targeted Augmentation of Nuclear Gene Output [TANGO]. This platform develops RNA binding components that restore missing proteins, alleviating severe disorder symptoms.

Source: Corporate Presentation. May 2024.

This mechanism of action matters because several genetic diseases stem from a gene mutation, making it non-functional and causing insufficient essential protein levels. When this occurs alongside a healthy gene copy, it leads to haploinsufficiency. Thus, TANGO uses antisense oligonucleotides [ASOs], short strands of nucleic acids, to bind into healthy gene’s RNAs so that the missing protein production increases and compensates for the deficiency caused by the mutated gene.

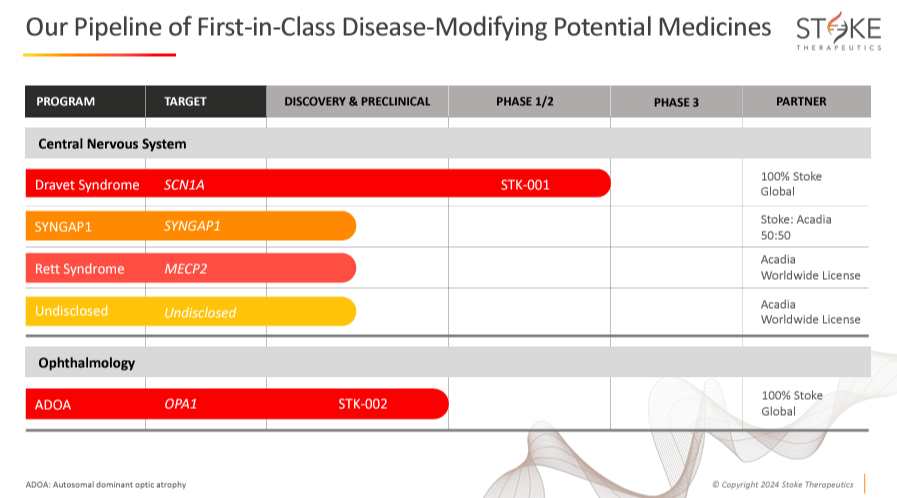

Currently, STOK’s research focuses on two genetic diseases: 1) Dravet syndrome and 2) ADOA. These two research programs are STOK’s most advanced. STOK conducts such Dravet and ADOA programs entirely on its own. However, I believe STOK’s leading drug candidate, STK-001 for Dravet syndrome, should be considered its main value driver.

Source: Corporate Presentation. May 2024.

Dravet syndrome is a progressive epilepsy with frequent intractable or drug-resistant seizures and severe symptoms like developmental delays, balance problems, and growth deficiencies, among others. Around 85% of Dravet syndrome patients present a mutation of the SCN1A gene. STOK uses its TANGO platform to produce components that increase NaV1.1 protein expression, genetically addressing Dravet syndrome’s root cause.

Dravet syndrome’s premature death rate is high due to sudden unexplained death in epilepsy [SUDEP]. This is not an inheritable disease, as 90% of parents’ patients do not have this mutation. Unfortunately, 20% of children with Dravet don’t survive until adulthood, and approximately 35,000 people suffer from this condition in the US, Canada, Japan, Germany, France, and the UK. The company’s pipeline is diverse, but its only clinical drug is Zorevunersen [STK-001], which is in phase 1/2 trials for Dravet syndrome.

Source: Corporate Presentation. May 2024.

On the other hand, ADOA is a rare disorder that causes vision loss in the first decade of life, with up to 46% of patients being legally blind. Around 20% of ADOA patients have a “plus” version of the disease, suffering from vision loss and other effects like hearing loss and additional nervous system and skeletal muscle complications. Approximately 65% to 90% of ADOA patients present an OPA1 gene mutation. Hence, STOK’s TANGO platform tackles such haploinsufficiency in the OPA1 gene. Around 18,000 people are diagnosed in the US, Canada, Japan, Germany, and the UK.

Aside from STOK’s main focus on Dravet syndrome and ADOA, it’s also developing therapies for Rett syndrome and SynGAP1. MECP2 X chromosome mutations cause Rett syndrome. Rett syndrome produces brain function issues such as seizures, disorganized breathing patterns, and scoliosis. One out of 10,000 to 15,000 females are born with Rett syndrome.

On the other hand, SynGAP1 is caused by mutations in the SYNGAP1 gene that produce the protein with the same name. These mutations provoke deficiency in the SynGAP protein levels, leading to developmental delay, generalized epilepsy, and other behavioral anomalies. 1 or 2 out of 100,000 children are born with SynGAP1. These research programs are in the discovery and preclinical stages for SynGAP1, Rett syndrome, and another undisclosed application. SynGAP1 therapies are studied in partnership with Acadia Pharmaceutics (ACAD), which owns the STOK’s worldwide licenses for Rett syndrome treatment and an undisclosed program.

Dravet Syndrome Progress and Partnerships

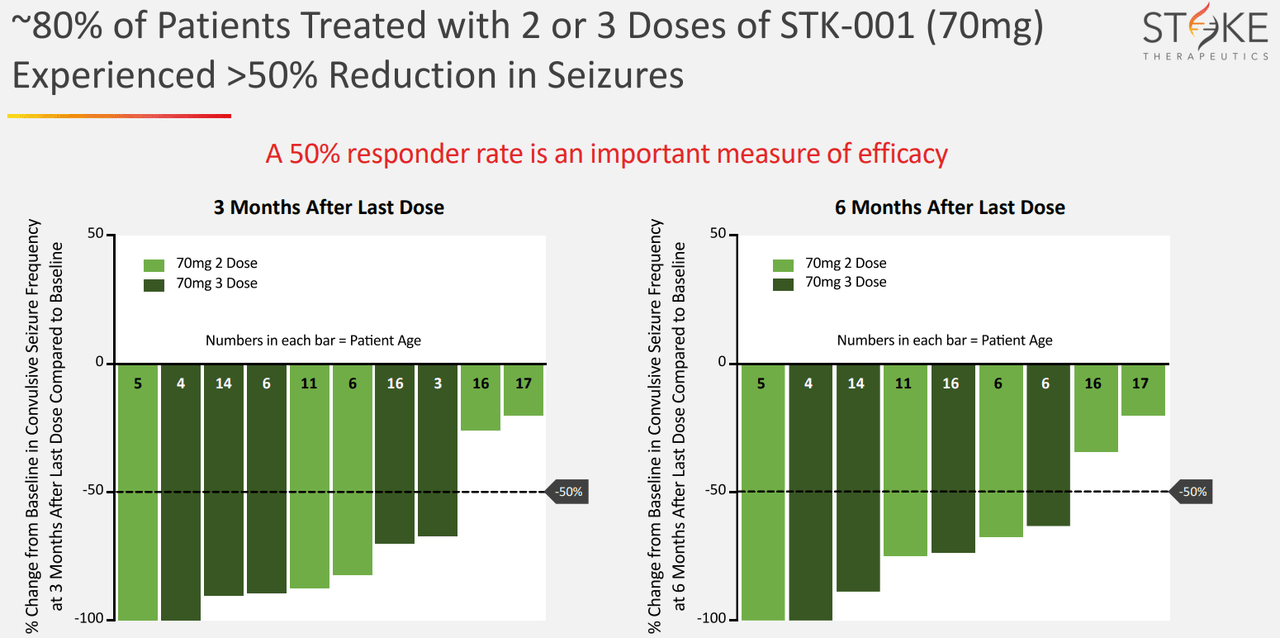

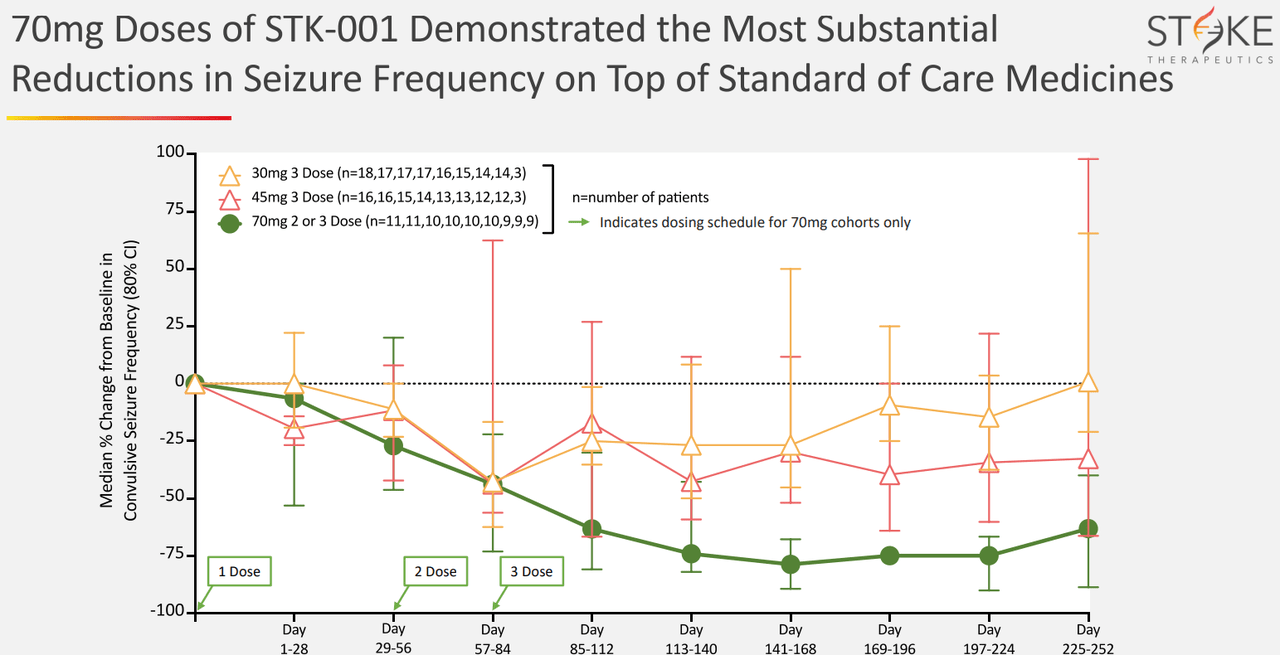

It’s also worth noting that on May 6, 2024, STOK reported its Q1 2024 financial results, highlighting promising results for STK-001. The data shows seizure frequency reduction, coupled with cognitive and behavioral improvements. Management mentioned they expect an update regarding STK-001’s registrational study design by Q2 2024. The positive aspect is that such a trial is designed with the regulator’s guidance, so it should address directly the requirements they’re looking for, which, in my experience, usually improves approval odds. A registrational study is typically a phase 3 trial that confirms drug safety and efficacy. This timeline suggests that STOK could quickly progress toward bringing STK-001 to market for Dravet syndrome, which is desperately needed.

Source: Corporate Presentation. May 2024.

As for the rest of the company’s pipeline, I highlight its partnership with ACAD. Its collaboration in SynGAP1 includes co-development and co-commercialization. Furthermore, ACAD received exclusive worldwide licenses for therapies developed for Rett syndrome and an undisclosed program in exchange for up to $907.0 million in royalties on future sales. For now, we shouldn’t expect any royalty revenues from this agreement. Still, over time, I think there’s a good chance it’ll become a meaningful revenue contributor, assuming it’s successfully developed and commercialized. After all, there’s synergy between STOK’s TANGO platform and ACAD’s neurology expertise and logistics, so it also leverages both companies’ complementing strengths.

Worth The Premium: Valuation Analysis

From a valuation perspective, the company trades at a $913.1 million market cap. It’s largely pre-revenues, as it has no product sales yet, but it has some negligible licensing revenues from its agreements with ACAD. STOK’s balance sheet holds $178.6 million in cash and equivalents as of March 31, 2024. However, in April 2024, the company raised an additional $125.0 million through an upsized equity offering. So, its cash balance should be approximately $303.6 million now.

Source: Seeking Alpha.

I also estimate its latest quarterly cash burn at $24.6 million by adding its CFOs and Net CAPEX. This implies a $98.4 million yearly cash burn, suggesting a cash runway of about 3.1 years post-raise. This is a healthy cash runway, as in three years, I believe that in 2024, we’ll see STOK finalize its registrational study design with regulators, likely leading to a phase 3 trial for STK-001 in 2025. It’s difficult to anticipate how long such a trial would take. Still, since STOK’s cash runway seems enough to last until 2027, I believe it should have more than enough resources to make meaningful progress on STK-001 by then.

Therefore, adding the recent $125.0 million to STOK’s latest book value will result in $265.3 million in stockholder’s equity today. This means STOK trades at a P/B ratio of 3.4, which is slightly expensive compared to its sector median P/B of 2.5. However, I think that by 2025, STOK could have a clear approval pathway for STK-001, coupled with a promising pipeline that could lead to significant royalty revenues with ACAD. Thus, I deem STOK a “buy,” particularly after the recent raise that bolstered its financials with enough resources for the foreseeable future.

Investment Caveats: Risk Analysis

Nevertheless, most of my thesis rests on STOK delivering a concrete update for a phase 3 trial by 2024. Indeed, management told us they expect an update regarding STK-001’s registrational study design by 2H2024. However, setbacks can happen, and if so, it would push back the optimistic timeline I’ve detailed above. This would probably translate into considerable downside for new investors, especially because the shares already have an embedded premium relative to peers.

Source: Corporate Presentation. May 2024.

Nevertheless, since STK-001 would be the first disease-modifying treatment for Dravet Syndrome’s root cause, I think it is a well-differentiated drug candidate with considerable potential. Also, STK-001’s effectiveness seems dose-dependent, which typically suggests its action mechanism indeed works. Its results are also meaningful, as 80% of patients treated with STK-001 showed over 50% seizure reduction.

Naturally, phase 3 trials are more rigorous and involve larger patient populations, so there’s a risk that such impressive results won’t hold under such conditions. But for now, I think STOK’s IP is promising, and there are enough reasons and resources to justify a “buy” rating. The only thing that holds me from giving it a “strong-buy” rating is that STOK already trades at a slight premium relative to peers.

Source: TradingView.

Promising Buy: Conclusion

Overall, I think STOK’s promising pipeline, particularly with STK-001, is quickly progressing along regulatory pathways. By next year, the company could have a well-defined path towards FDA approval, contingent on STK-001’s safety and efficacy holding up in more rigorous phase 3 trials. Additionally, the company has enough resources for the foreseeable future after the recent equity offering, eliminating dilution risks for now. As with any other biotech company, I reckon there are clinical trial risks in STOK. It also seems to trade at a slight premium relative to peers. Yet, despite such downsides, I think STOK justifies a “buy” rating for investors aware of the inherent risks.

Read the full article here