M&A activity rumors involving Stratasys (NASDAQ:SSYS) have died down in recent weeks, with Nano Dimension’s (NNDM) offer off the table and the Desktop Metal (DM) deal rejected by shareholders. Stratasys also continues to show little interest in 3D Systems’ (DDD) advances, and the fall in 3D Systems’ stock has decreased the appeal of its offer. This has contributed to a nearly 50% fall in Stratasys’ stock since I last wrote about the company and highlighted the downside risk associated with the failure to complete a deal.

Stratasys has insufficient scale to achieve profitability with its current cost structure, and absent a merger or acquisition, the company needs to generate significant growth to reach breakeven. This will be difficult in the current macro environment, particularly if interest rates continue to rise, leading to further downward pressure on Stratasys’ share price.

Market

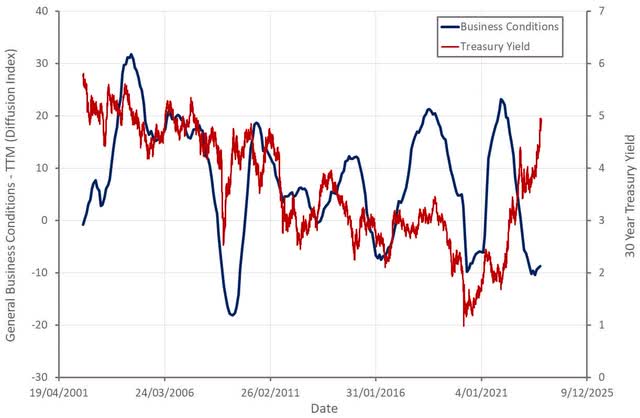

Similar to many companies supplying the manufacturing industry, Stratasys is facing a challenging CapEx environment. Sales cycles are currently longer than normal but Stratasys doesn’t believe orders will push out further going forward. There has reportedly been an improvement in conditions in the US, and customer demand and engagement stronger than ever. Despite the challenging macro environment, Stratasys remains confident in its medium-term prospects.

Figure 1: Treasury Yields and Manufacturing Survey Data (source: Created by author using data from The Federal Reserve)

Stratasys

Outside of a difficult macro environment and uncertainty regarding potential transactions, Stratasys believes it is well positioned for a number of reasons:

- Leading polymer technologies

- Broad range of polymer materials

- Unified software platform

- Large salesforce

I feel like it is difficult to invest in the additive manufacturing space based on printer technology or materials though. There are a large number of competing products with their own strengths and weaknesses, which has contributed to market fragmentation.

On a positive note, Stratasys appears to be building an attractive healthcare business. The immediate focus is dental and anatomic models but there is also long-term potential in bioprinting.

TrueDent is the only FDA-cleared full color monolithic 3D printed denture. Demand for the product is reportedly strong in the US and Stratasys is on track for availability in Europe next year. For example, the top 5 manufacturers of dentures in the US have either committed to buy or are evaluating TrueDent. The second quarter was also the first quarter of availability for Stratasys’ entry level J3 Dentajet printer. Dentures provide a 5 billion USD opportunity, with only 5% currently coming from additive manufacturing.

Stratasys offers PolyJet technology for dentures and has an SLA offering for aligners, although expects that in the future its SAF solution will contribute to the aligner business. The company expects that in the long run, PolyJet and DLP will be the winning technologies in dentures and aligners.

SLA is the most common resin 3D printing process, enabling the production of fine features with a smooth surface finish. PolyJet technology is best suited to dentures as it allows the printing of multiple colors and can print detailed parts with a smooth finish. SLA utilizes a laser to trace out the required cross-section and cure a liquid resin, whereas Digital Light Processing projects the entire cross-section at once. DLP is faster and less expensive but offers less resolution. Stratasys presumably expects accuracy improve to the point where DLP is competitive with SLA for aligners.

Within healthcare, Stratasys is also focused on bioprinting and surgical solutions. Stratasys has an agreement with CollPlant that combines Stratasys’ P3 technology with CollPlant’s rhCollagen-based bioinks. The companies are initially targeting the 2.6 billion USD regenerative breast implant market, with the potential to expand into other human tissues and organs. This is an area where Stratasys could end up competing with 3D Systems’, although 3D Systems is initially focused on lungs.

Stratasys has also partnered with Axial3D to make patient-specific 3D printing solutions for hospitals and medical device manufacturers more accessible. The FDA granted approval for Axial3D’s medical image segmentation platform in August. Axial3D’s platform automates the conversion of 2D images into 3D models. The platform is intended for orthopaedic, cardiovascular and maxillofacial applications, and is expected to help medical device companies scale up production processes.

Stratasys announced paid GrabCAD Print Pro software early in Q2. This software is designed to improve the efficiency of print preparation for FDM and SAF customers, with support for more technologies expected at a later date. There have reportedly been several purchases and there are over 75 active trials. Stratasys is now automatically attaching the software to new FDM and SAF system purchases, creating a recurring revenue stream. This could impact the software sales of companies like Materialise (MTLS) but bundling software and hardware may not be sufficient for Stratays’ software business to succeed if the software is not competitive on a standalone basis.

M&A Activity

Stratasys has been at the center of M&A activity in the additive manufacturing industry in recent months. It is not clear that any deal will end up being completed in the near term though.

Nano Dimension recently announced that it will no longer pursue its partial tender offer to acquire Stratasys, following the offers expiration in July. Nano also withdrew its director nominees for the Stratasys board.

Stratasys has favored a merger with Desktop Metal but has not been able to get it past shareholders. This deal now appears to be on the backburner, but I would not be surprised if merger talks come up again, particularly if Desktop Metal cannot stem its losses.

3D Systems continues to push for a deal, but Stratasys has not shown any interest. The fact that the 3D Systems deal is largely in stock means the deal now has even less chance of success. Stratasys is reportedly exploring strategic alternatives, including a strategic transaction, merger or sale. In response, 3D Systems was willing to amend its proposal to include 60-day go-shop period.

Financial Analysis

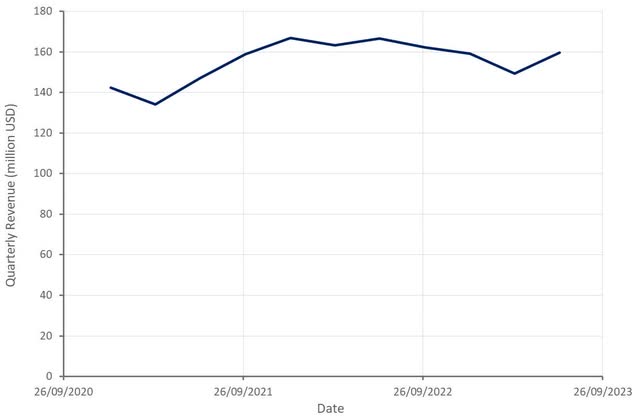

Stratasys’ revenue was down approximately 4% YoY in the second quarter, with strength coming from the automotive, aerospace and government verticals. Consumables revenue increased 7.3% on a constant currency basis, or 10.8% excluding the impact of the MakerBot divestiture. Consumables revenue growth was supported by the acquisition of Covestro at the beginning of April. Covestro contributed 4.6 million USD revenue in the quarter, creating roughly an 8% tailwind. Service revenue was flat YoY and product revenue was down nearly 6% YoY but increased 1.5% at constant currency adjusted for MakerBot. Stratasys’ largest format FDM system (F900) had a strong quarter amongst industrial customers. The F900 is designed for high end parts and tooling applications, and has found use in the aerospace, automotive, and defense verticals.

Stratasys is still guiding to 630-670 million USD revenue in 2023, with sequential growth in the third and fourth quarter. Stratasys also continues to target profitability and 1 billion USD revenue by 2026, implying a 15% annual growth rate.

Figure 2: Stratasys Revenue (source: Created by author using data from Stratasys)

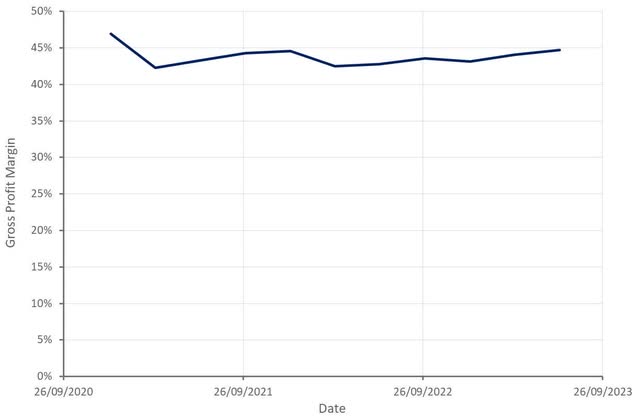

Stratasys’ gross profit margins have begun to recover in recent quarters, aided by the MakerBot carve-out and lower freight costs. This has been somewhat offset by deleveraging caused by lower hardware sales.

Figure 3: Stratasys Gross Profit Margin (source: Created by author using data from Stratasys)

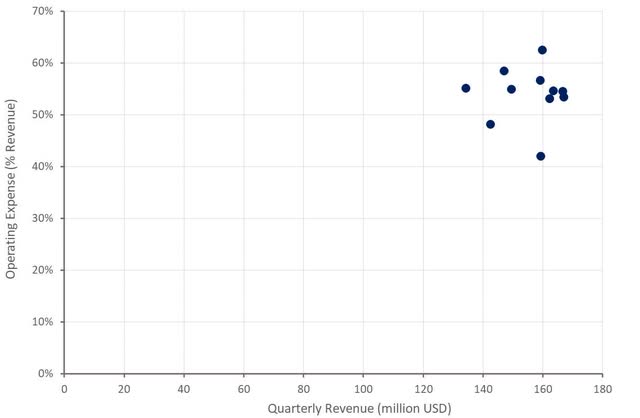

Stratays’ GAAP operating expenses were approximately 100 million USD in the second quarter, up 10% YoY. The increase was largely due to costs associated with M&A activity (Nano Dimension, 3D Systems and Desktop Metal). Cash use was also driven by annual incentive payments and increased accounts receivable.

Stratasys is still some way off profitability and given ongoing hiring, the company will likely need to generate substantial growth before reaching breakeven. Stratasys retains a strong balance sheet though, and M&A related costs are likely to ease in coming quarters.

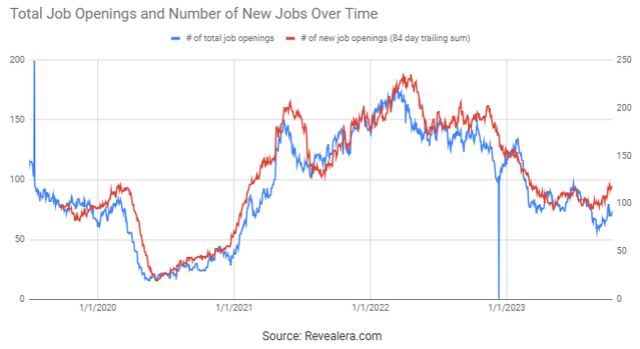

Figure 4: Stratasys Operating Expenses (source: Created by author using data from Stratasys) Figure 5: Stratasys Job Openings (source: Revealera.com)

Valuation

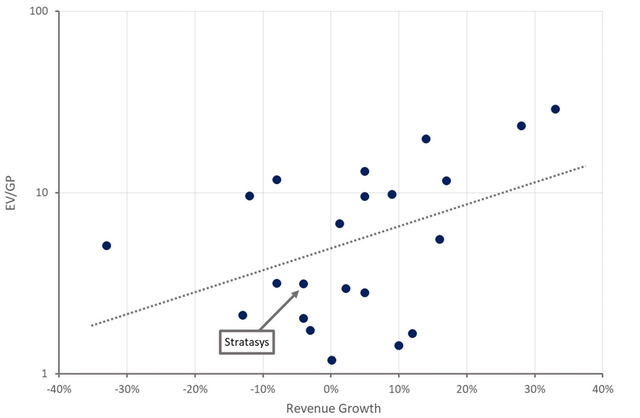

Stratasys’ stock has held up well relative to peers in recent months, as rising interest rates and weak manufacturing data has weighed on the additive manufacturing sector. From a valuation perspective, Stratasys appears to be slightly undervalued relative to peer companies.

Depressed investment by manufacturing companies is likely to continue weighing on product sales going forward, but this should be somewhat offset by consumable sales. Longer term, Stratasys’ healthcare portfolio and emerging software products could help to move the company towards profitability.

This is unlikely to matter in the short term though given the macro environment. I would not be surprised to see Stratasys’ stock gravitate towards the single-digit range, particularly if the broader market continues to move lower.

Figure 6: Stratasys Relative Valuation (source: Created by author using data from Seeking Alpha)

Read the full article here