Introduction

I like the regional banks industry a lot right now, as there are a lot of good deals to be picked in my opinion. Right now I think that Synovus Financial Corp (NYSE:SNV) is one of them as well. The company has seen its share price heavily decrease over the last couple of months and sits at an FWD p/e of under 7 with a dividend yield of 5%. I think the asset base of the company is sound, and the trends appear to be very positive, with interest rates increasing, for example, creating a stronger opportunity for SNV to raise the earnings potential.

For investors that lack exposure or perhaps wish to get some to the industry, I think that SNV right now is one of the better options to go with. With a limited downside risk given the valuations and quite immediate shareholder value because of the dividend that is also growing should be said, makes it a solid buy right now.

Company Structure

SNV serves as the bank holding entity for Synovus Bank, a provider of a comprehensive range of commercial and consumer banking products and services. The organization divides its operations into four distinct segments: Community Banking, Wholesale Banking, Consumer Banking, and Financial Management Services. Within its suite of commercial banking offerings, SNV provides essential services such as treasury and asset management, as well as expertise in capital markets to cater to the financial needs of businesses and individuals alike.

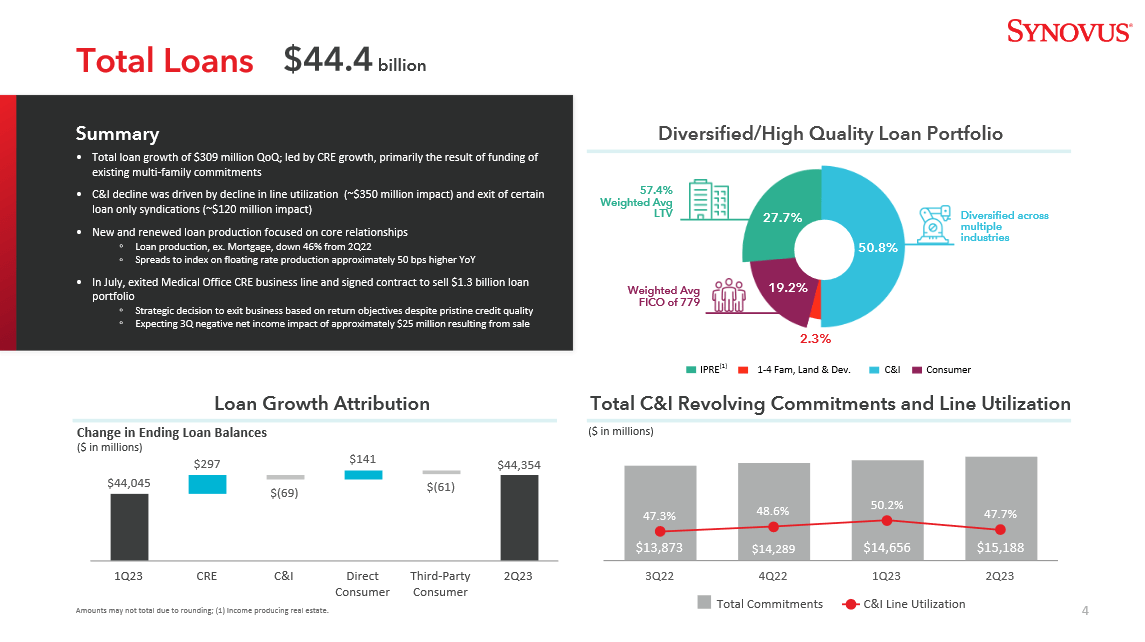

Total Loans (Investor Presentation)

What characterizes SNV right now I think is the solid loan portfolio and growth the company has been able to showcase over the last few years. The loans are diversified across several industries and lend themselves to making SNV able to raise the net interest earnings very well. The ROE, for example, has been very impressive and is at some of the highest levels in the company’s history, over 18%. In comparison to the sector 11.3% I think that SNV is shown here to be both an undervalued play and one that generates a significant amount of returns on the holdings it has. This should help drive long-term dividend increases and yield investors a market-beating return.

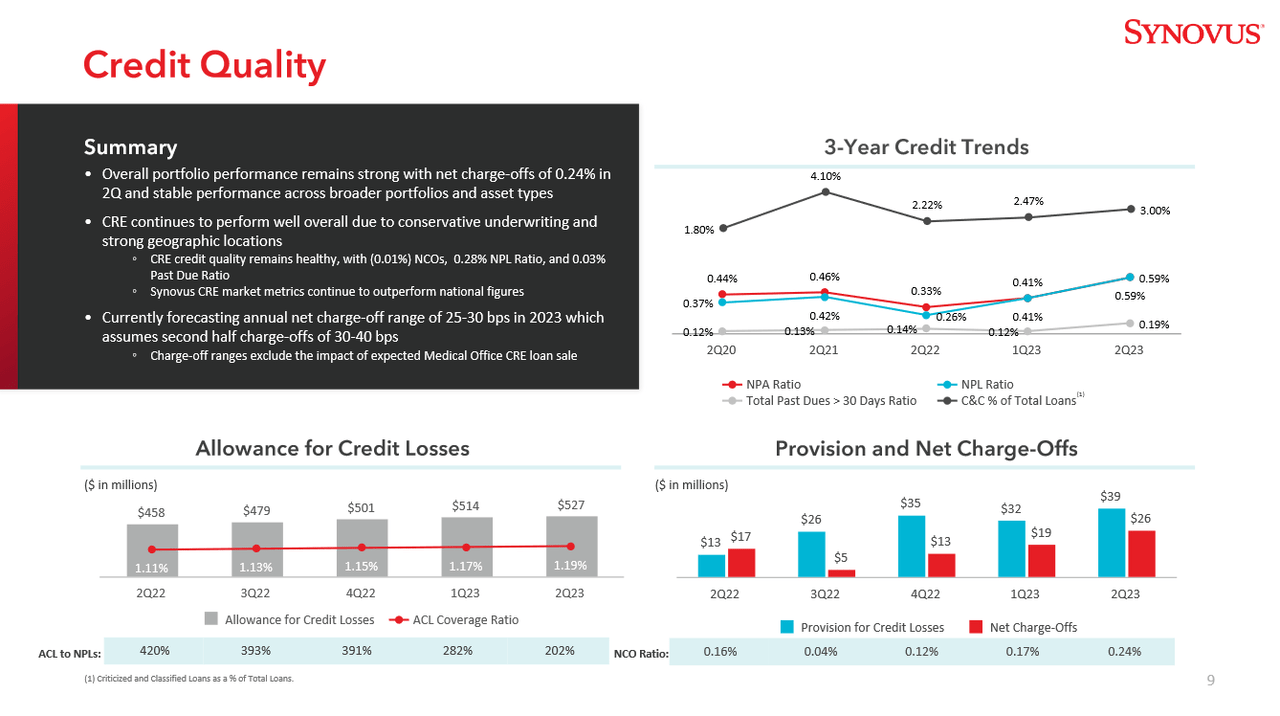

Credit Quality (Investor Presentation)

Furthermore, SNV has made strong progress in raising the credit quality in its assets, and I think this will in time be rewarded with more reliable earnings growth and a higher multiple set by the markets. Some highlights from the last quarter include the C&C of Total Loans growing to 3%. The measures taken by the company include conservative underwriting practices, which I think showcase its results very well here.

Earnings Transcript

From the last earnings call that SNV had, the CEO of the company, Kevin Blair, had some insightful comments on the performance and trends that are appearing.

-

“From a client perspective, deposit production remained strong, with second quarter levels over 130% higher compared to the same period last year. While loan production remains muted versus last year, commitment levels increased 4% versus last quarter and second quarter adjusted fee income is up 10% versus the previous year”.

Seeing strong loan production growth like this I think is incredibly nice for investors that have a strong conviction in the company, me included. If this trend can continue and SNV sees another set of deposit growth in the next quarter, I am confident the share price will continue trending upwards as it has been since May.

-

“We have also quickly responded to the changing economic environment and the recent industry headwinds to better manage the emerging risk. Over the course of the year, we have increased our CET1 ratio by approximately 20 basis points, reduced the percentage of deposits that are uninsured, increased contingent funding sources to $26 billion and reduce the midpoint of our expense guidance for the year by 3 percentage points, excluding the impact of the Qualpay transaction”.

Even though rising rates bring sets of positives for banks as they can raise the interest earnings, they also need to be worried about the loans that they take on. Seeing a spike in delinquency rates can be dangerous and could set off a sell-off in the share price, I think. For SNV they seem to be on the safer side for now though as they are making solid efforts and measures to reduce the risk profile and create a resilient loan portfolio.

Valuation & Comparison

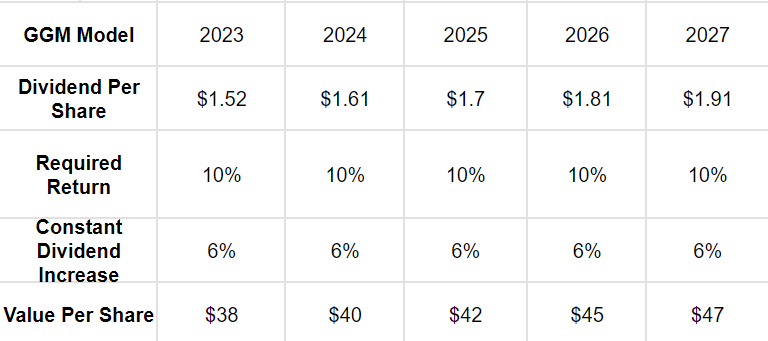

GGM Model (Author)

As I have made it clear with SNV, I think that the current price exhibits a very good entry point for investors. The GGM model above also showcases this further. I think that a terminal dividend increase of 6% is possible as the company has a lower payout ratio now as well, and the growing asset base is lending SNV the ability to grow its earnings quickly as well. The target price I have for 2023 is higher than where SNV trades right now. I like the business and the improvements in the credit quality are making it a sound addition for a dividend income portfolio.

Risk Associated

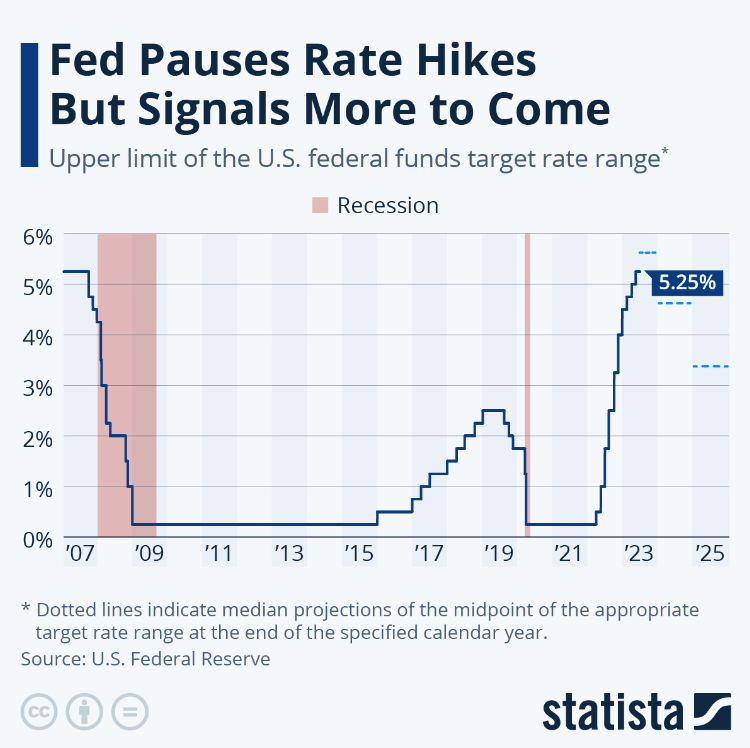

The bank’s current positioning leans towards anticipating a rise in interest rates. Consequently, if the Federal Reserve were to implement a rate reduction, it could lead to a reduction in the unrealized losses of the securities portfolio. However, this move might also negatively impact the bank’s Net Interest Income. This dual effect illustrates the potential consequences of interest rate fluctuations on the bank’s financial outlook. If there is a lack of growth in the NII in the coming quarters even when rates are rising, it could show some risks with SNV and an inability to grow with the market trends. This could result in a lower share price to reflect the results.

Interest Rates (Statista)

Investor Takeaway

I think that the regional bank industry is right now one of the most promising ones in the markets. Companies like SNV have seen their valuations slashed as the risk factor was increased with them. However, a lot of them have undesirably been cut in valuation and this leaves a good buying opportunity for some of them, SNV included. The valuation limits the downside risk in my opinion as you are buying at a discount to the sector. Besides that, the divide yield is very solid, and I think that the long-term prospects make SNV a good addition currently, resulting in a buy rating from me.

Read the full article here