Introduction

I upgrade my rating on Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) from a Buy to a Strong Buy following a number of recent developments, its Q2 financial results, and a decline in the share price.

I last covered TSMC two months ago when I rated the shares a buy. I highly recommend reading that article first as I take a deep dive into the company and explain all investors need to know in that article, whereas this one will simply be an update based on recent financial results, industry development, and business developments.

Since my previous article, the share price performance has been far from strong as shares are down 7% while the SP500 saw a positive 1% growth. This underperformance is the result of a lowered guidance that came with its very decent Q2 results and a number of disappointing economic indicators, which obviously don’t inspire any confidence in a highly cyclical stock that depends on economic health.

As a result of these factors, my prior estimates were too optimistic, and the company might continue to face a challenging operating environment for a prolonged period of time. The downturn in the market and struggling demand environment at least seems to be lasting longer than what I previously anticipated as a gradual recovery stays out. From this perspective, the underperformance is no surprise.

However, there have also been several positive developments over the last couple of months, including improving developments in the Arizona fab construction, TSMC’s capability to fight off competition, and the visible and impressive results of real AI adoption and investments visible in the Nvidia (NVDA) Q2 results, of which TSMC must be seen as a key beneficiary.

In this article, I will take you through the latest developments and update my estimates and view on the company accordingly.

AI investments are significant and the hype is real

Whereas later in this article, I will focus on developments like the Arizona fab, competition in the foundry industry, and TSMC’s recent financial results and outlook, I will first focus on a really crucial aspect being the impact of AI on demand for TSMC’s advanced nodes as I see TSMC as one of the most obvious beneficiaries of this AI wave, which I believe should already lead to upside in its near-term outlook.

On August 23, Nvidia released its Q2 earnings report and forward guidance. The company blew away the consensus as it outperformed its own previous expectations by a wide margin. The company’s datacenter segment is performing incredibly well as cloud service providers around the globe are fully focused and heavily investing in building out advanced computing capacity to run large AI programs for customers as demand for AI services has exploded.

Demand for the company’s leading datacenter GPU products has become so big that it is capacity-restricted as demand has now outgrown its ability to deliver. AI is such a hot topic that cloud service providers are doing everything they can to build out their high-performance datacenters to create room for sizeable generative AI programs for their clients. One of the most essential products to realize this computing power is Nvidia GPUs.

Furthermore, this demand for AI services is expected to accelerate further over the next several years and so will the demand for semiconductors (GPUs) powering these datacenters. Allied Market Research projects the AI chip market to grow at a CAGR of 38.2% through 2032, while Mordor Intelligence points to an expected 32.7% CAGR for the GPU market.

Long story short, Nvidia’s GPUs are the hottest product on the market today and will be for the foreseeable future. And who produces these GPUs for Nvidia? Yes, indeed, that is TSMC.

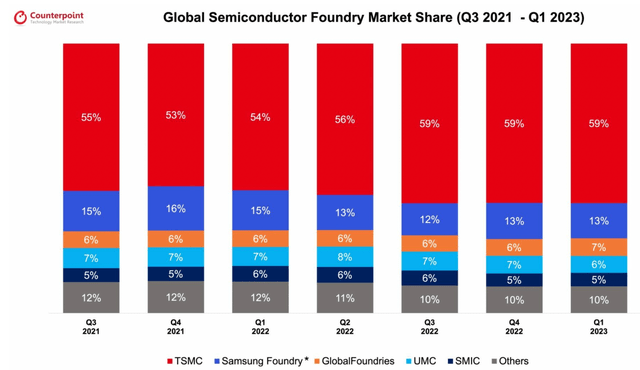

That is why this shift or hype, or whatever we should name it, is incredibly important for TSMC and its growth outlook. Currently, TSMC is the leading supplier of semiconductors globally with a market share of close to 60%, is the market leader by a margin in advanced nodes, and is the most important manufacturer for Nvidia.

Counterpoint Research

The only reason Nvidia is not reporting even faster growth is due to capacity constraints at TSMC. The company depends on TSMC to manufacture the smallest nodes used for Nvidia’s most advanced GPUs on 3nm nodes. The fact that Nvidia is saying it’s dealing with capacity constraints gives us a clear signal that TSMC, despite headwinds, is fully booked in 3nm nodes. This means the company, as it expands the production capacity of these nodes, sees incredible demand. AI processors currently account for approximately 6% of TSMC’s total revenue, but management forecasts this to grow at a CAGR of close to 50% over the next five years to increase to a low-teens percentage of total revenue. Today, though, it is unable to satisfy customer demand, limiting its growth potential.

As TSMC will expand advanced node manufacturing capacity, I expect this to be immediately and easily filled up with demand from Nvidia, along with many other technology companies. The only other alternative out there today would be Samsung (OTCPK:SSNLF), which has no chip packaging deal with Nvidia for its GPUs but could potentially become a partner if TSMC cannot build out capacity fast enough.

Still, in the end, TSMC remains the leader in 3nm nodes today and will be a primary beneficiary of this boom in demand for datacenter GPUs. As demand grows and TSMC remains the best or only high-volume option out there, it will benefit from growth in the AI semiconductor market massively.

The only thing holding both Nvidia and TSMC back today from reporting more impressive growth is production capacity, but TSMC is working hard on expanding its production capacity of advanced nodes through a new $2.9 billion investment in an advanced packaging facility in northern Taiwan as the company acknowledges the increasing demand for AI chips. This is what it recently said regarding its AI capacity:

TSMC is not able to satisfy customer demand brought on by the AI boom and intends to approximately double its capacity for advanced packaging — which involves placing several chips in a single device, reducing the added cost of more powerful computing.

Furthermore, the Arizona facility in which the company has invested $40 billion should also add to this increase in capacity as it should be able to produce 600,000 wafers, significantly increasing advanced node capacity.

Ramping up of the Arizona fab looks to be on schedule despite headwinds and a push forward to 2025

TSMC has seen tremendous improvement in the development of its Arizona fab with the first EUV machine installed last month. The company has been sending workers from Taiwan to Arizona to ramp up the construction of the factory. Still, the company was forced to push back the start of its production in the facility to the start of 2025 from 2024, mainly due to this shortage of skilled personnel.

The Arizona fab is a priority for TSMC since it is crucial to boost its Western presence and improve relationships with US technology companies. It is no secret that Western technology companies prefer to lower their exposure to Taiwan and by increasing their presence outside of Taiwan, TSMC is able to prevent customer losses (at least in part).

TSMC is investing over $40 billion in this fab and will be manufacturing advanced semiconductor nodes, which are currently in incredibly high demand due to the increased adoption of AI and IoT technologies. The first facility should become operational in 2024 and will be manufacturing 5nm nodes, with a second facility expected to be operational in 2026 and this one will be producing the more advanced and desired 3nm nodes, which are currently only manufactured in Taiwan. The strategic importance of this facility is obvious.

Eventually, the fab will be capable of producing 600,000 wafers a year, accounting for an additional $10 billion in annual revenue. Considering a total investment of $40 billion, this seems like quite a solid investment, especially as TSMC will be supported by the US Chips Act, with government support potentially getting as high as $15 billion in grants.

Furthermore, TSMC’s plans to diversify its production capacity to outside of Taiwan also includes investments in countries like Germany, Japan, and India. Last month, the company announced a joint venture with several German semiconductor manufacturers to build a new 300mm fab to boost the future capacity needs of automotive and industrial sectors, costing up to $11 billion ($3.8 billion committed by TSMC). TSMC will own 70% of the joint venture and will be running the fab. Again, these investments will be supported by grants from the European Union, which recently also approved a €47 billion Chips Act, benefitting TSMC.

So, while the investments are huge, the government support, high demand for the facility by customers with the first orders by companies like Apple (AAPL) and Nvidia already registered, and the strategic importance of it makes it a great investment by the company. Also, few peers can match these types of investments, protecting TSMC’s lead.

While competition is increasing and might be catching up, I do not see any problems for TSMC before the end of the decade

Semiconductor manufacturing is incredibly complex and requires a lot of in-house specialization and years of experience, which is why TSMC is unchallenged today. The industry leader has superior financial resources, allowing it to invest much more than any of its peers to maintain its lead. Its years of experience and in-house knowledge increase this lead even further. The only company currently able to match TSMC’s spend is Intel (INTC), which is not doing it sustainably as it is playing catch up and reports significant negative cash flows. A tough strategy in a highly complicated and competitive industry in which the company with superior technologies will end up on top.

Let me be clear: While I appreciate Intel’s optimism and drive to catch up, its product roadmap is too ambitious and will lead to disappointment. Looking at the current progress in Intel’s IFS, I do not see the company producing 2nm nodes by next year. These goals seem driven by creating investor enthusiasm and focused on beating TSMC’s and Samsung’s plans to produce 2nm nodes at scale by 2025. Based on the facts today, I do not see Intel challenging TSMC’s and Samsung’s 2nm nodes by 2025, both on volume and quality.

More importantly, Samsung is closer to TSMC from a technological perspective as it is believed to be roughly on par with its 4nm and 3nm nodes, compared to those of TSMC in terms of quality. This means Samsung has shown impressive progress in recent years after losing key customers like Nvidia and Qualcomm a few years back as its technologies back then could not match TSMC. Today, the company seems to be doing much better.

However, without getting too much into the technical details, a technology approach change with regard to transistors might give TSMC an edge in 2nm node production against Samsung. Additionally, TSMC leads in capacity by a large margin, accounting for close to 60% of global production, far above Samsung’s 13% share. As highlighted by Intel’s investments and TSMC’s $40 billion investment, building out capacity, especially in advanced nodes, is much easier said than done, making TSMC’s lead quite powerful.

I firmly believe neither Intel nor Samsung will be able to match TSMC before the decade’s end, despite their plans to do so. The lead of TSMC is often understated and the challenge and resources needed to be able to manufacture semiconductors of the quality and volume of TSMC is often understated.

Financials are heavily impacted by near-term economic weakness

TSMC reported Q2 earnings on July 20 and delivered revenue of $15.68 billion, down 13.7% YoY but beating the consensus by $300 million. The company’s performance continued to be impacted by a weak demand environment and inventory adjustments at customers as demand for electronics hardware remains weak. Therefore, the decline was absolutely no surprise.

Positively, the performance in the advanced technologies (7nm and smaller) continued to outperform as these increased as a percentage of total revenue, growing from 51% in Q1 to 53% in Q2.

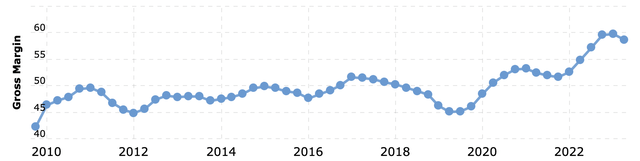

The gross margin decreased by 2.2 percentage points due to a decreasing top-line, continued investments, and higher electricity costs, to 54.1%. While this decrease might sound bad, gross margins still hold up quite well above historical levels and came in above the earlier guided range of 52%-54%. TSMC achieved this through more stringent cost-control efforts.

TSMC historical gross margin (Macrotrends)

Despite these headwinds the company is facing, management remains committed to its capital investments to support the development of N3 and N2 technologies. This is highlighted by its R&D expenses which were up 5.1% YoY and 6.4% sequentially, now accounting for 8.7% of revenue (up from 7.4% in 2Q22). This shows that TSMC continues to grow its investments in research, even as the top-line performance turns negative, in order to maintain its technological lead. However, this led to a 3.3 percentage point decrease in the operating margin to 42% in Q2.

I earlier discussed how TSMC’s growth today is partially held back due to packaging capacity constraints for advanced nodes and management is working hard on increasing capacity as a result. I am, therefore, happy to see TSMC not lowering its Capex expectations for the current fiscal year despite negative top-line growth and slight margin decreases. This is what management said during the earnings call regarding this:

Despite near-term inventory cycle, our commitment to support customers’ structural growth remains unchanged, and our disciplined CapEx and capacity planning remains based on the long-term market demand profile.

However, management did indicate that it now expects FY23 Capex to come in at the low end of the guided range of $32 billion to $36 billion.

The company remains committed to its Capex and capacity investments as it is working hard to at least double capacity as quickly as possible to satisfy customer demand for advanced nodes due to a boom in AI and rapid growth in other more advanced technologies like IoT.

While these choices might further impact margins this fiscal year and potentially going into 2024, it does allow the company to fully benefit from the demand for its products and drive spectacular top-line growth over the next couple of years.

If the company were to scale back Capex investments, I would become much more worried about its ability to grow and maintain its lead. Therefore, investors should see this as a significant positive that should not be underestimated.

Looking at the bottom line, TSMC generated around $5.21 billion in cash from operations while spending $8.17 billion on Capex. As a result, the company generated a negative $2.59 billion of FCF and reported EPS of $1.14, beating the consensus by $0.06.

Due to the declining top-line and continued heavy investments, the company saw its cash reserve fall by $3.4 billion as well. Luckily, the company can afford to temporarily decrease margins to boost Capex investments with $48 billion of cash on the balance sheet. TSMC has a mighty balance sheet and incredible financial resources. Therefore, I am not in the slightest worried about this temporary slowdown.

Outlook & TSM valuation

The most crucial point from the latest earnings call and report was the fact that TSMC significantly lowered its FY23 expectation from a low to mid-single-digit revenue decline to a decline of around 10%, indicating that an earlier communicated gradual recovery in the second half of the year is not going to happen and investors should expect continued challenges in the second half of the year.

For Q3, management now guides for revenue of between $16.7 billion and $17.5 billion, far below my earlier $17.77 billion estimate and pointing to a 9.1% sequential decline at the midpoint.

The gross margin is expected to be between 51.5% and 53.5%, declining a further 160 basis points. This is primarily the result of a continued ramp-up of 3nm technology, partially offset by a higher level of capacity utilization rate. Furthermore, the operating margin is expected to be between 38% and 40%, also down another 300 basis points sequentially at the midpoint.

Clearly, TSMC expects headwinds to persist in Q3 and to increasingly impact margins as investment spending remains high due to investments in advanced technologies and capacity expansion. These investments and top-line weakness are also expected to persist in Q4 as management now guides for the ramp-up in 3nm to dilute Q4 gross margin by about 3 to 4 percentage points.

Crucially, these investments should allow TSMC to benefit from the incredible demand for 3nm technology and boost growth in future quarters and years. So, while margin trends might look bad today and for the remainder of 2023, this should not worry long-term investors.

This argument is further solidified by management’s belief that a 53% gross margin is its minimum long-term target with higher also achievable, depending on the developments in the operating environment and the quality of the competition. On top of this and as a result of management’s commitment to invest through the cycles, it believes the company is well on track to keep growing at a CAGR of 15% to 20% over the next several years. This is another case in which investors who can look through the cycles can massively benefit from incredible future growth.

Moving back to the FY23 expectations, management continues to guide for a more healthy operating environment from Q3 onward but demand to be pressured by inventory corrections for a longer-than-anticipated period, in part due to persistent weaker overall economic conditions, a slower-than-expected demand recovery in China, and overall softer end market demand conditions. These conditions are expected to improve from the start of FY24 significantly.

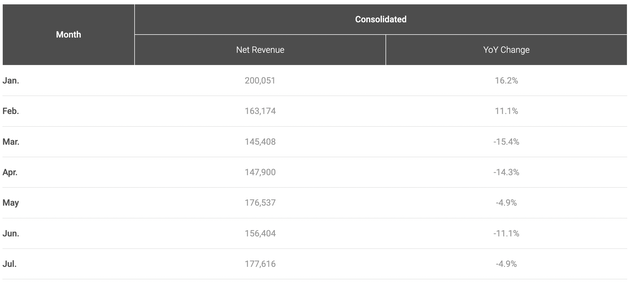

In the monthly data from TSMC, we can see an improving trend visible in the sales data. The July data shows a 13.6% sequential increase, with August sales data increasing a further 6.2% sequentially. However, August sales were still down 13.5% YoY, bringing the YTD YoY decline to 5.2%, which is far from bad considering the economic headwinds that TSMC faced over the last year or so and outperforms the overall industry. Therefore, TSMC continues to guide a mid-teens decline in the overall foundry industry in FY23 but expects to outperform the industry and report a sales decline of around 10%.

Monthly sales data (TSMC)

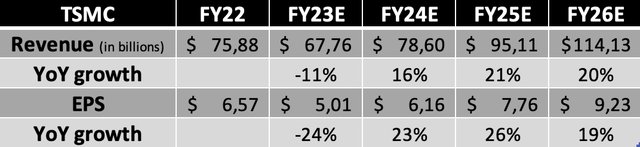

Following this downgraded short-term expectation, management’s commitment to investments and long-term growth, and recent developments, I have lowered my short-term expectations but remain bullish on the company’s long-term potential, resulting in the following financial projections through 2026.

Financial projections (By Author)

Moving to the valuation, shares are currently valued at a forward P/E of 18x, sitting below its 5-year average valuation of 21.5x and down from the 19.5x from when I last covered the shares. Considering its growth potential and global importance, shares are clearly undervalued. This is what I wrote last time regarding its valuation and this still holds up today:

Considering the company’s incredible moat, growth potential, impressive margin profile, capital allocation ability, and global importance, a higher P/E seems more than justified. Yet, we should also consider the geopolitical risks involved which will most likely remain a drag on the company’s share price. Therefore, I am opting for a slightly discounted P/E of 21x, which seems to leave a sufficient margin of safety in my eyes.

While short-term expectations have weakened, long-term prospects are improving and the company remains as strong as ever. Therefore, I believe that a 21x P/E is fully justified and leaves plenty of downside protection when considering the above-average risk level of the shares.

Based on this belief and my FY24 EPS projection, I calculate a target price of $129, down from $135, leaving an upside of approximately 43% from a current price of around $90 per share.

Going with an annual return of 10.5%, I believe a current fair value share price sits around $111 per share, meaning shares are currently undervalued by approximately 23%.

Risks & Conclusion

Of course, an investment in TSMC is not free of risks and could even be seen as having an above-average risk profile due to the majority of its manufacturing facilities being located in Taiwan. This brings with it quite some geopolitical risks due to the threat of a Chinese invasion. As a result, many Western technology companies are not fully comfortable depending on TSMC for their semiconductor supply and might, therefore, prefer alternatives like Samsung or Intel once these are able to produce chips of similar quality on a large scale.

This is no issue today as TSMC is the clear industry leader, both technologically and by production capacity. Also, a Chinese invasion is highly unlikely for several reasons, which I discussed more in-depth in my previous article on the company two months ago. I recommend reading that one for a deeper dive into the risks.

As TSMC is still the undisputed leader, customers have few other choices, and as a Chinese invasion is highly unlikely, I believe the company’s excellent financial health and global importance outweigh any of these risks.

Recent developments have only further solidified my confidence in this company and have made me more bullish on the shares, especially as the share price has declined. Of course, the recent financial performance and lowered FY23 outlook are far from ideal but are simply the result of near-term economic weakness. Yes, this has resulted in a significantly lower FY23 projection and lowered expectations for FY24 as weakness could last slightly longer than anticipated as economies worldwide continue to struggle.

Still, fundamentally, the company remains in excellent shape. I believe competition is still far from becoming a threat to TSMC, production diversification is well underway, and AI is becoming a serious tailwind for the company as well with serious potential to be a growth booster. While near-term estimates might have come down due to persisting economic headwinds, I have boosted my medium and long-term growth expectations as management remains committed to its growth and margin goals and looks extremely well-positioned to benefit from long-term growth in advanced technologies. Also, I see no signs of a weakening competitive position any time soon.

My long-term bull case has only become stronger and while the near-term performance might seem disappointing, I believe shares at a current price of below $90 offer very good value.

With my short-term outlook now revised downward due to demand weakness but my long-term outlook remaining roughly the same, partly due to the AI boost materializing, I have lowered my price target to $129 from $135 but remain bullish on the shares.

I upgrade my rating on TSMC to a Strong Buy as I see significant long-term growth potential and believe shares remain undervalued by approximately 23%.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here