Editor’s note: Seeking Alpha is proud to welcome GX Investing as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Introduction

As investors eagerly anticipate the release of GTA 6, Take-Two Interactive’s (NASDAQ:TTWO) stock price has been soaring, reflecting the fervent hype surrounding this much-awaited title. However, a closer examination reveals concerning indicators that should give investors pause. To me, the current stock price appears inflated, largely due to speculative anticipation rather than any concrete performance metrics. Additionally, recent financial struggles give me doubts about the company’s ability to deliver on its potential. In this article, I will explore the reasons why Take-Two may not be a wise buy and why investors should consider selling until there are concrete indications of GTA 6’s release or signs of financial improvement.

Weak Financials and Direction

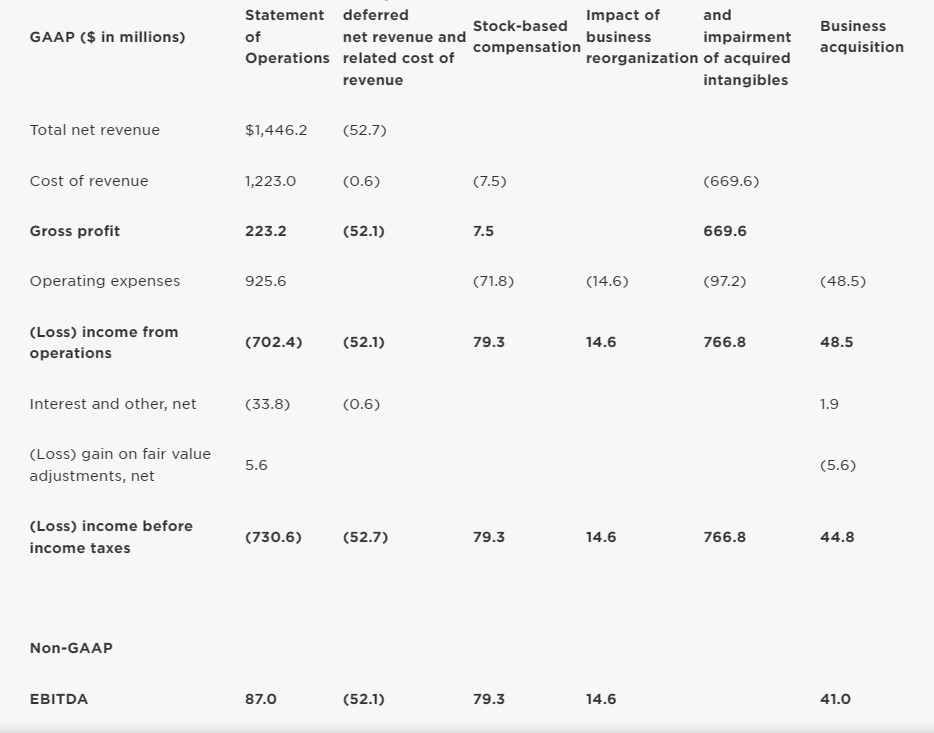

Take-Two GAAP reports (take2games.com)

Upon closer examination of Take-Two’s financials according to GAAP, I note some concerning indicators. Despite a 53% revenue growth in the full year 2022, the company recorded a $223 million in gross profit margin, experiencing a worrying 25% decline compared to just last year, bringing earnings well into the negatives. In addition, the company reported a significant net loss of nearly $1.1 billion and a cash burn of $203 million, despite the acquisition of Zynga, a mobile game company that was expected to drive increased revenue and profitability. However, riddled with integration costs and acquisition expenses, Take-Two’s ability to capitalize on Zynga was significantly hindered, delaying any net profit generation for the future.

Despite an EBITDA margin of 27.22% in 2021, typically indicative of lower operating expenses, a healthy gross profit margin, and a strong prospect for the future, it is obvious that Take-Two has yet to achieve these desired outcomes. The company faces many challenges, and managing costs efficiently and maintaining healthy profit margins are key factors for success in the fiercely competitive gaming industry. I, however, believe Take-Two’s shrinking profit margin and increased spending pose significant challenges, hindering TTWO’s ability to allocate resources to future projects that are crucial for innovation and success in the dynamic gaming landscape.

The company’s ability to manage costs, achieve healthier profit margins, and transform acquisitions into profitable assets will play a critical role in determining its long-term success. The gaming industry demands astute financial management and innovation to thrive. While Take-Two’s future potential remains uncertain, I will be looking for the company to demonstrate concrete improvements in its financials and operational efficiency in order to position itself for sustainable growth in the years to come.

Valuation

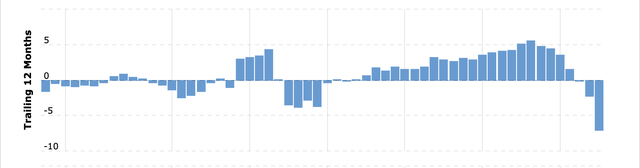

Take-Two 12-month trailing EPS (macrotrends)

In my view, Take-Two Interactive appears to be overvalued, especially when compared to one of its numerous competitors, Activision Blizzard (ATVI). Despite facing similar challenges in the gaming industry, Activision maintains a significantly higher earnings per share (EPS) of $0.74, while Take-Two lags with an EPS of -$7.03. Furthermore, a key factor to Activision’s success that Take-Two lacks is its consistent release of blockbuster games, with Call of Duty grossing over $31 billion, whereas Take-Two’s GTA franchise has accumulated $7.7 billion in comparison.

Another indicator of overvaluation to me is the price-to-earnings (P/E) ratio, where Take-Two’s current P/E ratio is roughly 41.10, while Activision trades at a lower P/E ratio of 22.25. A higher P/E ratio for Take-Two suggests that investors are paying a premium for the anticipation of GTA 6 and the potential returns it would generate. However, other gaming companies with much more diversified catalogs of games reduce their reliance on a single product, making it a safer and substantially more stable investment compared to Take-Two.

Considering the company’s financial performance, growth prospects, and competitive position, investors should be cautious of Take-Two’s current valuation, as at $135, it is already trading well above its fair price of around $94 based on the two-stage growth model, I outline below.

Step-by-Step Model

Using a two-stage free cash flow to equity model has a substantial advantage for non-dividend yield companies such as Take-Two. The model itself takes into account two stages of growth, with the initial having a higher rate, and the second with a lower more stable growth to conclude a rough estimate of a company’s fair price.

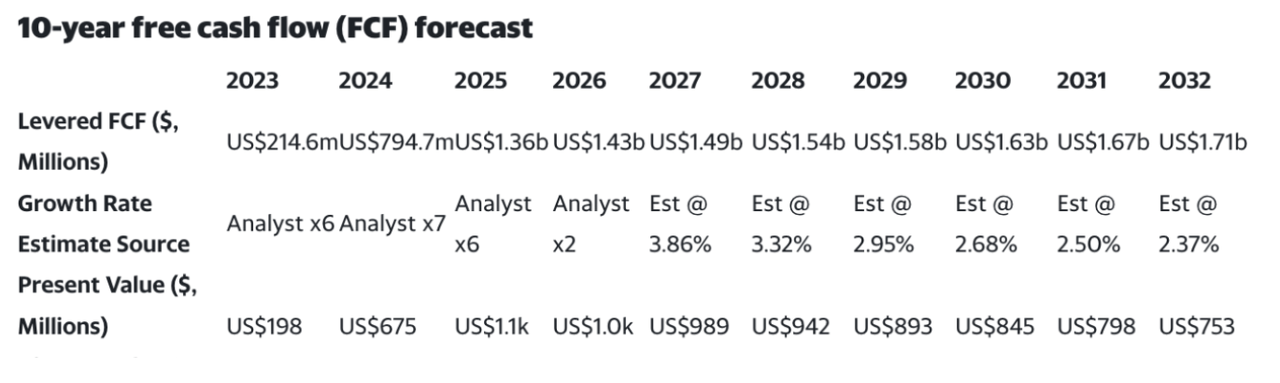

First off, I estimate the next 10 years of cash flows, which I use credible analyst estimates.

Take-Two free cash flow estimates (Simply Wall Street)

We will discount the value of these future cash flows by 7.2%, the current weighted average cost of equity, which is commonly employed in the Gordon Growth Formula in order to calculate the Terminal Value.

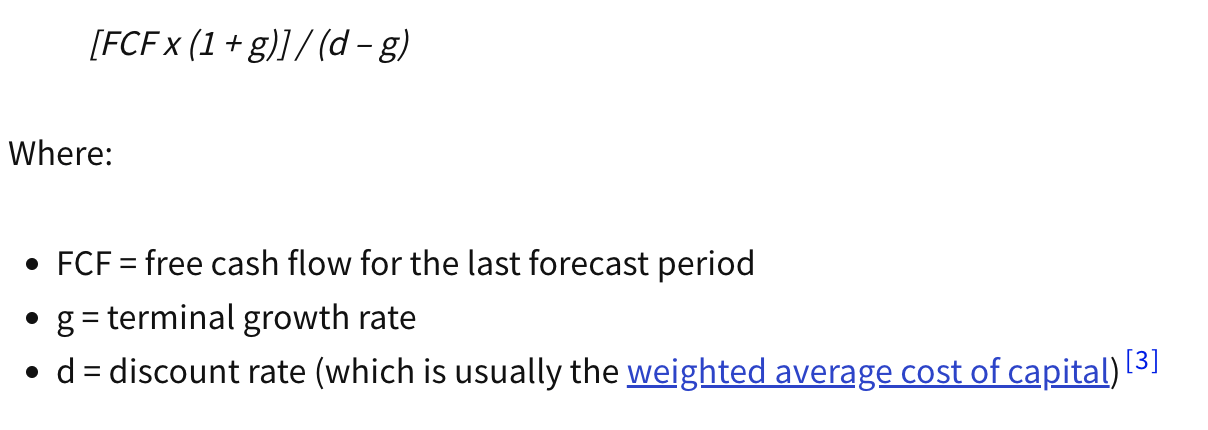

Terminal Value Formula (Investopedia)

Here, I use a 2.1% terminal growth rate, assuming Take-Two stays within the historical GDP growth rate in perpetuity, a sign and prediction that the company grows steadily in the far future.

The calculation for the Terminal Value is as follows:

[FCF2032=1.7b x (1+0.021)] / (0.72-0.021)] =~$34b

Next, using the terminal value, I can find the present value of the terminal value (PVTV) through this formula:

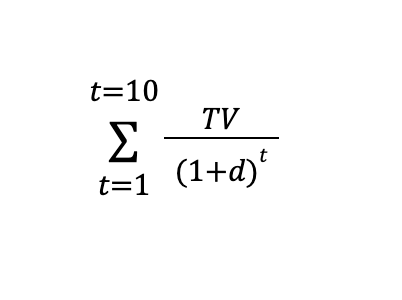

PVTV Formula (Investopedia)

In doing so, I calculate a PVTV of $15.97 billion and divided by Take-Two’s 169.33 million shares outstanding, I deduce a $94.29 fair price, making the TTWO stock incredibly overvalued. Note that the two-stage free cash flow to equity model is only a very rough estimate, with the valuation heavily dependent on assumptions. The valuation should be taken with a grain of salt.

Release of GTA 6

The uncertainty surrounding the release date of GTA 6 has been a source of frustration for investors and fans alike, and further delays could prove disastrous for Take-Two. After more than a decade of anticipation, the company is yet to release any confirmation of a solid release date for GTA 6, and another postponement may be imminent. I presume that with unreliable predictions and false hopes, too long a wait may cause disinterest and a potential decline in sales in the current GTA installment. Thus, Take-Two has an overwhelming amount of pressure to deliver a high-quality product, as fast as possible, to meet immense expectations.

On the other hand, rushing the release of GTA 6 to appease impatient fans could lead to a case similar to what happened with “Cyberpunk 2077.” The game, plagued with numerous issues, faced backlash from both players and critics, resulting in poor sales and a substantial drop in the developer’s stock price. Take-Two must tread carefully to avoid a similar fate. A subpar or unfinished product could lead to negative reviews and criticism, damaging the company’s image and leading to potential financial repercussions.

With investors closely monitoring the company’s every move, the success of GTA 6 is seen as crucial to the company’s future growth and profitability. Furthermore, this high level of scrutiny is proven to be detrimental, as any misstep or hiccup during the release is characteristic of a sharp decline in the stock price. The mounting pressure from shareholders, fans, and industry peers creates a challenging environment for Take-Two, and navigating this landscape requires a carefully crafted and well-executed strategy that Take-Two is yet to publicize.

Potential Upside

I imagine that Take-Two holds immense potential by breaking into a new gaming market through augmented reality (AR) and virtual reality (VR) adaptations of its already multiple AAA games. With the growing technology associated with the gaming industry, the company positions itself for even further profitability.

As the concept of the metaverse gains traction and reshapes the gaming landscape, Take-Two stands at a critical juncture with a tremendous opportunity to capitalize on this emerging trend. The convergence of the metaverse and the gaming industry opens doors to new and innovative gaming experiences, and Take-Two’s vast array of beloved franchises and creative expertise positions it favorably to break into the metaverse gaming space.

As investors consider the potential of the metaverse transforming the gaming industry, Take-Two’s strategic position and proven track record make it an attractive prospect for long-term growth. By leveraging its strong portfolio of new game releases, and AR/VR adaptations, and tapping into the metaverse’s vast potential, Take-Two is poised to unlock substantial value and maintain its leading position in the dynamic world of gaming. However, without any solid public releases, careful monitoring of execution and market dynamics remains crucial to fully capitalize on a long-term investment.

Conclusion

Take-Two has been one of the market’s biggest game companies, with its attractive games and dedicated fan base, I’m sure when the time comes GTA 6 will be an incredible catalyst for its stock price to soar higher. However, when looking more at the facts and the information available right now, Take-Two hasn’t been the prospected company just yet, and as time goes on, the company faces even more dire challenges. In my view, Take-Two is definitely a sell at this time until further news or updates on a future plan, and quite frankly the pressure for GTA 6 may be too strong for its own good enough, only adding unhealthy expectations on the company to perform. Given these uncertainties, the performance does not justify the price.

Read the full article here