Introduction

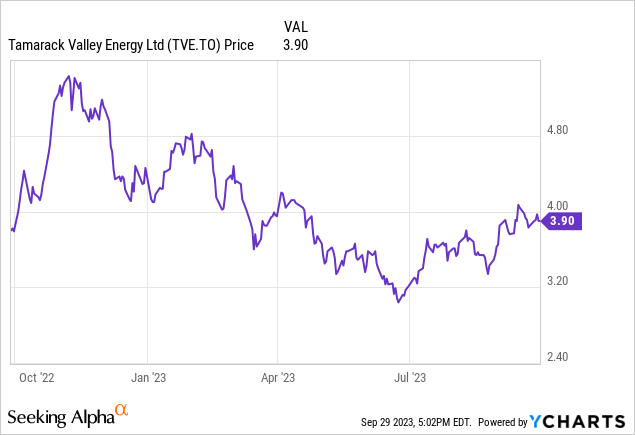

It’s been more than two years since I last discussed Tamarack Valley Energy (TSX:TVE:CA) (OTCPK:TNEYF). Although I liked the company when it exited the fallout of the COVID pandemic, the share price ran up too fast and I wasn’t quite sure the company could live up to the expectations after a few acquisitions. Although the net debt is still pretty high, at in excess of C$1.3B, the current strong oil price will allow the company to rapidly reduce that debt level and this will pave the way for additional shareholder rewards.

A look back at the second quarter, and the implications for Q3 and Q4

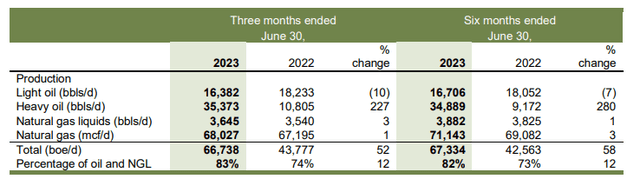

During the second quarter of the year, Tamarack produced an average of 66,700 barrels of oil equivalent per day with about a quarter consisting of light oil and in excess of 50% represented by heavy oil. The NGL and natural gas production generated 6% and about 17% of the total production which means about 83% of the total output consisted of oil and liquids.

TVE Investor Relations

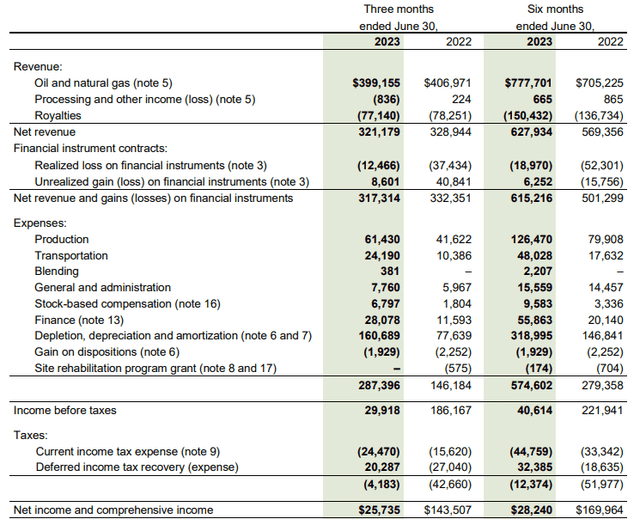

The relatively high percentage of heavy oil is an important reason why Q2 was OK and why investors should expect a strong Q3 result. While heavy oil has been trading at a pretty substantial discount to the light oil price in the past few years, that price differential has narrowed. The average realized price for light oil was almost C$92 for the quarter, but interestingly, heavy oil was sold at C$73 per barrel. That’s a 20% increase compared to the first quarter of the year. And it also explains why the average realized price per barrel of oil-equivalent was approximately 6% higher on a QoQ basis despite reporting lower prices for light oil, NGLs, and natural gas.

TVE Investor Relations

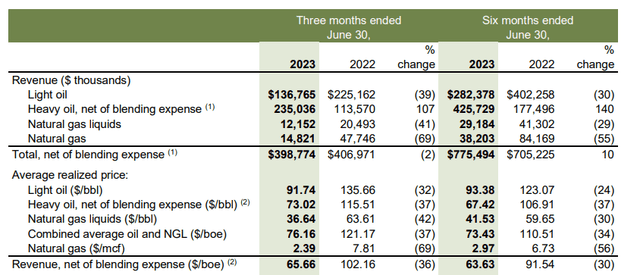

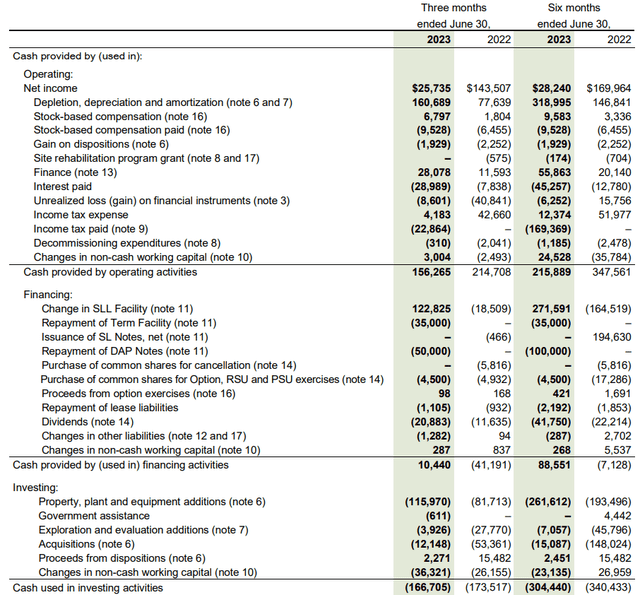

Total revenue in the second quarter was approximately C$321M net of royalty payments. There also was a small C$4M net loss on the hedge book, resulting in a net revenue of C$317M. The total operating expenses were pretty low (as you can see below) and this resulted in a pre-tax income of C$30M and a net profit of C$25.7M.

TVE Investor Relations

This represented an EPS of C$0.05. Relatively low, but keep in mind the depletion and depreciation expenses represented about 56% of the total operating expenses. This indicates it’s important to keep an eye on the total capital efficiency to ensure the total capex will be lower than the depreciation and amortization expenses. And that’s exactly the case at Tamarack and the underlying free cash flow is substantially higher than the net income.

In the second quarter, the company reported total operating cash flow of C$156.3M which includes a C$22.8M cash tax payment although the normalized taxes would have been approximately C$10-12M. Additionally, we do need to deduct the C$1.1M in lease payments and deduct the C$3M in working capital changes.

TVE Investor Relations

This means the normalized operating cash flow result for the quarter was approximately C$163M (using a normalized tax payment of C$12M).

As the image above shows, the total capex was approximately C$120M, which means the underlying free cash flow was C$43M or C$0.0.077 per share. Keep in mind the total capex bill is higher than what the company has been guiding for this year.

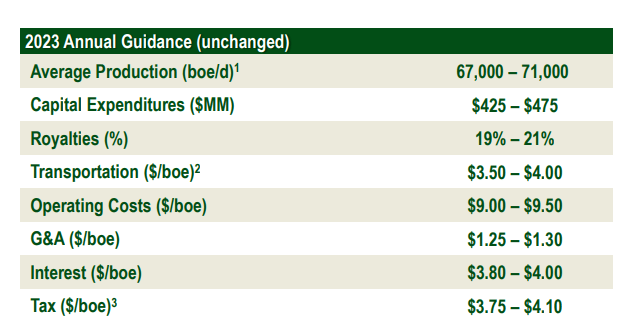

As you can see below, the full-year capex guidance calls for a total spend of C$425-475M, and this should result in a small production growth (the midpoint of the guidance represents 69,000 boe/day, which is higher than the H1 production rate).

TVE Investor Relations

Using an average quarterly capex of C$115M, the underlying free cash flow in the second quarter of the year was C$0.086 per share which represents about C$0.34 on an annual basis.

That’s based on a benchmark price of US$74 for WTI and a heavy oil price of around C$73 per barrel. WTI is now trading around US$90 while the heavy oil is trading at around C$100/barrel as prices increased throughout the quarter. This means (based on US$80 WTI and C$90 for heavy oil) we can expect a Q3 revenue increase of approximately C$50-55M before royalties and about C$40M after taking royalty payments into consideration.

This should boost the quarterly free cash flow by about C$25-30M to roughly C$75-80M in the third quarter of the year. This represents about C$0.14 per share in additional free cash flow using the mid-point of that equation. And the free cash flow could increase even further as the realized oil prices will have increased throughout the third quarter. This means the company’s fourth quarter will start pretty strong. Tamarack Valley is guiding for an H2 free cash flow result of C$250M.

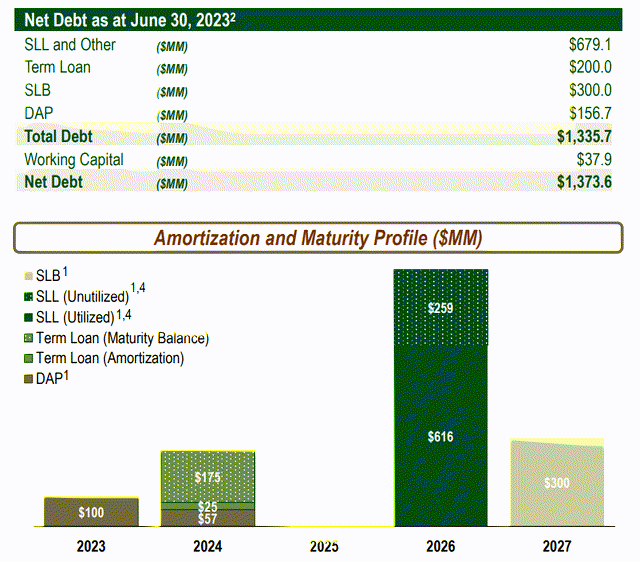

And, as the strong free cash flow will help reduce the net debt (which stood at C$1.33B excluding lease liabilities at the end of June and excluding the working capital deficit), the total interest expenses should at least stabilize and likely start to decrease.

TVE Investor Relations

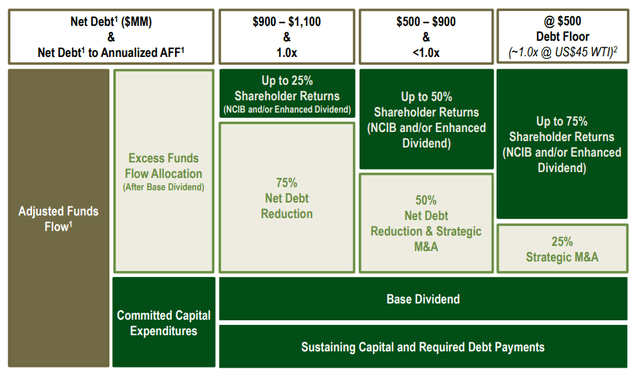

The company also unveiled a capital return framework. When the net debt level drops to less than C$1.1B while the net debt to AFF is lower than 1, about 25% of the excess funds flow (adjusted funds flow minus capex, required debt payments, and base dividend) will be spent on shareholder rewards. This will increase to 50% when the net debt drops below C$900M and that debt level threshold could potentially be reached in the second half of next year.

TVE Investor Relations

The current base dividend remains maintained at C$0.15 per year. This represents a yield of approximately 3.8% and requires just under C$85M of cash outflow per year.

And just to give you an idea of how the shareholder return framework would work: If you would assume a total operating cash flow of C$800M, a total capex of C$425M per year, and a C$85M base dividend, the excess funds flow would be C$290M. If the C$1.1B debt level threshold gets reached, just under C$75M would be made available for additional shareholder rewards (dividend or share buybacks).

Investment thesis

I currently have no position in Tamarack Valley Energy as I sold out of my position about a year ago when the share price had a nice run in the fourth quarter. That being said, I expect the company to post a very robust Q3 result while the financial result in the fourth quarter could be even stronger if the oil price remains at this level.

I’m in no rush, but the strong heavy oil price makes Tamarack Valley appealing again.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here