Taysha Gene Therapies, Inc. (NASDAQ:TSHA) is a speculative biotechnology stock aiming to potentially cure monogenic Central Nervous System (CNS) diseases via AAV-based gene therapies. The sector, poised for substantial growth, is anticipated to burgeon to a remarkable $82.24 billion by 2032. Spearheading TSHA’s endeavors is TSHA-102, a candidate formulated to combat Rett Syndrome. This initiative has garnered momentum courtesy of the FDA’s Fast Track Designation, auguring well for its market trajectory. However, TSHA is not without its risks, attributed to financial qualms, potential regulatory encumbrances, and the quintessential market volatility endemic to the biotech sphere. Despite these impediments, I surmise that the prospective efficacy of TSHA-102 could allow TSHA to tap into a potentially sizeable market, ostensibly making it a “buy” at these levels. Still, I think it’s worth noting TSHA’s inherently speculative nature.

Business Overview

Taysha Gene Therapies operates within the niche and crucial gene therapy market, specifically targeting monogenic diseases affecting the CNS. The company develops and aims to commercialize adeno-associated virus (AAV)-based gene therapies, envisioned as a cornerstone in mitigating or potentially eradicating monogenic CNS diseases. Revenue generation hinges on the successful development, approval, and subsequent commercialization of these therapies, targeting both rare and large patient populations, thereby encompassing a broad market scope. TSHA and UT Southwestern are progressing with a portfolio of gene therapy candidates.

The success of TSHA, and consequently the revenue generation, heavily relies on the efficacy and market acceptance of the AAV-based gene therapies they develop. Gene therapy is a high-stakes, high-reward market. The trajectory of the gene therapy market, with a projected leap from $15.46 billion in 2022 to a staggering $82.24 billion by 2032, unveils a decade brimming with financial promise and revolutionary medical advancements. This significant market expansion underscores a broader shift towards personalized medicine, leveraging genetic insights to combat previously insurmountable genetic disorders.

Source: Taysha’s website

The high costs of certain gene therapies, sometimes soaring into millions, pose a considerable barrier to market expansion despite the alleviation insurance coverage provides. These prices not only reflect production costs but also the groundbreaking value and extensive R&D behind these therapies. As the gene therapy field matures and becomes more competitive, prices may potentially become more accessible.

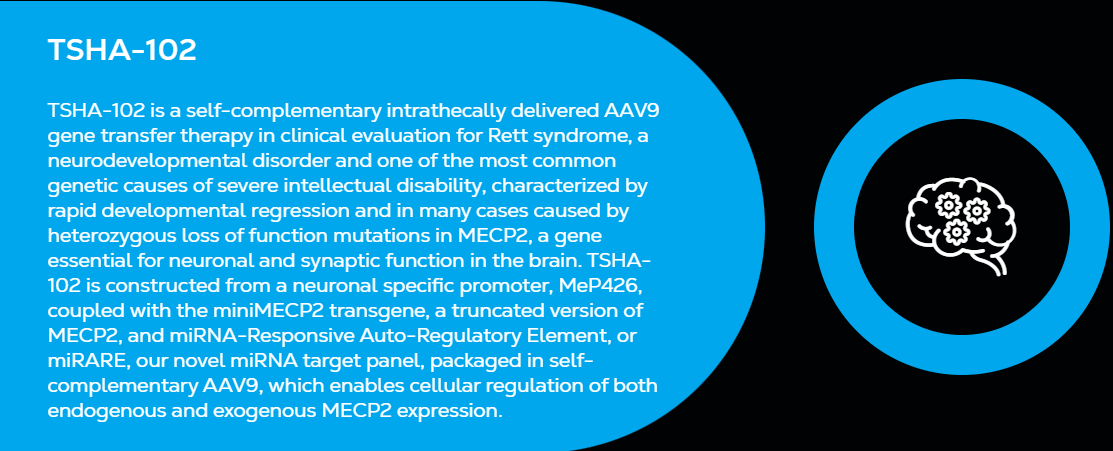

Currently, TSHA focuses on advancing TSHA-102 to treat Rett syndrome, a rare neurodevelopmental disorder triggered by mutations in the X-linked MECP2 gene. This disorder manifests through a range of challenges, including intellectual disabilities, communication loss, seizures, developmental regression or slowing, along with motor and respiratory impairments, consequently leading to a reduced life expectancy. The detrimental impact of Rett syndrome, stemming from a pathogenic or likely pathogenic MECP2 mutation, is prevalent, with an estimated 15,000 to 20,000 individuals affected across the United States, European Union, and the United Kingdom.

Pivotal Shifts and Promising Horizons

TSHA has recently experienced a gamut of developments, starting with the halting of its drug candidate TSHA-120’s development due to challenges in crafting a supportive study for FDA market application. The drug was a therapy for giant axonal neuropathy (GAN). Despite this halt, TSHA is exploring external strategic channels for TSHA-120’s further development. Interestingly, this cessation turned serendipitous, extending TSHA’s financial solvency through Q4 2025 with a $150 million private placement, steering resources toward another promising venture, TSHA-102, for treating Rett syndrome.

Transitioning to a brighter spectrum, TSHA experienced a stock price uplift post the announcement of regaining compliance with certain Nasdaq stock market requirements regarding minimum market value and bid price. This compliance, confirmed by Nasdaq notifications, fueled an approximately 18% uptick in TSHA’s shares, marking a pinnacle of intraday gains for the year. This positive market echo, following an earlier rise due to about a $150 million private placement, not only underscores TSHA’s robust market stance but also mirrors investor trust, substantiated by eight Buy ratings, a Hold rating, and zero Sell ratings.

Adding a milestone, TSHA clinched the FDA’s Fast Track Designation for its gene therapy, TSHA-102, aimed at treating Rett syndrome, catalyzing a roughly 10% pre-market ascent in TSHA’s stock. This designation is a stride towards expediting TSHA-102’s journey through a Phase 1/2 trial in Canada towards FDA approval, especially when no FDA-approved treatments exist for the disorder it targets. This acceleration signifies not only a regulatory milestone but also a beacon of hope for early patient access to this treatment, with the roadmap to administer TSHA-102 to the first pediatric patient in Q1 2024, post-FDA clearance for a children’s trial.

Source: Taysha’s website

Moreover, TSHA unveiled encouraging preclinical in vitro data on TSHA-102 at the European Society of Gene & Cell Therapy 30th Annual Congress. This data illustrated that the miRARE control element in TSHA-102 effectively regulates MECP2 transgene and protein expression in human and mouse cell lines, resonating with its potential to combat Rett syndrome. TSHA-102’s unique miRNA-Responsive Auto-Regulatory Element (miRARE) technology aims to balance MECP2 levels in the CNS without overexpression risk. With clinical data from two adult patients dosed with TSHA-102 due for report in mid-November and plans to dose the first pediatric patient in Q1 2024, TSHA continues to weave a narrative of hope and potential in addressing monogenic CNS diseases.

Upcoming Report

TSHA is expected to report earnings on November 14. Judging from the latest developments, I’d argue a critical focus will be the clinical advancement of TSHA’s leading candidate: TSHA-102. Data from the Phase 1/2 REVEAL trial concerning the dosing of the first adult patient with Rett Syndrome and the initial clinical safety findings will offer insights into TSHA-102’s safety profile, a crucial aspect of its regulatory journey. The progression of events hinges on the outcomes of the ongoing Phase 1/2 clinical trials with adults and the initiation of clinical trials with children for TSHA. A key point in this scenario includes the feedback on the Clinical Trial Application (CTA) submitted to the UK’s MHRA.

Source: Taysha’s website

Furthermore, engagements with regulatory authorities, particularly the FDA, will be highlighted in the next earnings report. Key regulatory activities include submitting persuasive findings to the FDA, the awaited formal meeting in the third quarter regarding alternative study designs, and feedback on the CMC module 3 amendment submission, detailing commercial process product manufacturing and drug comparability analysis. Monitoring updates and further explanations on these regulatory interactions will elucidate the regulatory framework and potential hurdles or accelerants for TSHA’s clinical programs.

Valuation Outlook

On the financial spectrum, the substantial cutback in R&D and G&A expenses last quarter-from $38.2 million to $12.5 million and $11.5 million to $8.8 million, respectively-is worth monitoring to see if this trend continues. Should this cost-management trajectory persist, it could bolster TSHA’s financial posture, extending its runway to propel its clinical programs forward. But, such cuts could also hamper TSHA’s R&D capabilities, so it’s a double-edged sword.

Nevertheless, I believe TSHA’s main value lies in its potential, particularly in its key revenue-generating project: the TSHA-102. This project leads TSHA’s venture into treating Rett Syndrome, a rare genetic disorder. The ongoing REVEAL Phase 1/2 trial assesses the safety and initial efficacy of TSHA-102 in adult females with Rett syndrome. Early results are encouraging, with a single dose showing substantial improvements in clinical evaluations, autonomic functions, vocalization, and motor skills without major adverse incidents. However, TSHA-102’s use as a one-dose treatment remains uncertain until further testing. For context, market forecasts predict growth in the Rett Syndrome sector, with projections estimating a rise from $225.02 million in 2022 to $515.06 million by 2029, at a 10.23% CAGR.

Yet, these figures don’t account for gene therapies like TSHA-102. Accordingly, to gauge the revenue potential of TSHA-102, which would be the first-ever gene therapy for Rett Syndrome, consider this: Rett Syndrome affects 1 in 10,000 females. In a US market with 165 million females, that’s potentially 16,500 patients for TSHA-102. While it’s early to fix a price for TSHA-102, we can reference other gene therapies. For example, Zolgensma for spinal muscular atrophy costs $2.1 million per single dose. Luxturna, for a rare inherited blindness, costs $425 thousand per eye. Yescarta and Kymriah, which involve genetically modifying patient cells to treat certain cancers, range from $373 thousand to $475 thousand. Given these figures, I’d estimate that if approved, TSHA-102 would be priced at a minimum of $373 thousand, aligning with the lower end of current gene therapy costs.

Therefore, the market could be worth between $6.15 billion (at $373 thousand per treatment) and $34.65 billion (at $2.1 million per treatment). While these numbers hint at TSHA-102’s TAM, they are not concrete projections or price targets but rather an indication of its financial opportunity if successfully launched. Thus, considering TSHA’s whole context, I think these factors make TSHA a good speculative buy at its current price.

Inherent Biotech Risks And Cash Runway

TSHA is developing gene therapy for specific brain diseases, a field with stringent regulations. Their product, TSHA-102, is still in its early Phase 1/2 testing stages. Achieving FDA approval is resource-intensive. A glance at TSHA’s financials reveals a debt of $60.4 million, a quarterly negative free cash flow of $15.8 million, and cash reserves of $45.1 million. When accounting for cash from operations and net CAPEX, the quarterly cash burn is $18.8 million. This results in an annualized cash burn rate of $63.2 million to $75.2 million. With their current cash reserves of $45.1 million, the projected cash runway is 0.60 to 0.71 years. Given this, TSHA may soon require additional financing, and if they choose equity financing, it could dilute value for existing shareholders.

Also, it’s worth noting that TSHA’s reliance on the efficacy of its AAV-based gene therapies is a risk that could be uncovered during clinical trials. Any adverse efficacy data or safety concerns could severely impede commercialization. Moreover, TSHA’s strategy to serve rare and larger patient demographics could stretch resources thin, which is concerning given its dwindling cash reserves.

The market appears to be optimistic regarding TSHA’s prospects. (TradingView)

Hence, as a whole, the blend of regulatory hurdles and gene therapy costs, alongside TSHA’s financial constraints, accentuates TSHA’s still challenging situation. Despite a seemingly cheap valuation, there’s still a long road ahead until an ultimate FDA approval, which slightly tempers my optimism. Yet, once a drug receives Fast Track Designation, the FDA usually communicates early and frequently throughout the entire drug development and review process, which can expedite TSHA-102’s time to approval.

Conclusion

Overall, TSHA has a nuanced biotech investment profile. It’s brimming with potential yet laden with substantial hurdles. Its prime candidate, TSHA-102 for Rett Syndrome, has garnered attention from the FDA’s Fast Track Designation. However, the financial and regulatory challenges ahead are non-trivial, epitomizing the speculative nature inherent to TSHA. In my view, the potential efficacy of TSHA-102, juxtaposed with the forecasted growth in gene therapy and TSHA-102’s market potential if approved, is why I rate TSHA a “buy.” Nevertheless, the biotech sector’s volatility, characterized by regulatory and market hurdles, mandates a prudent investment approach. While TSHA-102 could bolster TSHA’s revenue, aligning with bullish market projections, the path is uncertain. It’s imperative, I believe, for investors to proceed with a well-informed, cautious stance, carefully balancing optimism and due diligence.

Read the full article here