Summary

Readers may find my previous coverage via this link. My previous rating was a hold, as I believed Terex Corporation (NYSE:TEX) had reached my price target. I am revising my rating to buy after analyzing the business’s third quarter 2023 results, which indicate strong sales growth in the double-digit range. Furthermore, the company’s margins are increasing across the board thanks to its effective expense management. When comparing TEX to its competitors, it becomes evident that there is potential for its valuation to rise further due to its superior metrics in comparison to its peers.

Valuation

Based on my assessment of the business, I expect TEX to experience continued growth over the next two fiscal years. This forecast is shaped by both the guidance provided by the company’s management and prevailing market estimates. For FY23, the management has projected a 17% year-over-year increase, while the outlook for FY24 aligns with market expectations. This optimistic growth trajectory is reinforced by TEX’s recent commendable performance and strategic initiatives. The company has showcased impressive financial growth, marked by notable increases in sales and operating margins, driven by enhanced sales volumes, strategic pricing, and streamlined manufacturing processes. Even in the face of escalating costs, TEX’s rigorous cost and expense management strategies have ensured a substantial rise in EPS. The company’s leadership in various markets is underscored by its innovative products that resonate with global sustainability trends, especially in areas like infrastructure and digitization. TEX’s forward-thinking approach to waste management, highlighted by solutions such as EvoQuip shredders and Ecotec metal separators, underscores their dedication to environmental sustainability. Furthermore, TEX’s active participation in the electrification movement and its stronghold in the construction domain, particularly in mobile crushing and screening, bolster its market standing. Taken together, these factors strongly position TEX for growth in the future.

Peers overview:

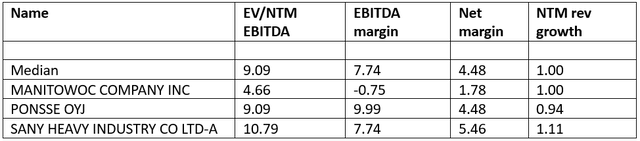

FactSet

Currently, TEX is trading at approximately 4x forward EV/EBITDA, which is notably below the peer median of around 9x. This valuation seems low, especially considering TEX’s EBITDA margin stands at 11.31%, surpassing the peer median of 7.74%. Additionally, its net margin of 6.8% exceeds the peer median of 4.48%. Furthermore, its projected growth rate for the next 12 months at 1% is marginally above the peer median of 0%. Given these metrics, I contend that TEX should be trading closer to the peer median of roughly 9x. To adopt a conservative approach, I’m adding a 20% premium to its forward EV/EBITDA, resulting in a 5.47x valuation. Based on this, there’s a potential upside of 15% for TEX. Taking into account these financial indicators, along with the inherent strengths of TEX previously discussed, I’m revising TEX to a buy rating at this point.

Comments

The company reported a robust sales figure of $1.3 billion, marking a 15% increase compared to the same period in the previous year. This growth in sales was attributed to a combination of higher volume and improved price realization. TEX reported operating margins of 12.7%, which is an expansion of 1.9% from the prior year. This improvement in margins was the result of a combination of factors. Higher sales volumes, effective pricing strategies, enhanced manufacturing efficiencies, and disciplined cost management all contributed to this margin expansion. These efforts effectively offset the challenges posed by rising costs. The EPS for the quarter stood at $1.75. This represents a 46% increase on a year-over-year basis. The robust EPS growth was fueled by increased volume, disciplined pricing to counteract rising costs, and continued cost management.

TEX’s gross margins experienced robust improvement, with 1.5% growth in the third quarter. This margin expansion resulted from a combination of factors, including increased sales volume, effective pricing strategies, enhanced manufacturing efficiency, cost reduction initiatives, and disciplined expense management. It is worth noting, however, that SG&A expenses did increase compared to the prior year. This uptick in SG&A expenses was driven by inflationary pressures, additional expenditures associated with recent acquisitions, and heightened allocations toward marketing, engineering, and technology-related expenses.

TEX has established itself as a leader in various end markets, thanks to its innovative products that cater to diverse sectors. This leadership is not just a result of product quality but also of the company’s ability to anticipate and meet the evolving needs of these sectors. One of the most significant global trends currently is the emphasis on sustainability, which has spurred increased investments in infrastructure. But modern infrastructure is not just about physical structures; it’s about creating systems that are sustainable in the long run, and digitization plays a crucial role in this. TEX is well-positioned to capitalize on the digitization trend, integrating advanced digital technologies into their products to enhance efficiency and productivity.

Another pressing global concern is waste management. The environmental impact of waste has led to a surge in demand for waste recycling solutions. TEX, with its MP segment, is at the forefront of this movement. They have brands like EvoQuip that have developed shredders for diverse applications, including construction waste. Their Ecotec brand stands out with its metal separator that extracts metals from waste, turning potential environmental hazards into valuable resources. Furthermore, their CBI business is pushing the boundaries of recycling with innovative solutions, such as recycling windmill blades, which previously would end up in landfills.

Electrification is another undeniable global shift, and TEX is right in the mix with its utilities business. They have a wide range of products that cater to the demands arising from electrification investments. Moreover, their Genie business offers products like scissors, verticals, and telehandlers, which have become indispensable in infrastructure projects. In construction, TEX’s MP aggregate business, with brands like Powerscreen and Finlay, dominates the mobile crushing and screening markets. These products not only cater to the demand for construction materials but also emphasize recycling, reducing unnecessary material handling.

TEX has demonstrated strong financial performance with significant growth in sales and an expansion in operating margins, attributed to effective cost management and strategic pricing. Beyond the numbers, TEX’s innovative products cater to emerging global trends, including sustainability-driven infrastructure, waste recycling, and electrification. Their adaptability to these trends, combined with market leadership in areas like mobile crushing and screening, positions them favorably for future growth.

Risk & conclusion

One potential downside risk to my buy rating for TEX could be supply chain disruptions. Given the global challenges in supply chains, from raw material shortages to transportation bottlenecks, companies across various sectors have faced delays and increased costs. If TEX were to encounter significant supply chain issues, it could impact its ability to meet product demand, potentially leading to decreased sales, increased operational costs, and subsequently, a potential decline in stock price. This risk is especially pertinent in the current economic climate, where global supply chains remain vulnerable to disruptions from factors like geopolitical tensions, pandemic-related challenges, and transportation constraints.

TEX presents a compelling investment opportunity based on a confluence of factors. The company has shown robust financial growth, evidenced by a strong growth in sales and a significant expansion in both operating and gross margins. This financial strength is underpinned by higher sales volumes, astute pricing strategies, manufacturing efficiencies, and rigorous cost management. Additionally, the company’s EPS has seen remarkable year-over-year growth. On the operational front, TEX’s leadership in various markets is accentuated by its innovative product suite that aligns with global sustainability and digitization trends. Their proactive solutions in waste management and electrification further solidify their market position. Notably, in terms of valuation, TEX’s current forward EV/EBITDA appears low. When compared with its peers, TEX’s superior EBITDA and net margins, coupled with its projected growth rate, suggest it’s trading below its deserved valuation. Even with a conservative adjustment to its forward EV/EBITDA, there’s discernible upside potential for the stock. Given this amalgamation of strong financial performance, strategic market positioning, and undervaluation relative to peers, I am revising to a buy rating for TEX.

Read the full article here