Nvidia Corporation (NVDA) is driving massive distortions across the markets, making them appear stronger than they are. The most considerable distortions are in the Nasdaq 100-Index (NDX) and the Invesco QQQ Trust ETF (NASDAQ:QQQ). This has driven wide gaps between the market cap-weighted indexes and ETFs and the equal-weight indexes and ETFs.

More Than 40% of The Gains

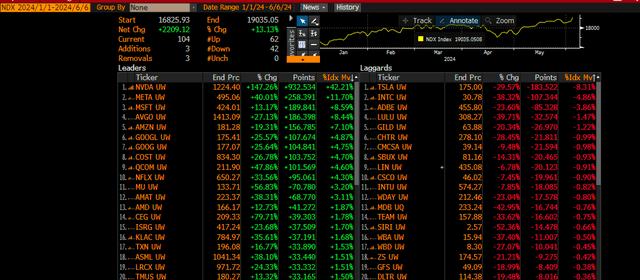

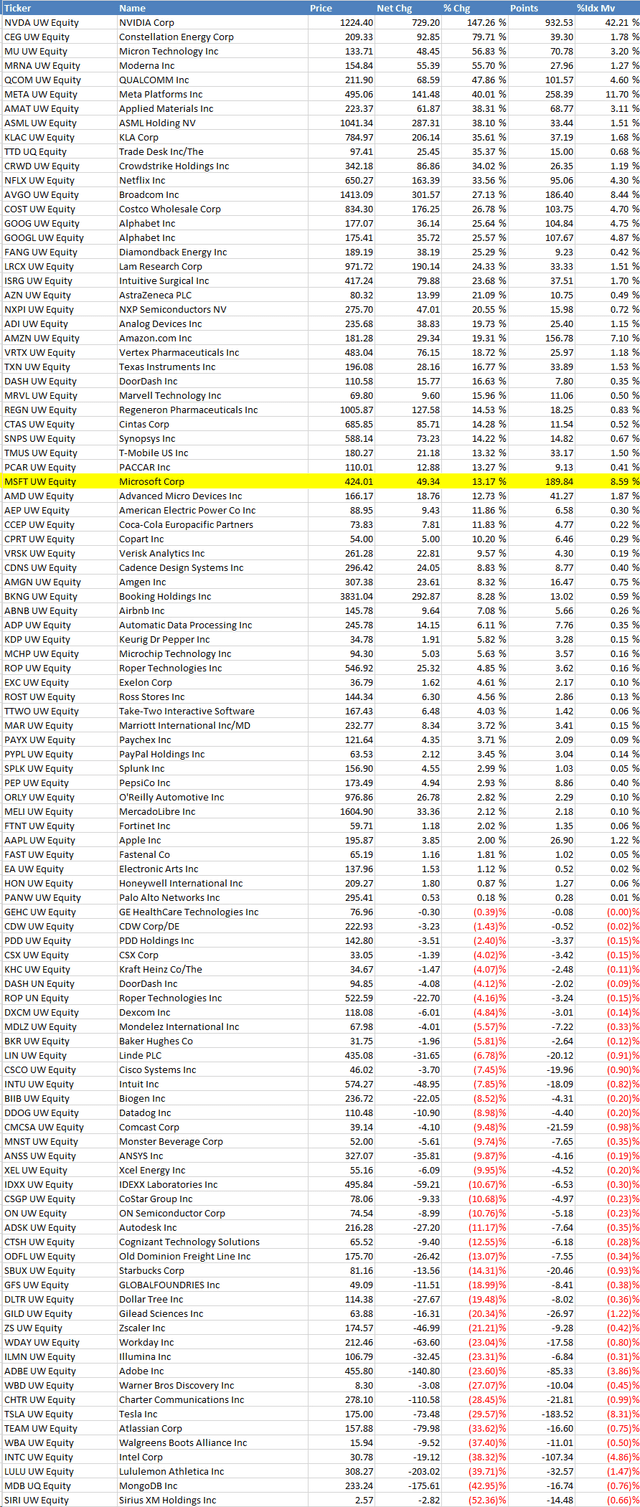

Since the start of 2024, Nvidia has accounted for nearly 42.2% of the gains in the Nasdaq 100 through June 5. What this means is that out of the 2,209 points that the Nasdaq 100 has gained, Nvidia has contributed 932 of those points. This is a huge sum, despite the index’s current number of advancers standing at just 62 and the number of decliners at 42.

Bloomberg

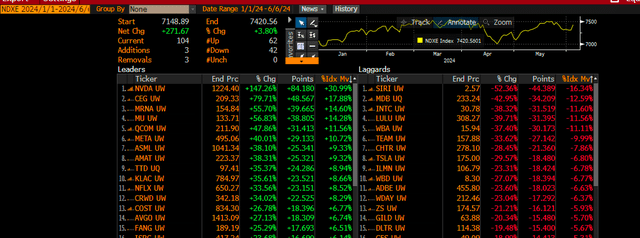

This compares to the NASDAQ equal weight index, where even here, Nvidia is responsible for nearly 31% of all the gains and has added roughly 84 points to the equal weight index gains of 271 points. However, the equal weight index has only climbed by 3.8% in the year, while the Nasdaq market cap-weighted index has climbed by 13.1%.

Bloomberg

Big Divergences

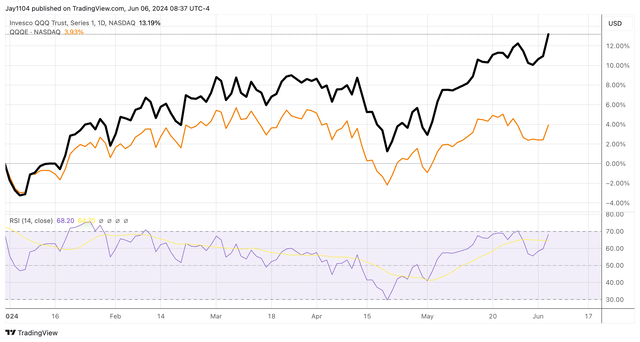

It is also notable that while the QQQ has easily surpassed its March highs, the Direxion NASDAQ-100® Equal Weighted Index Shares ETF (QQQE) has not surpassed its March highs. This, again, shows the influences that one stock overall has across the market and the perceptions it can drive among investors about the health and strength of the overall market.

TradingView

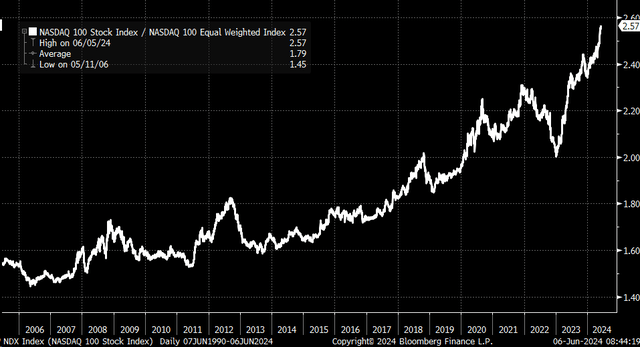

The wide gaps in performance have led to a ratio of Nasdaq 100 to Nasdaq 100. Equal indexes widened to nearly 2.57, the largest amount on record going back to 2006 when the first data points were available.

Bloomberg

Most Stocks Not Keep Pacing

When looking closer at the Nasdaq 100, only 33 stocks are actually outperforming the market cap-weighted index this year, with the rest of the stocks underperforming the broader Nasdaq 100. So, while there are more advancers than decliners in the overall indexes, the vast majority of stocks are not keeping pace with the overall gains in the index.

Bloomberg

What this would suggest is that because of Nvidia’s strong performance, it is overstating broader market strength; this means that if Nvidia’s stock should falter, the broader equity market may be due to suffer as Nvidia’s stock normalizes or pulls back. In an interview on the Fox Business Channel’s Show Making Money with Charles Payne, I recently discussed how dependent the overall stock market has become on Nvidia.

Stock Split

The recent rally could be due to the strong results in the previous quarter and optimism about the future. It is also possible that the stock is merely rising due to the upcoming stock split, which is expected to come after the close of trading on June 7. We have seen this type of price action before, with stocks trading higher ahead of the expected stock split and then trading lower following the actual split.

What seems clear at this point is that Nvidia is rising rapidly; whether the move higher is justified is a separate matter over the longer term. But the pace of the move recently has been frantic. Given the size of Nvidia’s market cap, it has resulted in a distortion in the market cap weight index, making the index appear stronger than perhaps what it is beneath the surface and how the vast majority of stocks within the index are performing.

It just means that, at this point, the market has a lot riding on just one stock.

Join Reading The Markets

Reading the Markets helps readers cut through all the noise, delivering daily video and written market commentaries to prepare you for upcoming events.

We use a repeated and detailed process of watching the fundamental trends, technical charts, and options trading data. The process helps isolate and determine where a stock, sector, or market may be heading over various time frames.

Read the full article here