The Recessionistas Have Arrived, Want Proof? Teeth Have Gone Out Of Style

Exhibit “A” Align Technology (ALGN)

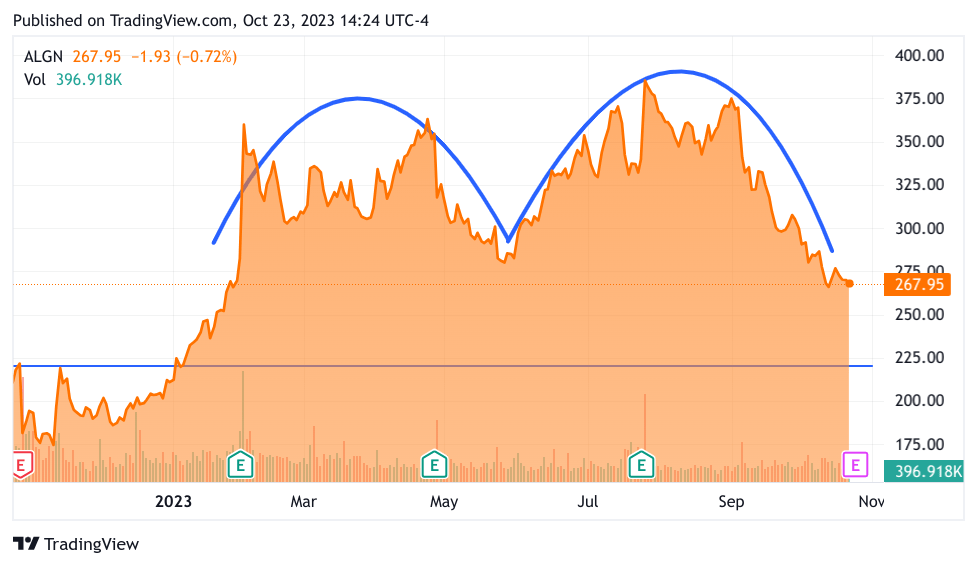

On Monday I had this brainstorm, the consumer is still consuming experiences, and a straight set of teeth would be a very nice accouterment to those experiences. I imagined showing up to that high school reunion with perfect teeth as a great way to show off. This was on Monday as you can see from the chart. This article besides being a herald of a new narrative for stocks is a testament to the value of charting stocks before you tread into them. Here is the chart I drew, spoiler alert, this is a dreadful 6 month chart –

TradeView

There are several ways this is bad. One can describe this as a massive double-top. It is also the exact inverse of a bullish rising UU where the rightmost U would be higher than the prior U. We decided to give it its own moniker though I don’t think the editors would approve, but head to the next chart that shows where we are today.

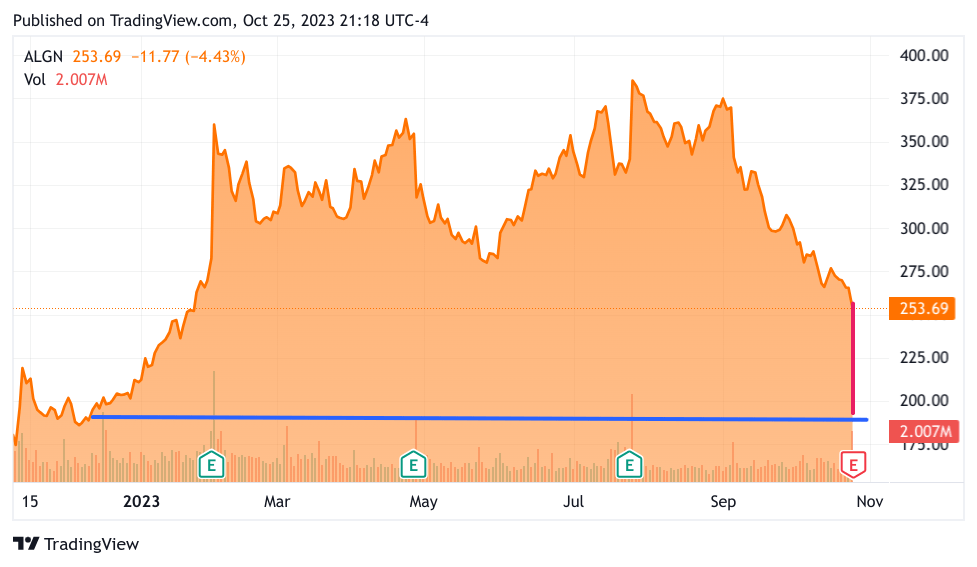

TradeView

Yes, you see it correctly ALGN lost a total of 75 points, and most of that was in the after-hours. It is possible that it will recover somewhat tomorrow but I highly doubt it. Could this be just about teeth? Getting your teeth straightened as an adult is a very aspirational “want” not an existential need. Perhaps you can’t skimp on your kids’ teeth but you can certainly give them the cheaper model. Let’s let the CEO tell it… Align Technology President and CEO Joe Hogan commented on the results, stating,

“Our third quarter results reflect lower-than-expected demand and a more difficult macro environment than we experienced in the first half of 2023. Despite these headwinds, total Q323 worldwide revenues were up 7.8% year-over-year with growth across all regions.”

Align’s Future Outlook

For Q4’23, the company anticipates worldwide revenue to be in the range of $920M to $940M, down sequentially from Q3’23. Clear Aligner and Systems and Services Revenues are expected to be down sequentially due to a more challenging macro-economic environment

Not just teeth

Could be just about the teeth? Look at the Shares of Paris-listed Kering, which owns Gucci and Bottega Veneta, the company reported a 9% drop in third-quarter sales compared with a year earlier. Kering’s stock now has lost almost one-fifth of its value since January. It is another sign that demand in the luxury goods industry is petering out after a record year in 2022.

Yes, people are still flying hither and yonder but those trips have been booked in advance, and paid for. Even so, most airlines are not doing great. I just looked at Delta Air Lines (DAL) arguably the best-run airline and it is only about a dollar above the 52WL. So I am seeing the first signs of a real slowdown to my eye. Frankly, it the message of the market loud and clear based on the market reaction to good earnings so far.

So once again I must issue one of my mea culpae

While it is possible that the market does rally into year-end the likelihood that we reach old highs at this point is likely remote. This week was supposed to buoy the bulls, and really the earnings have so far been really good. Even Alphabet (GOOGL) which everyone is hating on because it “missed” estimates. It wasn’t even their guidance. It was the collective hot air of analysts’ average estimate who decided that Google Cloud’s growing revenue at 23% wasn’t good enough. A $20M miss on $8B in revenue. At some point soon, once GOOGL stops going down it will be a screaming buy. Unfortunately, everything is a screaming buy. It has finally sunk in that when the Fed means higher for longer they mean it. Meta Platforms (META) blew away earnings and revenue. The monthly aggregate users is well over 2B people, that is a quarter of humanity. They are using AI in all kinds of ways, perhaps they are spending way too much money on the Metaverse nonsense but he is not immune to the blandishments of the market and perhaps he will throttle back on the spending there.

It seems not even the most successful earnings reports from the Great 8 are holding up under the panic in the aftermarket. Netflix (NFLX) hit a recent high of nearly 418, but in the after-hours, it fell an additional 1% to close out the day at 407.

I can only conclude that the “long and variable lags” are starting to bite

Instead of this being bad news, I think it might actually bring succor. Let’s face it, this has been anything but a great year-end. I have been touting the fact that this year has been very good at following seasonal patterns, well, that hasn’t worked out so well lately. The Nasdaq is now down nearly 11% (correction territory), and the S&P 500 is down more than a negative 9%. We know Powell doesn’t care about the stock market until he does. With the way bond auctions have been going, today being the 5% T-Bill that stank up the joint, he might just start paying attention. Really, the market caught on to the notion that higher for longer was not merely a slogan. Now that the 10-year bond is back to just under 5% no one can deny that Jay Powell meant what he said.

Let me stress the word “Meant” perhaps in past tense

Now that we see evidence that luxury items are being consumed less, I expect what I and others call the “Recessionistas”, or sometimes I refer to them as the “Greek Chorus” of doom will soon step up to the mic to announce the next big recession. Tony Dwyer whom I like and respect, is the strategist of Canaccord Genuity, he isn’t a habitual doom-sayer but has been bearish a lot lately and announced today that the roaring 20s are over. He listed a lot of stats about the slowing economy which I should have written down. Instead of being especially gloomy, he said something I really appreciate. He said we are now going to be lower for shorter. This is a real insight, and it brightened what was a very difficult day. Now that we see the slowdown coming, Powell is going to have to change his tune. Don’t forget, he has done 180s several times before, including getting the anti-inflation religion and practically being possessed by Paul Volker’s ghost, he was busy stoking the fires of inflation, don’t forget that! Remember hearing transitory over and again when it was clear that inflation wasn’t, in fact transitory.

The last thing Powell wants is to be known as that guy

Which guy? The guy that took a perfectly good economy, jacked up inflation (with help from both parties), and then jammed it into a recession. Both actions were totally unnecessary. He just held on too long. I think this time noises will be made and there will be talk of cuts. Does that save the stock market? It doesn’t have to, but Powell could decide that QT right now is just too much pressure for this economy. Holding the 10-Y at 5% is just fine. The economy can handle that especially when we can practically hear the hoofbeats of the cavalry coming to save the day.

What to do now?

I would wait for some indication that the 10-year has stabilized. Powell doesn’t have to say anything just yet, just ease off of the QT should be okay for now. If we do see more evidence of a slowdown, the narrative of “lower for shorter” will form on its own.

At this point, it’s too late to sell. I am going to discuss Hedging and individual downside plays with the Group Mind Investors community tomorrow. It might be too late for that. If you have cash hold on to it for now.

Read the full article here