As some of my followers know by now, I like to write about undiscovered gems and underfollowed growth stocks that have the potential to outperform the broader market over the long-term, or those that may have experienced a special situation such as a failed merger as in the case of Silicon Motion (SIMO), which I wrote about recently.

One underfollowed growth company that I recently discovered went public via the SPAC option, which is a sort of special situation for taking a company public instead of doing an IPO. That company is Tigo Energy, Inc. (NASDAQ:TYGO), a maker of electrical components including hardware and software for solar energy installations. According to the Tigo website, they are the leading worldwide manufacturer of Flex MLPE (Module Level Power Electronics).

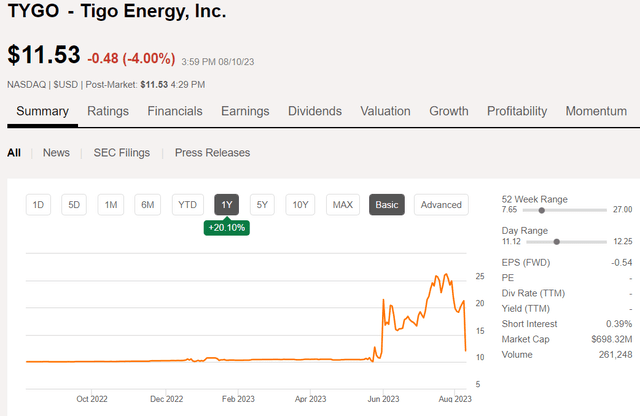

Tigo Energy was initially founded in Silicon Valley in 2007 to help accelerate the worldwide adoption of solar energy. In December 2022, it announced the agreement to merge with the SPAC Roth CH Acquisition IV in a deal that estimated the value of TYGO at around $600 million. The merger deal was consummated on May 23, 2023, and shares of the combined company began trading as TYGO on May 24. The price action in the stock has been volatile from the beginning.

Seeking Alpha

Shortly after opening at a price of $21.33 Wednesday, May 24, the share price shot up over 50% and eventually reached a 52-week high of $27 at the end of July. Then on August 9, 2023, TYGO announced their first earnings for Q2 as a newly public company, and the price of the shares plummeted by more than 40% despite reporting a 290% YOY increase in revenues. As of today, the shares are now trading back in the mid-$11 range, slightly above the post-SPAC opening price of $10.

Q2 2023 Earnings Results

In attempting to understand why the market punished the shares post-earnings, I delved into the report to try to understand the market dynamics behind TYGO stock. On first glance, it appears that the earnings reported were very good in terms of growth and profitability, with record revenues of $68.8M (up 290% compared to Q222) and record gross profit of $29.5M (up 368% compared to Q222). However, a net loss of -$22.2M was reported, compared to net income of $0.2M in Q222. The net loss was due to the mark to market impact of $38M relative to the convertible note of the SPAC offering, partially offset by a discrete (one time) tax benefit of $10.9M in the quarter. Investors may have been disappointed to see a net loss reported, even though record revenues and profits were realized in the quarter.

From the management commentary in the press release, it is also apparent that a recent slowdown in the solar energy markets may be a factor in knocking down the share price due to concerns over forward guidance.

“Tigo achieved a record-setting financial quarter with a number of significant accomplishments, including reaching the highest revenue and gross profit in Tigo’s history and completing a successful closing of our business combination as announced in May,” said Zvi Alon, Chairman and CEO of Tigo.

“We recently started seeing some demand softening in the channel as supply constraints that defined 2022 began to improve in 2023. We believe these supply constraints led to some across-the-board over-ordering that the industry is now facing. However, end market demand remains strong and we have seen a significant increase in installations, which give us confidence that the current market environment is temporary and our overall growth strategy remains intact. Over the longer term, we remain confident that the market is realizing the value of our technology’s open architecture, easy installation, and powerful software position, and that we can continue to outgrow the market.”

The disappointment in forward guidance for TYGO is not unique to the company, and is also reflected in other companies that participate in the solar energy industry, including SolarEdge Technologies (SEDG). They reported weak guidance due to lower demand. Prior to that report, Enphase Energy (ENPH) also reported weak guidance for Q3 when they reported Q2 earnings on July 28, sending that stock to a 52-week low.

“There is a growing negative backdrop especially when looking at the U.S. residential market and relatively high inventory in the channel, which ENPH is now trying to correct by under-shipping volumes into 3Q,” DB analyst Corrine Blanchard wrote, adding demand softness in key markets such as California coupled with seasonality in Europe also will add pressure to Enphase’s full-year revenues, now guided down to $550M-$600M.

What Makes Tigo Different?

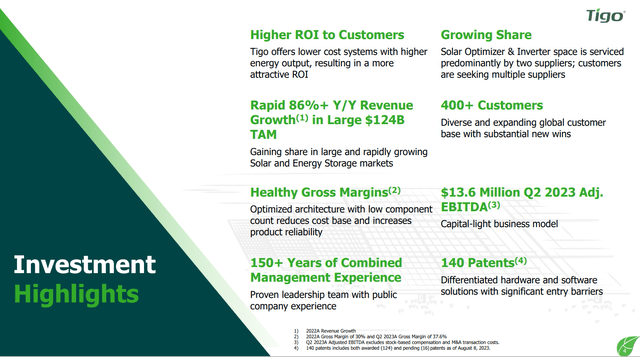

Although the company only recently went public, they have been around for more than 15 years and have over 150 years of combined management experience. Tigo’s mission is to deliver smart hardware and software solutions that enhance safety, increase energy yield, and improve operational performance for residential, commercial, and utility-scale solar systems. From the August investor presentation, some of the investment highlights are noted in this slide.

Tigo investor presentation

The total addressable market (“TAM”) for Tigo products is estimated to reach $124B by 2025. By offering competitive solutions, especially in Energy Intelligence or EI, as well as MLPE products, Tigo expects to capture higher market share due to their improved ROI to customers in all 3 areas of solar industry investments – residential, commercial and utility-scale.

In FY22 the company generated $81M in revenues and already in the first half of 2023 they have generated revenues of $119M. Adjusted EBITDA for all of 2022 was just $2.5M, while so far in the first half of 2023 they have realized $22.1M.

Valuation and Future Outlook

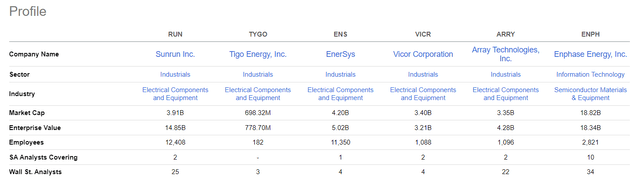

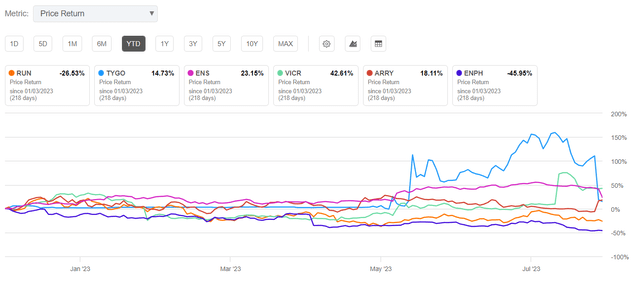

Because TYGO is only recently a public company and, therefore, does not have much of a track record to evaluate, I am interested in comparing them to several peers in the industry including ENPH and Sunrun Inc. (RUN), who had a good Q2 earnings report with a surprise profit when they announced on August 3. Although TYGO is much smaller and has less history and fewer employees than their peers, they have had better YTD performance even with the recent pullback in share price.

Seeking Alpha

Small cap companies tend to be more volatile but can have better forward growth prospects than their larger competitors and that can be seen in the share price comparison based on YTD results.

Seeking Alpha

Of course, the flip side of that equation is that there is more risk in investing in a newly public company that does not have a proven track record of success. With the recent volatility in solar energy markets and the downward pressure on forward guidance, I would recommend keeping an eye on TYGO stock over the next several months before pulling the trigger on buying shares.

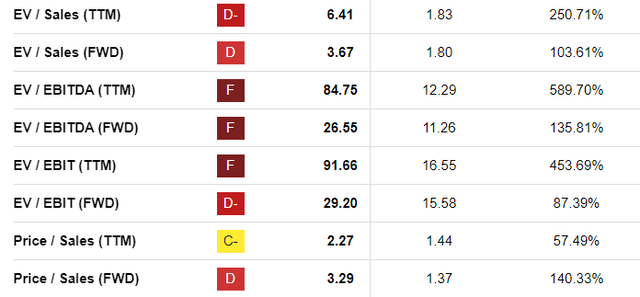

The Valuation grade from the SA Quant system gives the stock an F rating, but I would take that rating with a grain of salt since it is just based on one quarter of earnings reported as a public company. For example, the factors used to come up with the F rating include high EV/Sales and high EV/EBITDA ratios.

Seeking Alpha

The company did report cash and cash equivalents of $62M at the end of the quarter as of June 30, 2023. They also reported forward guidance of revenues in the range of $41M to $45M in Q3 with adjusted EBITDA expected to be in the range of $1M to $3M (compared to $13.6M in Q2). That is a rather considerable decrease in revenues and profits QOQ, so it is not a big surprise that the stock price took a hit after seeing those numbers.

Summary

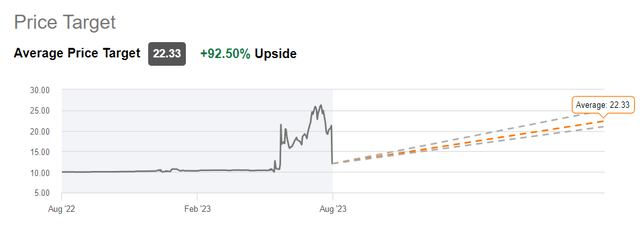

Of the 3 Wall Street analysts who follow the TYGO stock, 2 give it a Strong Buy and 1 gives it a Buy rating. The average price target is over $22, offering upside potential of about 90% from the current price.

Seeking Alpha

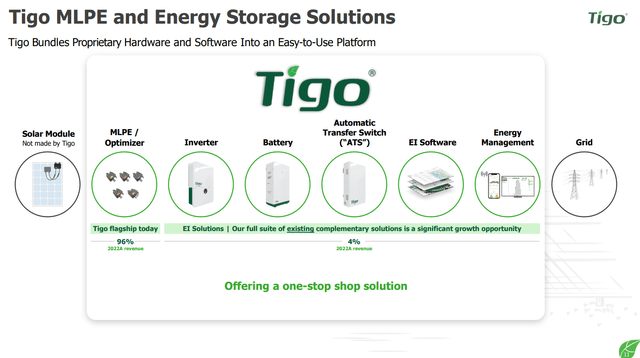

Tigo offers their customers an asset light, supply chain resilient one-stop solution for their solar energy storage solution needs, as illustrated in this slide from their August investor presentation.

Tigo investor presentation

As the markets for solar energy expand and gain traction with tailwinds from the IRA (Inflation Reduction Act) in the U.S. along with REPowerEU clean energy investment expansion in the EU, TYGO stock should benefit from the increase in revenues and profits that are expected to come in the future. The current slowdown in solar energy investment that is impacting forward guidance for Q3 should reverse course at some point in the next couple of months, and that change in sentiment is likely to affect the price movement of TYGO, most likely in the positive direction.

If I were a risk tolerant investor interested in a strong growth prospect for long-term investment, I might be a buyer of TYGO for a price around $11 with the expectation that it could easily increase by 50% or more in the coming months. However, the current market sentiment is likely to continue to keep the price down while interest rates are still high and potentially rising, so I would not be a buyer yet. I rate Tigo Energy, Inc. stock a Hold at the current price, but will be adding this one to my watch list of growth stocks to monitor for any news that could send the shares higher.

Read the full article here