Shares in The TJX Companies (NYSE:TJX) have outperformed over the past year due in part to consumer trade down, as detailed in my prior coverage on the stock. With their outperformance in mind, are shares a buy ahead of earnings? Here’s what to watch when TJX reports Q2 results on Wednesday.

TJX Key Stock Metrics

TJX reported +$11.8B in total sales in Q1. On a comparable store basis, total sales were up 3% YOY, with 5% growth out of their largest unit, Marmaxx, offset by HomeGoods, which declined 7%.

The stock is up 10% YTD. This notably outperforms their off-price counterparts, Ross Stores (ROST) and Burlington (BURL), who are down a respective 1.5% and 21%.

Seeking Alpha – YTD Returns Of TJX Compared To Peers

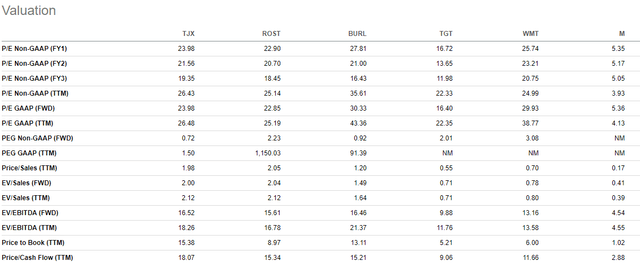

And for this outperformance, TJX doesn’t command much of a premium. On a forward basis, shares trade at about 25x earnings. That’s either lower or comparable to much of their peer set. The takeaway is similar when assessed using other valuation metrics, such as the EV/EBITDA multiple.

Seeking Alpha – Valuation Metrics Of TJX Compared To Peers

The average multiple is despite more profitable operations. Their operating margins, for example, are more than double that of BURL and slightly below ROST.

Seeking Alpha – Profitability Metrics Of TJX Compared To Peers

TJX Guidance and Estimates

Profitability has been an area of strength for TJX. And their track record of coming in ahead of expectations is stronger in this area than in revenues.

Seeking Alpha – TJX Recent Earnings And Revenues History

In Q1, both pre-tax profit margins and EPS exceeded expectations. This provided TJX the confidence to raise full-year guidance for both. In outlining guidance, CFO, John Klinger, targeted pre-tax margins of 10.4% at the midpoint based on a 53-week calendar and margins of 10.3% on a more comparable 52-week basis. On a 52-week basis, this would represent a 60 basis point (“bps”) increase at the midpoint from last year’s 9.7%.

Overall comparable sales are seen increasing between 2% and 3%. And comparable full-year EPS is expected to land at a midpoint of $3.44/share. This represents an increase of 10.6% from last’s $3.11/share.

For Q2, comparable store sales are expected to be up 2.5% at the midpoint, generally in line with the first quarter. More to the bottom line, significantly lower freight costs were expected to contribute to pre-tax margins of 9.4% at the midpoint. While this would be well below the 10.3% reported in Q1, results at that time benefited from a favorable one-time freight accrual adjustment. Additionally, timing-related factors on wage and supply chain investments were also expected to serve as headwinds in Q2.

All considered, Q2 EPS is expected to land at $0.735/share at the midpoint, which would represent a YOY increase of 6.5%.

What To Watch In TJX’s Q2 Earnings

HomeGoods: After outperforming through fiscal 2022, the division has been a laggard for TJX. Moderating demand for furnishings and other décor is one part of it. But a significant factor is simply the unfavorable base effects for the YOY comparison. In fiscal 2022, sales in the unit were growing at rates of over 20%. This created tough comps in fiscal 2023, which evidently also carried forward into fiscal 2024.

While TJX is still finding themselves cycling through difficult comps, Klinger stated in their Q1 discussion that he expects YOY comparable sales to improve for the remainder of the year. This is feasible. In fact, the division even has the potential to top expectations.

The shuttering of Bed Bath & Beyond (OTCPK:BBBYQ) provides HomeGoods the opportunity to seize valuable market share. In Q1, the division opened its 900th store in the U.S. In my view, they appear well positioned to capture additional share in the U.S. home market.

CEO, Ernie Herrman, also noted that store traffic was beginning to tick up during the time of their Q1 release, which would have been in mid-May. If the traffic ultimately translated to sales, it would be a notable complement to the strength seen in Marmaxx. Any beat on the top-line, then, would likely be attributable to a surprise in the HomeGoods unit.

Margin Outlook: Profitability recovered quicker than expected for TJX. Along with the conducive business model for inflationary environments, profitability strength is one reason investors have bid up shares over the past year.

By fiscal 2025, TJX is aiming to achieve pre-tax margins of 10.6% and will strive to exceed this over the long-term. The company is in a good position to attain this target. But they could face some setbacks along the way.

In setting guidance, TJX is expecting to receive a significant benefit from lower freight expenses. The full-year margin outlook, for example, assumes a freight benefit of more than 100bps, some of which includes a pull forward of the benefit they had expected to receive in fiscal 2025. The simple risk is that freight rates begin to tick higher.

The recent Yellow (YELL) bankruptcy is already shaking up the ground game. The carrier was known for their low-cost business model. With business absorbed elsewhere, retailers may be in for higher-than-expected freight costs.

In fairness, TJX did mention that much of the benefit they’re seeing in freight is on the ocean rates. Still, if domestic rail/truck rates begin to increase, that could impact their full-year margin outlook.

Customer Demographics: One benefit TJX has over their peers, such as ROST, is that their customer base is on the higher end of the income spectrum. This has served them well through changing business cycles and will continue to do so moving forward.

Recently, however, the company has attracted an outsized number of younger customers, such as Gen Z and Millennials. A larger fraction of their new customers is also being derived from the younger age group. TJX’s successful merchandise procurement strategies have enabled them to stay on top of the latest fashion trends, which has proved a competitive advantage in gaining share among the younger cohort.

While certainly a benefit, this also exposes TJX to the incoming threat of the restart in student loan repayments. This headwind in retail is not necessarily unique to TJX, but it is expected to be a prominent theme among the group during the Q2 earnings season.

In my view, I see it as overdone. Real incomes are up, inflationary pressures are on the mend, and consumers generally are in a historically better position than in prior recessionary environments. Still, I wouldn’t discount the potential headwind completely.

Is TJX Stock A Buy, Sell, Or Hold?

TJX is outperforming for good reasons. Their off-price business model remains a draw for consumers of all income levels who continue to seek a good bargain when they can get one. Successful merchandising strategies have also allowed the company to procure in-demand product offerings. This has enabled them to gain share among the younger cohort, which is both a benefit and a risk due to the incoming restart in student loan repayments.

Profitability remains a strength and is likely to remain so moving forward, though I expect a downward revision in margin guidance. A significant factor in TJX’s margin guidance is lower freight costs. The recent bankruptcy of freight carrier, Yellow, however, could complicate this outlook. Heading into earnings, I would prefer to temper any expectations on margins, given this new uncertainty.

Any downward revision in guidance would likely expose shares to a moderate pullback following the release, especially given the recent outperformance. However, I would remain bullish on the stock. Long-term, I see TJX continuing to take market share among younger consumers. And I see operating margins eventually exceeding their 10.6% target.

Analysts at Argus recently affixed a $95 price target on the stock. This is in-line with the overall consensus as well. I, on the other hand, maintain a $100 target price and would support this assertion with TJX’s profitability strength and market share potential among the younger generation, as well as the newfound share opportunity in their HomeGoods division arising out of the Bed Bath bankruptcy.

For investors seeking new or added positioning, TJX remains viewed as one of the best bets in retail.

Read the full article here