Thesis

Toronto-Dominion Bank (NYSE:TD) is the second-largest bank in Canada. Its balance sheet is neat and clean, with adequate liquidity to weather potential economic downturns. Typical for Canadian banks, TD has paid dividends even during crises such as GFC 2008. Its business is well diversified geographically between the US and Canada.

It offers a 4.6% dividend yield, well-diversified income streams, and potential for expansion. On top of that, it is deeply undervalued, measured with the Excess Return Model. However, it commands the second-highest forward PE multiples compared to its Canadian peers. I have more than enough reasons to give TD a buy rating.

Company Overview

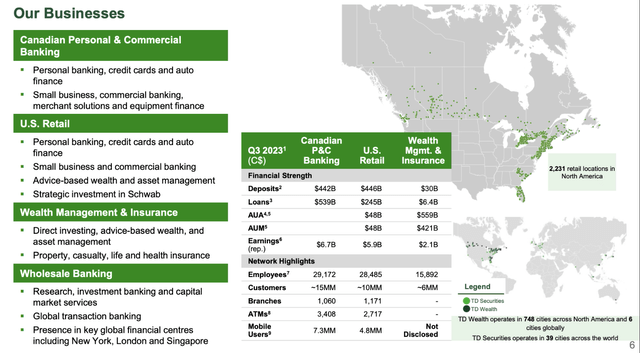

Toronto Dominion offers widely diversified services. The image below from the last company presentation shows bank operations by segment and country.

TD presentation

Nearly 40% of their revenue in 2022 came from the United States. Additionally, TD maintains its deposit base and liquidity by ranking as the third-largest federal banking cash manager in the United States. TD is in a beneficial position for the future despite persistent pressure to reduce its deposit levels.

Canadian Personal and Commercial Banking accounts for just a third of total revenue. 25% of its revenues come from U.S. retail. Over a fifth of all sales are in the health and insurance sectors.

TD is pushing to increase its footprint in wealth management services for high-net-worth individuals, emulating its Canadian success in the United States. The company’s wealth management division has over CAD 420 billion assets under administration as of 3Q23. It is Canada’s largest institutional money manager.

In March 2023, Toronto Dominion acquired Cowen Inc. The acquisition is an addition to the TD Securities segment. The expertise of Cowen in M&A, mid-market customers, and equity capital markets complement those of TD. With Cowen’s platform integrated, TD will have access to a sizable prospect pool and the potential to serve mid-market clients across the board.

Toronto Dominion also holds a 12.4% stake in Schwab (SCHW). This entails expanding the team of financial advisors, establishing physical offices in strategic areas, and creating specialized units to serve high-net-worth clients.

The bank is switching to an organic growth strategy after failing to complete the First Horizon (FHN) acquisition. The focus is to grow the wealth management segment and develop the mid-market business in industries like healthcare and education. TD has a solid track record of achieving organic growth in the US. The 10 million customers and 1,171 branches are actual proof.

Bank financials

Toronto Dominion’s balance sheet provides sufficient liquidity. Besides that, the bank has a well-diversified loan portfolio and deposits base. The table below shows some metrics I use to assess balance sheet quality. The data is taken from the last financial report.

|

Asset ratios: assets structure |

|

|

Cash/Total Assets |

4.6% |

|

Loans (total) /Total Assets |

46% |

|

Consumer Loans/Total Assets |

6.6% |

|

Credit Cards/Total Assets |

1.9% |

|

Mortgages/Total Assets |

16% |

|

Commercial Loans/Total Assets |

16.6% |

|

Liability ratios: capital structure |

|

|

Deposits (total)/ Total Liabilities |

69% |

|

NIB deposits /Total Deposits |

11.4% |

|

IB deposits/Total Deposits |

49% |

|

Long-term debt/ Total Liabilities |

7.5 % |

|

Equity/ Total Liabilities + Equity |

8.7% |

|

Solvency ratios: |

|

|

Loans /Deposits |

71% |

|

Cash/Deposits |

7.6% |

|

Borrowings (inc. bonds)/ Total Assets |

20% |

The bank deposit base is well distributed between interest-bearing deposits (IB) and non-interest-bearing deposits [NBR]. The former represents 49%, while the latter is 11.4%. The remaining 39.6% are institutional deposits.

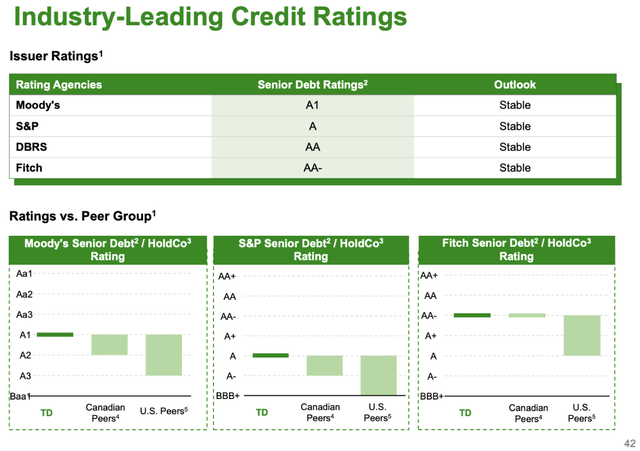

TD has a low cash-to-deposit ratio of 4.6%. Royal Bank of Canada (RY), Bank of Montreal (BMO), and Bank of Nova Scotia (BNS) have better cash-to-deposit ratios in the range of 6.9% to 8.2%. The loan-to-deposit ratio is 71%, like BMO with 71% and RY with 69%. TD’s credit rating is excellent and has a stable outlook, as seen in the chart below.

TD presentation

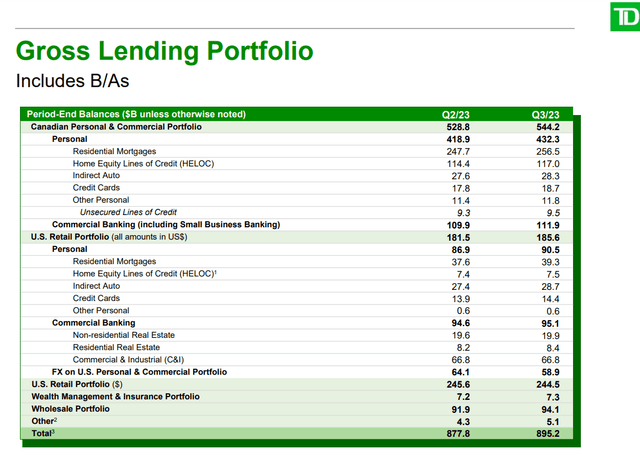

The bank loan portfolio is well diversified geographically and between various customers. CRE represents 14% of US loans and 4.9% of total TD loans. Residential mortgages represent the largest part (53.7%)of banks` loan portfolio. The image below shows TD’s gross lending portfolio.

TD presentation

Basel III capital metrics are in line with the Canadian banking industry. The table below shows Toronto Dominion’s capital adequacy. The data is taken from the last financial report.

|

Capital (in billions of Canadian dollars): |

|

|

Regulatory Capital |

92.08 |

|

Tier 1 capital |

88.8 |

|

Common equity tier 1 (CET1) |

82.23 |

|

Risk-Weighted Assets |

544.9 |

|

Basel III Ratios: |

|

|

Regulatory capital ratio (Capital adequacy ratio) |

16.9% |

|

Tier 1 ratio |

16.3% |

|

CET1 ratio |

15.2% |

|

LCR |

133% |

|

NFSR |

129% |

TD`s CET1 ratio is 15.2%, reflecting both organic capital growth and the effects of the 14 million common shares repurchased last quarter. The management anticipates finishing the 30 million common share buyback by early September, subject to market conditions.

Toronto Dominion`s profitability is higher than the industry average but lower than TD`s five-year average.

|

ROE |

11.2% |

|

RoTE |

14.1% |

|

RoCET 1 |

17.7% |

|

ROA |

0.77% |

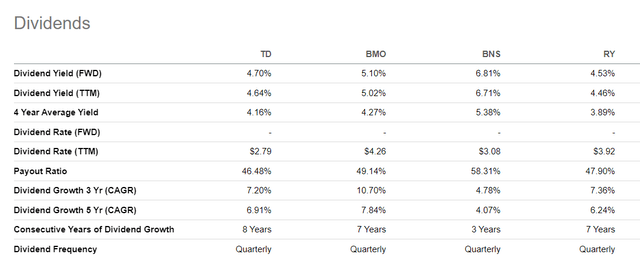

In contrast to the majority of banks in North America, Toronto-Dominion has maintained its dividend throughout the Great Financial Crisis. The table below compares Toronto Dominion with its peer’s dividend metrics.

Seeking Alpha

Currently, the stock pays a quarterly dividend of $2.79 per share. A 47% payout ratio, comfortably within the company’s preferred payout range of 40% to 50%, protects the dividend. TD, likely to Bank of Nova Scotia, has paid dividends yearly since its incorporation.

Q3 results

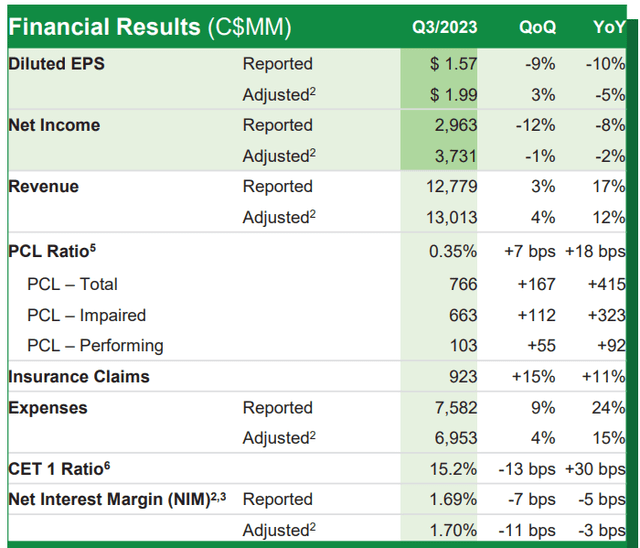

Toronto Dominion had a successful last quarter. Revenue increased by 12% from the previous year, and profit after tax was $3.7 billion, or $1.99 per share. The chart below shows 3Q23 highlights.

TD 3Q23 report

Net margin has dropped QoQ and YoY due to growing expenses. Provision for Credit Losses [PCL] came up, together with the expenses, thus adversely affecting banks` bottom line. Net interest margin illustrates that. It has dropped QoQ with 7bps and YoY with 5bps.

Company Valuation

To value TD, I use the Excess Return Model to value the company. I follow Professor Damodaran’s framework and database.

Assumptions and inputs:

- Risk-free rate equals the 5Y average of USA long-term Government bond Rate, 2.2%.

- Growth rate, g, equals the 5Y average of the USA long-term Government bond Rate, 2.2%.

- TD has operations in Canada and the US. Thus, I use a weighted equity risk premium of 5.00%.

- TD’ unlevered Beta 0.93

- TD debt/equity ratio is 338 %.

- TD’s effective tax rate is 5Y on average due to its international operations, which is 15.88%.

- TD ROE (TTM) 11.2%

- TD book value per share $ 44.4

1. Calculate Levered Beta with the formula below:

Levered Beta = Unlevered Beta * (1+D*(1-T)/E).

2. Calculate the discount rate (discount rate as the cost of equity) using the resulting value for leveraged beta. The formula I use is:

Cost of Equity = Risk-Free Rate + (Levered Beta * Equity Risk Premium).

3. Calculate Excess Returns using TD’s ROE, Book Value, and Cost of Equity:

Excess equity return = = (Stable Return on equity – Cost of equity) x (Book Value of Equity per share).

4. Calculate Excess Returns Terminal Value assuming perpetual constant growth and stable cost of equity:

Excess Returns Terminal Value = = Excess Returns / (Cost of Equity – Expected Growth Rate).

6. Calculate the Value of Equity.

Value of Equity = Book Value per share + Terminal Value of Excess Returns.

For TD, I get the following results:

Intrinsic value per share = $ 99.9

Current Market price = $ 60.34 on Sept 27, 2023

Using excess return valuation, TD is deeply undervalued at the current market price and offers a significant margin of safety of 39%.

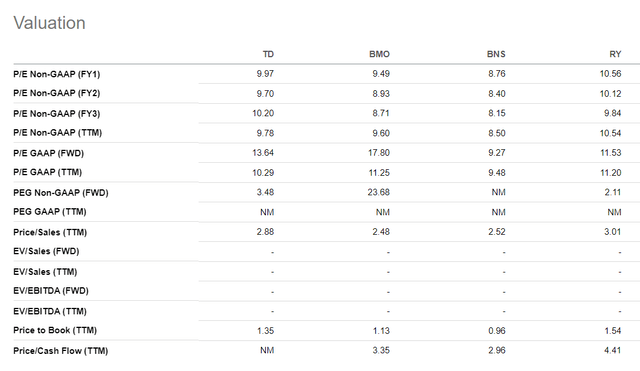

I compare TD with the following banks:

- Bank of Montreal (BMO)

- Bank of Nova Scotia (BNS)

- Royal Bank of Canda (RY)

Seeking Alpha

TD is the second most expensive Canadian bank to Royal Bank of Canada measured with forward PE multiples and Price/Sales ratio. BNS, in my opinion, offers more value; however, it is at higher risk due to its exposure to emerging markets such as Mexico, Peru, and the Caribbean. Both banks are suitable enough for income-minded investors, though they suit different investor risk profiles.

Risks

TD is not excused from the usual risks for banking business: credit, liquidity, operational and market risk. The economic risk deserves its sentence because it is crucial for every business. The latter means simply the impact of three variables: inflation, economic growth, and unemployment. Central Banks’ mandate is to regulate all three within prescribed limits. TD operates in Canada and the US. Their central banks` policies mirror each other.

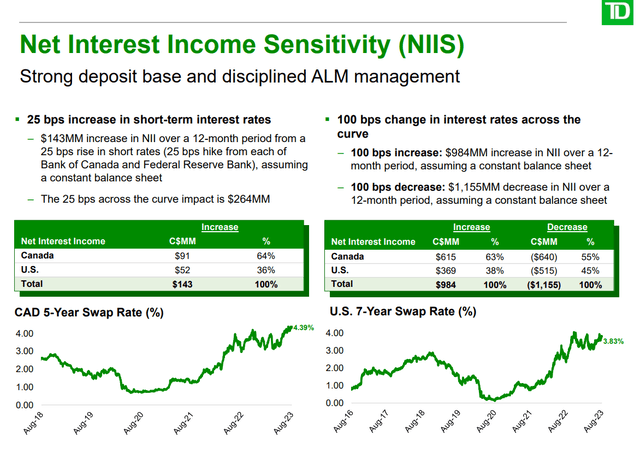

Bank of Canada opted to maintain its benchmark interest rate at 5%. The bank cited deteriorating economic conditions and easing labor-market pressures to justify its decision. The table below shows net interest income sensitivity to interest rate variations.

TD presentation

The image represents two scenarios. The left is 25bps change, and the right is 100 bps change. An equal amount of change yet different polarity leads to distinct outcomes. Declining rates cause a net income squeeze higher than rising rates and consequent income growth.

Last year, all central banks raised interest rates too quickly to suppress inflation. As a result, the Bank of Canada, like the Fed, cannot lower interest rates since the inflation is still here. Structural inflations will dominate the current decade. Declining demography in the most developed countries (excluding the US), new commodity bull run, and growing political and economic fragmentation are the inflationary driving forces. Banks are also affected by this. I expect the rates to remain higher for longer, though not steady or continuously rising.

Conclusion

Toronto-Dominion Bank has a diversified business model, solid growth potential, and an appealing dividend yield. Investors seeking exposure to the banking industry and adequate dividends should consider TD. Despite banks` qualities, TD is not a short-term investment. It is a long-term bet on quality banks for sale with a solid margin of safety. Considering all variables, I give TD a buy rating.

Read the full article here