This article is part of a series that provides an ongoing analysis of the changes made to William von Mueffling’s 13F stock portfolio on a quarterly basis. It is based on William von Mueffling’s regulatory 13F Form filed on 11/6/2023. Please visit our Tracking William von Mueffling‘s Cantillon Capital Management Portfolio series to get an idea of his investment philosophy and our previous update for the fund’s moves during Q2 2023.

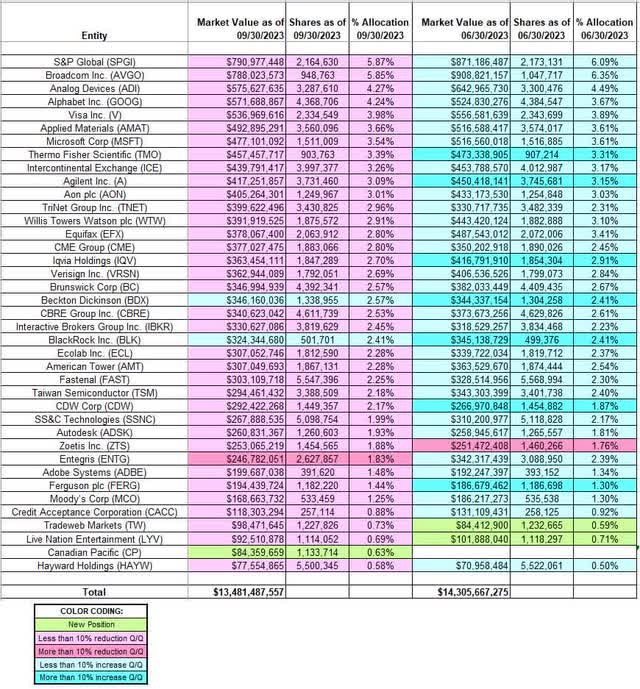

This quarter, William von Mueffling’s 13F portfolio value decreased ~6% from $14.31B to $13.48B. The number of holdings increased from 38 to 39. The portfolio continues to be heavily concentrated with the top five positions representing ~23% of the total 13F holdings. The largest stake is S&P Global, which accounts for 5.87% of the portfolio. The largest five positions are S&P Global, Broadcom, Analog Devices, Alphabet, and Visa.

New Stakes:

Canadian Pacific (CP): CP is a small 0.63% of the portfolio stake established this quarter at prices between ~$74 and ~$84 and the stock currently trades near the bottom of that range at $74.32.

Stake Disposals:

None.

Stake Increases:

BlackRock Inc. (BLK): The 2.41% of the portfolio position in BLK was built over the four quarters through Q3 2022 at prices between ~$550 and ~$970 and the stock currently trades at ~$653. There was a ~15% stake increase this quarter at prices between ~$626 and ~$711.

Beckton Dickinson (BDX): The 2.57% BDX stake saw a minor ~3% stake increase this quarter.

Stake Decreases:

S&P Global (SPGI) previously McGraw Hill Financial: SPGI is currently the largest position at ~6% of the portfolio. It was established in Q1 2015 at prices between $86 and $109. The stake was built through Q1 2016 at around the same price range. Since then, the position saw a ~52% selling at prices between ~$97 and ~$479. The stock currently trades at ~$385. There was a ~6% stake increase last quarter and marginal trimming this quarter.

Broadcom Inc. (AVGO): AVGO is now in the second largest position at 5.85% of the portfolio. It was established in Q1 2017 at prices between $174 and $227 and increased by ~55% in Q3 2017 at prices between $230 and $257. There was another ~20% stake increase in Q1 2018 at prices between $228 and $273. The period since had seen a combined one-third reduction at prices between ~$192 and ~$665. The stock currently trades at ~$881. Last quarter saw a ~6% stake increase while this quarter there was a ~9% trimming.

Analog Devices (ADI): ADI is a long-term stake that has been in the portfolio since 2010. At the time, it accounted for just over 10% of the portfolio. The position was increased by two-thirds in 2011 as well. The last major buying was in Q4 2014 when the stake saw a ~20% increase at prices between $43 and $58. The three years through Q1 2020 saw a combined ~28% reduction at prices between ~$72 and ~$125. Q1 2021 saw a similar reduction at prices between $144 and $164. The stock currently trades at ~$168 and the stake is at 4.27% of the portfolio. The last quarter saw a ~6% stake increase while this quarter there was marginal trimming.

Alphabet Inc. (GOOG) (GOOGL): The original GOOG stake was established in 2010 and doubled in 2011 at very low prices. The last significant buying was in Q2 2014 when the position was increased by ~14% at prices between $25.50 and $29. The stake has seen selling since Q3 2016: ~50% combined reduction through 2022 at prices between ~$35 and ~$151. That was followed with another ~50% selling during Q1 2023 at prices between ~$87 and ~$109. The last quarter saw a ~6% stake increase while this quarter there was marginal trimming. The stock currently trades at ~$132 and the stake is at 4.24% of the portfolio.

Visa Inc. (V): V is a ~4% stake established in Q4 2015 at prices between $70 and $80. It was increased by ~125% in 2016 at prices between $70 and $83. Q1 2017 saw another ~15% stake increase at prices between $78 and $90. Since then, the position was reduced by ~37% at prices between ~$90 and ~$251. The stock currently trades at ~$235. There was a ~6% stake increase last quarter while this quarter saw marginal trimming.

Applied Materials (AMAT): The 3.66% AMAT stake was purchased in Q1 2020 at prices between $38 and $67 and increased by ~60% next quarter at prices between $42 and $60. The last quarter also saw a ~6% stake increase. The stock currently trades at ~$140. There was marginal trimming this quarter.

Microsoft Corp (MSFT): MSFT is a 3.54% of the portfolio stake established in Q1 2020 at prices between $135 and $189. There was a ~55% stake increase in Q2 2021 at prices between ~$240 and ~$270. The three quarters through Q3 2022 saw another ~30% increase at prices between ~$242 and ~$335. There was a ~20% further increase during Q1 2023 at prices between ~$222 and ~$281. That was followed by a ~6% increase last quarter. The stock is now at ~$357. There was marginal trimming this quarter.

Thermo Fisher Scientific (TMO): TMO is a 3.39% of the portfolio position established in Q3 2018 at prices between $206 and $249 and increased by ~90% next quarter at prices between $208 and $252. The four years through Q1 2023 saw a combined ~19% selling at prices between ~$270 and ~$667. The last quarter saw a ~11% stake increase at prices between ~$508 and ~$591. The stock currently trades at ~$455. There was marginal trimming this quarter.

Intercontinental Exchange (ICE): ICE is a 3.26% of the portfolio stake established in Q4 2014 at prices between $39 and $45. The following two quarters saw the position almost double at prices between $44 and $48. There was another ~17% increase in Q4 2016 at prices between $52.50 and $60. The three years through Q1 2020 saw a combined ~28% selling at prices $57 and ~$102. The stock currently trades at ~$108. There was a ~6% stake increase last quarter while this quarter saw marginal trimming.

Note: Prices are adjusted for the 5-for-1 stock-split in October 2016.

Agilent Inc. (A): Agilent is a ~3% of the portfolio position established in Q4 2015 at prices between $33.50 and $42.50. Q4 2016 saw a ~17% increase at prices between $43 and $48. There was a ~15% reduction in Q1 2018 at prices between $65 and $75 and that was followed with a ~10% trimming over the next two quarters. The following two quarters saw a ~20% stake increase at prices between $65.50 and $82. There was a ~13% further increase last quarter at prices between ~$115 and ~$141. The stock currently trades at ~$108. This quarter saw marginal trimming.

Aon plc (AON): The ~3% AON position was increased by ~50% in Q2 2018 at prices between $135 and $145 and the stock is now at ~$326. There was a ~10% stake increase in Q1 2019. The last quarter also saw a ~6% increase. There was marginal trimming this quarter.

Willis Towers Watson plc (WTW): The 2.91% stake came about because of the merger between Willis Group Holdings and Towers Watson that closed in January 2016. Cantillon’s large stake in Willis Group Holdings got converted to WTW shares. The original position is from Q3 2013, and their overall cost-basis is ~$110 compared to the current price of ~$236. The stake was reduced by ~50% over the four years through Q3 2021 at prices between ~$117 and ~$235. There was a ~6% stake increase last quarter and marginal trimming this quarter.

Equifax (EFX): EFX is a 2.80% of the portfolio stake purchased in Q4 2016 at prices between $112 and $135. H1 2017 saw a ~80% stake increase at prices between $117 and $143 and that was followed with a ~130% increase in Q3 2017 at prices between $93 and $146. Q3 2018 saw a ~30% stake increase at prices between $123 and $138. The period since Q1 2020 saw a ~17% selling at prices between ~$106 and ~$295. The last quarter saw a ~6% increase while this quarter there was marginal trimming. The stock is now at ~$181.

CME Group (CME): CME is a 2.80% of the 13F portfolio stake established in Q4 2014 at prices between $78 and $93. Q4 2015 saw a ~60% stake increase at prices between $87 and $100. The four years through Q1 2020 saw a combined ~30% selling at prices between ~$85 and ~$225. The two quarters through Q1 2023 saw a ~20% stake increase at prices between ~$170 and ~$195. The stock currently trades at ~$213. There was marginal trimming this quarter.

IQVIA Holdings (IQV): The 2.70% of the portfolio stake in IQV was established in Q1 2021 at prices between $173 and $195. Next quarter saw a ~20% stake increase at prices between ~$195 and ~$247. The three quarters through Q2 2022 saw another ~40% increase at prices between ~$197 and ~$283. That was followed with a ~14% increase last quarter at prices between ~$184 and ~$225. The stock is now at ~$198. There was marginal trimming this quarter.

VeriSign Inc. (VRSN): The 2.69% VRSN stake was purchased in Q3 2017 at prices between $93 and $106. The position saw a ~40% increase in Q4 2018 at prices between $134 and $165. There was a ~23% stake increase in Q1 2021 at prices between $188 and $216. That was followed by a ~6% stake increase last quarter. The stock currently trades at ~$203. There was marginal trimming this quarter.

Brunswick Corp (BC): BC is a 2.57% of the portfolio stake established in Q2 2019 at prices between $41.50 and $54.50 and increased by ~45% next quarter at around the same price range. The three quarters through Q2 2020 saw a ~20% stake increase at prices between $26.50 and $66. The stock is currently at ~$73. There was a ~6% stake increase last quarter and marginal trimming this quarter.

Note: Cantillon has a ~6.8% ownership stake in the business.

CBRE Group Inc. (CBRE): The 2.53% stake in CBRE was purchased in Q1 2016 at prices between $23 and $34.50 and increased by ~125% over the next two quarters at prices between $24.50 and $31. Q1 2021 saw a ~30% selling at prices between $59.50 and $81. The stock is now at ~$75. There was a ~6% stake increase last quarter and marginal trimming this quarter.

Adobe (ADBE), American Tower (AMT), Autodesk (ADSK), Credit Acceptance Corporation (CACC), CDW Corp. (CDW), Entegris (ENTG), Ecolab Inc. (ECL), Fastenal (FAST), Ferguson plc (FERG), Hayward Holdings (HAYW), Interactive Brokers Group Inc. (IBKR), Live Nation Entertainment (LYV), Moody’s Corp. (MCO), SS&C Technologies (SSNC), TriNet Group (TNET), Taiwan Semiconductor (TSM), Tradeweb Markets (TW), and Zoetis Inc. (ZTS): These stakes were decreased this quarter.

Note: Cantillon controls ~6% of TriNet Group.

The spreadsheet below highlights changes to von Mueffling’s 13F stock holdings in Q3 2023:

William Von Mueffling – Cantillon Capital Management’s Q3 2023 13F Report Q/Q Comparison (John Vincent (author))

Source: John Vincent. Data constructed from Cantillon’s 13F filings for Q2 2023 and Q3 2023.

Read the full article here