Note:

I have covered Transocean Ltd. (NYSE:RIG) previously, so investors should view this as an update to my earlier articles on the company.

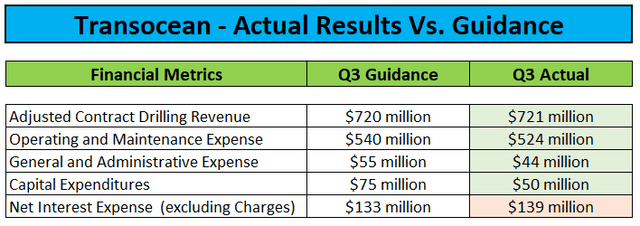

After the close of Monday’s session, leading offshore driller Transocean Ltd. or “Transocean” reported third quarter results mostly ahead of guidance provided on the Q2 conference call in early August:

Q2 Conference Call Transcript / Q3 Earnings Release

However, Adjusted EBITDA decreased by more than 30% sequentially to $162 million thus resulting in margin dropping by 920 basis points to 22.5%.

Regulatory Filings

Free cash flow was negative $94 million, primarily due to approximately $135 million of contract preparation and mobilization costs for the rigs Deepwater Mykonos, Deepwater Corcovado, Deepwater Orion, Dhirubhai Deepwater KG2, Transocean Barents, Transocean Endurance and Transocean Equinox.

On the conference call, management warned of additional contract preparation and mobilization costs impacting near-term EBITDA margins.

Transocean finished the quarter with approximately $1.4 billion in liquidity including the $0.6 billion available under its undrawn revolving credit facility.

As already expected by me following disclosures in last week’s fleet status report, the company guided Q4 revenues well below the $830 million consensus estimate:

Q3 Conference Call Transcript

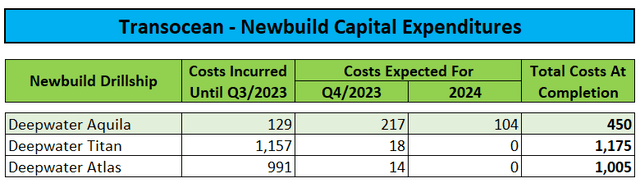

Please note that the company’s Q4 capex guidance includes more than $200 million in anticipated cash outflows for the recent acquisition and activation of the newbuild drillship Deepwater Aquila. In total, Transocean expects to spend $450 million on the rig:

Regulatory Filing

However, the company’s top line guidance for next year is in line with current estimates but based on management’s statements on the call, requires Transocean to generate between $350 million and $400 million in revenue from contracts not yet signed.

At the midpoint of the provided ranges, I would estimate the company to generate approximately $1.4 billion in Adjusted EBITDA and between $550 and $600 million in free cash flow in 2024.

On the conference call, management projected liquidity at the end of next year to range between $1.5 billion and $1.7 billion.

During the questions-and-answers session, several analysts expressed their concerns with regard to the recent slowdown in contracting activity, and dayrates apparently stalled just shy of the $500,000 mark.

While management admitted to some difficulties in pushing dayrates even further as customers remain committed to capital discipline, they didn’t view the current lull as indicative of fundamental changes in the marketplace.

However, further reactivation of cold-stacked assets or activation of newbuild rigs still stranded in shipyards might be pushed out by at least several quarters now.

Nevertheless, the company remained highly constructive on the industry outlook as outlined in more detail by Chief Commercial Officer Roddie Mackenzie on the call (emphasis added by author):

So as we enter like the last couple of months of the year, the things that we’re actively engaged in just now are all long-term in nature. There’s 1 or 2 short-term things but the majority of the stuff, especially the headlines that you’re going to see over the next couple of 3 months is all for long-term stuff. And we’re not just talking about 1-year deals. We’re talking about like 3, 4, 5, maybe even 10-year deals. So there’s a lot of stuff in terms of the stats on the number of fixtures made. But what we’re looking at is kind of, Jeremy said, is that making sure we’re picking up the right pieces of work that give us that length of contract but also at really good day rates, because the decisions we make are all about generating returns and value to the shareholders. So we’re going to continue pushing down that track.

And in terms of seasonality, I think you’re basically right in budget season right now for the major operators, so they’re kind of going through that churn. And typically, what we see is a lot of interest in the fourth quarter where people start thinking about what other fixtures they’ll make in ’24 and start putting out tenders. So you may or may not be aware but there’s — some of the big operators are out for tenders just now and there’s more expected for kind of multiyear, multi-rig, multi-country head of tenders [ph]. So we expect to see several of those in the near term.

More rigs getting employed on long-term contracts should greatly benefit the industry as the number of units available for short-term opportunities would shrink thus supporting the ability to push dayrates for the remaining rigs.

However, I no longer expect Transocean to reactivate cold-stacked assets in the near future. Consequently, I have reduced my 2025 Adjusted EBITDA estimate from $2.0 billion to $1.6 billion:

Company Projections / Author’s Estimates

Moreover, with the potential earnings power of the company’s cold-stacked fleet now unlikely to come into play anytime soon, I am no longer assigning a premium valuation multiple to the stock:

Author’s Estimates and Calculations

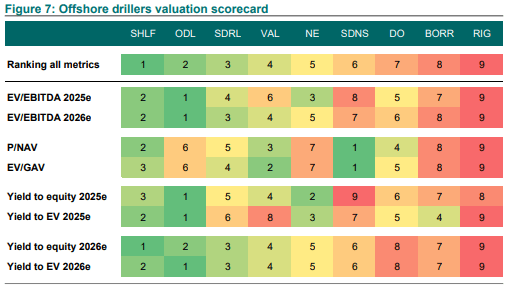

At 6x EV/Adjusted EBITDA, shares are currently trading at an approximately 18% premium to the price target of $5.63. Even using my previous 7x multiple would only provide for 15% upside from current levels.

In addition, Transocean remains expensive relative to peers on a number of other financial metrics:

DNB Markets

Consequently, I am downgrading Transocean’s shares from “Buy” to “Hold“.

Bottom Line

While Transocean reported a respectable third quarter, the company’s Q4 revenue guidance was well below consensus expectations and management warned of near-term profitability being impacted by an elevated number of rigs currently undergoing preparation and mobilization for contract commencements over the course of 2024.

Management also admitted to “lumpiness” in the timing of contract awards as customers remain steadfast in their commitment to capital discipline.

Clearly, I have been too optimistic regarding the pace of incremental dayrate increases and operators’ near-term desire to secure additional rig capacity.

However, similar to Transocean’s management, I still anticipate a strong multi-year upcycle for the industry, albeit further exponential margin expansion is looking less likely now.

As a result, I now expect Transocean to abstain from reactivating cold-stacked assets for the time being and have reduced my 2025 Adjusted EBITDA estimates accordingly

Moreover, I am no longer assigning a premium valuation to the company’s stock but even when using my previous 7x EV/Adjusted EBITDA multiple, upside would be limited relative to peers.

Consequently, I am downgrading Transocean’s shares from “Buy” to “Hold“.

Key Risk Factor:

Offshore drilling stocks are heavily correlated to oil prices so any sustained down-move in the commodity would almost certainly result in Transocean’s shares taking a further hit.

Read the full article here